14 Mar 2018

Planning your finances as a business owner

As a business owner, there are a number of tactics you can employ to extract profit from your business while keeping an eye on tax efficiency.

If you operate through your own UK limited company, you may want to consider extracting money from your company through a combination of salary and dividends.

Salary

The personal allowance for the 2018/19 tax year is £11,850 meaning this income is tax-free.

If your income consists solely of your company director salary, any additional salary above your personal allowance will be taxed at the following rates:

| Salary Income | Tax Rate |

|---|---|

| £0-£34,500 | 20% |

| £34,501-£150,000 | 40% |

| £150,000 + | 45% |

Dividend allowance

For the 2018/19 tax year the dividend allowance reduces from £5,000 to £2,000 per annum.

The dividend allowance means that an individual’s first £2,000 of dividends are tax-free. Income in excess of £2,000 in the form of dividends will be taxed at the following rates:

| Dividend Income | Tax Rate |

|---|---|

| £0-£34,500 | 7.5% |

| £34,501 - £150,000 | 32.5% |

| £150,000 + | 38.1% |

Income in excess of £100,000 will result in a loss of Personal Allowance (£11,850) of £1 for every £2 over £100,000.

Making personal pension contributions

When you pay money into your pension, you receive tax relief that reflects the rate of income tax you pay. Therefore, as a basic rate taxpayer, you effectively only pay £80 net to save £100 gross into your pension. Higher rate tax payers can reclaim additional tax relief via their self-assessment.

Although there’s no limit to the amount you can pay into your pension, there are limits to the amount you can contribute and still receive tax relief. The limit is currently 100% of your income, up to a maximum of £40,000.

If you earn £3,600 annually or less, the maximum amount you can contribute to your pension is £3,600 gross (£2,880 net of tax relief).

The Lifetime Allowance is the maximum value of benefits that can be taken from a registered pension scheme without being subject to a Lifetime Allowance charge. It may be possible to protect benefits in excess of the Lifetime Allowance that currently stands at £1 million increasing to £1.03 million from April 2018. The Lifetime Allowance will increase each year in line with the Consumer Price Index.

Making personal contributions as the director of a limited company

If you own a limited company and you draw salary and dividends, the dividends do not count as ‘Relevant UK Earnings’. Therefore, only your salary will be used to determine the amount of tax relief that you receive on your contributions.

Therefore, if you wish to increase the level of contribution into your pension and enjoy greater tax benefits, you can either increase your salary, or make the pension contribution straight from your limited company as an employer contribution.

Making employer contributions directly from your limited company

A limited company can contribute pre-taxed company income to your pension on the basis an employer contribution counts as an allowable business expense. Therefore, your company will receive tax relief against Corporation Tax, saving the company up to 20%.

Employers do not have to meet National Insurance obligations on pension contributions. The National Insurance rate for 2018/19 is 13.8%. Therefore, by contributing directly into your pension rather than drawing the equivalent in salary, the company saves up to 13.8%.

This is a total saving for the company of up to 33.8% (Corporation Tax savings plus the National Insurance savings) which equates to a saving of £13,520 on a £40,000 contribution.

However, your contributions must abide by HMRC rules for allowable deductions that state the pension contributions should be ‘wholly and exclusively’ for the purposes of the business.

