20 Sep 2022

Investec Market Review August 2022

The Investec Equity Capital Markets Review takes a moment to look back upon the key month-by-month trends and talking points surrounding UK Equity Capital Markets (ECM), whilst also reflecting on wider equity market performance and those key drivers that are sitting high on the agendas of investors.

Executive summary

In the second half of August we have seen a significant reversal of the gains made by equity markets during what we previously characterised as a Bear Market Rally.

Rising energy prices dominated highlights in August as Gazprom announced further maintenance related closures of the Nord Stream1 pipeline, further contributing towards increasing inflationary pressures and concerns over the health of the global economy.

UK ECM activity was quiet but in-line with August 2020 and August 2021. Markets remain open for compelling accretive M&A deals.

Public M&A activity has been buoyant so far this year. There are a number of large, announced transactions that are yet to complete, and so it is likely that the remainder of 2022 will continue to be busy for public takeover activity.

Market backdrop

After a positive performance in July, gains reversed in August

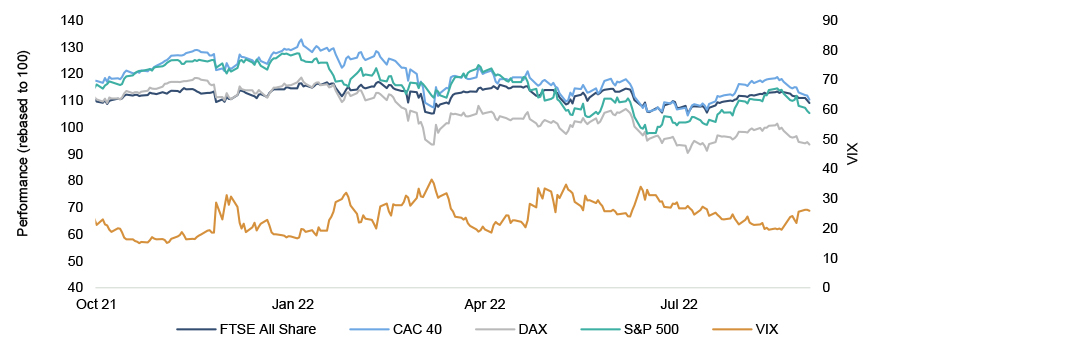

Despite a positive start to the month, worsening economic outlook and further inflationary pressures, reversed some of the gains made in July. The FTSE All Share dropped by 2.3% over the month, and the French CAC 40 and German DAX 40 dropped both by 4.8%. The S&P 500 lost 4.0%.

Stalled business activity and rising energy prices set the tone for the Autumn

Business activity in the UK stalled as the PMI fell to an 18 month low of 50.9 in August from 52.1 in July. The services sector expanded but at the slowest rate registered in the last 18 months. The Eurozone’s PMI also reached an 18 month low of 49.9, signalling a contraction.

The energy cap rose will increase to £3,549 from 1 October 2022 which implies that household bills could jump by 80%. This follows Gazprom’s maintenance related closures of the Nord Stream 1 pipeline.

As energy prices continue to soar, Goldman Sachs forecasts that inflation in the UK could reach 22% in 2023.

Consumer confidence also hit new lows in August. A survey of 2,000 consumers ran by the GfK Institute indicated that confidence would fall to new record low in September driven by increased savings of households to cover for higher energy bills.

On the other hand, despite steeper mortgage rates and further pressure on household finances, house prices registered an increase of 10% in August vs the previous year. Capital Economics forecast that as mortgage rates continue to rise and demand softens, prices could start to fall in Q4 22.

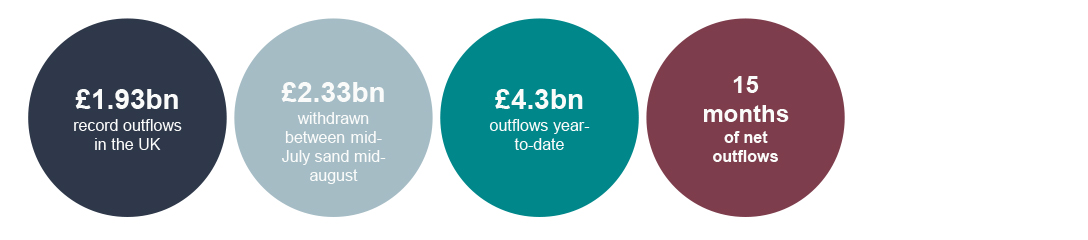

£2.33bn withdrawn from equity funds between mid-July and mid-august, UK-focused funds worst hit

Data provider Calastone have reported that all geographies saw outflows in August. In the UK, investors withdrew a record net £1.93bn, the previous record (£1.56bn) was set in July 2016 following the Brexit vote.

