08 Feb 2019

Finance fit for the future

Innovative financing solutions support an increasingly sophisticated secondaries industry.

Record levels of capital are flooding into the global secondaries market. No less than 30 funds raised an aggregate $37bn in 2017, according to Preqin. And the popularity of the asset class shows no signs of waning. 2018 saw a spate of secondaries mega funds close, including Landmark, which hit its $7bn hard cap in October. Coller Capital is targeting $9bn for its latest flagship vehicle, while Ardian and Lexington Partners are both chasing $12bn, which would make them joint holders of the record for the largest secondaries fund ever raised.

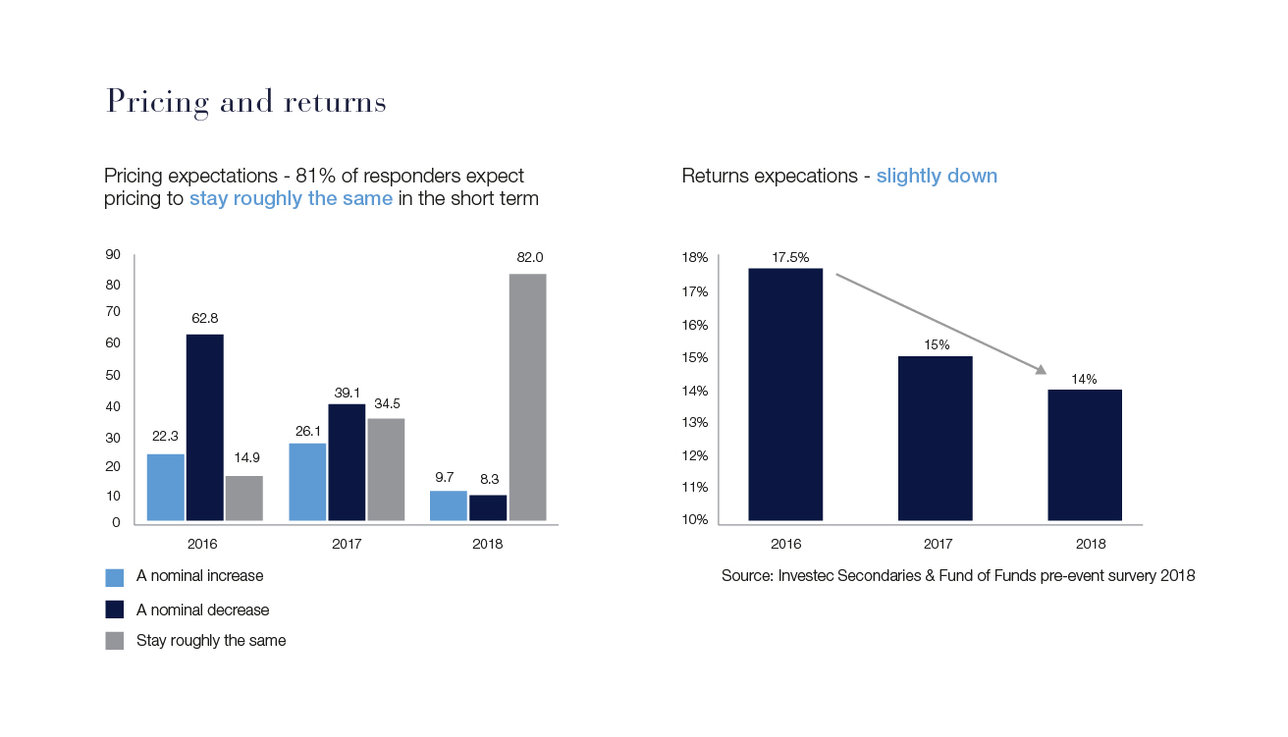

Escalating institutional appetite has resulted in unprecedented levels of uninvested capital. The industry was sitting on a total of $192bn of near term capital as of the end of 2018, as the Greenhill report states. This is four times the level seen in 2013. Pressure to deploy this abundance of funds is having a marked impact on pricing. Average pricing reached 98% of net asset value (NAV) in 2018, according to fund advisory firm Triago, up from 91% in 2012. Post 2012 vintages, with upside remaining, often trade at a premium.

