A Confusing Picture

18 July 2023

It is not just the strength of the US economy that puzzled investment strategists and set the hare running.

5 min read

18 Jul 2023

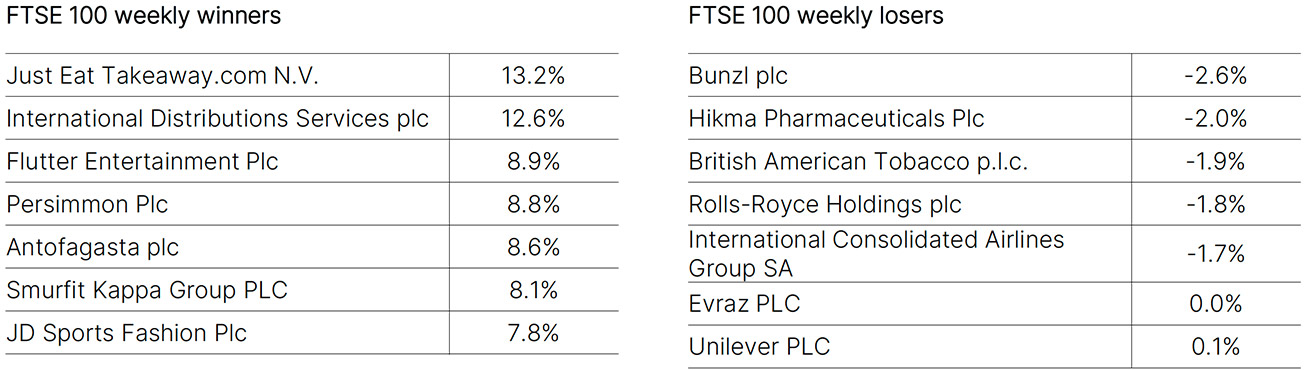

Welcome to our Economic Highlights, bringing you market updates from across the UK, US, Europe and China, as well as the FTSE weekly winners and losers.

The UK economy contracted by 0.1% month-on-month in May, compared with consensus estimates of a 0.3% fall (Investec -0.5%). Services were flat on the month, while construction output fell by 0.2%, as did manufacturing. The wider measure of industrial production declined by 0.6%, driven principally by a 2.0% drop in utility output, possibly a result of warmer weather conditions. May’s decline in GDP followed a 0.2% rise in April but overall economic growth between March to May was zero compared with the previous three months. On a monthly basis the economy is now 0.3% smaller than its peak before the Covid pandemic in January 2020. In aggregate terms, GDP was restrained by the additional Bank Holiday for the coronation of King Charles III, although the impact may have been slightly less than expected. Earlier, there were some tentative signs of loosening in the labour market, with the unemployment rate rising from 3.8% to 4% in May. However, wage growth of 7.3% means that the Bank of England will be in no mood to pause its policy tightening.

June’s inflation report was soft, with headline CPI inflation dropping further, hitting 3.0%, slightly below consensus for a 3.1% rise. The core measure, which excludes food and energy, remains far stickier, coming in at 4.8% (consensus: 5.0%), 1.8% points below the 6.6% peak hit in September 2022. Pulling down on the core measure, and in contrast to the past two months, were used car prices which fell by 0.5% on the month, as well as an 8.1% decline in air fares. Adding to that was a moderation in shelter price inflation, which makes up around 40% of the core CPI measure. The shelter price index gained just 0.4% on the month. But, does a slight inflation undershoot relative to expectations fundamentally change the collective view on the rate-setting Federal Open Market Committee? Probably not. The Fed, after having had its inflation-fighting credentials questioned during this tightening cycle, is likely to feel uncomfortable with a 4.8% core inflation rate, prompting a further rate increase later this month. However, it is possible that might constitute the last increase of this cycle.

Sentiment survey data continued to deteriorate. The Sentix Investor Confidence reading fell another five points to -22.5, and has now give back about half of its recovery from last October’s low point. There is a similar shape to the chart of the ZEW survey for expectations of economic growth. That fell from -10 to -12. It hit a low of -60 last autumn (which was lower than in March 2020 when the pandemic struck) and last peaked at 30 in February. Despite these survey results, the European Central Bank is not for turning yet, and two more 0.25% interest rate increases are expected.

GDP expanded by 0.8% quarter-on-quarter in Q2, a sharp slowdown from the 2.2% recorded in Q1. The weaker quarterly bounce comes amid a struggling external demand environment which has hit Chinese export growth, coupled with domestic property woes and a cautious Chinese consumer that is preferring to save its pandemic savings, rather than spend. The monthly activity numbers, which accompanied the quarterly data,highlighted some of these headwinds to growth for the Chinese economy. For example, real estate investment was 7.9% lower in the first half of 2023 compared to the first half of 2022, while youth unemployment (defined as those aged 16-24) hit a new record high of 21.3%. There is a distinct skills mismatch hitting fresh graduates in China, with the recent crackdown on sectors such as private education, which would typically sweep up many new graduates, limiting the amount of graduate jobs available. This comes at a time where the supply of students finishing college or university is set to reach a record high this year. With external demand weakening the Chinese economy can no longer rely on an export driven model to stimulate economic growth. The issue for policymakers is that the domestic economy is struggling to make up the difference. The People’s Bank of China has started to cut rates to try to stimulate domestic growth and there has been talk of a stimulus package coming, but details are scarce.

The information in this document is for private circulation and is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgement as of this date and are subject to change. The Company and its related Companies, directors, employees and clients may have positions or engage in transactions in any of the securities mentioned. Past performance is not necessarily a guide to future performance. The value of shares, and the income derived from them, may fall as well as rise. The information contained in this publication does not constitute a personal recommendation and the investment or investment services referred to may not be suitable for all investors. Copyright Investec Wealth & Investment Limited. Reproduction prohibited without permission.

Member firm of the London Stock Exchange. Authorised and regulated by the Financial Conduct Authority.

Investec Wealth & Investment Limited is registered in England.

Registered No. 2122340. Registered Office: 30 Gresham Street, London EC2V 7QN.