29 Oct 2018

Loving and losing

As financial broadcasters fixate on historical performances and yearly lows, investment managers need to keep their calm analytical hats on

Last week was trying for equity investors, with headlines proclaiming that this was the worst week since whenever, or that indices are revisiting levels last seen any number of weeks, months or years ago. Consider yourself lucky if you don’t have a screen carrying either a permanent Bloomberg TV or CNBC feed anywhere near you.

Financial broadcasters seem to have become obsessed with such statistics, which are a poor substitute for the sort of calm analysis that is required in current circumstances.

Even so, I acknowledge that there is a fine line to be drawn between addressing the seriousness of the current correction and appearing insouciant. Tennyson wrote: “’Tis better to have loved and lost than never to have loved at all”, but human psychology is such that investors hate losing (paper) profits that they have made (and not banked) more than they enjoyed accruing the gains in the first place.

If a portfolio rose 10% in the first nine months of the year and then gave back 8% in the final quarter, most people would feel much more depressed than if it had just gone up 1.2% very slowly!

Another human trait is to seek the comfort of a comprehensible narrative, whether for financial markets, politics or wider society. This speaks to the difference between “risk” and “uncertainty”. Imagine being faced with having to jump across a gap in a bridge.

Taking into account the distance, the underfoot conditions and your general fitness, you can make a risk assessment as to whether you can make it over. Then you take into account the consequences of failure. Is it just a few feet down to a grassy landing, or a hundred foot drop into a raging torrent? That might make your mind up. Now imagine making all those decisions in the dark. Talk about uncertainty.

Successful investing is all about taking proportionate risk while trying to avoid the consequences of uncertainty. No risk generally means no (or limited) return. But if you want to make half decent returns there will always be at least some probability of loss.

FTSE 100 Weekly Winners

| British American Tobacco | 9.7% |

| easyJet | 9.4% |

| NMC Health | 6.5% |

| Rightmove | 5.7% |

| International Consolidated Airlines | 5.1% |

| Associated British Foods | 4.2% |

| Imperial Brands | 4.2% |

Source: FactSet

FTSE 100 Weekly Losers

| WPP | -15.4% |

| Micro Focus International | -10.7% |

| GVC Holdings | -9.8% |

| Ocado Group | -7.6% |

| BT Group | -6.9% |

| Schroders | -6.7% |

| ITV | -6.6% |

Source: FactSet

So why did equity markets fall out of bed? I have been trailing some of the factors in the last few weeks. Hanging over everything is the slow but sure withdrawal of central bank liquidity, mainly seen in US interest rate rises and the gradual winding down and eventual reversal of Quantitative Easing by the world’s central banks.

In many ways we should welcome this development as a signal that the world is returning to some kind of normality following the financial crisis, but we have consistently viewed it as removing a tailwind for financial assets, and indeed creating a potential headwind.

It has already helped to contribute to a derating of equity markets this year, but this was, until recently, being offset by decent growth prospects, and it is those that seem to have come under pressure recently, triggering a negative response.

If one had to pin the change in growth expectations on a single factor, it would be the perceived escalation of President Trump’s trade war with China. Over the summer there was a generally held view that Trump was trying to make short term political capital ahead of next week’s mid-term elections, but as they approach the rhetoric has become even more aggressive, and there is certainly no sign of imminent resolution.

We are of the opinion that increased global trade has been a good thing for investors, although it is equally clear that the benefits have not been equitably distributed through society, hence the rise of what has generally been referred to as “populism”, although that now seems to be evolving more into “nationalism”.

Several large companies, including US manufacturing bellwethers Caterpillar and 3M, have specifically referred to the effect of new tariffs in lowering their outlook for future growth. Maybe they were just “sending a message” to Mr Trump, but it has rattled markets.

I noted that this all seemed to kick off when the IMF downgraded its global GDP growth forecasts at the beginning of October – referring specifically to the trade war threat - and the negative momentum accelerated when China reported its weakest quarter of GDP growth since 2009 – a still impressive 6.5%, which any government in the West would sell its soul for (if it still had one).

Add some political uncertainty (Italy/Brexit/Saudi) and throw in the resulting effects of higher volatility that forces certain types of investors to sell riskier assets and it became a “perfect storm”.

The good news, at least for balanced portfolio investors, is that bonds have rallied, which is very much the opposite of what happened in February. This tends to confirm that we are in the midst of a “growth scare” rather than an “inflation scare”.

The key thing now is to assess the growth risk. Yes, growth is a bit slower than last year, and the much welcomed “synchronised global growth” that materialised briefly in 2017 has now become decidedly desynchronised, but the IMF, for example, is still looking for 3.7% global growth this year and next, which is better than we have experienced in most years of this decade.

On Friday the US reported better-than-expected growth of 3.5% in the third quarter. Even China’s “slowdown” was generally confined to more the speculative categories of investment, an area which the government has been deliberately dampening. If, as we believe, no recession is imminent, either in the US or globally, then the probability of this correction turning into something more vicious is low.