Increased pricing is inevitably having an impact on returns. Investec’s own survey, ahead of its Secondaries and Fund of Funds Debt Seminar, held in London in September 2018, showed that secondaries' returns expectations fell from 17.5% in 2016 to 14% in 2018.

The growing maturity of secondaries as an asset class, coupled with this pressure on returns, means that firms are executing ever-more complex deals in order to deliver to their investors. In particular, there has been a marked rise in General Partner (GP)-led transactions, including a €2.5bn deal backed by Coller Capital and Goldman Sachs, which saw nine companies from Nordic Capital’s seventh fund moved into a new vehicle in April.

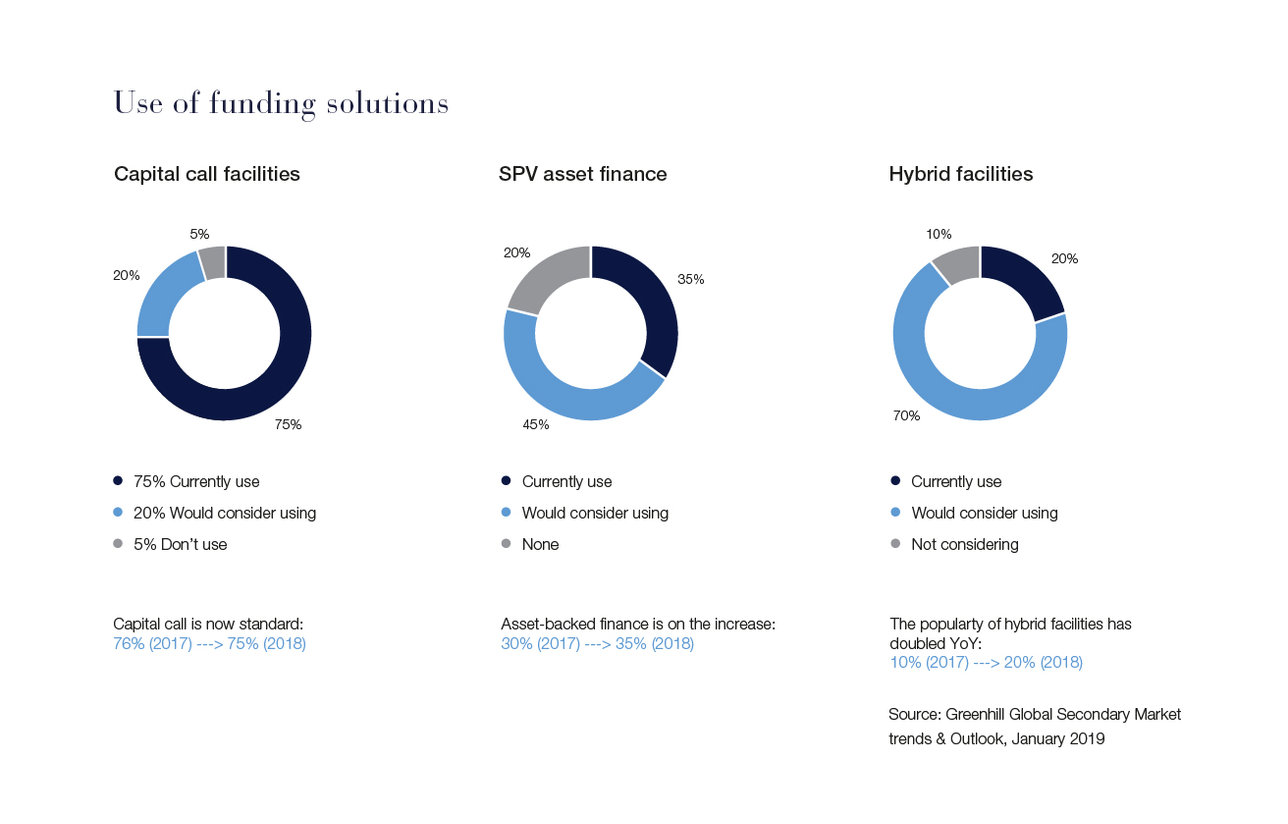

Returns compression has also led to a more pervasive use of fund finance. Just over three quarters (75%) of managers are using some form of capital call facility, according to Investec’s pre-event survey. But alongside increasingly complex transactions, the use of leverage is also becoming more sophisticated.

