Embracing the real-world AI revolution - transforming financial services

The integration of Artificial Intelligence (AI) into financial services is reshaping the industry, offering unparalleled opportunities for innovation and efficiency. As businesses lean into AI's capabilities, they are leveraging its power to automate manual processes, analyse data, and provide real-time insights. However, the adoption of AI in the financial sector requires a thoughtful approach that balances innovation with robust risk management and oversight.

Prompting competitive advantage

Generative artificial intelligence (AI) has exploded on the scene as one of the most influential innovations in modern history since the agricultural and industrial revolutions and the advent of the internet age. According to research conducted by Slalom, a global consulting company, a staggering 84% of businesses in the UK and Ireland are already using AI to some extent.

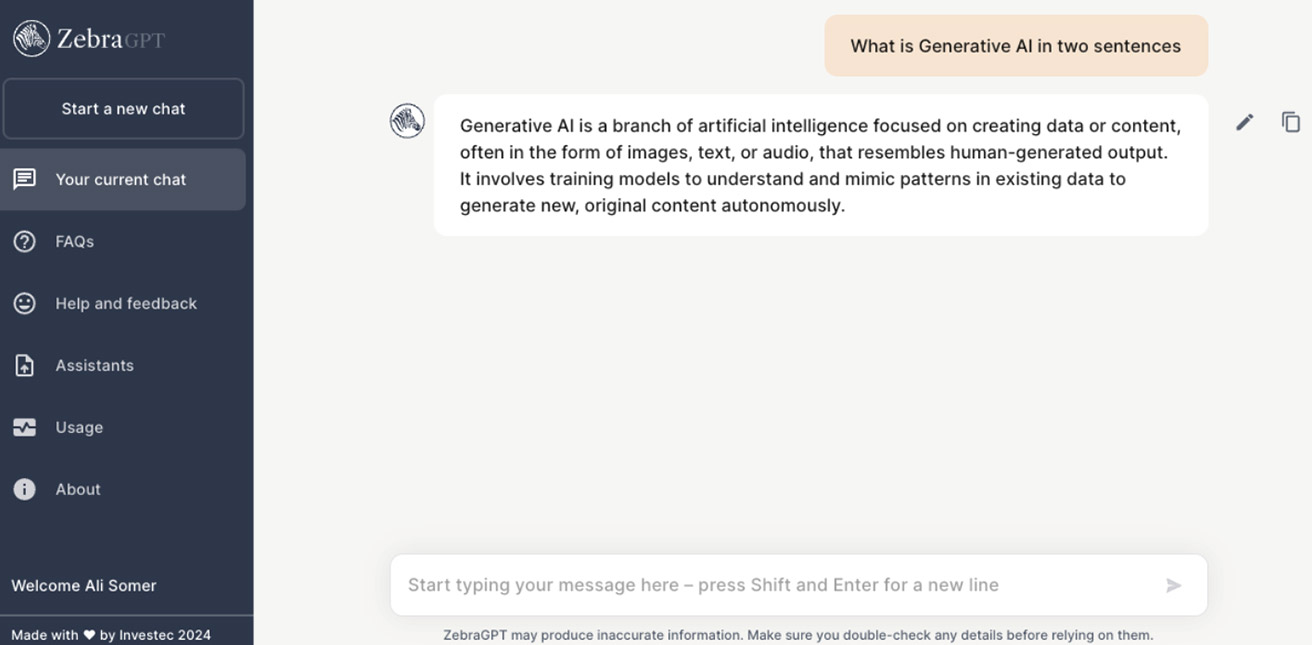

But what precisely is AI? Who better to provide a definition than ZebraGPT, a generative AI application, powered by Microsoft’s Azure Cloud?

You: What is Generative AI in two sentences:

Zebra GPT: “Generative AI is a branch of artificial intelligence focused on creating data or content, often in the form of images, text, or audio, that resembles human-generated output. It involves training models to understand and mimic patterns in existing data to generate new, original content autonomously.”

