22 Mar 2022

Aviation Market Snapshot Q3 2020

Executive Summary

-

Covid-19 has disrupted the market equilibrium

However, the fundamental investment thesis remains intact, long-term demand for air travel still exists and is correlated with economic growth. As capital becomes scare we are seeing increasing opportunities to lock-in attractive risk adjusted returns with top-tier airlines generated by long-term non-cancellable lease cash flow secured by real assets.

-

Government support packages

Packages totalling ~$159 billion (as of mid-September 2020) across multiple jurisdictions, confirming the key role aviation plays in economic development. In October, IATA reiterated its call for further government relief measures to sustain airlines financially and avoid massive job losses, noting that the loss of aviation connectivity will have a dramatic effect on global GDP, threatening $1.8 trillion in economic activity.

-

Multi-speed market recovery

A multi-speed market recovery is anticipated both at the market segmental level and geographically. Domestic traffic has seen the strongest rebound with flight numbers exceeding pre-pandemic levels in China and Russia. Regional flying has increased in recent months, while international operations remain at low levels reflecting quarantine restrictions which have had a significant impact on the relative value of travel.

The second wave of Covid-19 will push airlines to look for additional sources of liquidity, especially European carriers that typically have weak Q4s/Q1s. EasyJet’s sale and leaseback of another 11 aircraft is prime example and demonstrates the opportunities for funding top airlines in this market. The recovery in Asia should not be neglected either. Asian airlines like Spring and Juneyao, in China, and Korean Airlines made encouraging operating profits in Q3. In these unique market circumstances Investec is applying its experience and expertise to manage investor portfolios and to source the right opportunities for them.

At the beginning of the 3rd quarter, European low-cost airlines EasyJet, Ryanair and Wizz Air had begun to ramp-up their operations as lockdowns eased in an effort to stimulate tourist traffic during the northern-hemisphere holiday season. In the third week in July Europe’s budget airlines operated ~5,000 flights per day versus fewer than 1,000 in the same period in June. However, second surges of infections across the continent forced governments to react by re-imposing travel restrictions on certain destinations and the rebound in levels of aircraft being operated had stalled by the end of August, with several airlines pulling back on capacity as the summer matured.

The resilience of the Chinese carriers and the modest recovery that was made by European and US airlines has vastly reduced the number of parked aircraft globally from the lows of April and May as airlines have gradually increased fleet activity. In particular younger narrowbody aircraft have been returned to service first, with older technology and larger aircraft lagging behind as international travel remains slow and airlines focus on cost saving by deploying their most fuel efficient assets.

Higher margins and better terms on new secured aircraft loans have attracted the attention of hedge funds seeking to offer debt to airlines directly through debt funds and private placements. The volume of financing for airlines overall has dropped in the past few months as airlines are funding relatively few aircraft deliveries. However, there is still demand from airlines to raise debt as they seek liquidity to help protect their business from a drop in revenues. Risk-adjusted margins for senior debt have stabilised around 250bp-350bp on average for top-tier airline credits.

In the news this quarter

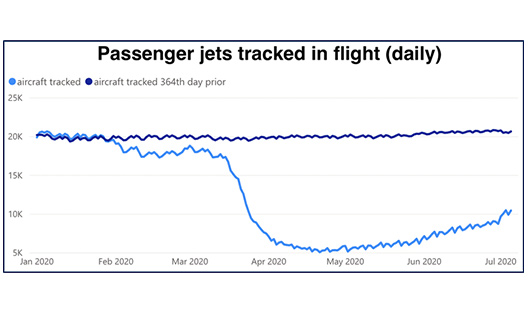

The number of passenger jets tracked flying at least once in a 24h period exceeded 50% of 2019's pre-coronavirus level for the first time since late March, as airlines around the world made steady progress in restoring flight operations. More than 10,500 passenger jets saw active service on 3 July 2020, compared with just under 20,600 on 5 July 2019.

The trend of government bailouts continued in early July with the EU commission approving the €150m bailout of Austrian Airlines, the €250m bailout of Air Baltic and KLM's €3.4bn state-support package. In addition, Virgin Atlantic agreed a £1.2bn recapitalisation plan. In the Middle East, El Al approved a fundraising package which resulted in the airline being 14% State owned. In South Africa, creditors approved the business-rescue plan for South African Airways, which included circa $1.6 billion in state funding. In Asia, Cathay Pacific’s shareholders gave the green light for a $5.03bn recapitalisation plan.

