31 Jul 2020

The impact of Covid-19 on aviation

The aviation sector was hit hard when the world went into lockdown and the global Coronavirus pandemic took hold. As travel restrictions ease, Investec’s Aviation Finance Report examines the outlook for the industry and identifies the opportunities for growth.

Executive summary

-

The impact of Covid-19

Covid-19’s impact on air travel has been significantly more disruptive than 9/11, SARS or the GFC. In June, IATA estimated air travel will decrease by ~55% in 2020 relative to 2019 levels. The severe impact has led to sizeable government support packages, worth in excess of $125bn (as of early June 2020) across multiple jurisdictions (principally led by the US, France, the Netherlands, Germany and Singapore), confirming the crucial role aviation plays in the global economy.

-

Rebalancing of risks and rewards

We are seeing a rebalancing of the risk / reward metric in the aviation debt and equity markets as capital becomes increasingly scarce. In addition, top tier airlines are now using their unencumbered aircraft assets to raise cash and shore up their balance sheets, presenting increased opportunities for financiers. We are already working with several airlines to support them while providing opportunities to our investors.

-

Opportunities for investment

Investec Aviation Debt Funds invest in senior secured loans backed by new generation, in-production commercial jet aircraft. Loans to airlines and aircraft lessors globally with tenors of 4 – 12 years that yield 3 – 6% through the cycle in a diversified portfolio of select new generation assets present opportunities to build a diverse portfolio of loans, across credits, geographies and assets.

Following a near total shutdown in air travel, recovery is underway, albeit at differing rates across geographical regions. In Europe we see that it is the leisure focussed carriers which have quickly added capacity – noting that the more nimble low cost carriers have been able to grow faster than their legacy airline rivals whose business models rely more on connecting traffic from long-haul destinations.

We view the recovery as lumpy in the short to medium term as additional waves of the pandemic occur and create setbacks. Airlines with large domestic markets and those which are able to efficiently adapt to changing route networks and practises will be best placed to capitalise as the recovery continues.

The space for insurance wrapped aircraft financing has been growing in recent years with products such as AFIC and Balthazar aimed at new aircraft deliveries. Other Non-Payment Insurance (NPI) products for delivered aircraft are also available.

In these NPI–backed transactions, lenders/investors finance the aircraft with an enhanced credit risk profile, benefitting from the significantly higher credit rating of insurers than airlines. The yields of these transactions have also increased compared to pre-COVID levels, and we view this as an attractive proposition to investors seeking exposure to investment grade risk baked by hard asset security.

As expected spreads have increased generally, with the magnitude of the increase varying significantly between different geographies and airline credits. In April / May, European top tier airlines saw a circa 100bps increase in their aircraft secured spreads. The increase was more pronounced for US carriers, which saw increases of up to ~400 bps among the big 4 US carriers. Lessor spreads have also increased with many banks only lending to their core clients and not lending into limited recourse transactions.

The lessor ABS market remains shut along with tax structures such as the JOLCO. We believe that these factors will continue to support higher spreads in the short term but we note that certain European banks and financiers are returning to business supporting Tier 1 credits. As such, we expect the spreads for stronger credits to start reducing gradually but will remain high for weaker credits.

In the news this quarter

A bullish outlook for recovery

Recovery in Europe is moving at a slower pace than China and North America. However, central European low-cost carrier, Wizz Air has been quick out of the blocks in relaunching its operations. Whereas, EasyJet announced they would increase the number of routes operated from the start of July as they looked to serve half their normal destinations that month and 75% in August.

EasyJet was planning to operate around 500 flights per day across Europe from the start of July. Although this represents a significant ramp-up of operations, it still represents only around 30% of normal summer capacity. Airlines in Europe are also moving to reduce costs with further announced redundancies looming: British Airways, EasyJet, Virgin Atlantic, Ryanair, SAS, and Lufthansa seeking to cut a combined total of 53,650 employees.

