The shadow of inflation continues to loom

In my last article, “Cash isn’t always king”, I suggested that readers with significant cash deposits should consider moving some of their long-term savings into investments, as inflation looked set to rise.

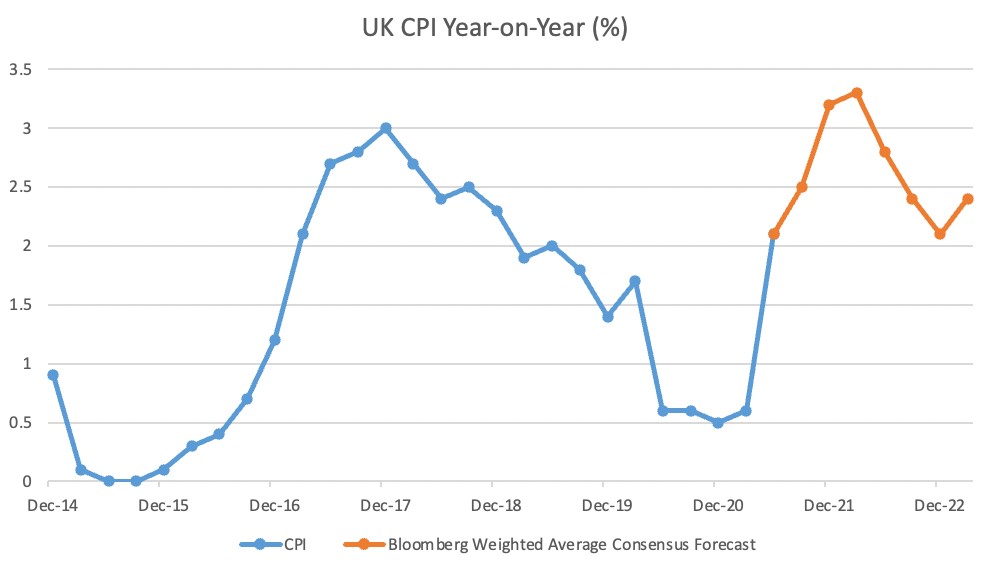

Since then, inflation has accelerated as predicted, and the outlook is even more concerning. The Bank of England now forecasts that UK inflation will hit 4%, a ten-year high, by the end of 2021. While this was previously expected to be a temporary peak, inflation is now expected to remain above the Bank of England’s 2% target for some time. The graph below shows predicted inflation in the 2-4% range until the end of 2022.

Source: IW&I and Bloomberg

Protecting your savings is a priority

In some respects, inflation can be seen as a positive. It’s a sign of strong economic recovery post-COVID, increasing salaries, and higher consumer spending. If you own your home, the inflation in property prices has probably added 7-8% to your property wealth.

However, it is undeniably bad news for your cash savings. If a typical cash savings account offers 0.6% interest, you don’t need a calculator to tell you that 4% inflation will cost you money. In fact, it would cost you £340 for every £10,000 you have saved in the account.

If your goal is to protect your wealth in these conditions, you will need to invest at least a portion of it in assets which offer returns that outpace inflation. This will always involve an element of risk.

Equities can offer protection from inflation

Equities are considered one of the highest risk asset classes and, correspondingly, offer the highest potential returns, which have historically outpaced inflation by a significant margin.

