The 2019 general elections are a watershed event in South Africa. Results and post-election policy, and reform momentum will give clear indications of an impending political risk turn or a more structural decline.

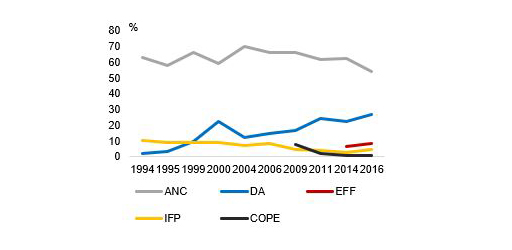

According to Dirk Kotzé, a Professor in Political Sciences at UNISA, the outcome “will provide for the South African public a very good insight into the future of all the main parties. The ANC, DA and EFF, each one in their own way, is currently in a transition stage and the election will give them an indication of how successful their transition strategies have been.” The registration of 19 new political parties will also be important in the evolving political landscape.

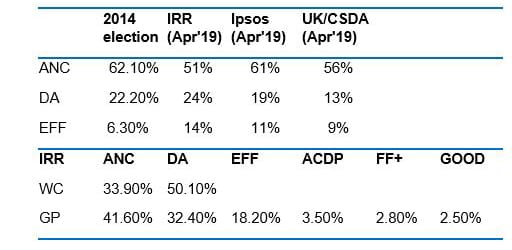

After reviewing the latest poll forecasts, Investec Treasury Economist, Tertia Jacobs, presupposes an ANC victory at the national polls of between 55% and 58%.

“The outcome of the provincial vote in Gauteng, the economic powerhouse and representing a large constitutional base for the ANC, DA and EFF, will be critical in the context of the weak economy and ability of coalition governments to put the country ahead of party manifestos and interests,” says Jacobs.

The outcome of the provincial vote in Gauteng, the economic powerhouse and representing a large constitutional base for the ANC, DA and EFF, will be critical in the context of the weak economy and ability of coalition governments to put the country ahead of party manifestos and interests.

Source: Dirk Kotze and Bloomberg (April 30)

Here are the top five things to look out for post election:

1. Priorities of the Ramaphosa administration with regards to economic policy, the public sector, parastatals and land will only gradually become clear after the election.

2. Investments and job creation with the participation of the private sector have been high on President Ramaphosa’s list at a national level (SONA, labour and investment summits), as well as the ANC election campaign.

3. The election outcome and a cabinet reshuffle will provide the earliest guidelines of how this could start to unfold.

4. The role of the economic cluster will become all important in President Ramaphosa’s investment drive. The ease of doing business, establishment of an infrastructure fund and the involvement of the private sector, funding from pension funds in the context of cleaner government and policies are all important developments.

5. There is a likelihood of the implementation of some of the ANC’s December 2017 resolutions. The nationalisation of the Reserve Bank is currently being debated with the focus on ownership in contrast to the mandate of the Reserve Bank that is enshrined in the constitution.

The timeline after 8 May

11 May: IEC briefing of the election results

15 May: Allocation of Parliamentary party seats, composition of Parliament and the appointment of the President and Speaker

25 May: The inauguration at Loftus Versfeld

26 May (possible): A new cabinet is announced

Unknown date: State of the Nation address (SONA)

*Figures accurate at time of writing

Tertia Jacobs is Investec’s Treasury Economist. The views expressed are her own and not Investec Bank Ltd.

The information contained in this communication does not constitute an offer, advertisement or solicitation for investment, financial or banking services. It is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice.

Corporate and Institutional Banking, a division of Investec Bank Limited. Reg.No. 1969/004763/06. An Authorised Financial Services Provider and registered Credit Provider. A member of the Investec Group.

Receive Focus insights straight to your inbox

About the author

Ingrid Booth

Lead digital content producer

Ingrid Booth is a consumer magazine journalist who made the successful transition to corporate PR and back into digital publishing. As part of Investec's Brand Centre digital content team, her role entails coordinating and producing multi-media content from across the Group for Investec's publishing platform, Focus.