Introduction

Private investors and developers are the backbone of the property industry – entrepreneurial, innovative and often discreet.

So, in asking FTI Consulting to poll a select group of private clients active in real estate, we were keen to seek the views of an influential group who are often ahead of the game in spotting emerging trends.

This group of stakeholders have made up a significant portion of our loan book since we started out 25 years ago. In fact, 2021/22 saw our private client team provide a record £515 million of financing to borrowers. Investec’s loan book to entrepreneurial private clients now stands at more than £1 billion, with more than £450 million of development finance for commercial and residential assets.

These are the people who call the market early – early adopters with the flexibility to buy when they see value, and develop and refurbish properties to lease or sell in anticipation of an increase in demand.

This is why the findings of our research make fascinating reading, and provide a glimpse into the future direction of travel for UK real estate. Our private clients have adapted to the turbulence of the Global Financial Crisis, Brexit and the Covid-19 pandemic to demonstrate resilience and optimism about real estate.

It is exciting to hear insights from this traditionally discreet group - and encouraging to see that they retain their capacity to innovate and speculate ahead of the rest of the real estate world.

A further challenge was presented in May by the Bank of England, whose Monetary Policy Committee increased the base rate to 1% and forecast an economic contraction in 2023. These changes could signal the beginning of a new era for real estate investors, which will require them to remain agile and opportunistic, and to fully understand the impact of the shifting landscape. As Investec’s Chief Economist Philip Shaw points out in this report, the Bank’s base rate is now the highest it has been for more than 13 years.

In this report, our respondents’ views on two asset classes caught our attention: the first is that private clients are even more bullish than traditionally optimistic agents when it comes to residential, believing that capital values and rents will outperform other industry predictions.

You cannot escape the logic of this: the United Kingdom and particularly the South-east have a serious under-supply of homes for sale or rent, which is caused largely by the challenging planning system. With 52% of last year’s loan book exposed to residential, we are well placed to capture this demand.

And secondly, private clients’ attitude to retail property also catches the eye, with 42% seeing this sector as appealing over the next five years as values have fallen – causing investors and retailers to both become more active again.

As innovative as ever, private investors are now moving up the risk curve to generate the higher returns they traditionally demand as they invest on their own rather than external investors’ behalf.

It is exciting to hear insights from this traditionally discreet group – and encouraging to see that they retain their capacity to innovate and speculate ahead of the rest of the real estate world.

Executive summary

If there is one word to describe the performance of the UK real estate sector in recent years, it is resilient. Investors have been operating against an unprecedented backdrop of macro-economic disruption, with Brexit, Covid-19, and the Ukraine crisis.

Reflecting the entrepreneurial element of the private client investor cohort, these challenging times have failed to dampen sentiment and can often be perceived as an opportunity. Whereas institutional investors can often be restrained by allocation and return constraints, perhaps the most intriguing result of our research is that private client investors sense an opportunity across all the real estate subsectors. Both office and retail, which have seen significant downward pressure on valuations as a result of the pandemic, are slowly starting to benefit from tailwinds, and are viewed favourably for investment both today and five years hence.

Unsurprisingly, the stable economic and political environment in the UK helps – this was cited as the top primary motivation for being active here amongst the respondents of our survey. London continues to be the clear frontrunner as an investment location, despite the government’s Levelling Up agenda.

Earlier this year, we spoke to 110 High Net Worth Individuals who are either investing in, or developing, UK real estate, with a total net worth of £12.2 billion.

Included as part of the research are the comments of Alex James, Head of Private Client Commercial Advisory at Knight Frank; Gary Sacks, Chairman and CEO of London focused developer City & Docklands; Paul Foster, Founder and now part-time consultant at Craigard; and Hayley Scott, who is part of the Real Estate Private Client team here at Investec.

Their comments echo the quantitative findings, namely that the breadth of opportunity for investors is enormous across the UK and that Covid-19 has permanently altered the real estate landscape. In line with the sophisticated and trailblazing traits of this cohort, ESG is now also very much embedded into private investors’ decisionmaking.

