15 Oct 2018

Fangst*

*Fangst (noun) – a state of anxiety brought on by the precipitous fall in the value of technology stocks in an investment portfolio.

Today I introduce a new word to describe how many investors might be feeling after the stock market gyrations of the past week or so. Apparently there is a restaurant called Fangst in Oslo, and it was also the name of a now discontinued children’s toy organiser sold by IKEA, but I can find no reference to it in the context that I have proposed.

You heard it here first, as they say! (Please feel free to correct me if I am mistaken) More on the FAANG stocks below.

I am not a Bible scholar by any means, but one phrase that sticks with me is “The last shall be first, and the first shall be last”, because I often think of this whenever there is a violent stock market rotation such as we have witnessed recently. The biblical reference has more to do with personal morality and sacrifice, and there is no moral judgement to be passed on certain stocks just because they perform well or badly.

However, there are commentators who accuse those who have been swept up in the excitement of technology stock outperformance of being no more than greedy speculators who deserve everything that’s coming to them when there is a sell-off. We tend to view such things as the normal (if uncomfortable) ebb and flow of market sentiment and liquidity.

Why have markets performed as they have done this autumn after what was a relatively benign summer? I have commented on a couple of worrisome factors in recent Weekly Digests, with the gradual but inexorable tightening of monetary policy in the United States being the main concern.

I still believe that the market could have dealt with that in isolation, but we can add to it the threat of an escalation of global trade disruption, with little sign of a warming of the relationship between the US and China.

This was highlighted as a key concern by the International Monetary Fund, which last week downgraded its growth estimates for the world economy from 3.9% to 3.7% for both this year and 2019. Sometimes an “official” endorsement of a fear that has been lurking for a while is enough to tip sentiment over the edge.

FTSE 100 Weekly Winners

| Fresnillo | 10.3% |

| Randgold Resources | 7.3% |

| Marks and Spencer | 5.2% |

| BT Group | 2.5% |

| Sage Group | 2.1% |

| Kingfisher | 1.8% |

| Ocado Group | 1.2% |

Source: FactSet

FTSE 100 Weekly Losers

| Hargreaves Lansdown | -14.3% |

| Ashtead Group | -13.4% |

| DS Smith | -11.7% |

| Halma | -11.4% |

| Smurfit Kappa | -11.3% |

| Melrose Industries | -11.1% |

| Croda International | -10.3% |

Source: FactSet

I have long subscribed to the “three strikes” law in investing. Markets can often bear one or two negative developments, but the third is often fatal. In another context, more than one of my clients when I was a stockbroker told me that if they heard a buy (or sell) recommendation for the first time they would politely take note.

If a second broker reiterated the view, they would sit up and pay attention. The third broker to come on and say exactly the same thing would inevitably get the order to buy the shares! Similarly, one unexpected piece of economic data could just be an outlier; a second is worrying; a third confirms a new trend.

Investors, being human, tend to need more evidence to shift their position, especially if there are costs involved – either dealing costs or the more emotional cost of changing one’s opinion.

The third strike (or final straw) in this case might have been Italy’s proposed budget for the next three years, which was given a huge thumbs down by the bond market. We still believe that a total breakdown of relations between Rome and Brussels is a low probability event, but the potential impact, which, in a worst case scenario, sees Italy exiting the eurozone, is catastrophic, and so investors are pricing in at least a small chance of it happening.

Investors, being human, tend to need more evidence to shift their position, especially if there are costs involved.

Markets have recalibrated to take account of these developing risks, and no guarantees can be offered as to when they will settle down. I have referred in the past to the analogy of a sand pile which can be built up a grain at a time with no sign of instability until it suddenly collapses – and then it will equally unexpectedly stabilise again.

The investment author John Mauldin expanded on this topic (including a fascinating account of the physics experiments involved) in a recent newsletter (The Growing Economic Sandpile) on his Thoughts from the Frontline website.

It really isn’t worth expending too much energy trying to guess exactly when this squall will blow over. We have faith in the processes we have in place to adjust overall portfolio risk and to pick individual shares, bonds and funds to invest in.

On the F(a)angs (Facebook, Apple, Amazon, Netflix, Google) specifically, we have been concerned for a while that they have all been organised into a collective basket with a catchy name. They might represent the most visible, popular embodiment of US tech leadership, but are very different in many respects.

Signs that investors are taking a step back include the poorly received (over-priced?) Initial Public Offerings of Aston Martin and Funding Circle.

Do people buying ETFs based on the NYSE’s FANG+ Index really know what they are getting into? That index also includes Twitter, chip designer NVIDIA, Tesla and Chinese internet giants Baidu and Alibaba.

Some of the constituents make bucket loads of money while others are burning cash; some have a subscription revenue model, whereas others are almost entirely dependent on advertising revenue (with the conflicts of interest that come with that); there is a broad spread of regulatory risk involved in these companies. The index is up 16% year-to-date, but down 15% from its peak in June.