Global equity market performance & equity market volatility

Source: Bloomberg, FactSet, Calastone

UK equity fund-flows snapshot

Source: Bloomberg, FactSet, Calastone

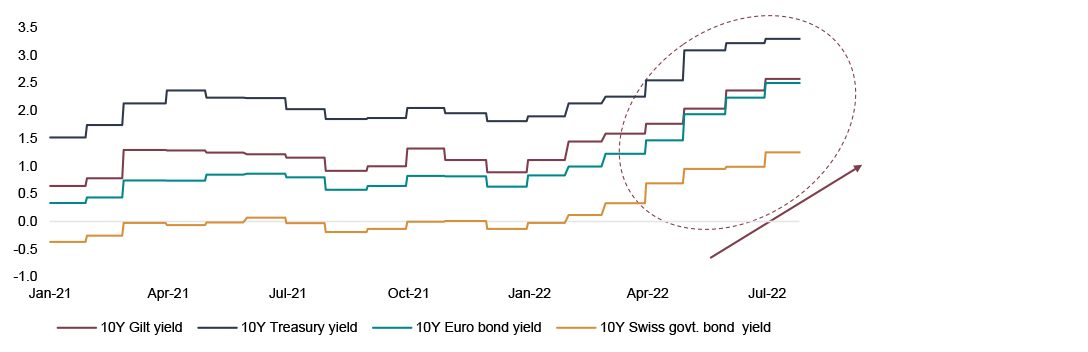

Bond yields have been steadily increasing

Source: Bloomberg, FactSet, Calastone

UK sector performance

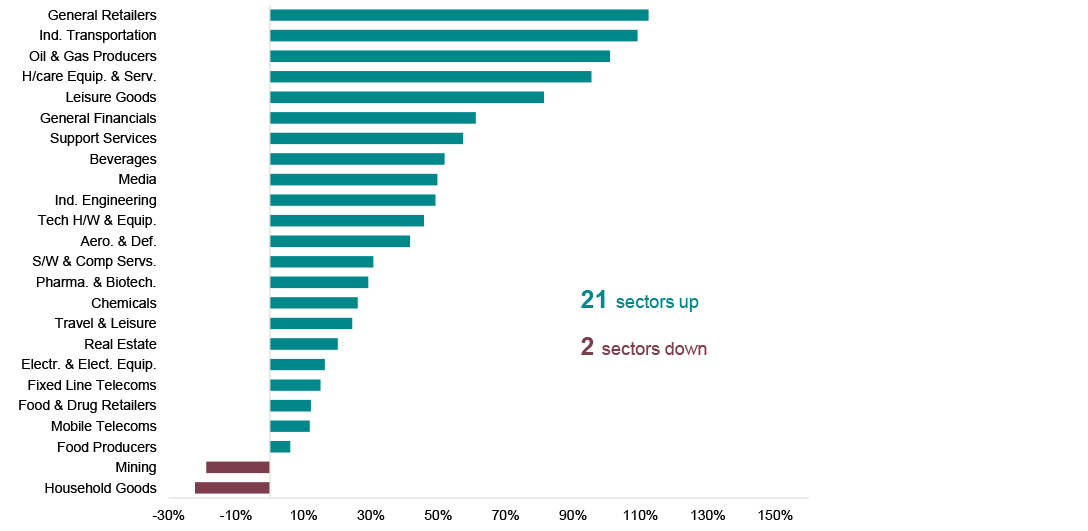

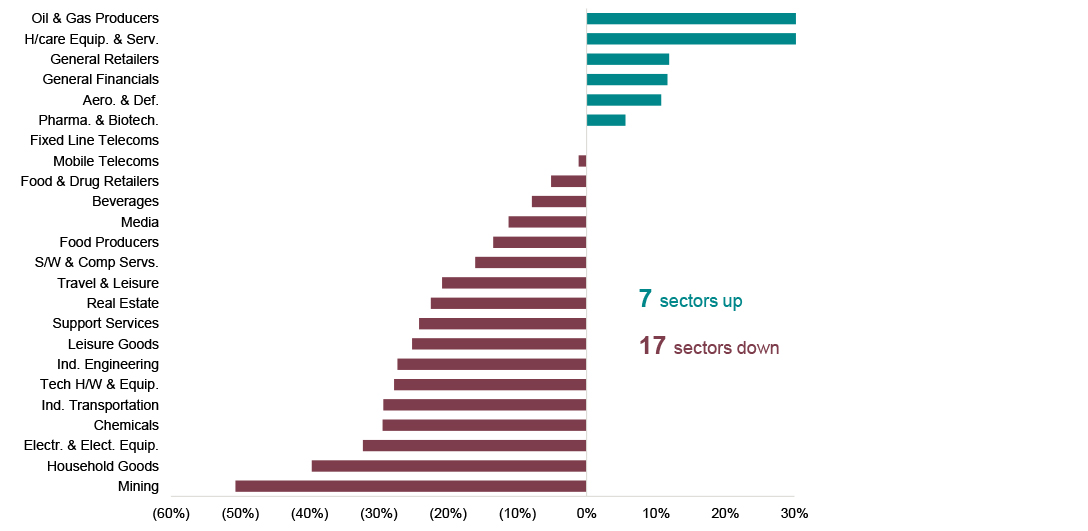

It continues to be a disappointing year for the majority of UK sectors, with only a handful maintaining the ground won in July

After a good month for most sectors in July, August proved difficult. Seven UK sectors had registered share price gains, one less than in July. Seventeen sectors ended the month in red. Software and Computer Services added a further 8% to the 10% gains registered in July. Despite mounting inflation and decrease in discretionary spending, Travel and Leisure stocks maintained the gains from July adding a further 2.9% increase.

Further inflationary pressures from increasing energy prices dampen the economic outlook for Q4 22