Of course, investors are wary about potential obstacles too, such as high inflation – which is a dominant topic of conversation, impacting both development business plans and profit on cost targets.

Among our key findings from private clients in 2022 are:

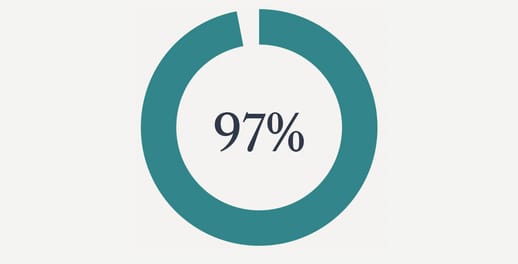

London is the most appealing location for UK real estate investment, with 97% of respondents seeing London as very or slightly appealing. It is followed by Bristol, which scored 93% respectively.

Residential for sale and rent are the asset classes viewed as the most appealing from an investment perspective over the next five years.

More than three times as many private clients believe that an opportunistic real estate strategy offers the best relative risk adjusted return today (29%) versus three years ago (9%).

Private clients are seeking only marginally higher profit on cost returns, due to headwinds such as high land values, rising development costs and inflationary pressures.

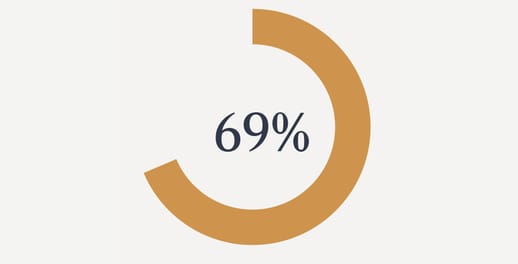

69% of private clients believe a VAT regime that penalises refurbishment over new builds is an environmentally unsound policy.

The Macro Landscape

Bullish sentiment

One of the most encouraging takeaways from our research is just how strong private client optimism is. Those polled believe that return targets are more likely to increase than stay the same over the next five years in nearly three quarters of real estate use classes.

As a dominant global city and economic haven, London, and its residential sector in particular, is viewed especially favourably as an attractive market for real estate investment: 91% of private clients expect Prime Central London returns to increase in the next five years. Investec’s Hayley Scott suggested that “Even in turbulent economic times, across multiple cycles, as a bank we have always seen central London retain its capital values and therefore historically it’s been much stronger market from a banker’s perspective.”

Our research shows that a stable economic and political environment is the primary motivation for 22% of private clients investing or developing properties in UK real estate, ahead of income characteristics (16%) and a favourable return profile (15%). This helps us understand the positive sentiment towards the UK market, with its relative stability a welcome support during uncertain times.

Of course private clients have faced unprecedented challenges over the last few years. A period of significant political uncertainty and a global pandemic has forced them to adapt their strategies - 80% of investors and developers have seen their real estate strategies fundamentally altered by Covid-19 - but at the same presented new and exciting opportunities.

Gary Sacks, Chairman and CEO of City & Docklands, commented: “Clearly there’s some uncertainty around, but market sentiment is quite strong and there’s a lot of money to be spent. I think Covid was a blip. We’ve already seen our rental income recover to 18% above where it was pre-pandemic.”

A note from Phil Shaw, Chief Economist at Investec

In May, the Bank of England’s UK Monetary Policy Committee (MPC) voted to lift the Bank Rate by 25bps to 1.00%. The change signalled a major shift in monetary policy, bringing the policy rate to its highest level in more than 13 years, the period which preceded the start of Quantitative Easing in March 2009. Arguably the most eye-catching feature of the report was the GDP projections. While 2022’s forecast was held at 3.75%, the MPC downgraded the outlook for 2023 to -0.25% (from +1.25%) and +0.25% for 2024 (from +1.0%). Governor Andrew Bailey stated that the new outlook would not technically result in a recession because the typical definition of one is two consecutive quarters of declining economic output.