The growing maturity of secondaries as an asset class, coupled with this pressure on returns, means that firms are executing ever-more complex deals in order to deliver to their investors.

Hybrid facilities in particular, which blend capital call financing with financing secured against NAV, have taken centre stage. Uptake of hybrid structures has doubled to 20% year-on-year, the Investec survey shows. Furthermore, new solutions are continually being brought to market. One recent innovation that is supporting the growing sophistication of the secondaries market is Fund Unitranche Capital - a flexible, credit-based tool that blends preferred equity and asset-backed finance capital. (For more see Innovative Solutions below).

How existing solutions are evolving - Capital call facilities

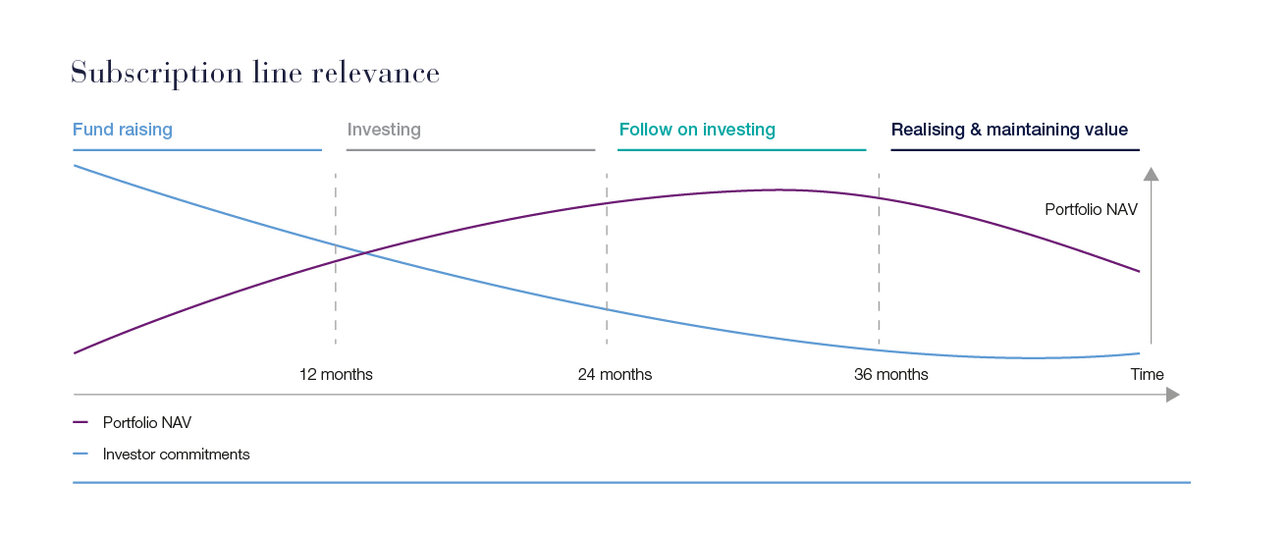

Capital call facilities may now be commonplace, particularly in the early stages of the fund cycle, but this mainstay of the fund finance world continues to evolve in terms of both the way it is structured and the way it is used. These facilities are no longer employed simply for operational reasons – to smooth the capital call process – but are being put in place for everything from bridging to a second close during the fundraising process; to financing GP commitments; optimising fund equity and facilitating bolt-on acquisitions.

Plain vanilla capital call facilities are widely available in the market and, in addition, Investec provides the following flexible and innovative solutions:

- Facilities can be based on revolving credit, term loans or guarantees

- They can be put in place at fund level, or below

- Uncommitted structures can quickly be switched to committed structures

- They can be multicurrency

- Hedging can be incorporated so that there is no mark-to-market settlement required (See Hedging for Success below)

It is worth noting that capital call facilities have sometimes attracted negative press but Limited Partners (LPs) themselves are broadly supportive of the use of fund finance, providing that there is adequate transparency and disclosure. Limited partner agreements are, in fact, becoming more flexible with regards length of term and borrowing restrictions.