Other signs that investors are taking a step back include the poorly received (over-priced?) Initial Public Offerings of Aston Martin and Funding Circle, with other IPOs being postponed. The financial shenanigans at Patisserie Valerie could be viewed as the icing on the cake…

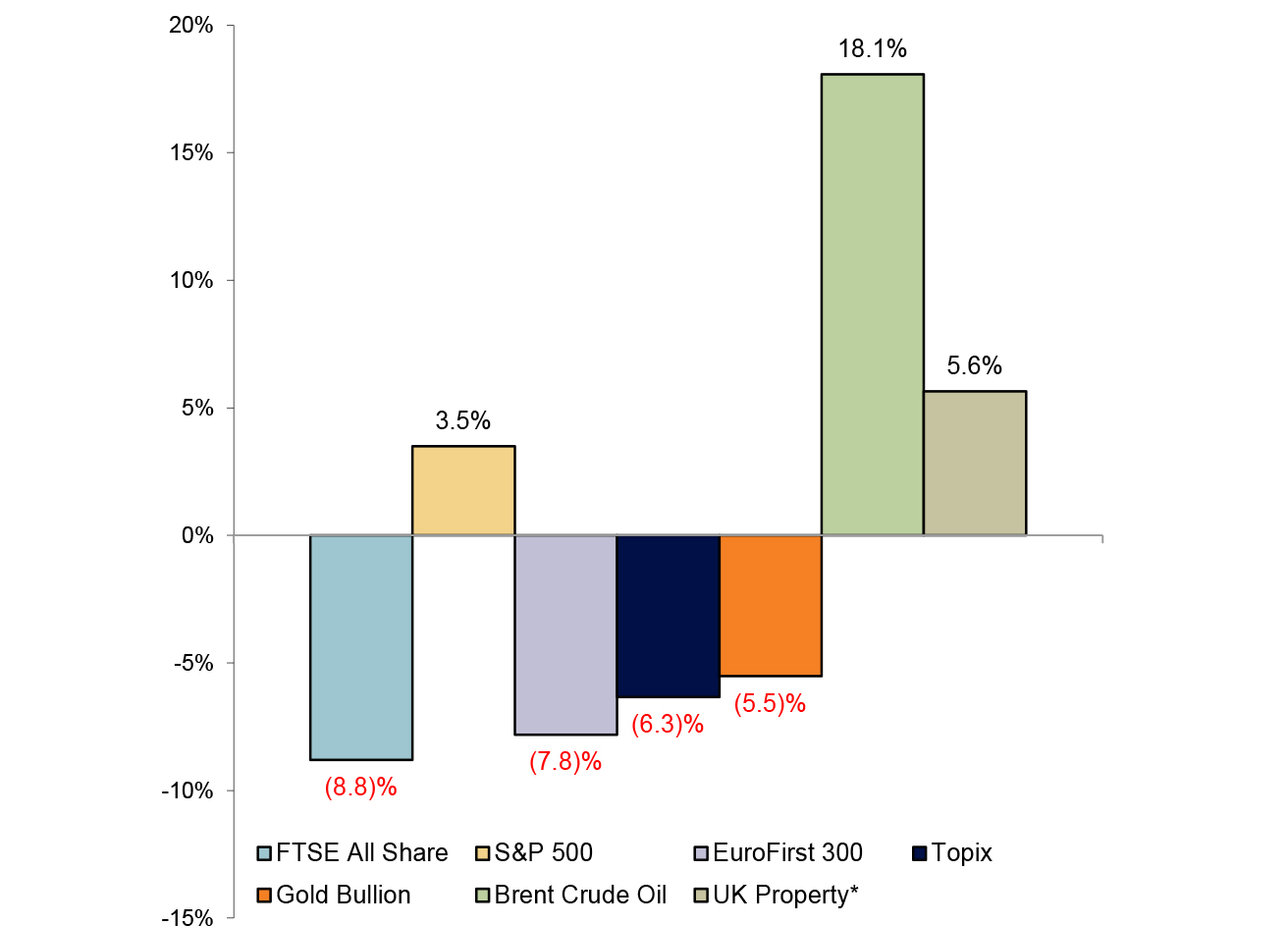

Year to Date Market Performance

Source: FactSet

*IPD Total Return to August 2018

FTSE 100 Index, Past 12 Months

Source: FactSet

This newsletter is for professional financial advisers only and is not intended to be a financial promotion for retail clients. The information in this document is for private circulation and is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgement as of this date and are subject to change. The Company and its related Companies, directors, employees and clients may have positions or engage in transactions in any of the securities mentioned. Past performance is not necessarily a guide to future performance. The value of shares, and the income derived from them, may fall as well as rise. The information contained in this publication does not constitute a personal recommendation and the investment or investment services referred to may not be suitable for all investors. Copyright Investec Wealth & Investment Limited. Reproduction prohibited without permission.

Member firm of the London Stock Exchange. Authorised and regulated by the Financial Conduct Authority.

Investec Wealth & Investment Limited is registered in England.

Registered No. 2122340. Registered Office: 30 Gresham Street, London EC2V 7QN.

Search articles in