Long-term fixed-rate mortgages: what do brokers need to know?

The number of homebuyers opting for long-term fixed-rate mortgages has increased in recent years due to a combination of low interest rates and heightened economic uncertainty. Here, we explore the impact of the trend with Investec’s Chief Economist Philip Shaw and Peter Izard, Head of the Intermediaries Business Development team.

Are more people fixing the rate on their mortgages for longer?

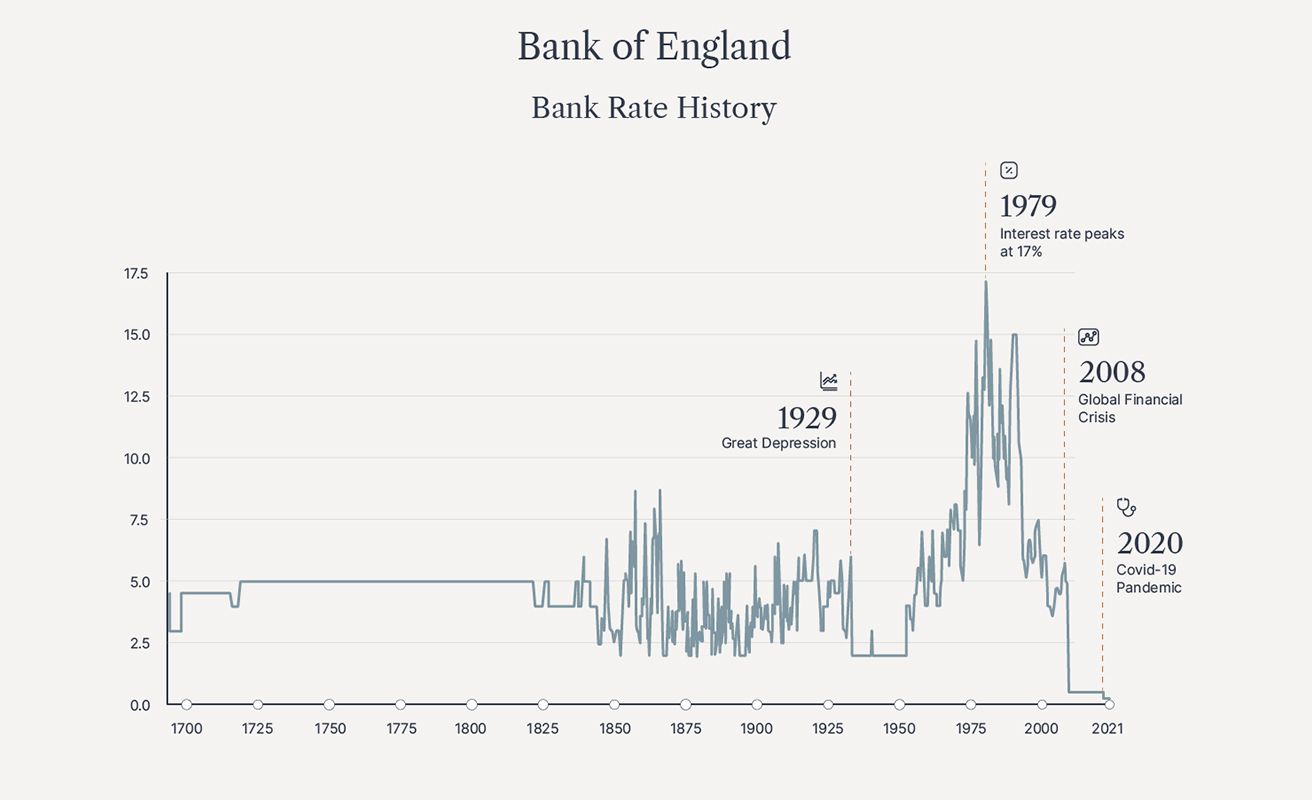

Following the 2008 financial crisis and the impact of Covid-19, the Bank of England cut its key interest rate – the Bank Rate – to just 0.1%, its lowest level in more than 300 years. The central bank has also spent hundreds of billions of pounds buying government bonds to push down borrowing costs throughout the economy. This has caused many lenders to reduce interest rates on long-term fixed-rate mortgages to historic lows, making these products an increasingly enticing option for homebuyers.

Coupled with continuing economic uncertainty due to the pandemic and economists predicting rising interest rates in the coming years, it's unsurprising that some borrowers think now is the right time to lock in their mortgage repayments and avoid fluctuations in their borrowing costs. According to research published last year by the Bank of England, mortgages with long-term fixed interest rates – defined as those with rates fixed for five or more years – accounted for half of new mortgage lending, compared with 30% in 20161.