Bailey explained that the majority of the economic pain was being inflicted by the surging cost of energy and other imports, rather than higher interest rates. Nevertheless, he argued that it remained necessary to tighten monetary policy to ensure that the inflation target was met. A drop in oil and gas prices (as implied by futures markets) would result in higher GDP and lower inflation, according to the Bank’s figures. However, this won’t necessarily comfort investors because in either case there are still serious headwinds facing the economy over the next couple of years. In this new phase of monetary policy, investors need to remain mindful of the changing environment and employ sensible long-term strategies.

London’s dominance

First articulated in his 2019 election manifesto, the Levelling Up agenda has been a focus of Boris Johnson’s government, with the aim of reducing the primarily economic imbalances between London and the southeast of England, and the rest of the UK.

83% of private clients think that the government’s commitment to Levelling Up will make the regions more attractive for real estate investment. It’s likely to take some time however, with 63% of respondents citing London as very

appealing for real estate investment, putting it significantly ahead of Birmingham (46%) and Manchester (45%).

“London still dominates the majority of investment volumes,” Knight Frank’s Alex James said. “There's definitely an increase in demand for regional space however. We are active across all the major UK cities, where yields and returns can often be significantly higher than those achieved in the West End.”

Reflecting its liquidity and the relative maturity of sectors including office, BTR and PBSA, Investec’s loan book aligns with these findings.

Gary Sacks commented, “It’s great that people, as well as companies, are moving to cities like Birmingham and Manchester but often it’s ultimately because the cost of living is cheaper than in London. However, from my perspective, a development project wouldn’t cost much less. A lot of the BTR towers I see being built have amazing facilities, but if tenants are paying £2,000 per month in Birmingham and could pay £2,200 in London for something similar, I know which one I would choose. Developing and taking opportunities presented by a buoyant market is one thing but long term London will outperform them every time.”

81% of private clients surveyed thought that regional real estate demand drivers would always be different to London demand drivers, and Hayley Scott agrees.

She added regional markets are “always going to be different from London, however great the impact of Levelling Up” and that despite London’s dominance, “the structural drivers of some sectors, like purpose built student accommodation or last mile logistics, transcend this Londoncentric position and mean that locations need to be considered on a case-by-case basis.”

When it comes to Prime Central London, Investec’s Hayley Scott said, “in recent years there has been subdued activity in this market because of stamp duty and hefty taxes, particularly targeted at foreign nationals, which means properties in this space are potentially undervalued. It explains why our respondents, and the wider market, expect values to increase in the medium term.”

How different sectors are performing

The political and economic upheaval of recent years, notably Brexit and then Covid-19, has affected the real estate subsectors in different ways, accelerating existing trends and acting as a catalyst for new ones. Private clients continue to evolve their investment and development strategies in the pursuit of reliable returns.

The appeal of residential

The residential sector was one of the best performing during Covid, and private clients believe there is more to come. 70% of respondents said that five year UK residential capital values would be either higher or significantly higher than the 13.1% predicted by Savills in 20211.

Investec’s own loan book supports this observation because, when compared with corporate borrowers, private clients are demonstrating a strong preference towards funding residential developments. In FY 21/22, private clients took a higher percentage of development loans than corporate clients (52% vs 42% respectively), and out of those loans a higher proportion went into the residential sector (66% vs 39%).

Investec’s Hayley Scott attributed the appeal of the residential sector to “favorable underlying demand-supply dynamics and government stimuli”, alongside “the entrepreneurial outlook” of private clients. Market data supports this confidence, with the March Nationwide House Price Index revealing annual house price growth rose to 14.3% in March with average prices hitting £265,000, the strongest pace of increase since 20042.

The picture is similar when it comes to rental values, with 63% of respondents believing that Savills’ five year increase of 19.9% will be exceeded. As private rented sector supply needs to increase by 227,000 homes a year to meet the demand for 1.8 million new households over the next decade, according to analysis by the consultancy Capital Economics3, residential-for-rent is viewed by private clients as the second most likely asset class to see increased total returns over the next five years. BTR has also become a more established use class, compared to 5 years ago in the UK, when the concept, yield and returns were less proven.