The Oil and Gas sector continues to be the top performer so far over 2022, registering an annual share price gain of roughly 38%, 9% higher than last month. The sector gained from the supply pressures following Gazprom’s announcement regarding the maintenance related closures at the end of August. The worst performer in August was Household Goods which lost c.17%. The sector includes notable stocks such as Made.com which have been hit by supply chain pressures and falling demand.

Overall however, most UK sectors continue to exhibit improvements in their share prices since the initial outbreak of COVID-19

Sector performance (since mid-March 2020)

Source: FactSet

Sector performance (YTD)

Source: FactSet

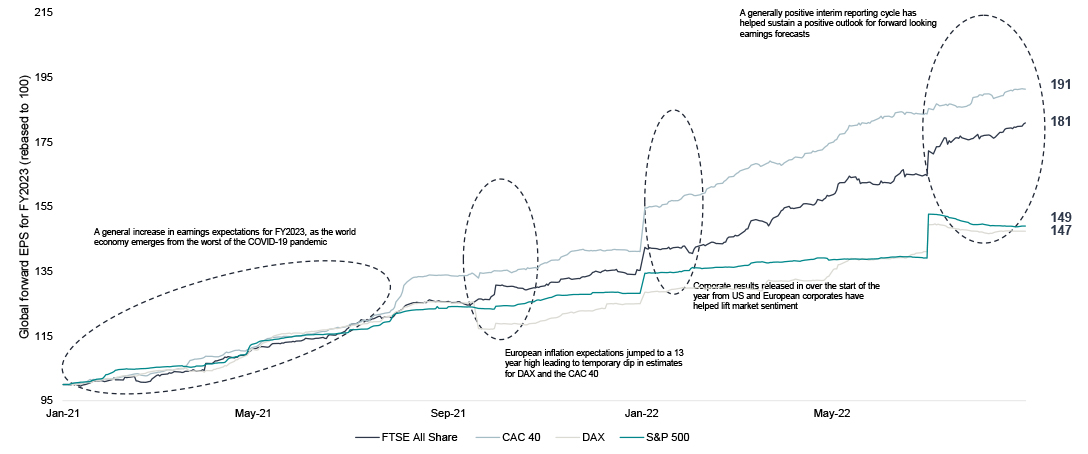

FY2023 global earnings snapshot

Whilst the outlook for the global economy remains mixed, it is clear that most developed economies are on a trajectory of recovery following the COVID-19 pandemic. This appears to be supporting a generally improved outlook for future earnings across numerous indices.