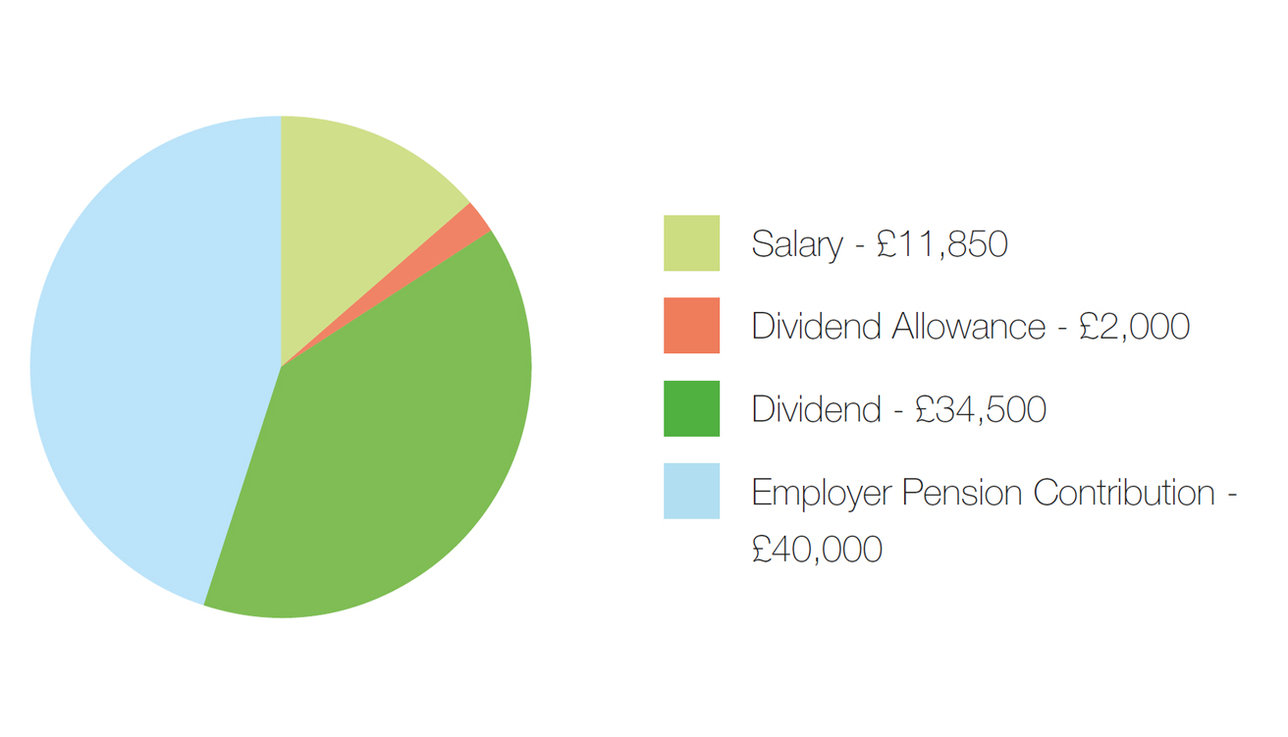

The example shows how an individual could structure their remuneration based on drawing £88,350 from the company in a tax-efficient manner:

| Source | Amount | Tax |

|---|---|---|

| Salary | £11,850 | £0 |

| Dividend Allowance | £2,000 | £0 |

| Dividend | £34,500 | £2,587.50 |

| Employer Pension Contribution (Gross) | £40,000 | £0 |

| Total | £88,350 | £2,587.50 |

Having made pension contributions and built a pension fund, there are numerous investment options now available. Understanding a client’s investment time frame, attitude to risk and capacity for loss is paramount when deciding on the most appropriate mix of asset classes.

Commercial Property

One investment option which many business owners find highly tax-efficient is buying commercial property via a SIPP (Self Invested Personal Pension). This is increasingly popular amongst business owners who choose to purchase their business premises via their pension scheme to take advantage of the tax breaks that are on offer.

It is not necessary for the SIPP to be able to purchase the property outright as it is permissible to borrow up to 50% of the net asset value of the pension fund to assist with the purchase. SIPP providers will allow external borrowing to raise the balance, which is particularly beneficial if the pension fund is not large enough to meet the full purchase cost of the property.

Permitted investments can include factories, offices, shops as well as hotels and care homes with any rental income received into the pension fund exempt from income tax. Therefore, if the commercial property is being rented by the business, the rent will be set at a market rate and paid into your SIPP rather than to a third party landlord. The rental payments are deemed to be an allowable business expense.

Other benefits include:

- Any gain resulting from an increase in the value of the property is exempt from Capital Gains Tax if sold within the pension wrapper.

- The fact a property held within a pension scheme is a totally separate legal entity to the member and/or their company, so it would be protected in the eventuality of financial distress of the member or the company.

- The new death benefit rules, which make investing in commercial property more popular for members who wish to undertake intergenerational planning in respect of their pension benefits. This can be tax-free if certain criteria are met.

- The possibility of leaving the pension and the assets to a non-dependent beneficiary, rather than paying it out as a lump sum, scope negating the need to sell the property on death.

As with any property investment, liquidity is something that needs to be considered as it is not possible to sell down a holding in part or quickly, in the way that you can with investment funds or equities for instance.

Summary

Please contact a member of the financial planning team to discuss how you currently structure your income, making pension contributions and your options regarding commercial property purchases via your pension, in more detail.

All statements within this article concerning tax treatment are based upon our understanding of current tax law and HMRC practice and can be subject to change.

This article is not intended to constitute personal advice and no action should be taken, or not taken, on account of the information provided.

Discover how you could benefit from financial planning services from our long-term strategic partner, Rathbones

Search articles in