30 Apr 2021

Aviation Market Snapshot - Q1 2021

Executive summary

-

The airline industry recovery looks to be sporadic

In the short term, the industry's recovery is dependent on the development and rollout of effective Covid-19 vaccines and the easing of travel restrictions. The recovery will be multispeed and patchy across travel segments and geographies, with the expectation of domestic travel recovering first, followed by short-haul leisure and then long-haul leisure and business travel.

-

Covid-19 continues to cause an unparalleled demand shock to airlines

Progress remains fragmented across markets. During the quarter, positive signs emerged from domestic markets in Australia, Russia and the US but most international markets deteriorated. Europe and Latin America were among the primary contributors of the global downward trend in air traffic during the quarter, reflecting new and more virulent waves of Covid-19. Slow vaccination progress in many countries has led many governments to maintain travel restrictions. North America has progressed the furthest, but in Africa and APAC, vaccinations have barely started.

-

Inconsistency in international quarantine requirements hinder the rebound

The response of governments to virus mutations has been simple, increase lockdowns and travel restrictions. While pre-departure testing has been introduced across much of the world, there is little coordination or concession on quarantine requirements, which is hindering the rebound in air travel. The International Air Transport Association (IATA) continues to lobby governments that systematic testing is a means to open borders safely without quarantine and will soon launch the IATA Travel Pass to help travellers and governments manage digital health credentials. However, for the full benefits of the IATA Travel Pass to be realised, governments must agree on the standards for the information they want.

-

Recovery to 2019 traffic levels some years away

The aviation sector is fundamental to trade and human interaction and repeatedly demonstrates resilience to global shocks. The ability of aircraft lessors who have recently priced both unsecured debt and aircraft asset-backed security (ABS) transactions at historically low interest rates coupled with a slight uptick in M&A activity is an indicator that optimism is returning to that market segment.

Capital markets are open to top tier airlines looking to raise liquidity as the pandemic persists. These carriers can borrow at significantly lower margins than this time last year, coupons of sub-150bps in some cases. Improved margins can be attained by investing in the debt tranche of leasing transactions, especially where there is an element of residual risk. Through the careful selection of airline credit, asset type and lease manager, superior risk-adjusted returns can be achieved. Non-bank lenders are turning their attention to the aircraft debt space, as evidenced by a number of new platforms, established to take advantage of opportunities as the recovery gathers pace.

This has been driven by a v-shaped recovery in global industrial production to above pre-pandemic levels, coupled with shipping constraints. The IMF forecasts global GDP to grow by 6% this year (2020 - contraction 3.3%). The growth is expected to continue as companies respond to increased demand and begin to restock inventory. Goods that ordinarily would have gone by sea are now going by air, as maritime shipping remains constrained and companies seek faster deliveries. The strongest trade lanes are between Asia and North America and over the Middle East hubs. Yields have increased as air cargo faces a continuing capacity shortage, with much of the widebody passenger fleet (belly-freight) grounded by travel restrictions.

There are signs that traffic will continue to pick up in North America. In three months, 22% of the US population has received a vaccine dose (40 million people are fully vaccinated and 33 million have received a single dose). Demand for domestic travel has recovered to ~2/3rds of pre-pandemic levels. This is welcome news for US carriers; wherein 2019 domestic travellers accounted for 85% of their passengers and generated 73% of revenues. The recovery for international traffic is still contingent upon the vaccine rollout across other countries and the coordination of global standards to securely record test and vaccination data.

The optimism being displayed in the aviation equity markets is well placed. The successful testing and gradual rollout of the global vaccine program has changed the question from if to when will airline passenger markets trend back to normality. It is becoming increasingly clear to us where investment in aviation will bear fruit first, based on the pace of vaccination and extent of domestic and regional flying that will be possible.

In the news this quarter

Global passenger traffic remained weak in February 2021, with Revenue Passenger Kilometres (RPKs) down 75% from pre-pandemic February 2019. The weakness was driven by deterioration in most international markets, including Domestic China. China experienced a dip in its domestic traffic recovery over the Lunar New Year following the resurgence of new Covid-19 cases and increased restrictions. However, domestic travel in China rebounded in March following containment of the virus.

IATA reported that airlines releasing financial results in Q4 2020, confirmed continued deep losses associated with the ongoing impact of Covid-19. Declining profitability was seen across all regions, most significantly Latin and North America. However, the extent of the losses was lower than the previous two quarters, with losses mitigated by robust cargo revenues (back to pre-pandemic levels) and dramatic cost-cutting measures.