Source: Bloomberg

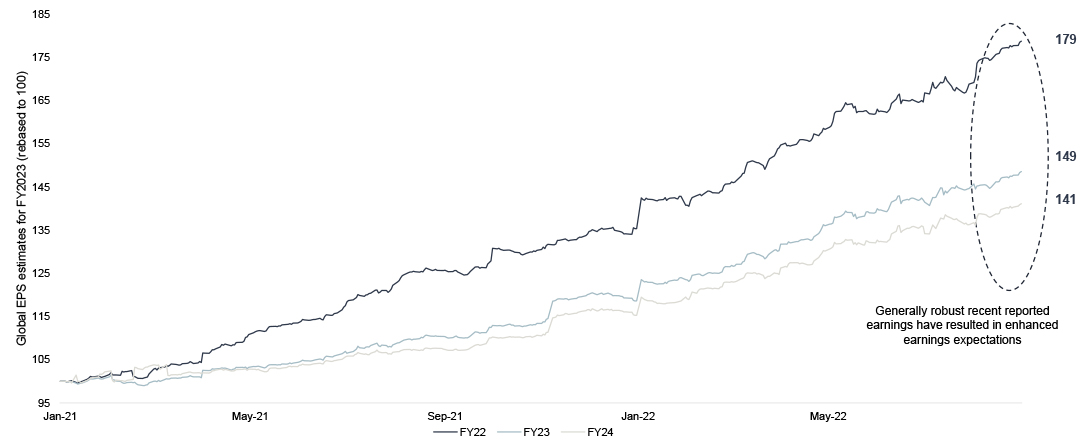

Overview of UK earnings forecast

Given the FTSE All Share’s significant weighting towards Financial and Oil and Gas stocks, one may expect earnings estimates for the index to continue to benefit from a rise in interest rates and commodity prices, with consensus views around the health of the UK economy no doubt impacting these two factors.