However, LP side-letters are fairly prescriptive about the use of leverage. It is important, therefore, that the manager clearly articulates the details of its fund finance strategy to LPs.

What happens next?

As the fund matures and the pool of undrawn capital to secure lending against diminishes, the focus shifts towards using the portfolio of assets acquired by the fund as collateral.

Indeed, the industry has sometimes voiced frustrations that capital call facilities can expire quickly when deployment rates are high. But Investec has responded with a solution that enables managers to implement new and more appropriate facilities within a single credit framework, negating the need to start afresh in the market. In these later stages of the investment cycle, facilities secured entirely or partially against the underlying portfolio canbe used to fund follow-on investments and unlock value where there is no dry powder remaining.

Equally, they can be used to fund covenant-cures for investments facing difficulties. As the fund moves into the post-investment stage, meanwhile, the fund finance facilities continue to add value, with capital available to support the portfolio through to exit, without diluting multiples.

The nature of the facilities employed will depend on the risk profile of the underlying portfolio. For a well-diversified portfolio, facilities may be exclusively secured against NAV with repayments made through liquidity events at a portfolio level.

There are a number of trends that we observe in the diversified portfolio lending space. These include:

- Loan-to-Value (LTV) requests are stabilising or even softening

- Cash sweeps are increasingly being negotiated

- Margins have stabilised but pricing ratchets are more prevalent

- Lenders are doing deeper due diligence on the underlying portfolio

For more concentrated portfolios, the due diligence required will be even greater and the lender will be looking for liquidity events with a high probability to fund repayment.

The industry has sometimes voiced frustrations that capital call facilities can expire quickly when deploymentrates are high.

A hybrid approach

Managers are increasingly opting to take a hybrid approach, however, with lending secured against a combination of portfolio assets, undrawn commitments and potentially recyclable distributions. Hybrid facilities are growing in popularity, particularly for GP-led deals where the portfolios concerned may involve just a handful of or even a single asset.

The advantages of the hybrid approach are:

- Reduced margins and LTVs.

- Greater flexibility on cash sweeps and LTVs

Innovative solutions

While core fund finance solutions continue to evolve, with the relatively new hybrid facilities still attracting a great deal of attention, innovation never stops. Hand in hand with the fund managers and institutional investors that makeup the secondaries community, Investec is leading the way in delivering new and ever-more sophisticated tools.

Fund Unitranche Capital

Fund Unitranche Capital is a flexible, credit-based tool, made from a blend of equity and asset-backed (NAV)capital. The blended risk capital allows for a higher LTV or more flexibility than pure debt, but at a lower cost than preferred equity.

Security is held over the assets, holdco or cash flows. The borrowing entity itself is flexible.Terms are typically 12 months or more.

It is used for secondaries deals when typical asset-backed facilities prove impossible, for dividend recaps and for highly complex transactions such as the acquisition of a GP stake.

Fund Unitranche Capital is also used extensively in optimising the capital structure of GP-led deals. In these situations, the assets involved are frequently very varied. They are at different stages and carry different levels of leverage. It is important to consider whether each individual structure is able to bring the right equity money multiple return.

If not, it is possible to plug in a Fund Unitranche Capital solution, in order to provide that optimisation without disturbing the underlying businesses and its existing financing packages.

Hedging for success

Another area where private equity’s approach is envolving is the use of hedging solutions, in particular solutions for hedging foreign currency exposure. The way in which managers approach hedging varies significantly. While some have a highly developed policy in place, many give foreign exchange (FX) risk very little thought at all.

Analysis of EUR/USD, the most commonly traded currency pair in the world, shows annual positive and negative swings of between 20 and 30% every year for the past 18 years.

Profound FX movements caused by a spate of seismic geopolitical events over recent months and years have made headlines. According to Bloomeberg, sterling lost 20% of its value in four months following the Brexit referendum, while the Turkish lira lost 94% of its value against the US Dollar after Trump doubled existing trade tariffs when Turkey refused to release a US prisoner it claimed was involved in the attempted military coup.

