What does economic data tell us about the outlook for the UK?

Key data points have been less supportive of the case for a cut in the Bank rate. Although Consumer Price Index (CPI) inflation fell sharply in April to 2.3% from 3.2%, the decline was less than the Bank of England (BoE) had expected. More importantly, services CPI inflation barely nudged down, to 5.9% from 6.0%, whereas the BoE had pencilled in an outturn of 5.5%. Similarly, the official measure of private sector pay growth (excluding bonuses) remained relatively stubborn in March, at 5.9%. These last two figures are the Monetary Policy Committee's main gauge of what it terms 'inflation persistence' or price pressures that may last into the medium-term, which could make it less inclined to bring rates down soon.

Do you think there will be a base rate cut on 20 June, and could the impending General Election influence the decision?

Updated inflation and wage data are set be released ahead of the next Monetary Policy Commitee meeting. It seems likely that these will be more favourable, although perhaps not quite in line with the committee's expectations.

The BoE is independent of the government and will take a dispassionate view of what it needs to do with rates, irrespective of political events. However, by convention, its officials do not make any public comments during the campaign period, making it difficult to steer markets ahead of the MPC meeting, or even provide any explanations afterwards. Mainly for this reason we now tend to the view that the committee will keep the Bank rate on hold at 5.25% in June and begin the rate cutting cycle at the subsequent meeting in August.

How low does Investec predict interest rates could fall by the end of 2024 or 2025?

As inflation pressures subside, it seems likely that interest rates will fall further. Any move down is unlikely to be aggressive, as the economy seems set to continue to expand, but we are nonetheless forecasting the Bank rate falling to 4.75% by the end of this year. After that, depending on the signs of inflation persistence, further interest rate reductions will probably be on the cards over 2025. We see the Bank rate closing next year at 3.75%.

How interlinked are the Base rate and the interest rates paid on mortgages or savings?

The Bank of England's official policy rate, the 'Bank rate' which is often referred to as the 'Base rate', feeds through to a variety of interest rates in financial markets. A significant channel is the swap rate which, put in slightly simplified terms, represents the rate at which banks will lend to each other over terms of up to 30 years. Swap rates are effectively determined by expectations of the path of the Bank rate over this period and form the basis of fixed-term mortgage rates which make up some 80% of the stock of the UK home loan market. Hence mortgage rates will follow market forecasts of the policy rate. Savings rates are set on a similar basis, depending on the terms of the savings product.

Why did the European Central Bank cut its rates and do we expect further changes?

The European Central Bank (ECB) cut its policy rates by 0.25% at this month's Governing Council meeting, including the key Deposit rate which now stands at 3.75%. The Euro area economy escaped a very shallow recession in Q1, in much the same way as the UK. Headline inflation is similar as well, with rates a little above the central banks' 2% targets in each jurisdiction. But what differentiates the two is that the ECB is confident that eurozone inflation will be at the 2.0% sustainably in the medium-term. This thinking is not shared by the Bank of England (BoE), at least yet, and explains why the BoE may be reticent to lower the Bank rate as quickly. Our feeling is that there is further scope for the ECB to bring rates down again, although it does not appear to be in an immediate hurry and is likely to ease policy again in September and December.

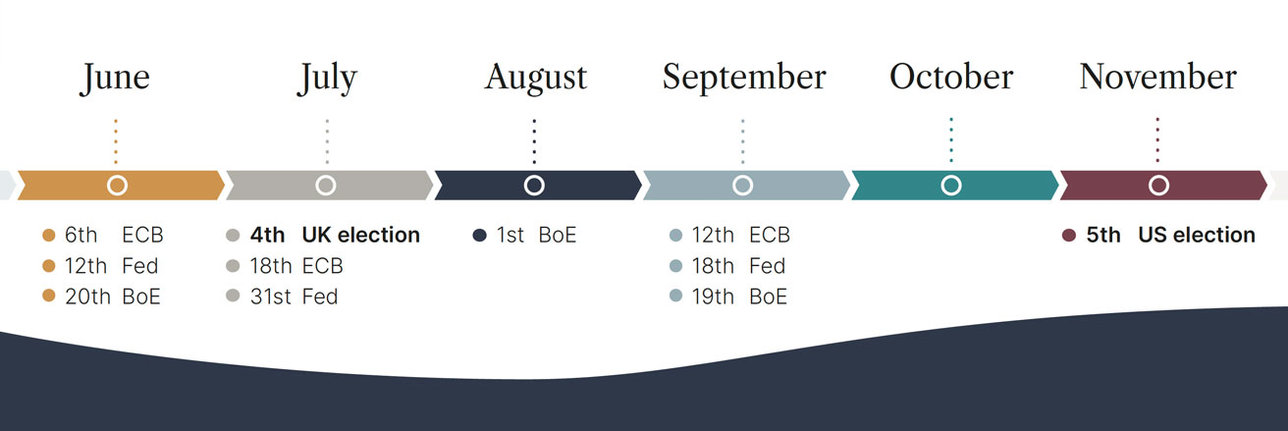

Key cental bank decision dates:

Want to know more about how the economy could affect you in 2024? Contact us today.

Our banking teams are highly experienced with a history in complex lending and relationship management.

Important information:

This article is for general information purposes only and should not be used or relied upon as professional advice. It is advisable to contact a professional advisor if you need financial advic

Browse articles in