20 Oct 2021

Aviation Market Snapshot - Q3 2021

Executive summary

-

Moderate global recovery

Following the worst year on record for the aviation industry, traffic recovery has been slow in 2021, severely hampered by the resurgence of outbreaks across regions alongside stricter travel restrictions. IATA published its semi-annual Industry Economic Performance report early October, noting the following:

- Global RPKs forecast to reach 40% of pre-pandemic levels in 2021 and 61% of pre-pandemic levels in 2022, driven by vaccines allowing some governments to relax restrictions and the continued growth of domestic travel.

- Air cargo has recovered above 2019 levels and expected to remain strong in 2022, with the support of strong global trade.

- The industry is forecast to make net losses of $52bn in 2021, reducing these losses to $12bn in 2022.

- Airlines continue to receive huge support from governments, totalling $243bn since the start of the pandemic. This support prevented widespread airline failures in 2021, but is unevenly distributed across regions with limited support in Latin America and Africa.

-

Regional discrepancies

Regions with large domestic markets, faster vaccine rollout and less restrictive government intervention continue to recover faster.

- Airlines in North America, the strongest region pre-pandemic, are forecast to return to profitability in 2022 supported by the large domestic travel market, the pick-up in regional travel and the opening of North Atlantic travel.

- European recovery is gaining pace but airlines dependent on medium / long haul international travel.

- Asia Pacific’s recovery has been stagnating impacted by tight government restrictions and slower vaccine procurement and rollout in emerging countries in the region. Ex China, Asia Pacific’s actual flying hours in July (typically a peak month) were lower than in March 2021, and, only 43% of the hours flown in March 2019. However, Chinese airlines starting to achieve cash breakeven on the back of a strong domestic market.

- In the Middle East, the dependence on connecting international flights and the lack of large domestic markets is delaying recovery.

- Latin America has seen interregional traffic recovering, but the improvement in financial performance is slow due to lack of government support and restructuring of a number of airlines.

-

Increasing optimism

On the financing side, major carriers and aircraft lessors have been able to access the capital markets at attractive spreads throughout 2021. Some airlines have placed new orders with the OEMs as airlines plan for future fleet replacements and aircraft deliveries are increasing again. Aircraft orders for the first half of 2021 were 64% higher than the same period in 2020 and 56% higher than in 2019. Boeing and Airbus delivered 453 aircraft in the first half of 2021, the majority of which are narrowbodies, reflecting the current market environment with domestic travel recovering significantly faster than international travel. Aircraft orders are also improving with 245 net orders for Airbus and Boeing in total at the end of July 2021, which compares with -230 for the whole of 2020. Optimism in the sector’s recovery is increasingly visible.

Derek Wong, Head of Aviation Debt Fund

“Broader investor confidence is returning to the aviation sector as key industry recovery indicators sustain their positive trend. Alternative capital providers are playing an increasing role in offering aircraft secured debt. During Q3 2021, Investec closed a series of debt financings for airlines/lessors with conservative parameters and strong risk-adjusted returns. Heading into Q4, the northern winter will bring its usual challenges to seasonal airline markets, now with the additional headwinds of rising interest rates and fuel prices. Investec will continue to be selective with asset origination with a strong focus on creating and protecting value for investors.”

The lack of coordination amongst governments on pre and post travel testing, quarantine restrictions and vaccine standards is hampering the recovery in global air travel. Disparate decisions by governments around the world has added cost, complexity and uncertainty. Throughout the pandemic, passengers have faced huge disruption to their travels as different countries impose sometimes vastly different and often confusing rules on arrivals. There are tentative signs that travel is getting less restricted in some parts of the world, the UK for instance simplified its travel rules in October, whereas in others, particularly places pursuing zero-case COVID strategies, border controls have been tightened. The International Air Transport Association (IATA) has taken steps with its IATA Travel Pass to digitise health credentials; however, there is still no standardized vaccine passport for use globally, nor a consistent set of travel rules.

The 4 - 5,000 aircraft parked in response to the pandemic has not yielded the thousands of aircraft retirements feared, with airlines and lessors preferring to wait and see how traffic recovers. Most of the aircraft retired in 2020 and so far in 2021 had already been marked for retirement. The average age of the 676 aircraft retired in 2020 was 23.5 years and of the ~276 retirements to mid-August 2021, the average age is 21.8 years (NAVEO, August 2021).