US airlines secure $12.4bn in government funding

As of May, 93 US airlines have secured $12.4bn of an available $25bn in government funding for payrolls, each getting 70 per cent in the form of grants that do not have to be repaid. As well as curbing share buybacks and executive pay, companies that took the money agreed not to lay off staff or axe routes until September 30, even though air passenger volumes in the US have fallen by more than 90 per cent since March.

US airlines also have the option of further government funding from a second $25bn bailout pot, which would come as secured loans with an interest rate that fluctuates based on a carrier’s creditworthiness.

South America: grounded

In June, IATA strengthened calls for Latin American governments to assist their respective airline industries in order to help them survive the coronavirus crisis that has brought the sector to a near-standstill. Air traffic fell by ~96% in Latin America and the Caribbean as the coronavirus pandemic reached its peak in April, and has yet to make any significant steps toward recovery. Latin American governments have been much less forthcoming in their support for the commercial aviation industry than those in other areas, such as North America and Europe.

Much of South America continues to have significant travel restrictions in place. In May two of the continent’s major airlines, Colombia’s Avianca and Chile-based LATAM Airlines filed for Chapter 11 bankruptcy in the US, with Grupo Aeromexico filing in June as they look to rebalance debt and protect themselves from creditors.

B737 MAX7 awaiting take-off

At the end of June, pilots and test crew from the US Federal Aviation Administration (FAA) and Boeing took to the skies in a B737 MAX 7, and in a little over 10 hours of flight, completed the certification test flights schedule for the B737 MAX.

The FAA has said it will now evaluate data from the three days of testing. An extensive to-do list must be accomplished before the plane can receive clearance to fly passengers again, a milestone now expected no sooner than mid-September.

Slow recovery from Covid-19 expected

The industry generally expects a slow recovery to pre-crisis activity levels, with changes to industry practices (e.g. aircraft hygiene controls, passenger health screening) and passenger behavior (e.g. rapid adoption of video conferencing, increased preference for nonstop flights). As was the case with 9/11, certain aircraft types and age cohorts are expected to be the most vulnerable to permanent retirement.

The particulars of the coronavirus crisis and its acute effect on long-haul intercontinental traffic relative to short-haul and domestic travel is expected to disproportionately affect the widebody passenger aircraft market relative to the narrowbody passenger aircraft market.

How has the market responded?

Investment grade - Many issuers are experiencing some of the best funding conditions they have ever seen as rates remain near historic lows and spreads have retraced a significant portion of their widening. In June, Southwest priced a $2.0bn unsecured offering across a 3yr and 5yr tranche at 4.90% and 5.25%, respectively. This was the first unsecured airline offering in the aviation space post COVID-19.

BOC Aviation, a subsidiary of state owned Bank of China, raised $750m on 26 May 2020. The 3.5 year bonds, rated A- by both S&P and Fitch, closed with a coupon of 2.75%, and a spread of 260bps over US Treasuries. BOC Aviation, an aircraft leasing company, stands out among its peers for its business strategy during the pandemic. The company has moved to expand and grab a greater market share, knocking out competition that may be holding back because of the weak market. The lessor’s capital expenditure is expected to be about $6 billion - $6.5 billion in 2020.

No new ABS issuances since the COVID-19 shutdown in February 2020. ~89% of Class C and ~80% of Class A notes had principal shortfalls in May remittance reports.

Secondary Market trading volumes have decreased as cash flow stress becomes evident. Traded ABSs have been those with shorter tenors and ‘cleaner’ portfolios (narrowbody aircraft, without significant exposure to weaker lessees).

