10 Mar 2021

The mining carbon conundrum

Is the sector an enemy or ally in the climate fight?

As the economic picture grows stronger, we’re seeing a rise in commodity prices and shares in mining companies outperforming the markets in which they are traded. Some investors question the merit of investing in these sectors, with concerns regarding their history of high carbon emissions. But, while emissions remain high, mining companies are making substantial progress to bring them under control. More importantly, we must recognise that the minerals produced by miners are crucial to the decarbonisation of sectors such as transport and power.

Emissions in the mining sector have improved over the last decade

If we look at the UK equity market, four of the top ten emitters are in the oil or mining sectors, (with oil taking the top two slots, per million dollars of revenue). However, mining companies have made significant progress in recent years. As the charts below show, average greenhouse gas emissions and power consumption intensities in the mining sector are -45% and -20% respectively compared to a decade ago.

Source: Company reports for Anglo American, BHP, Rio Tinto, Glencore and South32

Alignment with the Paris Agreement (an international treaty aiming to limit global temperature increases) has fast become non-optional for all listed companies. Despite being a relatively small producer of greenhouse gases (roughly 2% of global emissions, excluding fugitive methane emissions in coal), most mining companies have ambitious, yet credible, carbon reduction plans, pledging to substantially lower greenhouse gas emissions by 2030. All larger companies have announced net-zero carbon goals (the date by which their operations will produce no carbon at all on a net basis).

Assessment of non-financial performance is becoming easier

As environmental performance is improving, disclosure is also evolving in a consistent and constructive way, informed by more competent in-house teams, and by better guidance and vetting from representative bodies like the Task Force on Climate-related Financial Disclosure (TCFD), the Responsible Mining Foundation (RMF) and third-party sources, such as Sustainalytics.

It has become easier to incorporate non-financial performance metrics into the valuation and selection of companies for stock portfolios, and easier to gauge the sector’s relative investment appeal as an industry that can thrive through economic and social cycles, while setting itself up as an industry of the future.

This latter point is what excites us. While the sector’s ten-year sustainability track record is impressive, what is arguably more important (and appealing) is what it can do to help create more sustainable industries over the next ten years.

Certain minerals are fundamental to decarbonisation

Let’s look at some of the mining products with a crucial role in the climate fight.

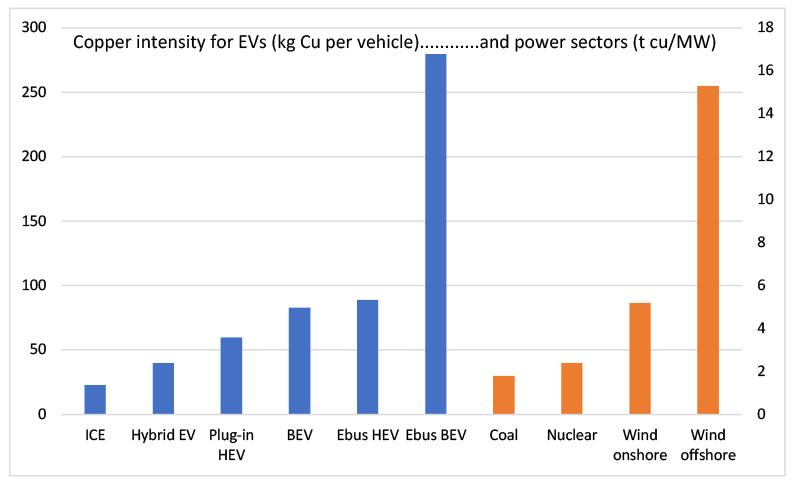

Copper is key to the low carbon transition due to its role in renewable energy and the electrification of transport. The average wind turbine has a copper usage intensity of about six times that of fossil fuels or nuclear plants for the same unit of output. A hybrid or electric vehicle (EV) requires around five times the amount of copper as a vehicle with an internal combustion engine. It is estimated that global copper demand will increase by around 80% over the next decade.

Such growth is even more pronounced in the case of nickel. Nickel is a critical metal used in the cathodes of electric vehicle batteries, and even the most conservative projections of future EV adoption will require a doubling in supply of the metal by 2040.

Aluminium, which is light, strong, and infinitely recyclable, is seen as the future metal of choice for vehicle manufacturers and for packaging. Though aluminium production is very energy and GHG intensive, producers now often use renewable energy.