Whilst many airlines have announced the retirement of their A380 fleets, a small number of airlines are reversing that trend. Qatar Airways recently announced plans to return five of its 10 Airbus A380s to service by early November and the entire fleet in 2022 to meet resurgent demand. In addition, British Airways plan to return the A380 to its active fleet to increase capacity to the US and Dubai.

Paul Da Vall, Head of Aviation Equity Fund

“The aviation finance community has just completed three weeks of face-to-face conferences in London, Dubai and Edinburgh. This was the first time in 18 months that our industry participants have been able to gather in person and was seen as highly significant in marking an end to the virtual business world we have been living in. The sentiment remained cautiously optimistic that more territories are opening up to international travel and more aircraft being returned to service to cater for it. Caution was still being applied to the uneven recovery, with notably Asia struggling to re-open, and a nod to gradually rising jet-fuel prices potentially adding cost pressure to the airlines. We see the combination of increasing interest rates and a reduced number of parked aircraft as being helpful to a recovery in aircraft lease rates going forward.”

In the news this quarter

IATA reported that following improvements during the first half of the year, global air travel deteriorated slightly in August, due to the spread of the Delta variant impacting travel in domestic markets. Industry-wide Revenue Passenger Kilometres (RPKs), an indicator of global passenger demand, fell by 56% compared to August 2019, down from a 53% fall in July.

In domestic air travel trends, China in particular significantly tightened its domestic travel restrictions following further localized outbreaks of COVID. Total case numbers were relatively low and the expectation is that Chinese domestic travel will rebound in September-October. Japan and Australia also reinforced domestic travel restrictions resulting in a fall in seasonally adjusted RPKs, whereas positive domestic travel trends emerged in India due to low case numbers and increased vaccination rates. Russia continues to post the best domestic results supported by booming domestic tourism.

International travel is showing slight improvement, albeit off a low base, driven by growing vaccination rates and a relaxation of international travel restrictions in certain regions. Airlines in Europe performed best in August as the vaccine rollout allowed governments to ease international travel restrictions over the summer. International RPKs of Asia Pacific carriers continue to lag behind other regions due to COVID outbreaks and elevated travel restrictions.