British technology entrepreneur Kathryn Parsons, writing for The Sunday Times, categorises users into three groups: those who want to ‘lean in’ to AI, those who opt to ‘lean back’ and those in ‘learn mode’.

To explore the transformative potential of AI within financial services, we sat down with two industry experts who are fully ‘leaning in’ to AI’s capabilities.

Igniting innovation with Spark Intel

In April 2021, CEO Julian Dobbin founded Spark Intel, drawing on a wealth of experience in mergers & acquisitions and foreign exchange. Recognising the potential of utilising publicly available data to address lenders’ enquiries during the business funding process, he set out on a mission to revolutionise SME lending.

Recent innovations at Spark include the introduction of automated AI-generated insights, speeding up funding decisions and broadening SMEs access to finance. Julian emphasised AI’s role in automating manual processes, gathering extensive financial and non-financial data for analysis, and providing lenders with concise yet comprehensive real-time reports.

He elaborated: “Our ALI (Artificial Learning Intelligence) module delivers contextual relevance, which is Spark’s ‘secret sauce’. This utilises complex fuzzy logic, combining data such as customer demographics, supply chain dynamics and directors’ histories. We analyse sector trends and benchmark prospects against their peers, providing tailored insights to equip lenders with the knowledge to ask even more relevant questions and make informed decisions.”

Reflecting on the introduction of ChatGPT in November 2022, Julian Dobbin remarked: “The investment of billions of dollars into its development by Microsoft was crucial. Without it, we wouldn't have achieved the advancements you see today. In June last year, we reached a breakthrough with our first AI-driven automated insight, or ‘credit paper’ as we called it at the time. Seeing it on the screen after all the blood, sweat and tears, we knew we had something special.”

He described the complexity of financial decision-making using the analogy of solving a Rubik's cube in the jungle: “While technology can calculate the cube’s 43,000 million combinations in a fraction of a second, navigating the jungle poses challenges such as unpredictable weather, an ever-changing landscape and numerous variables that you couldn’t predict. AI can collate and curate the data – humans are still needed to make the judgements.”

“Full adoption of AI may take longer than other industries, and that’s just because there’s so much at stake.”

The industry’s risk focus could impact significantly on the level of AI adoption: “When AI models generate scenarios to assist human decision-making, they employ machine learning to refine suggestions and improve their accuracy over time. However, there’s some nervousness within the lending community towards overreliance on technology. Full adoption of AI may take longer than other industries, and that’s just because there’s so much at stake. When you lend a million pounds or more, there’s the potential of fraud, risk and a variety of considerations that are very different in other sectors.”

“AI will revolutionise lending globally, transforming an industry that’s ripe for innovation.”

Julian Dobbin outlines his vision for AI’s role in the next decade: “While significant investments have been made in AI surrounding automated decision-making, we believe it’s not yet ready for fully autonomous lending decisions, other than the very smallest deals. The power of AI lies in supporting decision-making for those qualified to do so. AI will revolutionise lending globally, transforming an industry that’s ripe for innovation.”

Developing the future of finance

Since its launch in 2023, Investec ZebraGPT, a secure version of the GPT model hosted on Microsoft Azure Cloud, has been embraced enthusiastically throughout the business. Over two-thirds of employees regularly use the platform.

Ali Somer, Investec’s AI Engineer, shared his insights on the technology: “AI acts as a co-pilot, augmenting human capabilities rather than replacing them. This aligns perfectly with Investec’s ‘stretch’ ethos, a cultural pillar that encourages people to go beyond their existing responsibilities. When ChatGPT first appeared, it was clear that it was more than just a toy; it’s a serious tool with far reaching applications, such as generating high-quality software, financial documents and analysing text.”

Ali Somer explained that Investec approaches AI adoption through three distinct lenses:

- Personal productivity, which makes tasks like coding, writing emails, and summarising text faster and easier.

