07 Oct 2018

On Your Marks!

Last week I reviewed the performance of equity markets during the third quarter, declaring that investors had reason to be satisfied given the wide range of things that could have undermined confidence. Equities are the narcissists within portfolios, hogging the attention of headline-writers with their extravagant daily movements. The FTSE 100 Index and (anachronistically) the Dow Jones Industrial Average are quoted faithfully in news bulletins, the pound usually gets some coverage, but bond yields are rarely given a second thought, and so today it’s time to redress the balance in favour of Fixed Income investments.

My colleagues whose professional existence is based upon researching bond markets often claim that bonds are the driving force of investment, and that equity valuations are subservient to bond yields. They do have a point. The valuation of shares is driven by three main factors: the growth rate; the discount rate; and the Equity Risk Premium (or the extra return that shareholders demand for assuming more risk in buying a more volatile asset class which can more easily be wiped out in the event of corporate failure). The growth rate forecast is the result of subjective analysis; the Equity Risk Premium is a more objective observation, but hugely prone to all-too-human swings in sentiment; which leaves the discount rate as the most concrete valuation driver. Whatever claims might be made for more local bond markets, the one that really counts to global investors is the US discount rate, with the yield on 10-year Treasury bonds being the key number.

First a quick look back to the third quarter, when it proved well-nigh impossible to make a positive return investing in government bonds. For a start, as has been the case for several years, there wasn’t much yield (or “carry”) available, so any notable tick up in yields (or fall in capital values, to look at it another way) was going to more than wipe out the income accrued. This duly occurred in response to evidence of strong growth, particularly in the US, and the accompanying concerns about higher inflation, with investors in the US, UK, Europe and Japan all experiencing losses, even on a total return basis (including income). The tale was similar in Emerging Markets, thanks to a strong dollar and the stresses in several countries including Argentina, Venezuela and Turkey. It might come as a surprise to many that the one corner of the mainstream bond market to generate a positive return was High Yield Credit – the artist formerly known as the Junk Bond Market. This jungle is inhabited by some of the more precariously financed companies, many of which fail to turn a profit, but the clue to the bulk of returns is in the label “High Yield” – at least you get some “carry” here (the US High Yield Index currently sports a yield of 6.41%, against a little over 3% for super safe government bonds of a similar maturity). Furthermore, financially constrained companies have more chance of meeting their obligations in a strong economic environment, and that is exactly what we have in the US today.

FTSE 100 Weekly Winners

| Rentokil Initial | 4.9% |

| BT Group | 2.1% |

| ITV | 1.8% |

| Paddy Power Betfair | 1.2% |

| WPP | 0.8% |

| Barclays | 0.7% |

| GVC Holdings | 0.4% |

Source: FactSet

FTSE 100 Weekly Losers

| Royal Mail | -27.7% |

| Ocado Group | -10.1% |

| Tesco | -10.4% |

| Ferguson | -8.2% |

| easyJet | -8.0% |

| International Consolidated Airlines | -7.4% |

| Smurfit Kappa | -7.3% |

Source: FactSet

Even here, though, there are signs that trouble is brewing in the event of a future economic downturn. The veteran credit investor Howard Marks, founder and co-chairman of Oaktree Capital, alludes to many factors in his latest Memo, and these include very high leverage levels and diminishing safeguards for investors in lower quality bonds. I have been lucky enough to hear him speak in person a couple of times and (although he has just published a new book about how to navigate market cycles) he is not one to sensationalise matters. A visit to the Oaktree website reveals a treasure trove of his Memos going back to 1990 and is well worth a visit. He is not currently predicting imminent disaster, but does emphasise the maturity of the current cycle and the growing risks, which is a fair reflection of our current approach to investment markets.

So what about the here and now? Last week bond investors suffered further losses as yields rose across the world. Once again this appears to have been in response to robust economic data, especially in the US, but there were also hawkish sounding comments from several members of the Federal Reserve. Interestingly, despite fears of a tighter US economy, it is real yields that are rising rather than inflation expectations, with the theory being that the Fed can raise rates higher without upsetting the apple cart. Even so, there will inevitably come a point where the economy does decelerate, and that is when Mr Marks will be hunting for bargains amongst the detritus of defaulting bonds.