1 Savills: Residential Property Forecasts - Winter 2021

2. Nationwide House Price Index, March 2022

From an investment perspective, our research showed that residential for sale and residential for rent are the two most attractive asset classes, with 49% and 47% of investors believing that they will be particularly appealing over the next five years.

The residential sector’s resilience over the past two years has been well publicised and looks set to continue. The for sale market has benefited from the stamp duty holiday, race for space, an acute supply demand imbalance and favourable borrowing environment, while for rent has benefited from similar structural trends and its simple criticality.

City & Docklands’ Gary Sacks commented, “All the fundamentals are there. Residential demand is outstripping supply and rents are rising, which we see as the ultimate valuation of a property. Inflation will also see rents increase further, which makes the sector even more appealing to private investors as instead of getting 3% in the bank, I can buy a rental property that delivers income as well as capital growth.”

Q4 2021 saw the highest quarterly investment into Build to Rent on record, bringing total investment for the year to a record high of £4.2 billion; 20% higher than the previous peak in 20204.

Investec’s Hayley Scott said, “residential for rent is seen as stable and predictable due to its captive audience and having delivered reliable income during Covid-19. Inflation has a silver lining for leveraged clients as, in theory, it serves to erode the total debt amount vis a vis accreting capital values.”

With Capital Economics reporting that the cost of renting is set to become cheaper than that of a mortgage for the first time in 14 years, and UK consumer confidence falling, the rental sector’s defensive characteristics are set to underpin its outperformance over the medium term. Investec recently provided its largest ever Build to Rent loan, arranging a £170 million refinancing for a scheme in the Docklands.

3. Capital Economics, Rental growth on the launchpad, February 2022

4. CBRE - United Kingdom Residential Investment Marketview Q4 2021

Retail resurgence

Despite recent turbulence, 42% of investors see retail as particularly appealing over the next five years,indicating that they are considering returning to the sector and seeing potential value dislocation. Echoing CBRE’s view that “for the retail sector, the recovery is already underway and we expect this to continue, strongly boosted by the highest levels of savings on record built up during the pandemic,” Scott said, “Investors are increasingly opportunistic and perhaps think the retail market has bottomed out. Returns are improving and for that reason they seem a bit undervalued. Our clients are seeing yield plays, where they are able to purchase assets with underlying tenant covenants which make sense, and where the cashflows can strongly amortise over the course of a loan facility.”

Paul Foster agreed, “We're fundamentally looking at where the rent sits, where the yield sits, what the covenant strength is like and where can we take the asset through active asset management. We're always looking for opportunity rather than running away scared by a negative view on an asset class.”

This is reflected by private client’s investment and development activity, with 85% of investors and 93% of developers expecting to be involved in the retail sector over the next three years, while the respective figures are 91% and 89% over the next five years.

Of course, not all retail is equal. Schroders predicts a recovery in retail park rents from 2023 onwards as discount retailers expand out-of-town, while the real attraction is their high initial yield of 6.2%. By contrast, the outlook for town centre retail is bleak with shop and shopping centre rents expected to fall by a further 5 to 10% over the next two years and then stagnate5.

Offices resilient

Offices have also undergone a period of significant disruption, with Brexit taking its toll and enforced working at home decimating occupancy levels. Although leasing activity remains well below the fiveyear quarterly average of 3.6 million sq ft, there is strengthening demand with office space take up totalling 2.0 million sq ft in the first quarter of 2022; a rise of 42% on the previous quarter’s level6.

Investec’s research supports this, with 85% of investors and developers expect to be involved in offices over the next three years. In the next five years, 84% of investors and 80% of developers anticipate undertaking activity in the sector. Private clients have taken note of the capital value recovery being seen in the space. Following a very difficult year in 2020, which saw the weakest annual performance for capital values since 2009, Q4 2021 saw annual growth of 3.9%, with annual growth coming to 4.3%, the strongest annual performance since 20177.