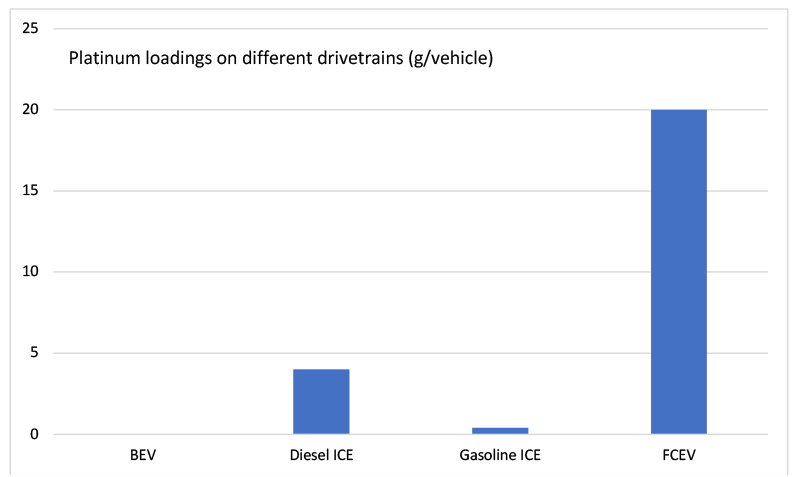

Platinum is a catalyst used in the production of hydrogen from renewables energies. Hydrogen could well end up being a substitute for natural gas in the steel-making process (i.e. green steel), as a clean source of power for heavy trucks, shipping and aviation (i.e. fuel cells), in the fossil fuel-free production of ammonia for fertilizers, and in combination with CO2 to produce methanol and other chemicals.

Source: Investec Wealth & Investment, Anglo American Platinum

Source: Investec Wealth & Investment, Anglo American Platinum

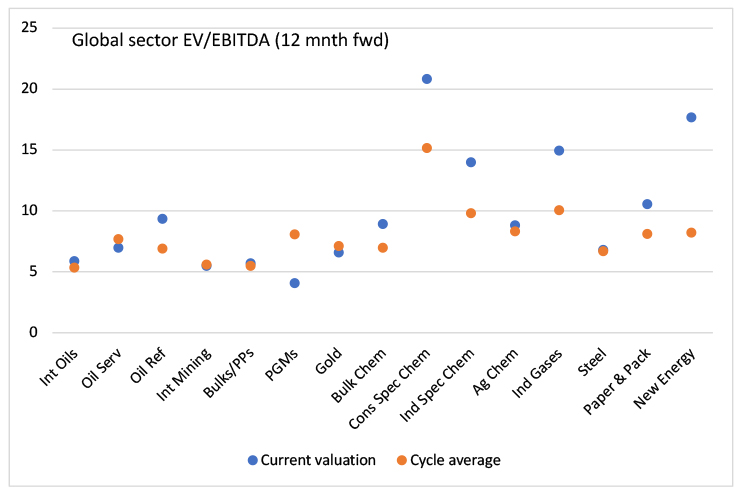

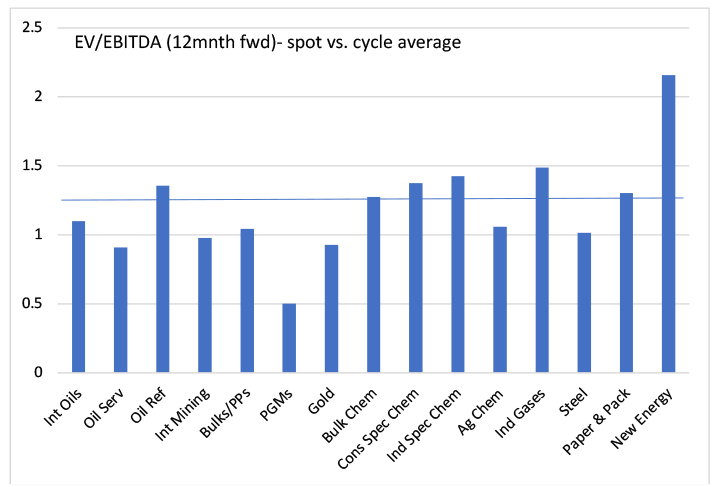

Identifying sustainable investment opportunities in the sector

The mining sub-sectors – integrated miners, bulks & pure plays, and precious metals – still trade on multiples that are below the averages of the past decade. In the context of improved portfolio positioning, better cash flows, stronger balance sheets, healthier returns to investors, and the sustainability factors discussed above, this doesn’t seem right, and so the sector provides both an attractive investment opportunity, in our opinion, and a source of the materials needed to help economies move onto a more sustainable path.

Source: Bloomberg consensus

Source: Bloomberg consensus

Within the sector, how do we identify the sustainability winners? We like companies that have steadily improving social and environmental track records, backed up by first-class disclosure, and clear and credible targets. We prefer companies that provide semi-annual reporting on sustainability matters, rather than annual. We like companies and management teams that weave sustainability into their strategies while optimising and improving the performance of legacy assets: more capital directed towards faster-growing, future-facing commodities such as copper and nickel, and the harvesting, optimisation and divestiture of legacy assets in fossil fuels.

To sum up: current market valuations contradict the mining sector’s strong financial and non-financial characteristics, new methods of production mean that the sectors’ emissions are much lower than they have been historically, and many of its products, like copper, aluminium, and platinum, are essential components when building a greener and more sustainable world. All things considered, we believe there is a strong case to be made for investment in the mining sector when considering climate change within client portfolios.

About the author

Campbell Parry is an analyst with Investec Wealth & Investment (IW&I), based in Cape Town, South Africa. He is responsible for analysis and coverage of resource companies in the global mining, oil & gas, chemicals, steel, and paper and packaging sectors. Prior to IW&I, he spent 7 years in institutional asset management covering resource companies and running a global equity fund, and 18 years prior to that on the sell-side with Investec and HSBC in South Africa, and with Scotiabank in Toronto, Canada. He has a Ph.D in chemistry from the University of Kwazulu-Natal and Purdue University, Indiana.