For now, at least, the strong pace of corporate earnings growth is enough to offset the depressing effect on valuations of the higher discount rate; and the Equity Risk Premium starts from a relatively high level thanks to the depressed bond yields resulting from Quantitative Easing. Thus, for all the shrill warnings, we continue to believe that there is enough puff left in the market cycle for us not to have to take a hard defensive position yet. However, as we have noted before, a continued sharp rise in bond yields which is not accompanied by decent earnings growth would set portfolios up for the worst scenario in which both bonds and equities fall, the positive correlation between the two asset classes that has rarely been evident since the 1990s (which was generally a benign era of falling inflation expectations, so both asset classes provided positive returns). Like the Chairman of the Fed, we are keeping an eagle eye on inflation expectations, which are the prime candidate for reigniting volatility, as happened in February.

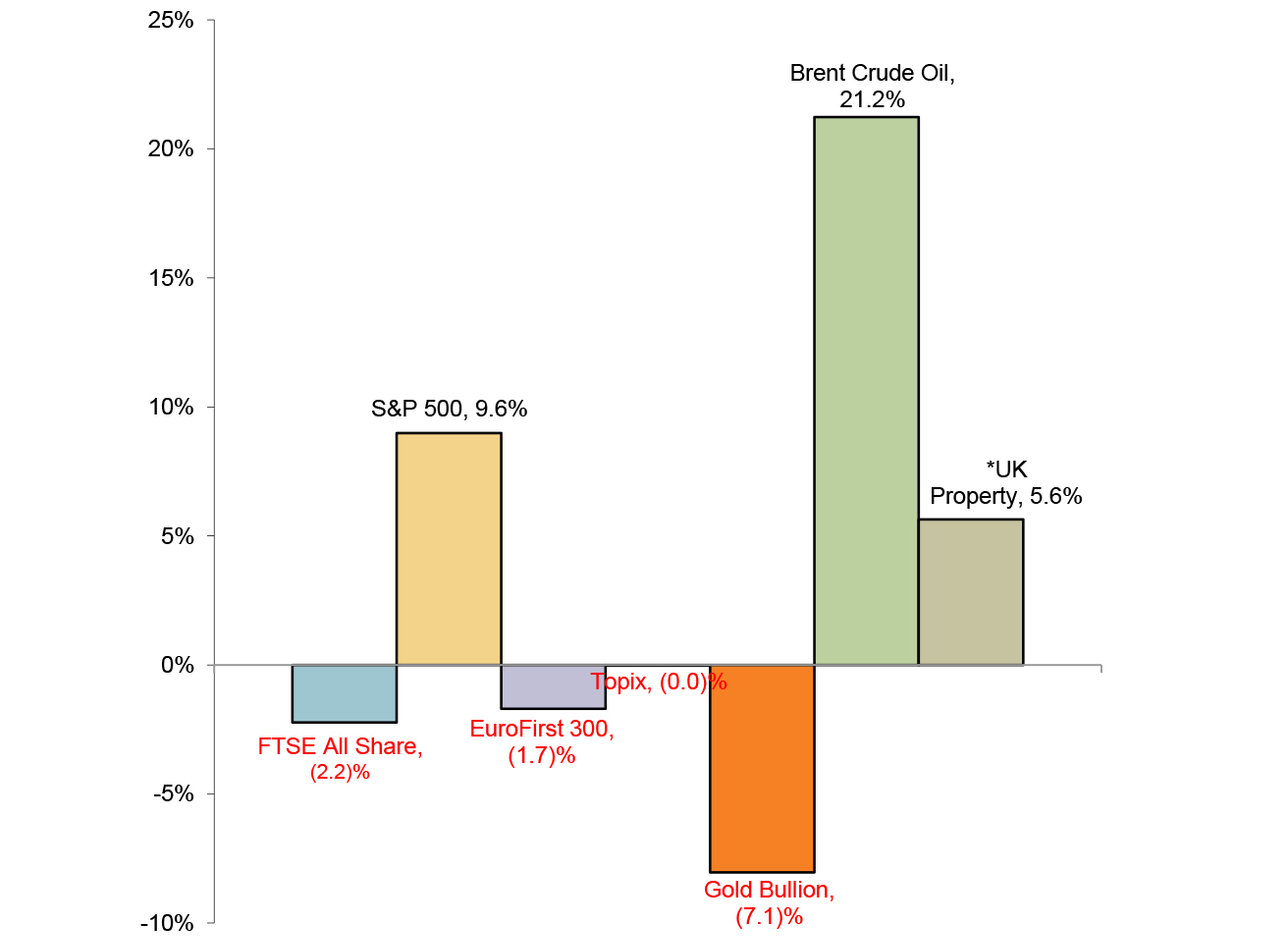

Year to Date Market Performance

Source: FactSet

* IPD Total Return to September 2018

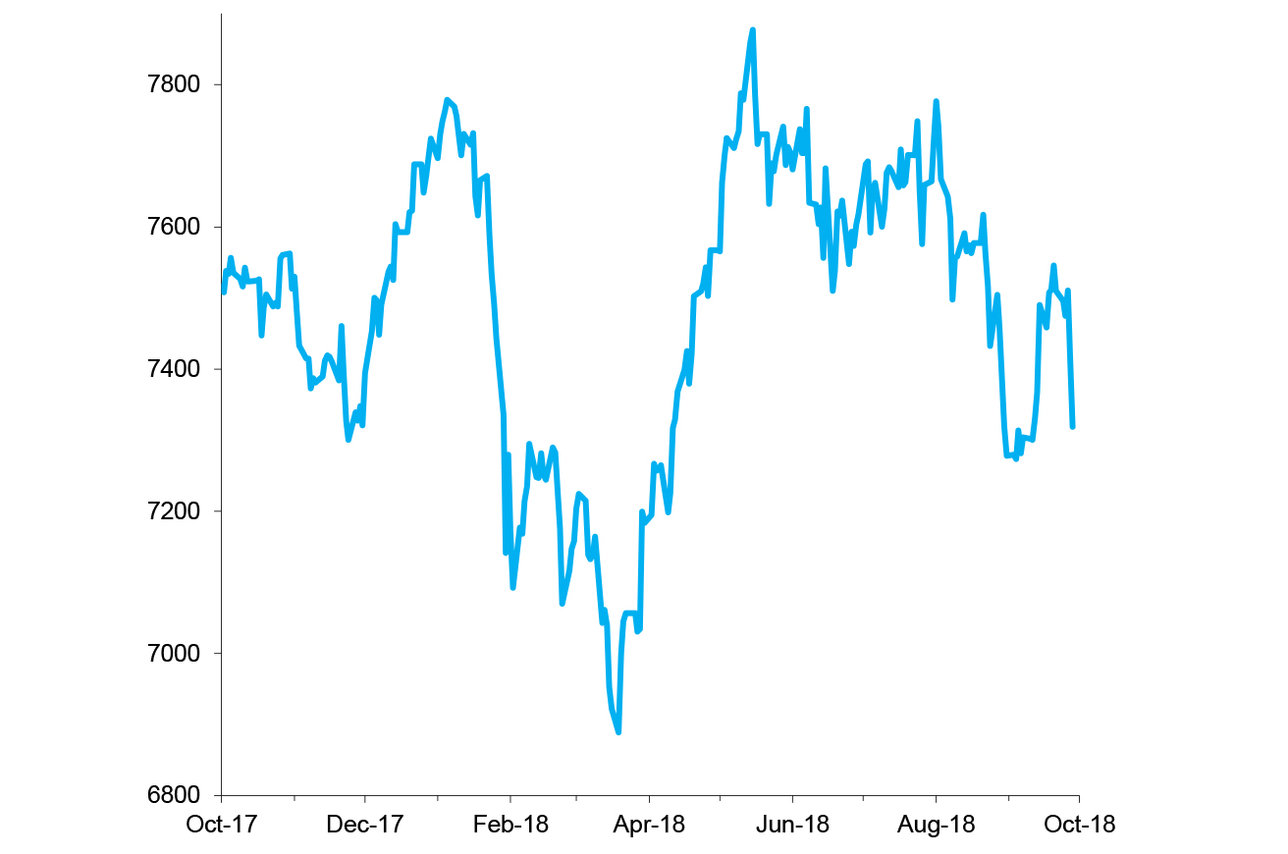

FTSE 100 Index, Past 12 Months

Source: FactSet

This newsletter is for professional financial advisers only and is not intended to be a financial promotion for retail clients. The information in this document is for private circulation and is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgement as of this date and are subject to change. The Company and its related Companies, directors, employees and clients may have positions or engage in transactions in any of the securities mentioned. Past performance is not necessarily a guide to future performance. The value of shares, and the income derived from them, may fall as well as rise. The information contained in this publication does not constitute a personal recommendation and the investment or investment services referred to may not be suitable for all investors. Copyright Investec Wealth & Investment Limited. Reproduction prohibited without permission.

Member firm of the London Stock Exchange. Authorised and regulated by the Financial Conduct Authority.

Investec Wealth & Investment Limited is registered in England.

Registered No. 2122340. Registered Office: 30 Gresham Street, London EC2V 7QN.

Search articles in