With airlines increasing levels of activity, an expected recovery in capacity took shape towards the end of July, albeit at differing rates across geographic regions. While Europe saw double-digit growth, in the Americas, particularly in the US, early capacity recovery began to stall while many states began reversing their re-openings as infections flared up once more. The recovery in the Middle East was driven by the Gulf super connectors, Emirates and Etihad, which added significant capacity on core routes. In the APAC region the Chinese airlines continued maximising the advantage of tapping into a large domestic market, but in Australia the recovery ground to a halt as the country began limiting the number of citizens allowed to return once again. In Africa, the continent registered a 25% increase in capacity, driven by Ethiopian and EgyptAir, however South African Airways, previously one of the continent’s largest airlines, remains grounded.

By the end of July IATA had dimmed its view of the return of global passenger traffic to pre-Covid-19 levels, primarily driven by "slow virus containment" in the USA and developing economies. The trade association predicted that global passenger traffic as represented by revenue passenger-kilometres (RPKs) would not return to pre Covid-19 levels until 2024, a year later than its previous projection. Global passenger numbers are expected to decline by 55% in 2020 compared with 2019, down from 46% predicted in April.

Despite passenger traffic rising during the third quarter it is likely that there will be a winter of discontent ahead for Europe’s airlines with many reducing winter capacity. The third quarter recovery was neither as strong as expected, nor an indicator of any meaningful momentum heading into the fourth quarter. Eurocontrol data shows traffic largely flatlining during August at around 50% of 2019 levels, then tailing away in year-on-year terms by early September.

Airlines are being hindered by continued restrictions on international travel, both intra-European and in markets such as the lucrative transatlantic sector. IAG has pulled back its capacity planning for this year and next after encouraging signs of booking recovery in the air transport crisis started to level off. Ryanair and Wizz Air have already said they will be operating with lower capacity than originally planned.

Despite this, two of China’s three largest carriers have recorded new highs in domestic passenger traffic for the year and are closing in on full domestic traffic recovery, underpinning the Chinese airline industry’s rapid domestic recovery from the coronavirus outbreak. In traffic results released for August, China Eastern Airlines and China Southern Airlines carried more passengers than they did in January, right before traffic bottomed out, amid onerous lockdowns imposed in several Chinese cities and provinces to curb the pandemic.

In news that hopefully provides some reassurance to travellers, a joint study by Boeing and the University of Arizona found that disinfectants already used on aircraft are successful in killing coronaviruses like the one that causes Covid-19. In related news, the US military released results from a study into the possible airborne spread of the Covid-19 virus within aircraft cabins. That study concluded that the “overall exposure risk from aerosolised pathogens, like coronavirus, is very low”.

- On 3 August JetBlue Airways priced a dual-tranche EETC with a total size of $808m. The $635m Class A priced at a 4.000% coupon and initial LTV of 59.0%. The $172m Class B priced at a 7.750% coupon and initial LTV of 75.0%. The Class A and B were rated A2/A and Baa2/BBBby Moody’s and Fitch, respectively.

- On 1 September Qantas Airways priced a AUD500m senior unsecured note due in 2030. The issuance has a coupon of 5.250% and is rated Baa2 by Moody’s.

- On 2 September Spirit Airlines priced a $850m senior secured note due in 2025 and secured by the Spirit Loyalty program. The issuance has a coupon of 8.000% and is rated Ba3 and BB+ by Moody’s and Fitch, respectively.

- On 8 September Ryanair priced an €850m senior unsecured note due in 2025. The issuance has coupon of 2.875% and is rated BBB by S&P and Fitch, respectively.

- On 9 September Air Canada priced a dual-tranche EETC with a total size of $553m. The $453m Class A priced at a 5.250% coupon and initial LTV of 53.5%. The $100m Class B priced at a 9.000% coupon and initial LTV of 65.3%. The Class A and B were rated A/A- and BBB-/BBB- by S&P and Fitch, respectively.

- On 16 September Delta Air Lines entered into a $3.0bn credit facility due in 2027. The facility has a margin of L+375bps and is rated Baa1 and BBB by Moody’s and Fitch, respectively.

- On 23 September Delta Air Lines priced $6.0bn of senior secured notes due in 2025 and 2028, respectively, and secured by the SkyMiles program. The issuances have coupons of 4.500% and 4.750% and are rated Baa1 and BBB by Moody’s and Fitch, respectively.

- On 7 October Allegiant closed a $150m senior unsecured note due in 2024. The issuance has a coupon of 8.500% and is rated Ba3 and B+ by Moody’s and S&P, respectively

- On 20 October United Airlines priced a $3.0bn Class A EETC, the largest transaction of its kind, that matures in 2027 and is secured by a combination of vintage aircraft, spare engines, and spare parts. The Class A issuance priced with a 5.875% coupon and initial LTV of 51.6%. The issuance was rated A3 and A by Moody’s and S&P, respectively.