Western governments continue to support state carriers, confirming the key role that aviation plays in economic development. Recently the French government announced additional funding of up to $4.7 billion to Air France/KLM. In the US, airlines and airports will benefit from the new $1.9 trillion Coronavirus Relief Package.

In North America, the news was more upbeat, with United joining budget carriers Allegiant Air, Frontier Airlines and Spirit Airlines in resuming pilot hiring. United CEO, Scott Kirby noted that domestic leisure travel demand has nearly recovered to pre-Covid levels. American Airlines also reported that it would return most of its fleet to service with net bookings at 90 per cent of 2019 levels. Meanwhile, Alaska reported that it had generated positive operating cash flow in March for the first time since early 2020 with bookings strong going into the summer.

AerCap and GECAS announced a $30 billion mega-merger between the industry’s two largest lessors. The combined entity will have more than 2,000 aircraft under management, 900 aircraft engines and 300 helicopters, accounting for circa 17% of the total market share of leased aircraft.

In March, AerCap and GECAS announced a $30 billion mega-merger between the industry’s two largest lessors. The combined entity will have more than 2,000 aircraft under management, 900 aircraft engines and 300 helicopters, accounting for circa 17% of the total market share of leased aircraft. The next largest leasing company is Avolon, with 593 aircraft and circa 5% of the leased fleet. AerCap CEO, Angus Kelly, recently said that cost-conscious airlines globally would broadly shift from owning to leasing aircraft. This trend is anticipated to accelerate as airlines emerge from the Covid-19 downturn, with airlines focusing on paying down debt and any government state aid loan obligations ahead of buying aircraft. The transaction is expected to close in Q4 2021 following regulatory approvals.

Despite the pandemic, appetite remains for leasing platforms, which can provide solid returns across a diverse lessee base. On 29 March 2021, global investment firm Carlyle announced the acquisition of Fly Leasing Limited (NYSE: FLY). The total enterprise value of the transaction is ~$2.36 billion. The per-share cash consideration represents a premium of ~29% to FLY’s closing price on 26 March. CEO of FLY, Colin Barrington, noted that the transaction represents strong value for Fly shareholders at a time when airlines are facing an extremely difficult environment and smaller aircraft lessors are disadvantaged in the debt markets. Fly’s portfolio consists of 84 aircraft and seven engines on lease to 37 airlines in 22 countries. The transaction is expected to close in Q3 2021 following regulatory approvals.

During the quarter, further investments were reported in the growing area of electric aircraft. British Airways announced that it had joined a consortium of companies investing $24.3 million in ZeroAvia and the developmental hydrogen-electric aircraft. ZeroAvia has ambitious plans for a hydrogen-electric 20-seat aircraft by 2024, a 50-seat plus aircraft by 2026, and a 100-seat plus aircraft post-2030. Finnair, United Airlines and Widerøe (a Norwegian regional airline) have also announced deals with electric aircraft developers in recent months.

How has the market responded?

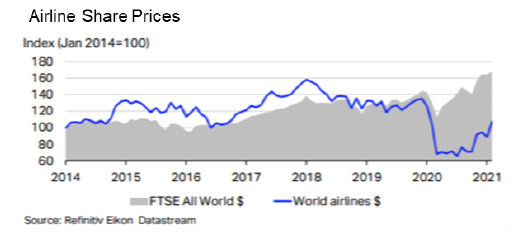

- Airline share prices increased ~21% in February (month on month) reflecting optimism over the vaccine rollout and the recovery of leisure travel for the summer season. The increase was across all regions, with North American airlines showing the largest rise (29%). However, the airline index was well below pre-pandemic levels (-21% vs Dec 2019) and lagging behind global equity markets. Come March, the trend was reversing, amid concerns of virus spikes in Europe dampening enthusiasm of summer travel, offsetting positive developments in the US.

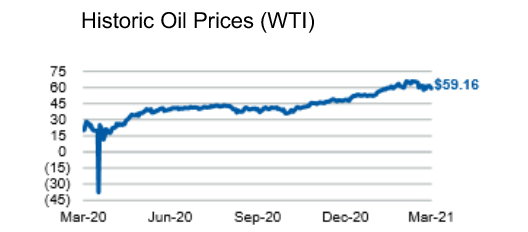

- Oil and jet fuel prices strengthened in March amid growing optimism of wider economic growth. This increase in jet fuel, which represents ~25% of total airline operating costs, will add to the challenge airlines face becoming cash positive.

- Capital markets continue to remain active for stronger airline credits and investment-grade investments. Examples of recent debt capital market deals include:

- 18 March, IAG priced a two-part $1.4bn senior unsecured bond issuance due in 2025 and 2029. The notes have coupons of 2.750% and 3.750% and are rated B1 and BB by Moody’s and S&P, respectively.

