How we use Cash Flow Return on Invested Capital to help build your portfolio

In the previous edition of Private Insight, we introduced the concept of Cash Flow Return on Invested Capital (CFROIC), and how we use it at Investec Wealth & Investment. We explained how we use CFROIC as our primary metric to evaluate how well a company’s management allocates capital.

In this article we show that if a company generates returns on capital greater than the cost of capital, then the company should attempt to grow. It should grow by investing in ‘value-creating’ projects; projects which generate returns on capital greater than the cost of capital. Conversely, if a company is generating returns below the cost of capital, it should fix the problem, either by employing measures to improve returns on capital, or by withdrawing capital from the business. Simply put: if returns on capital are greater than cost of capital, the company should seek to grow; if returns on capital are lower than the cost of capital, the company should look to shrink.

What should a company do if it has the opportunity to invest in projects where the returns are above the cost of capital, but below the returns the company is currently generating? Surely this would cause the company’s returns on capital to fall, and therefore cause the company to generate less value?

To answer this question, we introduce another concept: economic profit. By multiplying the difference between return on capital and cost of capital by the amount of capital invested, we arrive at the total value added by this investment, which we term economic profit.

Economic profit shows us the simultaneous result of returns on capital, cost of capital, and total capital invested.

The amount by which a company’s returns on capital exceed its cost of capital tells us only the difference between return on, and cost of, capital. It tells us nothing about the amount of capital invested, and therefore about the total amount of value created. Economic profit shows us the simultaneous result of returns on capital, cost of capital, and total capital invested.

We illustrate this with an example. Imagine that a company is evaluating investing in two projects, project A and project B. Project A generates a return of 11%, while project B generates a return of 10%. Assume that the company’s cost of capital is 7.5%. Which project should the company invest in first? Without further information, the obvious answer is project A, because it generates a higher return. However, what if we told you that project A is tiny in nature, and that the maximum you could invest in it was £1,000, while project B is enormous, requiring a total investment of £100 million?

The total quantum of value added by investing in project B is greater than project A, therefore the correct answer is for the company to invest in project B first (assuming it can finance the total investment of £100 million without changing its cost of capital). The important observation is that project B generates a higher economic profit (£100million x (10%- 7.5%) = £2.5million) than project A (£1,000 x (11%-7.5%) = £35). Therefore the company should prioritise investment in project B, because it produces a bigger quantum of value creation.

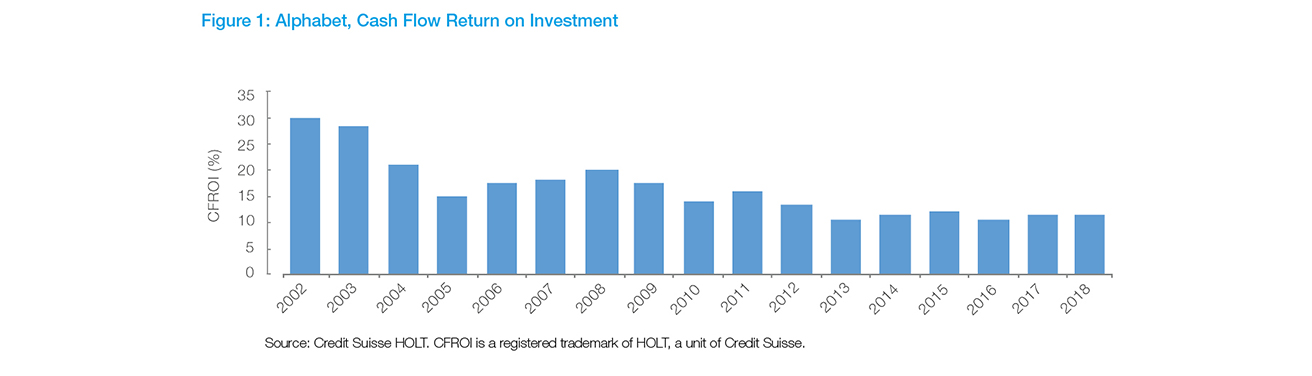

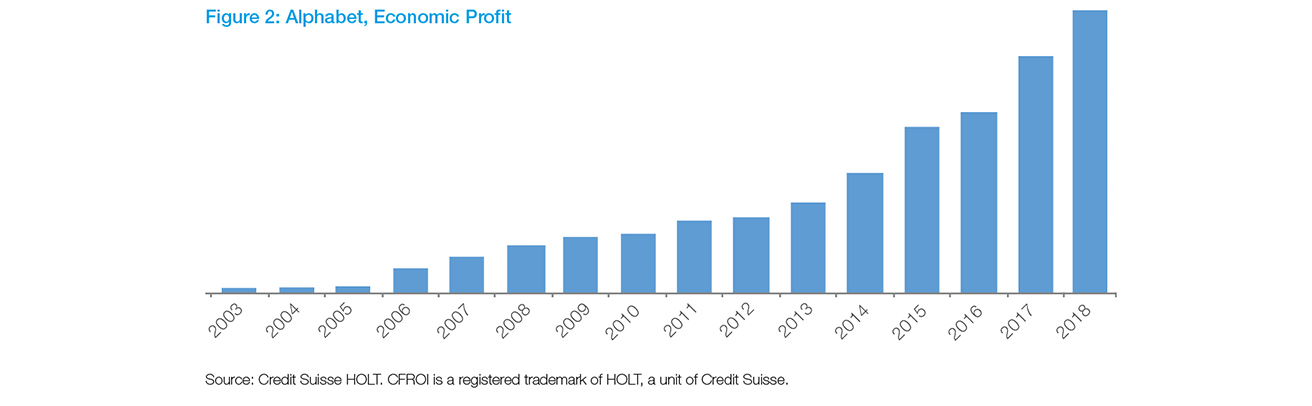

Focusing only on return on capital without considering economic profit can lead one to erroneously discard strongly value-creating companies, particularly when returns on capital are falling. For example, Alphabet, which owns Google, has seen its returns on capital fall over time, although these are still well above the cost of capital. This fall has been driven by the company investing in projects that generate a return on capital above the cost of capital, but where these return on capital were lower than the company’s historic returns.

Focusing only on return on capital without considering economic profit can lead one to erroneously discard strongly value-creating companies, particularly when returns on capital are falling.

Figure 1 clearly shows that over time, Alphabet’s returns on capital have fallen, although they are still well above the cost of capital (so Alphabet is certainly value creating). However, Figure 2 emphatically shows the scale of value that Alphabet has created over time. This has been rewarded by share price appreciation over this time.

Further consideration of the maths behind economic profit gives us further insights into the ways that companies can create economic profits. To increase economic profit, a company can: (1) improve its returns on capital by running its operations efficiently, (2) reduce its cost of capital through the judicious use of a variety of funding sources, and (3) if returns on capital are greater than the cost of capital, by investing more capital in the business. Indeed, companies may be able to do all three at the same time.

At IW&I, our stock selection process is designed to target all three of these elements, and find companies that satisfy these criteria: (1) generation of high and stable returns on capital, (2) a conservatively funded balance sheet (leading to a lower cost of capital), and (3) ample growth opportunities (leading to growth in the amount of capital employed in the business).

A final additional consideration is the valuation we pay for businesses like these. Companies with these characteristics generally do not come cheap, so we should be careful not to pay too much for them. We achieve this through a disciplined valuation process, which we look forward to telling you about in future editions of Private Insight

Discover how you could benefit from our wealth management services for private clients

Browse articles in