- On 21 October Global Jet Capital priced a three-tranche, $521m aircraft ABS due in 2026. The Class A priced with a 3.000% yield and initial LTV of 67.0%. The Class B priced with a 4.000% yield and initial LTV of 77.0%. The Class C priced with a 7.250% yield and initial LTV of 82.0%. The collateral includes 55 business jets. The Class A, B, and C were rated A/A-, BBB/BBB, and BB/BB by S&P and Kroll, respectively.

- Kroll Bond Rating Agency has downgraded 81 aviation asset-backed securities as part of its review of 155 global aviation ABS. KBRA considered the results of its cash flow analysis, as well as the performance of the subject transactions, many which include declining cash flows and delinquent or deferred lease payments. KBRA noted: "The near cessation in travel has had a substantive impact on securitisation cash flows. Despite an increase in travel in the regions where aircraft are located, a significant time period may elapse for securitisation cash flows to meaningfully improve and/or return to pre-crisis performance levels owing to general economic conditions and the status of the health crises surrounding Covid."

- Airline credit ratings have on average fallen by 2 notches. Despite the introduction of significant cost-cutting measures to preserve cash the sharp decline in air travel demand has resulted in considerable cash burn and a deterioration in the financial outlook.

- At the end of the 3rd quarter airlines globally have raised a total of $204 billion of new debt, with $41 billion of this coming from the capital markets. US airlines continue raising capital through both conventional and non-conventional instruments, recent examples of innovative instruments include IP and loyalty program backed finance by United, American Airlines and Delta.

- 305 aircraft have been permanently retired YTD, representing just 0.9% of the installed fleet. The average age of the retired aircraft is 23 years (versus 25 years in 2019). Despite low oil prices, retirements are expected to spike as airlines will likely only retain their most efficient aircraft to cater for reduced demand levels.

Investec Aviation Debt Funds

$5bn

6 years

25+

Strong alignment of interest

Proven track record

Secured loans

Find out more about Aviation finance from Investec

Investec co-invests in all managed platforms, with strong technical capabilities and a proven track record in originating, releasing and remarketing aircraft.

Disclaimer

This presentation and any attachments (including any e-mail that accompanies it) (together “this presentation”) is for general information only and is the property of Investec Bank plc (“Investec”). It is of a confidential nature and all information disclosed herein should be treated accordingly.

Making this presentation available in no circumstances whatsoever implies the existence of an offer or commitment or contract by or with Investec, or any of its affiliated entities, or any of its or their respective subsidiaries, directors, officers, representatives, employees, advisers or agents (“Affiliates”) for any purpose.

This presentation as well as any other related documents or information do not purport to be all inclusive or to contain all the information that you may need. There is no obligation of any kind on Investec or its Affiliates to update this presentation. No representation or warranty, express or implied, is or will be made in relation to, and no responsibility or liability is or will be accepted by Investec or its Affiliates as to, or in relation to, the accuracy, reliability, or completeness of any information contained in this presentation and Investec (for itself and on behalf of its Affiliates) hereby expressly disclaims any and all responsibility or liability (other than in respect of a fraudulent misrepresentation) for the accuracy, reliability and completeness of such information. All projections, estimations, forecasts, budgets and the like in this presentation are illustrative exercises involving significant elements of judgement and analysis and using the assumptions described herein, which assumptions, judgements and analyses may or may not prove to be correct. The actual outcome may be materially affected by changes in e.g. economic and/or other circumstances. Therefore, in particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the achievability or reasonableness or any projection of the future, budgets, forecasts, management targets or estimates, prospects or returns. You should not do anything (including entry into any transaction of any kind) or forebear to do anything on the basis of this presentation. Before entering into any arrangement, commitment or transaction you should take steps to ensure that you understand the transaction and have made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. No information, representations or opinions set out or expressed in this presentation will form the basis of any contract. You will have been required to acknowledge in an engagement letter, or will be required to acknowledge in any eventual engagement letter, (as applicable) that you have not relied on or been induced to enter into engaging Investec by any representation or warranty, except as expressly provided in such engagement letter. Investec expressly reserve the right, without giving reasons therefore, at any time and in any respect, to amend or terminate discussions with you without prior notice and disclaim hereby expressly any liability for any losses, costs or expenses incurred by that client.

Investec Bank plc whose registered office is at 30 Gresham Street, London EC2V 7QP is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, registered no.172330.