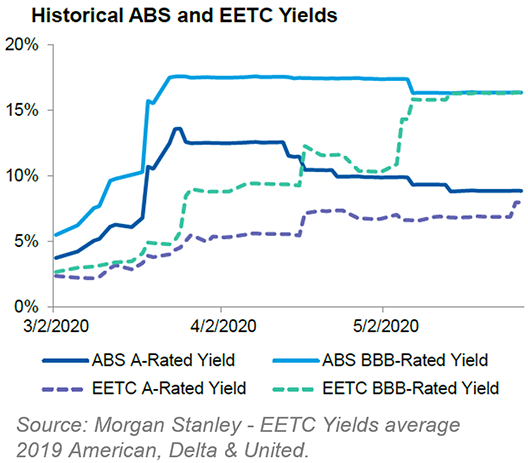

Yields on aircraft ABS widened more dramatically and sooner than yields on EETC’s. Yields have since converged for A-rated ABS and EETCs, and for BBB-rated ABS and EETC’s – see graph opposite.

27th May, Air Canada issued a $325m ‘Super C’ EETC due in 2023. Priced at 10.5% coupon. The transaction is cross-collateralized by 27 aircraft (including 737Max and widebody aircraft), with an LTV of ~84% and is subordinate to previously issued EETCs. The transaction was rated Ba2 by Moody’s and BB by S&P.

YTD there have been a number of capital raises across US carriers (including: Delta, United, American, Hawaiian, JetBlue, Southwest, Allegiant & Spirit) with debt issuances totaling $29.5bn.

Looking ahead: what can we learn from China’s Travel restart experience

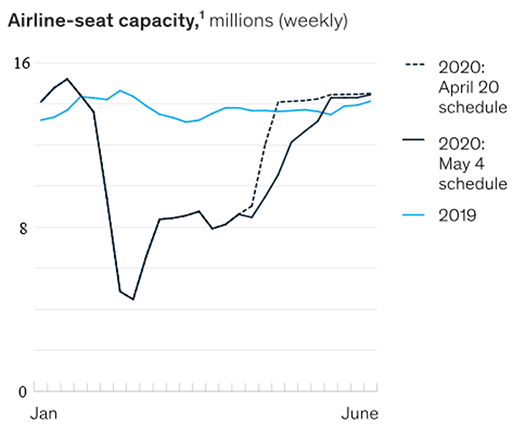

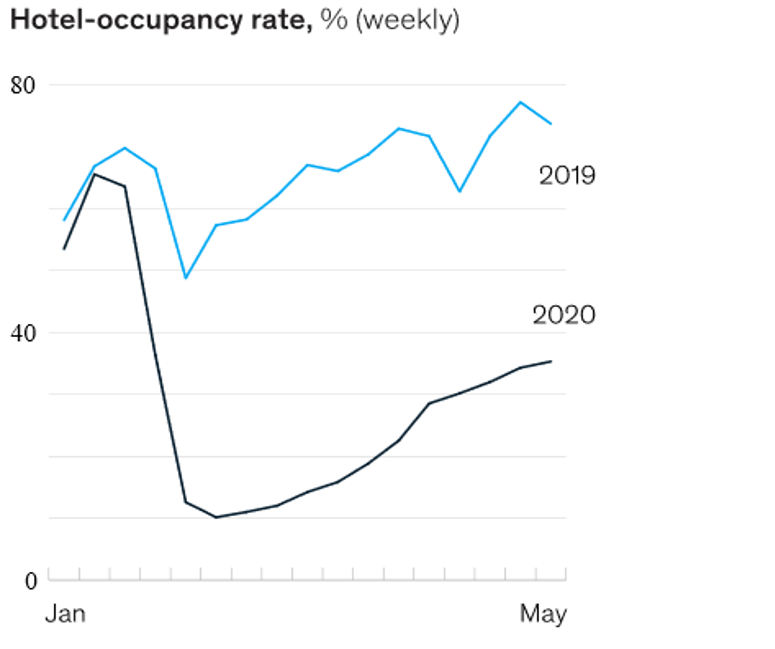

With China’s Covid-19 lockdown over, travel is beginning to restart. A recent McKinsey consumer survey reports that when lockdown ends, the first thing people want to spend money on is eating out, the second is travel, and that confidence in domestic travel had risen 60% over the first two weeks of May. Domestic flight capacity and hotel occupancy are rising gradually as illustrated below.