- Productivity efficiency with creativity gains, which involves integrating AI within existing processes or developing AI assistants to support teams and functions and boost overall productivity.

- Game-changing or paradigm shift AI, which transforms how tasks and processes are approached, for example, reinventing corporate onboarding processes with AI-powered chat interfaces.

Ali Somer added: “We employ a technique known as RAG (Retrieval Augmented Generation), enabling users to build a knowledge base by enriching AI with their own data. This allows us to index the data and conduct semantic searches based on their meanings, rather than keywords, thus eliminating the need for extensive fine-tuning.”

He continued: “ZebraGPT is an invaluable teaching tool, especially for newer team members. It’s like having a teacher available 24/7, which takes some pressure off the senior managers in handling queries.”

“It’s highly possible we could see an ‘arms race’ in AI technologies.”

In this new AI-enabled era, recognising, assessing and mitigating fraud risk is becoming a critical factor for lenders, as Ali Somer observed: “It’s highly possible we could see an ‘arms race’ in AI technologies. Criminals could exploit AI for fraudulent means at low cost, creating fake or altered documentation, and manipulating voices and videos. Consequently, there’s a need to enhance our risk controls and implement stronger fraud checks. As bad actors utilise AI, it’s crucial that we also harness AI to detect and combat them, safeguarding against potential threats.”

“Whereas the industrial revolution spanned a century, the AI revolution could take as little as five years. Thinking about the future evolution of AI is a bit like entering the realms of science fiction.”

Looking ahead, Ali Somer commented: “Whereas the industrial revolution spanned a century, the AI revolution could take as little as five years. Thinking about the future evolution of AI is a bit like entering the realms of science fiction. The concept of an ‘agent swarm’, in which a 'board' of independent AI agents collaborates on tasks while producing and overseeing sub-agents, is a feasible scenario.”

Although AI has enormous disruptive potential, its widespread adoption in the financial sector may take longer than in other industries, owing to an escalating focus on risk management and oversight. Nonetheless, it offers unparalleled opportunities for increased innovation and efficiency, contingent upon the continued involvement of qualified individuals in the decision-making process.

We expect human-AI collaboration to become common place by transforming multiple facets of our daily lives. Yet, AI’s significance extends beyond process efficiencies; it’s an inflexion point in the financial services industry and holds the key to shaping its future.

The integration of AI into business operations is not just a passing trend; it’s a transformative force that is reshaping the financial services industry. By automating longstanding manual processes and facilitating the rapid transfer of information, AI is proving to be a powerful tool to drive efficiency. From executing basic tasks to structuring complex strategic development plans, AI’s versatility is evident across the board.

Lean in, lean back or learn?

The early adoption of AI reflects a commitment to innovation and a relentless drive to better serve clients. This proactive approach aligns with the ethos of many forward-thinking financial organisations that have always embraced new technologies with enthusiasm. Such institutions are often at the forefront of the 'lean in' camp, recognising the competitive edge that AI can provide.

However, this enthusiasm is tempered by an awareness of the broader implications of AI. As with any significant technological advancement, there are macro risks to consider, including potential social and economic consequences. The disruption caused by AI could indeed be as profound as that of the Industrial Revolution, albeit unfolding at a much faster pace.

The concerns surrounding the misuse of technology are not new; they mirror the apprehension that accompanied past revolutions. Yet, the speed at which AI is advancing means that its impact will be felt more rapidly and possibly more acutely. It is therefore crucial to remain vigilant about the long-term risks and to engage in a dialogue about the responsible development and deployment of AI.

In the financial sector, this means balancing the drive for innovation with robust risk management and oversight. It requires a thoughtful approach to integrating AI into the fabric of our services, ensuring that it complements human expertise rather than replacing it.

ZebraGPT. The image was prompted by a human and generated by AI. Prompt: ‘Large Rubik’s Cube in the foreground in a jungle’.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.