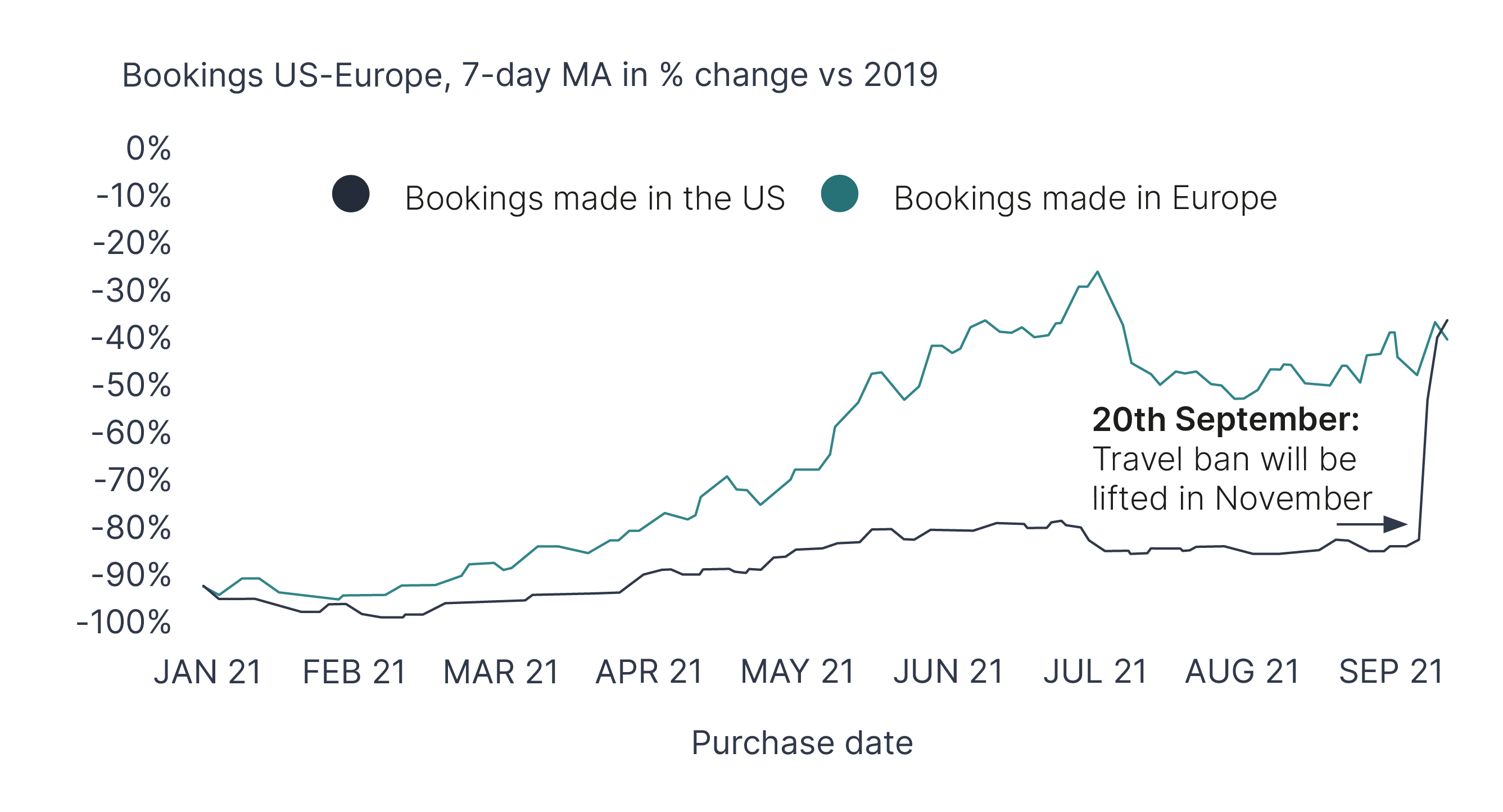

In September, the UK announced a simplification of its traffic light system and a reduction in testing requirements, while the US finally decided to open up the country to fully vaccinated UK / Europeans from early November. The chart below illustrates the strong pent-up demand for transatlantic travel.