- 12 March, China Eastern Airlines priced a two-part ¥9.0bn senior unsecured issuance due in 2027 and 2031, respectively. The notes have coupons of 3.680% and 3.950% and are unrated.

- 10 March, American airlines priced a $3.5bn senior unsecured term loan due in 2028. The issuance has a coupon of L+ 475bps and is rated Ba3, B- and B- by Moody’s, S&P, and Fitch, respectively.

- 10 March, American Airlines priced a two-part $6.5bn senior secured bond issuance due in 2026 and 2029. The notes have coupons of 5.500% and 5.750% and are rated Ba2 and BB by Moody’s and Fitch, respectively.

- 24 February, EasyJet priced €1.2bn of senior unsecured notes due 2028. The issuance has a coupon of 1.875% and is rated BBB- by S&P.

- 11 February, Lufthansa priced a €1.6bn two-part senior unsecured bond due 2025 and 2028. The issuance has coupons of 2.875% and 3.750% is rated Ba2 and BB- by Moody’s and S&P, respectively.

- We expect the bifurcation of the market to continue with spreads staying low for strong carriers and significantly above pre-COVD levels for the rest of the market.

- On 31 March, Frontier Airlines became the second US Low Cost Carrier in a month to file for an IPO, on the proposition that affordable leisure travel will rebound first from the pandemic. Frontier has a fleet of over 100 aircraft serving over 100 destinations to leisure-focused customers. The shares closed on 1 April at the lower end of the list price netting ~$266 million. In comparison, on 16 March, Sun Country Airlines, roughly half the size of Frontier, saw its shares soar 50% on its Wall Street debut. The IPO was 13 times oversubscribed and netted the airline ~$218 million. Proceeds from the IPO will go first to repaying the airline’s $45 million CARES Act loan and then towards funding an ambitious growth plan. Sun Country is a niche discount carrier with a fleet of 43 aircraft carrying both passengers and cargo. A key difference between the two airlines is that Sun Country also operates 12 x 737 freighters for Amazon that helped the airline achieve an operating profit in 2020.

Investec Aviation Funds

$5bn

6 years

Strong alignment of interest

10 years

Proven track record

25+ people

Find out more about Aviation finance from Investec

Investec co-invests in all managed platforms, with strong technical capabilities and a proven track record in originating, releasing and remarketing aircraft.

Disclaimer

This presentation and any attachments (including any e-mail that accompanies it) (together “this presentation”) is for general information only and is the property of Investec Bank plc (“Investec”). It is of a confidential nature and all information disclosed herein should be treated accordingly.

Making this presentation available in no circumstances whatsoever implies the existence of an offer or commitment or contract by or with Investec, or any of its affiliated entities, or any of its or their respective subsidiaries, directors, officers, representatives, employees, advisers or agents (“Affiliates”) for any purpose.

This presentation as well as any other related documents or information do not purport to be all inclusive or to contain all the information that you may need. There is no obligation of any kind on Investec or its Affiliates to update this presentation. No representation or warranty, express or implied, is or will be made in relation to, and no responsibility or liability is or will be accepted by Investec or its Affiliates as to, or in relation to, the accuracy, reliability, or completeness of any information contained in this presentation and Investec (for itself and on behalf of its Affiliates) hereby expressly disclaims any and all responsibility or liability (other than in respect of a fraudulent misrepresentation) for the accuracy, reliability and completeness of such information. All projections, estimations, forecasts, budgets and the like in this presentation are illustrative exercises involving significant elements of judgement and analysis and using the assumptions described herein, which assumptions, judgements and analyses may or may not prove to be correct. The actual outcome may be materially affected by changes in e.g. economic and/or other circumstances. Therefore, in particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the achievability or reasonableness or any projection of the future, budgets, forecasts, management targets or estimates, prospects or returns. You should not do anything (including entry into any transaction of any kind) or forebear to do anything on the basis of this presentation. Before entering into any arrangement, commitment or transaction you should take steps to ensure that you understand the transaction and have made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. No information, representations or opinions set out or expressed in this presentation will form the basis of any contract. You will have been required to acknowledge in an engagement letter, or will be required to acknowledge in any eventual engagement letter, (as applicable) that you have not relied on or been induced to enter into engaging Investec by any representation or warranty, except as expressly provided in such engagement letter. Investec expressly reserve the right, without giving reasons therefore, at any time and in any respect, to amend or terminate discussions with you without prior notice and disclaim hereby expressly any liability for any losses, costs or expenses incurred by that client.

Investec Bank plc whose registered office is at 30 Gresham Street, London EC2V 7QP is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, registered no.172330.