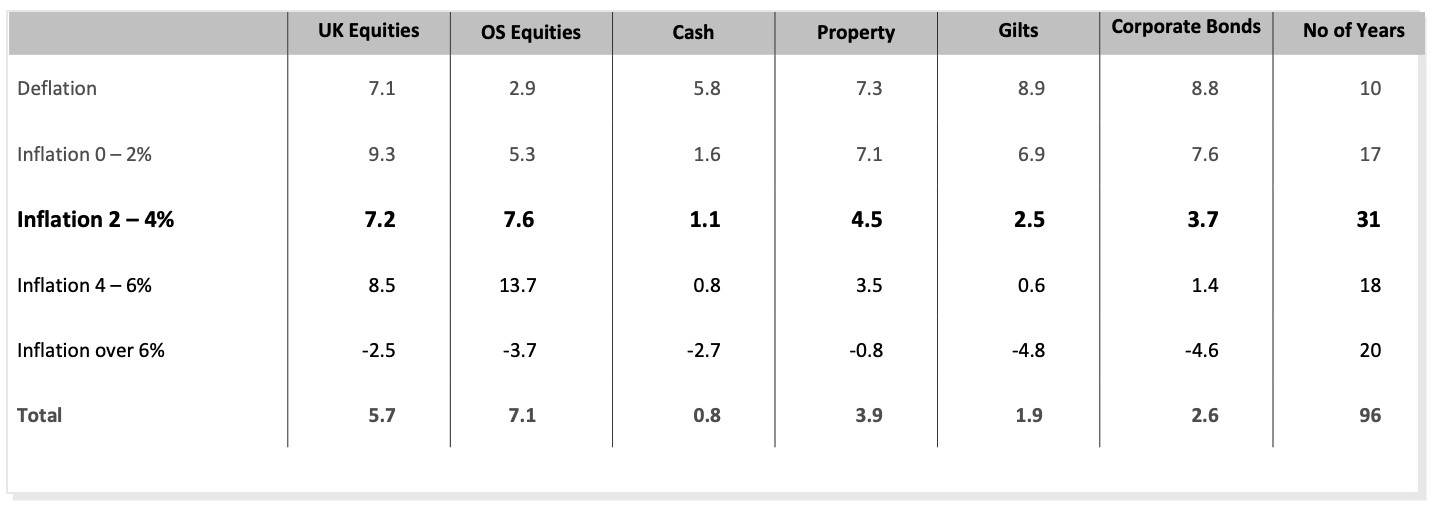

The following table shows total sterling returns, net of inflation, across the major asset classes in different inflation ranges from 1925 to 2020. In periods when inflation has been in the 2-4% range, sterling returns for equities, net of inflation, were 7.2% (UK) to 7.6% (overseas) per annum.

Source: IW&I, Barclays, CSFB, Deutsche Bank and IPD

Equities tend to perform well in most inflationary environments. To put it simply, when goods and services cost more, companies are often able to generate higher revenues. Higher company revenues can result in their share prices rising.

Of course, this won’t be true across the board. There’s a wide range of factors – too vast to cover entirely – that can affect equity values, and I must be very clear that prices can fall as well as rise.

One influential factor, particularly in an inflationary environment, is bond yields. As my colleague John wrote recently, the bond market has “power over pretty much every other asset class.”

Speaking simplistically, low bond yields are good for the equity market. Higher bond yields, which typically accompany high inflation, tend to impact equity prices negatively.

Another factor that must be mentioned is that most companies, like consumers, will experience the burden of rising costs of materials and energy due to inflation, and so will need to increase their spending. To perform well under these conditions, companies must have the ability to pass on these price increases to their consumers, to ensure that their revenue outpaces the rise in costs.

We call this ability “pricing power”, and it is one of the major factors we consider when investing in equities to protect against inflation.

Identifying companies with pricing power

The prevalence and influence of pricing power varies across different sectors. Here are some examples:

Consumer goods

Strong, familiar brands in categories like food and drink, beauty, and household can increase prices without losing customers, so have a lot of pricing power.

One way they can do this is by improving the value perception of their products, for example by making them healthier or more environmentally friendly, or by introducing a new ingredient or technology.

Luxury goods

Luxury brands, too, benefit from the ability to raise prices even in a tough economic climate. Despite the pandemic, Louis Vuitton has raised handbag prices twice in two years, while Christian Dior has increased its luxury goods prices by as much as 11%. This has helped the share price of their parent company, LVMH, to almost double since the start of the pandemic.

Leisure and travel

Leisure and travel companies have some pricing power, but there are other factors to consider, as the outlook in this sector is uncertain. If travel restrictions continue to ease, consumer demand could quickly grow, and this would potentially give companies greater control over prices and the option to charge more.

Technology

In the technology sector, the outlook is mixed. Manufacturers may suffer due to the increased cost of commodities and parts, such as semiconductors. Software companies will see less impact on their costs since they have less need to buy materials.

Utilities and telecoms

Water, gas, and electric companies tend to have pricing power due to low competition and so can pass on inflation-related cost increases to their customers. The marketplace for phone and broadband companies is much more competitive, and the customers more price sensitive, so there is less flexibility in pricing.

The benefits of an active approach to investing

Clearly, the choice of which equities to invest in is crucial. There will be an enormous difference in the returns generated by outperforming equities and underperforming equities, and only some will outpace inflation.

That’s one reason why Investec chooses to take an active approach to investment rather than a passive approach.

That is, we aim to beat the market by selecting outperforming equities and funds, rather than tracking overall market movements by investing broadly across an entire index.

If there is volatility in the market, which can be seen in response to high inflation, we’re well-positioned to take advantage of that, aiming to reduce losses when the markets fall and enhance gains when they rise.

Understanding the risk of investing in equities

While equities can offer greater protection against inflation than cash, they are subject to a different set of risks.

By nature, the prices of equities fluctuate over time, as a result of individual factors (e.g. company performance and reputation), global factors (e.g. changes to the political or economic environment) and market valuations (e.g. the price paid to own the investment). Equities are only appropriate as part of a long-term investment strategy, typically of three years or more.

Therefore, when considering moving some of your wealth into investments and incorporating equities into the mix, it’s crucial to do so based on your individual circumstances, investment experience, appetite for risk, and capacity for loss.

Investec’s approach to building an investment portfolio

At Investec, a typical client investment portfolio might include a proportion of equities along with a mix of other assets. Investing across a range of asset classes often smooths returns.

While this can offer protection from inflation, we don’t take the approach of investing for one specific outcome. Instead, we look to manage our clients’ portfolios in line with their short-, medium-, and long-term financial objectives and a holistic understanding of their affairs and needs.

In my next article, I will explain the approach Investec takes to establish the proportion of equities it is appropriate to include to help each of our clients achieve their individual financial goals. If you’d like to find out more before then, please feel free to get in touch.

About the author

To contact or read more about Matt Green, visit his biography here.