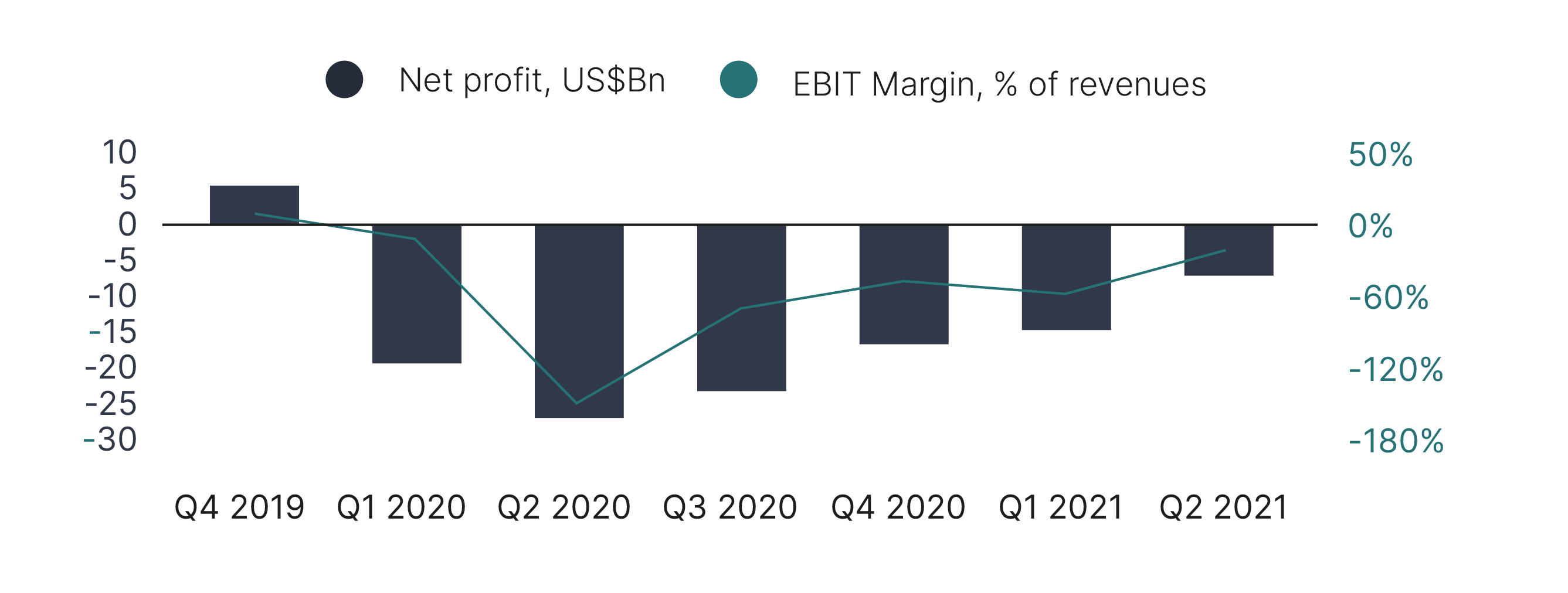

IATA reported that airlines releasing financial results in Q2 2021, showed an improvement to those reported in Q1 2021. The improvement was across all regions, led by North America whose aggregate net profit was positive reflecting the bounce in domestic travel driven by the vaccine rollout. Asia Pacific and European airlines posted small improvements reflecting muted international travel, which represented an important source of these airlines revenue pre crisis. Downside risk remains high due to new variants and increasing travel restrictions in certain regions.

As IATA reported, airline passenger revenue has declined 60% in Q2 2021 (versus same quarter 2019). Cargo has maintained its strength (increasing 72% versus Q2 2019) as the wider economy rebounds. Despite the efforts of airlines to cut costs, the year on year decline in operating costs was limited to 35%, short of the decline in revenue. Across the key cost items the reduction in labour costs (-27%), lagged the fall in fuel (-52%) and user charges (-48%).

Airline passenger revenue has declined 60% in Q2 2021 (versus same quarter 2019), while cargo has maintained its strength (increasing 72% versus Q2 2019) as the wider economy rebounds.

The 737Max is steadily returning to service, with Boeing delivering 145 units since the restart in December 2020. The majority of these were to North American airlines followed by European airlines. Boeing remains confident that re-certification by the Chinese regulator will occur by the end of 2021, opening up this key market for the Max. Circa 1/3rd of the 290 undelivered aircraft are designated for delivery to Chinese carriers. The Max order book has been reduced by 429 aircraft since the grounding began, however, the number of Max aircraft in service is steadily rising and flight data shows that airlines are starting to reap the benefits of younger and more efficient aircraft such as the Max.

During the quarter, Boeing published its annual Commercial Market Outlook (CMO), predicting that after 2024 airline traffic will return to the pre-pandemic forecast growth trajectory. The CMO forecasts a $3.2 trillion commercial aircraft market over the next 20 years, with 43,000 new aircraft required to fuel expected growth, resulting in a doubling of the global in-service fleet from 25,000 aircraft today to circa 50,000. Boeing forecasts passenger traffic to grow by 4% per year, in part fuelled by increasing urbanisation in emerging economies and increases in discretionary spending. In line with previous forecasts, Boeing expects long-haul international travel to return last, forecasting a return to 2019 levels by the beginning of 2024.

Boeing’s Darren Hulst, vice president of commercial marketing, noted that unlike in other airline industry crises, the fundamentals underpinning the industry, in particular global economic growth, remain strong, whilst the constraints on air travel are regulatory. 77% of the required aircraft will be single-aisle jets with airlines focusing on fleet and network flexibility, which could mean more market share for larger single-aisle aircraft, like the Boeing 737-10 or the A321, which can complete longer missions. The widebody market, meanwhile, will coalesce around smaller, longer-range aircraft, like the 787 or A350 families, Hulst said.

How has the market responded?

