If you are considering working with a Financial Planner and gaining the benefits of holistic financial planning, it is important that you first establish your aspirations and objectives. Doing so will allow the Financial Planner to maintain a clear understanding of what it is that you wish to achieve, like taking account of time horizons and prioritisation.

While you navigate your financial journey, your Financial Planner can also help you consider areas such as tax efficiency and the recommendation of suitable arrangements and plans to help meet objectives. Such recommendations can in effect be thought of as the Financial Planner’s toolkit: at hand to help you move towards the stated goal in the most beneficial and efficient manner.

Likewise, a robust and measurable investment management proposition is an integral component in ensuring that your objective may be successfully met, however, it does not define the goal.

Your Financial Planner is able to draw on experience, whilst applying their knowledge to your specific circumstances. It is this financial coaching on which many clients place the highest value.

Of course, one common challenge is that you may not always know exactly what your specific objectives may be. A common example may be the requirement for financial security in retirement. It is the role of your Financial Planner to uncover what this actually means for you. Your Financial Planner is able to draw on experience, whilst applying their knowledge to your specific circumstances. It is this financial coaching on which many clients place the highest value.

When considering how broad financial planning needs can be, it is important that your Financial Planner has an overarching view of your financial position and is empowered to provide advice on a holistic basis. Without this visibility of the broader landscape, it is not possible for your Financial Planner to provide informed advice and to deduce the progress of your financial plan.

Achieving your goals

After setting your goals there are many potential factors that could influence the objectivity and success of the plan. Common examples of these types of influences are investment returns and changes to legislation (such as future taxation rates). In order to manage the risk posed to the plan by such variance, it is necessary to review the position regularly.

In order to provide an analytical, objective and focused approach towards ensuring that your future provision is appropriate, our Financial Planners are able to produce cash flow modelling, which helps to provide a roadmap of your financial future based on your stated objectives. These models can be reviewed or altered at any point, which will allow your financial landscape to continually evolve.

How it works

The process begins by ensuring that appropriate assumptions have been made in terms of core areas such as inflation, investment returns (where Financial Planners can work alongside your Investment Manager) and dates for life events (such as retirement).

An understanding of the ongoing asset position can be beneficial not only in terms of lifetime planning requirements, but also from an estate planning perspective.

Once the assumptions, your objectives and current position details have been recorded, it is then possible to map out your financial future based on these inputs. This provides value in terms of allowing you, for example, to understand the level of income or capital realisable from the plan on a sustainable basis. An understanding of the ongoing asset position can be beneficial not only in terms of lifetime planning requirements, but also from an estate planning perspective. This demonstrates that cash flow modelling should not merely be considered a tool for specific events or situations, but rather as an ongoing tool to provide visibility and transparency to you.

Types of cash flows

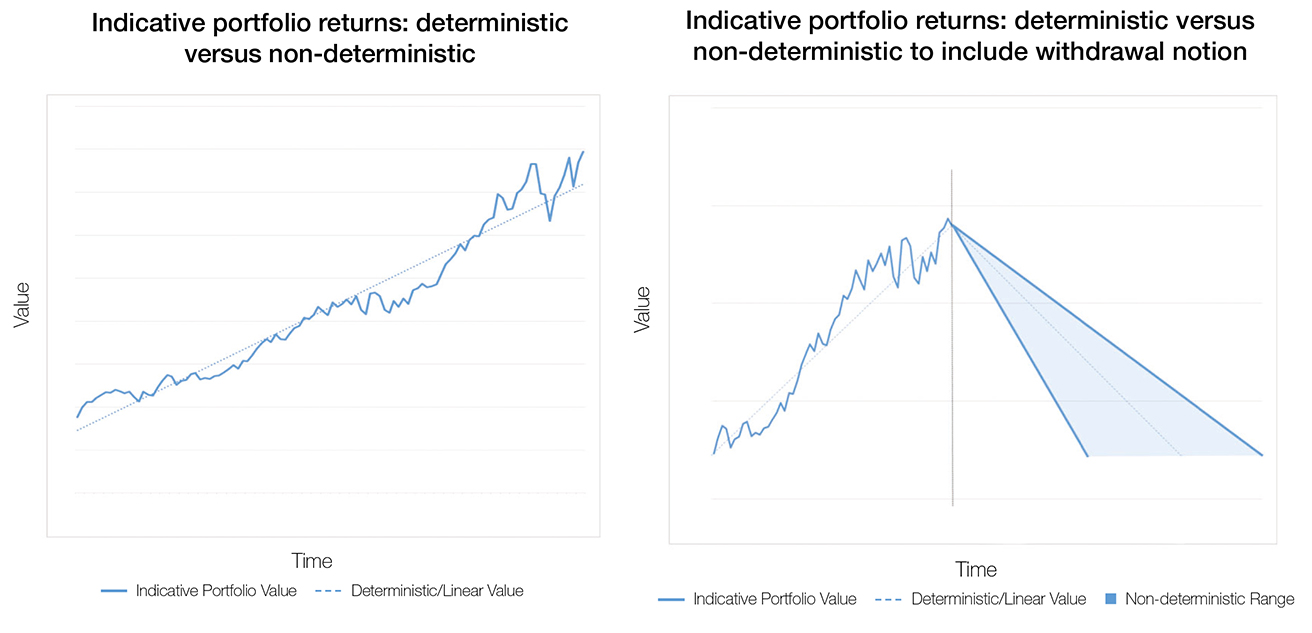

There are two main types of cash flow modelling; deterministic modelling and non-deterministic. Deterministic modelling, or linear modelling as it is also known, uses the assumptions and inputs used by the Financial Planner on a linear basis to arrive at a specified conclusion. Non-deterministic modelling, or stochastic modelling, introduces the ability to allow for market randomness.

The above graph gives simple context in terms of potential investment returns.

As highlighted in the above graph, one valid concern when using linear or deterministic cash flow modelling is that while the assumptions used are well researched, predominantly being based upon averages derived from historic data, this does not cater for future deviances from these averages. This can also be known as a form of sequencing risk.

To help combat this, non-deterministic or stochastic modelling can be employed to allow for market and assumption randomness and to provide a likelihood in percentage terms of your financial plan leading to successful fulfilment of your objectives. This sophistication can offer the opportunity to consider the impact of a much greater number of theoretically possible scenarios. A particularly stress- inducing example of sequencing risk could be demonstrated when considered along with reverse pound cost averaging, for example a requirement to make portfolio withdrawals in a falling market, which can substantially reduce longevity.

Moving one step further than shown in the above graph, we can also consider the effect on possible plan success introduced by drawing down on the portfolio. As can be demonstrated in the above graph, while the deterministic line suggests a very set outcome or exhaustion point, it is worth highlighting that under the stochastic modelling, the potential outputs could be very much better or indeed worse than as represented by the linear approach.

Deciding your approach

Taking the above into consideration, helps to demonstrate the role of holistic financial planning. Establishing your objectives prior to introducing measures such as a combination of the above cash flow modelling approaches will ultimately provide an optimal approach to understanding your ongoing position and to provide the greatest opportunity to measure plan success versus your ongoing objectives.

Our financial planning team would be delighted to meet with you to discuss your aspirations and to work together to produce a holistic plan to provide the opportunity for your financial goals to be achieved.

Discover how you could benefit from financial planning services from our long-term strategic partner, Rathbones

Browse articles in