Not surprisingly the young and the non-family segment are more open to resuming travel.

The changing traveller demographics are leading to a quicker rebound in midscale and economy hotel bookings. Luxury hotels have been hit by the new spending patterns coupled with the lack of inbound international business travel and conference demand.

The McKinsey consumer survey further reports that in China the travel-recovery peak will likely come after the national holiday in September 2020.

To control capacity tourist sites, including theme parks and even city level public parks have introduced preregistration schemes. Visitor must show a green QR code, issued by the government (based on previous travel histories and potential exposure to the virus).

On flights, all magazines and newspapers have been removed. For food and beverages, travellers get packaged snacks and bottled water. Airports check temperatures both when passengers arrive and right before they board their flights. A health QR code is required for check-in and, in certain destination airports, after landing. Some airlines have also launched new ancillary products catering to emerging customer demand; for instance, one-off lounge passes and extra fees to keep adjacent seats free.

Although the recovery will differ country by country, common themes are expected. People still want to travel. Many are calling this “revenge travel”. Bookings for cruises in the United States, arguably one of tourism’s hardest-hit sectors remain strong for 2021. International survey results resemble what is being seen in China; domestic travel will return first with international travel taking much more time to recover.

Travel is anticipated to return in other countries much as it has in China. The young will go first. Travel will involve nearby destinations. Economy travel will recover more quickly and outdoor and nature-related destinations will be more popular than congested cities.

Investec Aviation Debt Funds

$5bn

6 years

25+

Strong alignment of interest

Proven track record

Secured loans

Find out more about Aviation finance from Investec

Investec co-invests in all managed platforms, with strong technical capabilities and a proven track record in originating, releasing and remarketing aircraft.

Disclaimer

This presentation and any attachments (including any e-mail that accompanies it) (together “this presentation”) is for general information only and is the property of Investec Bank plc (“Investec”). It is of a confidential nature and all information disclosed herein should be treated accordingly.

Making this presentation available in no circumstances whatsoever implies the existence of an offer or commitment or contract by or with Investec, or any of its affiliated entities, or any of its or their respective subsidiaries, directors, officers, representatives, employees, advisers or agents (“Affiliates”) for any purpose.

This presentation as well as any other related documents or information do not purport to be all inclusive or to contain all the information that you may need. There is no obligation of any kind on Investec or its Affiliates to update this presentation. No representation or warranty, express or implied, is or will be made in relation to, and no responsibility or liability is or will be accepted by Investec or its Affiliates as to, or in relation to, the accuracy, reliability, or completeness of any information contained in this presentation and Investec (for itself and on behalf of its Affiliates) hereby expressly disclaims any and all responsibility or liability (other than in respect of a fraudulent misrepresentation) for the accuracy, reliability and completeness of such information. All projections, estimations, forecasts, budgets and the like in this presentation are illustrative exercises involving significant elements of judgement and analysis and using the assumptions described herein, which assumptions, judgements and analyses may or may not prove to be correct. The actual outcome may be materially affected by changes in e.g. economic and/or other circumstances. Therefore, in particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the achievability or reasonableness or any projection of the future, budgets, forecasts, management targets or estimates, prospects or returns. You should not do anything (including entry into any transaction of any kind) or forebear to do anything on the basis of this presentation. Before entering into any arrangement, commitment or transaction you should take steps to ensure that you understand the transaction and have made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. No information, representations or opinions set out or expressed in this presentation will form the basis of any contract. You will have been required to acknowledge in an engagement letter, or will be required to acknowledge in any eventual engagement letter, (as applicable) that you have not relied on or been induced to enter into engaging Investec by any representation or warranty, except as expressly provided in such engagement letter. Investec expressly reserve the right, without giving reasons therefore, at any time and in any respect, to amend or terminate discussions with you without prior notice and disclaim hereby expressly any liability for any losses, costs or expenses incurred by that client.

Investec Bank plc whose registered office is at 30 Gresham Street, London EC2V 7QP is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, registered no.172330.

Browse articles in