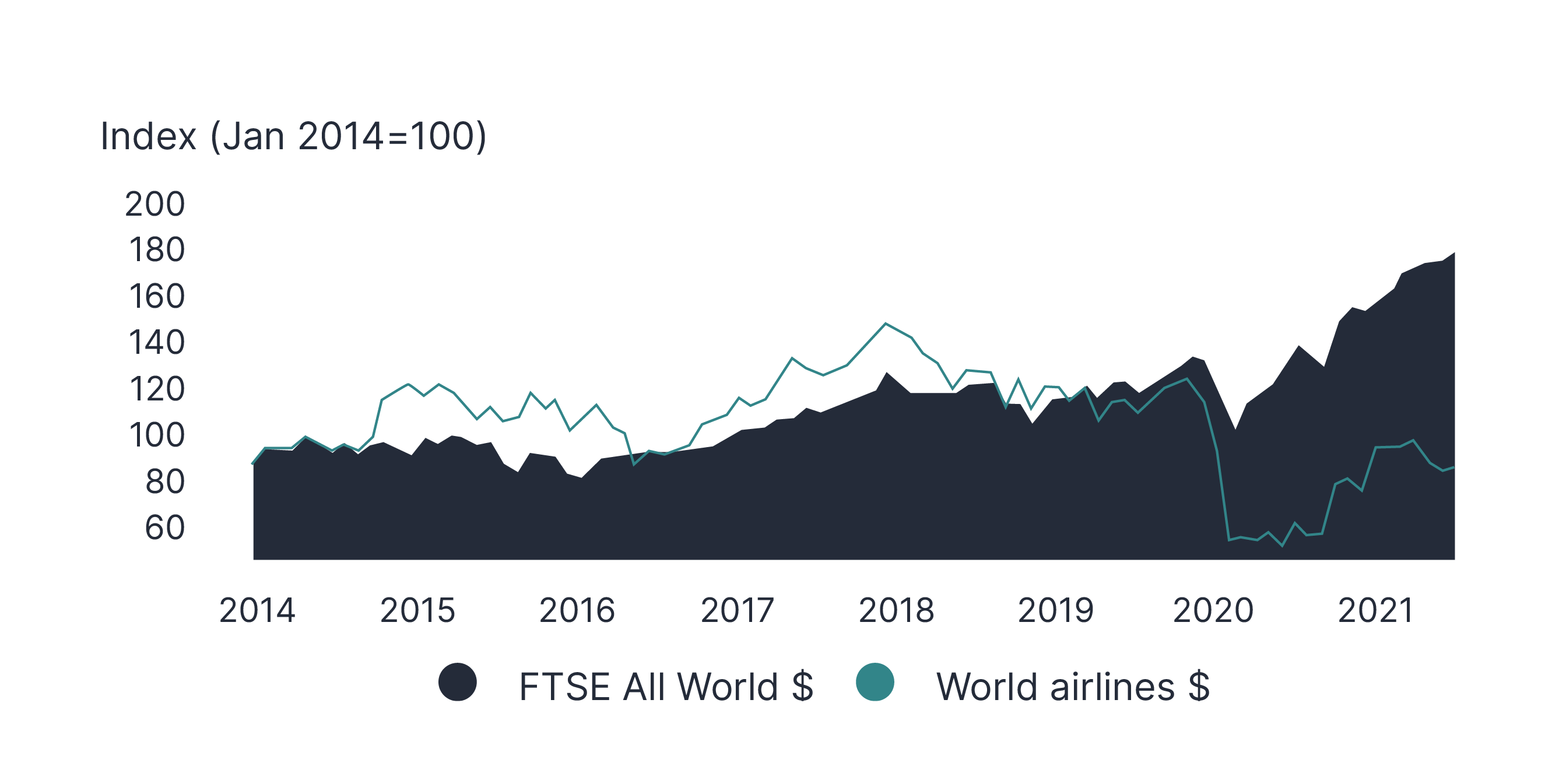

- IATA reported that airline shares started August in decline reflecting concerns over the fast spread of the Delta variant around the world. However, the approval of several vaccines by the FDA in the US and a decline in cases in China brought some optimism at the end of August resulting in a 0.7% increase (month on month). The muted recovery in airline stocks since the beginning of the year reflects the emergence of new variants and the absence of significant recovery in international and business travel. The year to date performance of the airline index is lagging behind the global equity markets, ~4% versus ~14%.

- Capital markets continue to remain active for stronger airline credits and investment grade investments. Recent debt capital market deals, include:

- 17 September, Qantas priced A$500m of unsecured notes due in 2028. The issuance has a coupon of 3.15% and was rated Baa2 by Moody’s.