But the dramatic currency shifts that have grabbed such widespread attention are not unusual occurrences. FX volatility is a constant. Bloomberg Analysis of EUR/USD, the most commonly traded currency pair in the world, shows annual positive and negative swings of between 20% and 30% every year for the past 18 years. Given that median private equity internal rate of returns (IRRs) remained flat at around 14% between 2010 and 2015, the potential impact of falling foul of unexpected currency movement is clear.

The challenge

And yet many private equity managers persist in ignoring FX risk, not because they object to hedging in principle, but because of the associated drain on capital from a collateral perspective.

Furthermore, it is likely that a fund will have to roll hedges and change the delivery date, either moving expiry further out or bringing it in. Rolling positions can create additional complexity and create further cash drag. If the contract has a negative mark-to-market at the time of rolling the deal, the manager must pay out additional capital to settle that loss before the expiry date can be changed.

Locking cash up in FX hedging tools in this way is an impractical solution for private equity managers focused on delivering return on capital for investors, not to mention having to find spare cash if the FX counterparty requests a variation margin at short notice.

The solution

Investec has sought to develop a more flexible, sympathetic offering, in response to the private equity industry’s specific needs. If the credit appetite is there, we will offer uncollateralised hedging lines. This could be a secured line, with security taken against LP commitments, the NAV of the underlying portfolio or future distributions from the fund. Investec also offers unsecured, uncollateralised lines.

Critically, our solution provides headroom on the hedging facility so that we don’t need to ask for capital upfront to book the contract. If those positions go out-of-the-money, it can also reduce the chance of calling for variation margin.

In addition to uncollateralised lines, we are able to change the delivery dates on hedges without having to settle any negative mark-to-market. We do this by incorporating the mark-to-market into the new hedge rate, rolling the deal off market so that there are no cash flow implications. Our ability to use credit limits to remove the negative cashflow impact has been crucial.

The fund finance industry has mirrored secondaries’ evolution with its own raft of innovations and Investec will continue to evolve it’s solutions to help facilitate complex transactions and boost returns.

Supporting change

Private equity is evolving rapidly and, as ever, it is the secondaries industry that is leading the charge. The market is fiercely competitive, prices are climbing and returns are coming down. The asset class has responded with a striking increase in sophistication, both in the complexity with which deals are being structured and in the savvy use of debt.

The fund finance industry, meanwhile, has mirrored secondaries’ evolution with its own raft of innovations and Investec will continue to evolve it’s solutions to help facilitate ever-more complex transactions and boost returns.

GP-led deals are becoming both more common and more complex. Big brand GPs are now embracing the opportunity and this has led to GP led activity surging to $24bn in 2018 with expectations that 2019 will exceed 2018's activity.

There are a number of motivations behind these deals. It could be driven by the need to raise capital for follow-on investment if uncalled commitments have runout, or it could be used to kickstart a new fundraising.

GP-led deals can be used to proactively manage portfolio construction, to realign incentives or to allow GPs to retain exposure to assets they believe in, even when they are forced to realise their investment for structural reasons.

LPs have welcomed these deals as a preferable alternative to managers selling assets to successor funds which can create inevitable conflicts. GP-led deals are also being structured in ever more creative ways.

We are seeing assets being rolled into new vehicles, for example the Coller Capital and Goldman Sachs-backed deal involving nine companies ownedby Nordic Capital. The advantage of these structures is that they can be tailored and generally at least 50% of LPs end up selling.

More recently, we have also seen GPs selling strips of funds. For example, Warburg Pincus sold a $1.2bn slice of Asian investments to a consortium led by Lexington Partners and Goldman Sachs in 2017.

These deals typically occur when a manager becomes over exposed to a particular geography, sector or vintage. Preferred equity solutions, meanwhile, have almost doubled in 2018, advisory firm Evercore says.

The ability for a lender to be nimble and adjust structure to a particular deal type will be important for GP, secondary buyers and fund LPs.

Strategic Funding for Secondary Funds

Browse articles in