Paul Foster narrowed this down further: “We see business park offices as especially attractive – we can buy at 8.5%, [one of which Investec is funding], for a decent building with reliable income. We believe they will come back even further as the business world gets back to normality and we've completed some very good office lettings on the business parks in the last two years even through the depths of Covid-19.”

Given private clients’ track record of taking non-institutional assets and making them fit for institutions, it seems likely that the office refurbishments they undertake in the future will have better ESG credentials. Given the high EPC requirements of institutional investors, their office involvements in the future are likely to reflect this need.

Finally, across the sector, private clients are facing up to a new normal regards lease lengths. Covid-19 has permanently reshaped how leases are structured, with both landlords and tenants seeking increased flexibility. Our research showed that 82% of private clients believe shorter lease terms are likely to be permanent feature of UK real estate and 56% have already seen the frequency of commercial tenant breaks increase since the start of the pandemic.

Investec’s Hayley Scott commented, “Flexibility is key for tenants, allowing them to scale up and down in line with their requirements. I see this as a structural trend rather than just a temporary response to the pandemic.”

5. Schroders - What to expect from UK real estate: Why investors should remain diversified

6. Cushman & Wakefield – UK MarketBeat Reports

7. https://news.cbre.co.uk/record-breaking-all-property-capital-growth-in-december-boosts-values-to-above-prepandemic-levels/#:~:text=Office%20rental%20values%20increased%200.2,the%20sector%20since%20March%202010

Challenges and opportunities

As the real estate sector evolves, our research reveals that private clients are grappling with a mix of newer and longer standing issues. Sustainability is now a top agenda point for pretty much all our respondents: 99% of private clients we surveyed have faced external pressures on the topic of sustainability. The planning system remains very restrictive and slow, and macroeconomic pressures are driving profit-on-cost targets down.

Sustainability

ESG has become embedded in decision making for private client investors and developers, as government policy evolves quickly to reflect a focus on improving the green credentials of real estate. This includes prohibiting landlords from renting out commercial properties that have EPC ratings of C or below from 2030 onwards and, in October last year, publishing a Net Zero Strategy to set out how the UK will decarbonise all sectors of the economy to meet its net zero target by 2050.

Stakeholders across the built environment have a role to play in mitigating against the effects of global warming. The government can do more. Incentivising borrowers to deliver schemes that meet certain standards should become the norm. In fact, Investec is already supporting such initiatives and is starting to see an increase in Green Loans. Investment in low carbon construction materials and carbon capture technologies needs to be prioritised, with landlords and occupiers working together to minimise their carbon footprint thereafter.

Not only are private clients facing external pressures on the topic of sustainability, but 43% of them see themselves as the stakeholder group that is most influential and demanding with regards to their real estate activity. This is followed by both the government and industry bodies (17%).

“ESG is now front and centre for all stakeholders in the real estate industry,” commented Alex James. “It’s much higher up the agenda for everyone, including the government. It used to be more of a box-ticking exercise, now investors are putting more pressure on institutions, funds and even tenants.”

Gary Sacks added, “ESG is becoming more important and for us as a privately owned company with a long term business view, it stems more from a personal belief and a desire to give something back. This means we allow our communities to thrive and rather than pushing rents up we would prefer to improve people’s lifestyle or do things a bit differently. For example, at one development, we have set up a café, where we fund three young architects to create various pieces such as lampshades from residents’ mulched cardboard. Clearly no one company is going to solve the climate crisis but we all have to play our part and we hope initiatives like this get people talking and thinking.”

40% of global greenhouse gas emissions come from buildings and, if left unchecked, they're set to double by 2050.8 But is the government’s current VAT policy structured correctly in order to avoid this fate? The private clients surveyed, and Investec, think not. Since 1973, 20% VAT has been charged on redevelopments and refurbishments, no matter what EPC rating or how green and sustainable the end product, yet 0% on demolition and new build, meaning that, in some cases, it can sometimes be more financially viable to knock down a property and start again. 84% of those polled either agree or strongly agree that it would be equitable to have the same VAT regime for new build and refurbishment activity. Hayley Scott suggests “whilst not all buildings are elected for VAT, reducing VAT on repositioning, where the end product meets certain EPC and sustainability criteria, would have an immediate impact, making more schemes viable and more quickly bringing more buildings up to modern standard, with potentially less carbon footprint than demolishing and starting from scratch.”