“We have seen a distinct increase in the number of clients who have been taking out a long-term fixed rate mortgage for five or ten-year terms,” says Peter Izard, Head of Intermediary Business Development at Investec. “In 2017, 25% of our mortgage lending was fixed for five years or more. That has increased to 29% so far this year. Also, enquiry levels about our long-term fixed-rate mortgages, particularly those with up to 10-year terms, have increased in recent months as the expectation of an eventual increase in interest rates grows.”

What are the main benefits that your clients should consider?

According to Investec’s Chief Economist, Philip Shaw, the most significant advantage of a long-term fixed-rate mortgage – particularly those with 10-year terms – lies in its predictability.

“Clients know what they’re going to be paying over a period of 10 years,” he said. “Clients don’t have any interest rate risk, whereas normally if they have a tracker or a variable rate, that will tend to rise and fall with the Bank of England’s Bank Rate.”

Other benefits include avoiding any product fees or lending criteria changes that might be incurred if switching products more frequently.

What are the main risks that your clients should consider?

Long-term fixed-rate mortgages aren’t suitable for everyone, and Brokers must make their clients aware of the potential risks.

“One of the main disadvantages is that clients might be in a position where interest rates fall even further than the rate they’re paying,” explains Philip. “The decision centres on how much clients want to reduce uncertainty over repayments and what their view is on the outlook for rates.”

A client could also miss out on lower mortgage rates that are available as their equity increases over time.

Additionally, if during the fixed term a client wanted to make an overpayment to their mortgage above any penalty-free limit allowed by the lender, or even wanted to pay it off in full, an early repayment fee would apply.

For these reasons, borrowers should get comprehensive advice before committing to a fixed-rate mortgage and fully understand its terms before making a decision.

Could now be a good time for your clients to consider fixing interest rates for longer?

With interest rates so low, it’s entirely likely that brokers will receive enquiries from clients seeking to lock in their mortgage rates for longer, particularly since there’s a growing expectation among economists of interest rates rising as the UK recovers from the pandemic.

“We know that the Bank of England’s Bank Rate is at an all-time low of 0.1%,” says Peter Izard. “Around the start of the year, there was speculation that the Bank of England may push the Bank Rate below zero. But as the economic recovery gathered pace, that appears to have been put on the backburner. The consensus among many economists now is that it is not a case of ‘if’ interest rates go up, but when and by how much.”

Philip Shaw says he and his team anticipate that if the economy continues to do well, the central bank would begin to pull back from record-low borrowing costs over the coming years.

“While, in our view, it’s too early to raise interest rates or tighten policy more generally now, we do expect that to start in the middle of next year, with the Bank Rate increasing to 0.5% by the end of next year and 1% by the end of 2023,” he explains.

Are fixed-rate mortgages suitable for your clients?

Aside from making your clients aware of the advantages and disadvantages, brokers should get borrowers to consider their personal circumstances before making such a decision.

For clients with more clarity about their future plans – such as those wanting to buy a long-term family home or a property investment – a fixed-rate mortgage with a five- or 10-year term could save them money in the long run and protect against interest rate increases.

However, if a client is looking to sell their property to move home or gain liquidity in the near future, then a short-term fix of two or three years could be more suitable and save them from paying any early repayment fees.

Any potential changes in circumstances might also shape a decision. These could include a change in income, the desire to move or financial plans that include paying off a mortgage balance.

What about overseas buyers and Buy-to-let clients?

For property investors, mortgage costs affect rental yield. “Buy-to-let clients could have greater certainty about their mortgage repayments with a fixed-rate mortgage, while their rental income may well increase over the course of the term,” Peter Izard said. “The ability to fix an expense for a set period can be a very compelling argument.”

Ongoing travel restrictions mean that many of Investec’s international clients are buying property remotely from overseas. Under these circumstances, international buyers need to factor in foreign exchange (FX) rates when choosing a mortgage. In this situation, it may be prudent to recommend that a borrower work with an FX professional to ensure they get the most value from their mortgage.

What flexibility could I get with a fixed-rate mortgage?

Investec’s mortgage solutions are bespoke to enable us to reflect our clients’ unique financial needs.

For example, we can give your clients the ability to combine various fixed rates that meet their short-, medium- and long-term goals. We also offer the ability to combine a mixture of fixed and variable tracker rates.

In addition, if your client’s income is complex and affected by bonuses, carry and stock, deferred payments or foreign currencies, we have teams dedicated to understanding this complexity who could structure repayments accordingly.

All applicants are considered on a case-by-case basis.

1 Why are more borrowers choosing long-term fixed-rate mortgage products? (Bank of England)

Want to discuss your clients’ options? Get in touch today.

To learn more about our mortgage offering, talk to a private banker or complete our callback form.

Disclaimer:

Security property may be repossessed if borrowers do not keep up repayments on their mortgage. Investec residential mortgages are only available for residential properties in England or Wales and are primarily available to UK residents and subject to eligibility. Interest rate past performance is not necessarily a guide to future performance. It is advisable for borrowers to contact a professional advisor if they need financial advice.

Browse articles in