That being the case, we are minded to look to increase equity holdings, with a focus on the US and Asian Emerging Markets, but would not be surprised by further bouts of volatility.

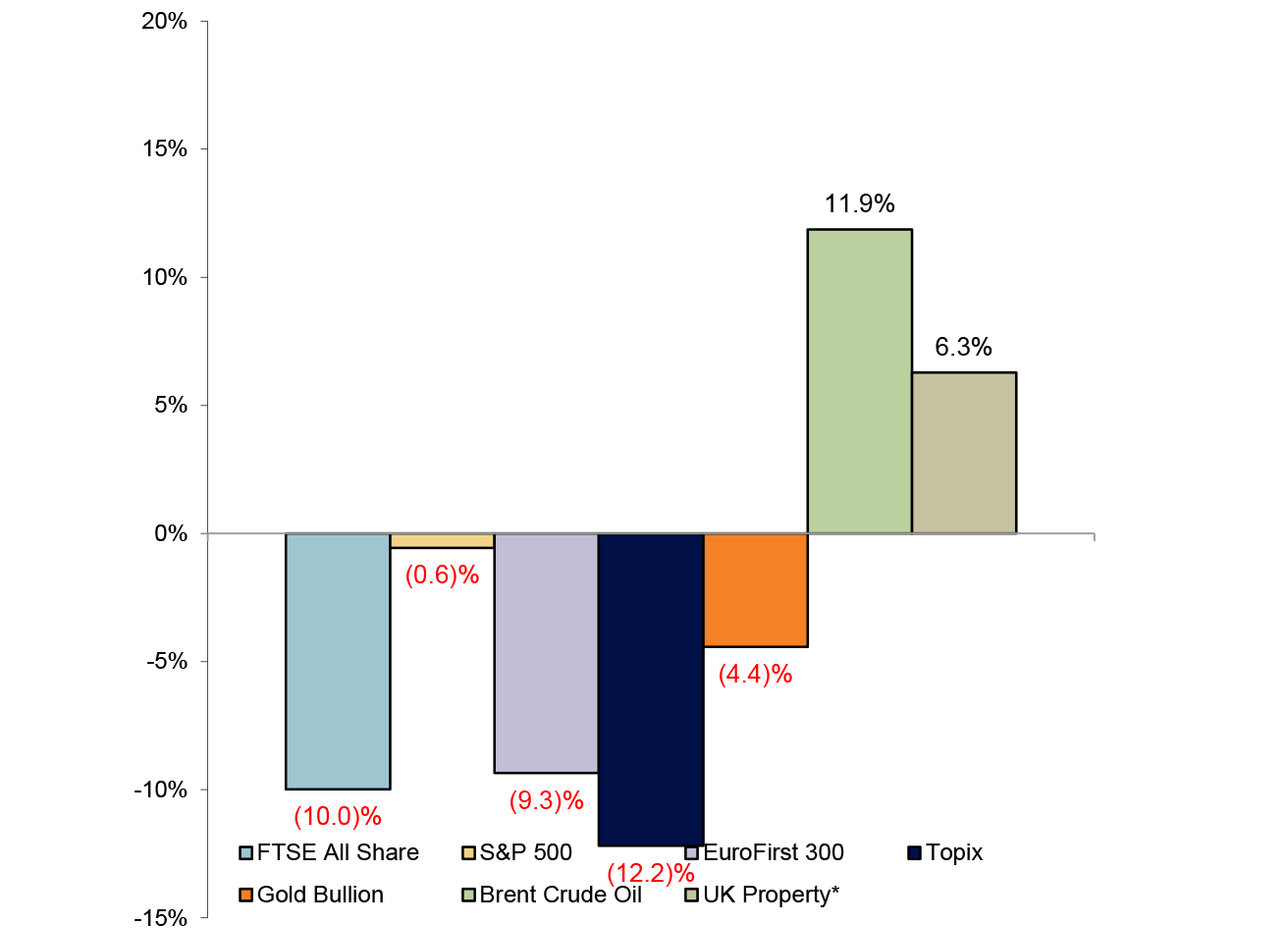

Year to Date Market Performance

Source: FactSet

*IPD Total Return to September 2018

FTSE 100 Index, Past 12 Months

Source: FactSet

This newsletter is for professional financial advisers only and is not intended to be a financial promotion for retail clients. The information in this document is for private circulation and is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgement as of this date and are subject to change. The Company and its related Companies, directors, employees and clients may have positions or engage in transactions in any of the securities mentioned. Past performance is not necessarily a guide to future performance. The value of shares, and the income derived from them, may fall as well as rise. The information contained in this publication does not constitute a personal recommendation and the investment or investment services referred to may not be suitable for all investors. Copyright Investec Wealth & Investment Limited. Reproduction prohibited without permission.

Member firm of the London Stock Exchange. Authorised and regulated by the Financial Conduct Authority.

Investec Wealth & Investment Limited is registered in England.

Registered No. 2122340. Registered Office: 30 Gresham Street, London EC2V 7QN.

Search articles in