Source: Bloomberg

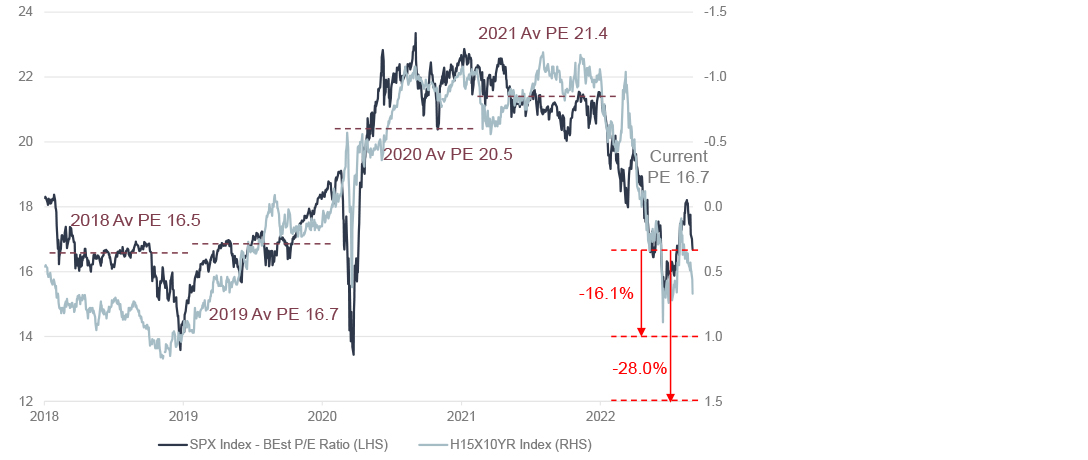

UK equity strategy - Reality hits the Summer Bear Market Rally

S&P500 vs Real Yields

Source: Bloomberg

In the second half of August we have seen a significant reversal of the gains made by equity markets during what we previously characterised as a Bear Market Rally. The S&P500 has retraced over half of its 17% rally, while the FTSE 250 has performed even worse, now trading within 1% of its previous lows as rising energy prices provided further risk to the domestic economy. However the recent pressure on equity markets has been primarily driven by a reappraisal of the supposed ‘Fed pivot’ whereby markets had convinced themselves that the Fed had reached ‘peak-hawkishness’ and therefore would start cutting rates in the early part of 2023. Those all-important ‘real yields’ hit a low of around 7bp shortly before the peak of the summer rally. In the lead up to Jackson Hole, many Federal Reserve Governors repeatedly tried to dissuade the market of the pivot narrative stressing that they intended to raise rates higher, and keep them higher for longer, a viewpoint held by our Economics Team’s forecasts.

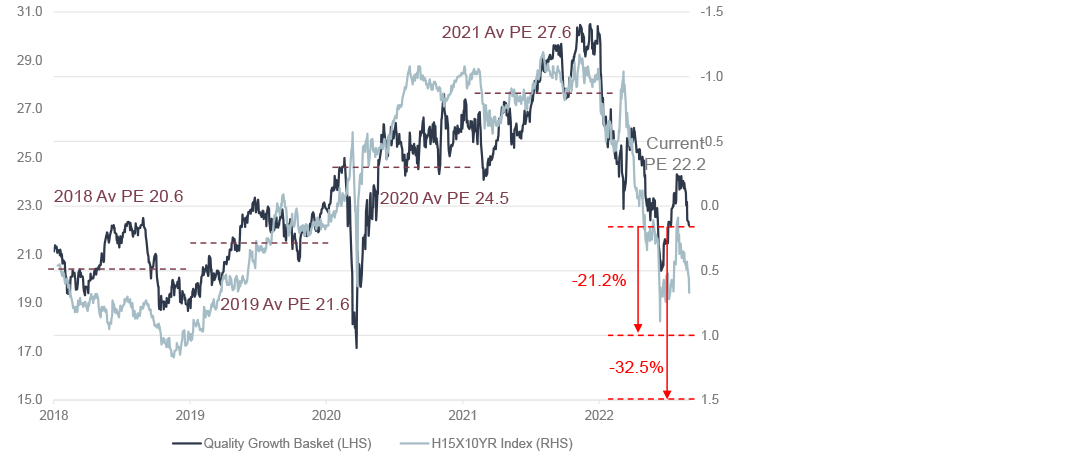

Real Yields vs Quality Growth Basket PE (CRDA, EXPN, R1, REL, SPX)

Source: Investec Securities, Bloomberg

After Chair Powell’s speech the market finally started to believe the Fed and those real yields have risen to 81bp as of close yesterday and the familiar valuation pressure has returned. As we have repeatedly said, the only other time in history when the Fed were raising rates and delivering QT, real rates went to 117bp. As can be seen on the charts above even 100bp on real yields would suggest a further 15% downside to the S&P500 taking out the June low and a further 20% downside to our UK Quality growth basket.

As we discussed in our recent note: The World has Changed: PE, E, and Duration Risks Remain... this multiple pressure is before we see the downgrades from rising inflation and the inevitable slowdown in demand as economies respond to tighter monetary policy. We therefore remain very defensively positioned where earnings security is paramount, and so we continue to favour a portfolio consisting of Banks, Energy, Staples and Utilities and this is entirely consistent with the overweight recommendations of our analysts covering those sectors.