This issue has taken on a new urgency for two reasons. Reducing embodied carbon to an absolute minimum is critical in supporting net zero targets. At the same time, property owners are under pressure to improve the sustainability credentials of their portfolios to meet government EPC targets.

The growing focus on ESG and the impact of Covid-19 on different sub-sectors is influencing where investors currently see the best repositioning opportunity. Mixed use is the top pick, cited by 1 in 5 of respondents, closely followed by retail-to-office and retail-to-industrial. Savills predicts that by the end of the decade there will be over 300 million sq ft of redundant retail space9, and with retail space often cheek-by-jowl with office districts and, in those towns and cities with busy office markets, conversion to workspace can make sense.

Last year saw legislation that introduced a new permitted development right that allows shop to residential conversions, which has the potential to build further upon the 72,687 homes delivered in the five years prior to March 2020 under the previous office to residential PD right (Class O)10 and as part of the government’s focus on housing delivery being achieved primarily through development of ‘brownfield’ land.

The opportunity has yet to strike a chord with private clients: this type of repositioning is seen as the worst opportunity (5%). There are a multitude of reasons for this. An education process is needed as to the scale of the opportunity. At the same time, the sustainability requirements for new homes has made private investors pause for thought. And with retail values showing signs of stabilising, and footfall figures rebounding towards pre-Covid-19 level, the economics look less viable with no obvious catalyst for change. “Arguably a well located vacant shop has got a higher value than if converted into a house,” argues Knight Frank’s James.

Profit on cost targets

UK inflation has been on the rise, with the Bank of England forecasting that it could peak at 10.25% later this year. For private clients, who may not have the forward purchase power of more institutional borrowers, construction and labour cost pressures are set to be headache over the short-to-medium term.

Are private clients taking on more risk in response to these pressures? Our research suggests so, with 29% of those surveyed believing that an opportunistic real estate strategy now offers the best relative risk adjusted return (versus just 9% three years ago). Core Plus strategies are still viewed as the most appealing by 58% of respondents, although that portion is down 18% from three years ago.

Our research also shows that, on average, profit on cost targets have shifted upwards slightly. But in the context of the significant increase in risk appetite identified above, the average increase appears to be quite small (from 15.8% three years ago, to 16.5% today). The fact that profit on cost targets have only marginally increased in the face of changing investment strategies may highlight the challenges facing private clients’ returns. As Hayley Scott pointed out, “For many who bought land two to three years ago, their profit on cost has been eroded as they look to start the build out, a function of rocketing material and labour costs, together with supply chain issues, which cause developments to become protracted and also impact the overall costs. It’s also causing schemes to be reassessed or value-engineered to help claw back the eroded profit.”

The experts we interviewed for this research supported the idea that targeted returns are being challenged by economic trends. Driven by the challenging macroeconomic backdrop and weight of capital seeking access to the sector, recent years have seen some investors forced to lower their return targets for the equivalent level of risk, said Knight Frank’s James: “This presents a challenge for private clients, for whom return targets have historically been quite high versus institutional investors.”

City & Dockland’s Sacks added that “returns are only going to get tighter as more capital chases deals and yields get tighter. If it’s a choice of leaving your money in the bank or accepting an 8% IRR instead of a 10% IRR, investors are always going to choose the latter.”

When broken down by sector, our research suggests that return targets for most sub-sectors are largely expected to increase or stay the same. The office sector is viewed as the most likely (58%) to see increased returns, likely driven by the return to the office trend. The fact that PBSA sentiment is relatively low initially looks surprising, but can likely be attributed to the fact that this sector has matured substantially in recent years, and offers a more predictable income profile accordingly.