- 11 August, Air Lease priced $600m of senior unsecured notes due in 2024 and $500m senior unsecured notes due in 2028. The issuance has a coupon of 0.80% and 2.10%, respectively, and both were rated A- and BBB by Fitch and Moody’s, respectively.

- 23 July, British Airways priced a two-tranche $553m green-linked aircraft EETC due in 2036. The Class A has a coupon of 2.90%, and the Class B has a coupon of 3.90%. The Class A was rated A and A2, and the Class B was rated BBB and Baa2 by S&P and Moody’s, respectively.

- 23 July, Castlelake priced a three-trance $450m refinance of their existing CLAS 2017-1 aircraft ABS. The Class A has a coupon of 2.74%, the Class B has a coupon of 3.92%, and the Class C has a coupon of 6.50%. The Class A was rated A, the Class B was rated BBB, and the Class C was rated B- by S&P. This is the seventh airline leasing ABS closed in 2021, taking the aggregate issued ABS debt in 2021 to ~$3.7bn.

- 8 July, China Eastern priced SGD500m of senior unsecured notes due in 2026. The issuance has a coupon of 2.00% and was rated A1 by Moody’s.

- 7 July, Lufthansa priced €500m of senior unsecured notes due in 2024 and €500m of senior unsecured notes due in 2029. The issuance has a coupon of 2.00% and 3.50% respectively, and both were rated Ba2 and BB- by Moody’s and S&P respectively.

- Pricing for issuers remains beneficial and we expect airlines and lessors to continue to access the capital markets, especially for issuers located in those areas recovering quicker from the impact of COVID. The bifurcation of the market is expected to continue with spreads staying low for strong carriers and significantly above pre-COVID levels for the rest of the market.

Investec Aviation Debt Funds

$5 bl

7-year

25+ people

Strong alignment of interest

Proven track record

Find out more about Aviation finance from Investec

Investec co-invests in all managed platforms, with strong technical capabilities and a proven track record in originating, releasing and remarketing aircraft.

Disclaimer

This presentation and any attachments (including any e-mail that accompanies it) (together “this presentation”) is for general information only and is the property of Investec Bank plc (“Investec”). It is of a confidential nature and all information disclosed herein should be treated accordingly.

Making this presentation available in no circumstances whatsoever implies the existence of an offer or commitment or contract by or with Investec, or any of its affiliated entities, or any of its or their respective subsidiaries, directors, officers, representatives, employees, advisers or agents (“Affiliates”) for any purpose.

This presentation as well as any other related documents or information do not purport to be all inclusive or to contain all the information that you may need. There is no obligation of any kind on Investec or its Affiliates to update this presentation. No representation or warranty, express or implied, is or will be made in relation to, and no responsibility or liability is or will be accepted by Investec or its Affiliates as to, or in relation to, the accuracy, reliability, or completeness of any information contained in this presentation and Investec (for itself and on behalf of its Affiliates) hereby expressly disclaims any and all responsibility or liability (other than in respect of a fraudulent misrepresentation) for the accuracy, reliability and completeness of such information. All projections, estimations, forecasts, budgets and the like in this presentation are illustrative exercises involving significant elements of judgement and analysis and using the assumptions described herein, which assumptions, judgements and analyses may or may not prove to be correct. The actual outcome may be materially affected by changes in e.g. economic and/or other circumstances. Therefore, in particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the achievability or reasonableness or any projection of the future, budgets, forecasts, management targets or estimates, prospects or returns. You should not do anything (including entry into any transaction of any kind) or forebear to do anything on the basis of this presentation. Before entering into any arrangement, commitment or transaction you should take steps to ensure that you understand the transaction and have made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. No information, representations or opinions set out or expressed in this presentation will form the basis of any contract. You will have been required to acknowledge in an engagement letter, or will be required to acknowledge in any eventual engagement letter, (as applicable) that you have not relied on or been induced to enter into engaging Investec by any representation or warranty, except as expressly provided in such engagement letter. Investec expressly reserve the right, without giving reasons therefore, at any time and in any respect, to amend or terminate discussions with you without prior notice and disclaim hereby expressly any liability for any losses, costs or expenses incurred by that client.

Investec Bank plc whose registered office is at 30 Gresham Street, London EC2V 7QP is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, registered no.172330.