UK ECM activity in August in-line with previous years

UK public equity-issuance lower in August

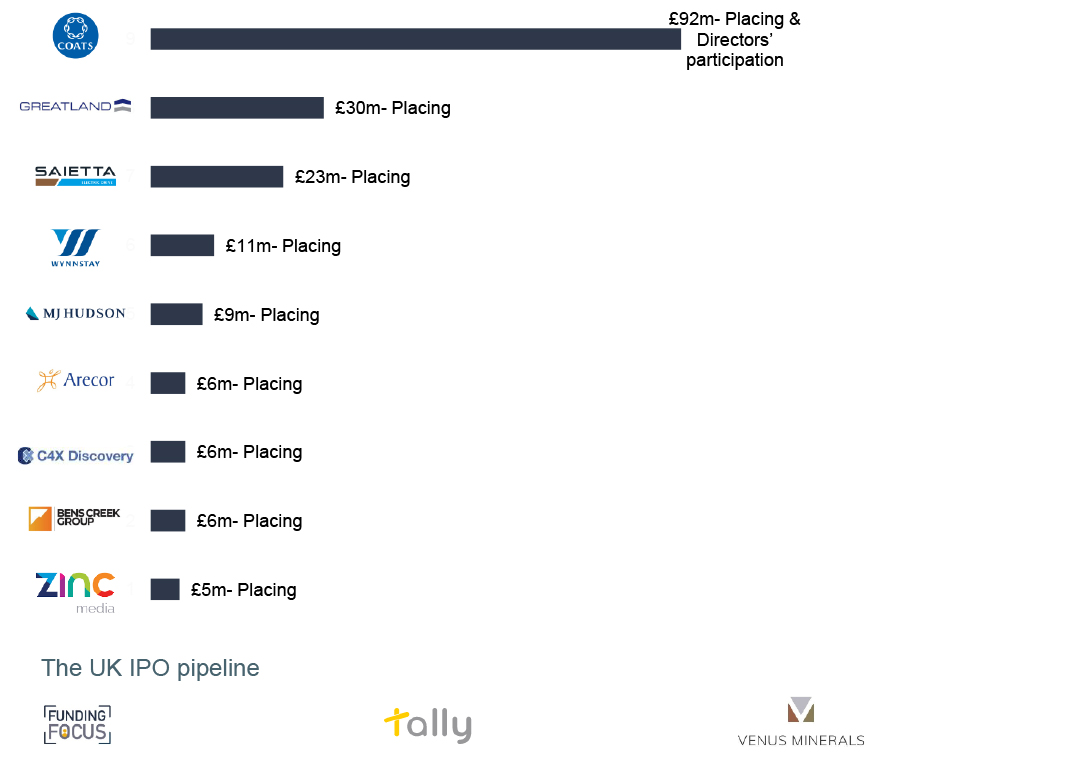

UK ECM activity was subdued in August, following elevated levels in June and July

- July saw a total of £187m raised across UK ECM transactions, representing only 16% of the levels witnessed in July.

- Both the quatum per transaction and number of of transactions was lower than July (9 transactions completed in August vs 12 in July).

- August is, historically, a quiet month for ECM activity. In August 2021, £165m were raised in total across 8 deals, almost double of the total amount raised in August 2020.

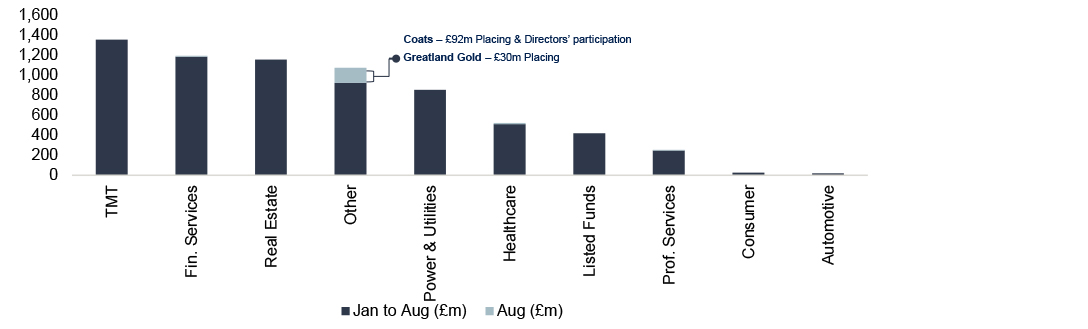

Public equity fund-raises by sector and highlighted deals

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

Coats follows Dechra’s example, of funding sizeable acquisitions with the help of new equity

Coats Group, a leading industrial thread manufacturer raised c.£92m from existing shareholders to fund the acquisition of Rhenoflex Gmbh, a leading manufacturer of sustainable structural material solutions for the footwear industry.

- The new shares were priced at 63.5p,a 4.5% discount to the closing price of 66.5p

- Directors subscribe for new shares in excess of £325,000

- Proceeds will be used to fund the acquisition of Rhenoflex and the costs associated with the acquisition. Coat’s proforma leverage to remain within the target of 1.0x-2.0x Net debt / EBITDA

ECM issuance across the deal size spectrum in August

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances

Browse articles in