CBRE’s prediction that much of the ground lost in 2020 with regards to office-based employment will have been made up by the yearend is shared by Knight Frank’s Alex James. “I really think we're going to see recovery in offices: we're already starting to see it on the ground with clients. The demand for best in class, green buildings is really going to accelerate, driving a rental rebound in a lot of major cities across the UK.”

Development expectations

The task for private clients will be to develop in those sectors where strong capital and rental growth will allow them to offset rising development costs.

In terms of expected development activity, two sectors appear to have caught the eye of private clients. In particular, industrial and purpose built student accommodation (PBSA) are expected to see the largest increase in development activity between the next three and five years, up from 75% to 87% and 80% to 87% respectively. The increase in industrial development in particular, where expected return targets are higher, supports the idea that private clients are keen to seek out opportunities.

Investec’s Hayley Scott said, “The long term outlook for these sectors is extremely positive. We know that last-mile logistics and online shopping are here to stay, which indicates the industrial sector needs to keep up with the growth of e-commerce. Meanwhile, the latest HESA data shows more than 2 million full-time students studying in the UK – demonstrating the continued strength of student living.”

Planning and the future

Planning comes in for particular criticism in our research. 89% of those polled believe the UK planning system has become more, rather than less restrictive. “The planning system is completely broken”, argues Craigard’s Paul Foster. “No amount of reorganisation or streamlining of the system will change the mindset of a local government officers, who seem disinterested in the outcome of activity that will drive forward the economic activity in their local area.”

The outlook isn’t any more positive, with the number of developers citing planning restrictions as the biggest obstacle to investing in real estate increasing three nearly threefold over the next five years. Private clients are keenly aware of the upcoming challenges that they face, so it’s not just planning on the list of their concerns. When surveyed earlier this year, our respondents named Covid-19 as the biggest single obstacle (25%), followed by land costs (16%) and rising interest rates (13%). We suspect that if asked again today, they would be much more focused on inflation and rising interest rates. As for what’s ahead, our survey suggests that the picture will look very different in five years, with higher taxes and supply chain issues (15%) the biggest obstacles, followed by planning restrictions

(13%).

8. https://www.theclimategroup.org/built-environment

9. Savills, Re:Imagining Retail

10 Ministry of Housing, Communities & Local Government - March 2021

Conclusion

There are many compelling real estate trends that private clients will be contemplating as they seek to stay ahead of the chasing pack.

The most encouraging takeaway from our survey is just how positive sentiment is for private clients. This is a reflection of both the fundamentals of real estate as an asset class in which different sectors are underpinned by numerous long-term trends, as well as private clients’ nimbleness, and an ability to think creatively to unlock innovative opportunities that larger corporates might not.

Residential for rent and sale is the top investment choice, reflecting the compelling demographic structural drivers. Meanwhile, the office and retail sectors, which saw capital values drop in recent years, are coming back into favour for those more opportunistic private clients.

The resilience of cities – and especially London – in the face of the Covid-19 pandemic has been striking. Talk of a mass exodus in 2020 turned to “boomerang residents” as many recent exiles were drawn back to the hustle and bustle of urban life. As the return-to-work trend gathers pace, our research shows that the capital remains the UK’s top investment destination by some way, reflecting its continued status as Europe’s pre-eminent financial and cultural centre.

There are barriers. The planning system is in decline, and is expected by those surveyed to become an even greater challenge in the future. And whilst our research revealed that ESG is embedded in private clients’ decision making, the need to upgrade assets to meet stringent Energy Performance Certificate targets will demand extensive investment within existing portfolios.

Meanwhile, the government’s perplexing unwillingness to review a VAT regime that penalises refurbishment over ground-up development feels at direct odds with its ambitious net zero strategy, and poses a challenge for private clients.

Finally, the macro-economic environment may also test private clients in the months and years ahead, as inflation remains high and monetary policy changes in response. But the opportunistic and flexible nature of our private clients means that they are well-placed to rise to the challenge.