Economic Q&A replay: the economy, markets, currency, retail and property in 2021

17 December 2020

From vaccines to Brexit and elections to currency. What does 2021 have in store for the UK?

60 min video | 60 min podcast

Improving PMI (purchasing managers index) data and a global reflation will boost sub-sectors across the board. However, Bourne argues that while we are turning a corner in the battle against Covid-19, performance is likely to be patchy and companies must prepare for a Darwinian-like struggle in an altered landscape.

“Overall, we are viewing 2021 as a transitional and expansionary year. It will be stop-start and we can expect dislocations across sub-sectors. Investors will be looking through to 2022 full-year estimates for a true reflection of the state of play.”

While the volatility has been acute, Bourne says, the pandemic has created a unique opportunity for some.

“We have moved past the period of ‘peak fear’. This has caused a rotation out of expensive defensives into cheaper cyclicals. And while this trade may be consensual, we expect it to continue. Disrupted supply chains and an uneven vaccine roll-out across regions will likely cause further dislocations.”

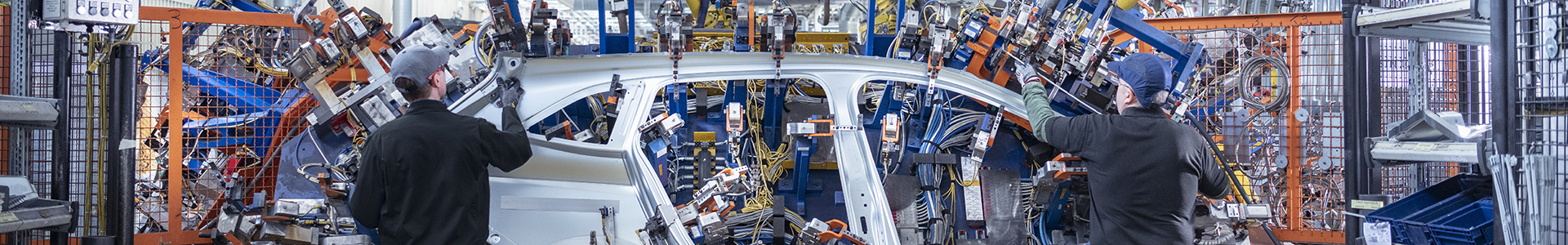

While some companies have stoutly navigated the pandemic despite the early panic, others will be left with deep scarring. Covid-19 has been the ultimate stress test for business resilience and supply chains, while accelerating digitisation and automation trends.

As global demand and price inflation pick up, we expect capital goods sub-sectors to broadly benefit but the spread between the strong and weak will likely widen.

While risks may be receding around Covid-19, Bourne believes we are not out of the woods yet, and it will be some time before we get back to 2019 demand levels.

Bourne says that while some companies have stoutly navigated the pandemic despite the early panic, others will be left with deep scarring. Covid-19 has been the ultimate stress test for business resilience and supply chains, while accelerating digitisation and automation trends. The impact has varied drastically depending on the exposure to the pandemic’s disruptive path.

“Semiconductor, Medical and Defence end markets, for example, have glided through the pandemic and improved demand, some sectors, like civil aerospace, will bear the negative legacy of Covid-19 for beyond our forecast horizon,” he says.

This leaves the diverse Capital Goods sector on varied paths to recovery. Bourne says the defence sector has remained highly resilient, supported by US investment where spending remains high driven by elevated geopolitical tension.

“Defence manufacturers profited from increased spending under Trump, but it is expected the status quo will largely remain under a Biden administration given its fiscal lever – despite calls from radical Democrat voices for cuts. Biden’s first federal budget will be released in early Spring and that should set the tone for the longer term”

Within the semiconductor end market, Bourne signals growth aided by China's drive to create self-reliance, global electrification and shorter cycles.

“Since the global financial crisis, China has moved from being the factory of the world to an increasingly service-based economy cultivating high-value capital goods sub-sectors. We expect this trend, which has been accelerated by US-China trade tensions, to continue to power semiconductors as we move out of the pandemic.”

Bourne believes semiconductors are also a microcosm of the two-speed world economy, where resurgent nations such as China have managed to effectively contain Covid-19 and restart their economies at a far quicker rate than Western counterparts.

However, other sectors are feeling the pain. Aerospace was already reeling from the 737 MAX disasters, says Bourne. “After a series of setbacks, Covid-19 grounded business. We remain very much in the foothills of recovery and there is a long runway before any semblance of normality returns to the sector.”

It is a similar story for oil field services. The Covid-19 pandemic and the accelerating energy transition have caused many to revise oil demand forecasts. However, Bourne believes while greater adoption of renewable energy is inevitable, the market may need to address the gap between perception and reality.

“There remain compelling reasons to search for investment opportunities in the space, and companies will generate value in both the short and the medium term. We are cutting back on hydrocarbon use but this is unlikely to entirely stem global demand.

The pandemic may have shut M&A activity, but Bourne believes the creative destruction we have seen across capital goods sub-sectors could unleash a new period of M&A. “Some companies will remain hindered by hefty debt, while others can seize the opportunity to expand.”

Bourne says in this new era, companies must prepare for the re-awakening of ‘animal spirits’: “The new normal will resemble a Darwinian struggle where the strong get stronger and the weak get weaker.

“While companies must demonstrate a clear route to recovery in the near term, how they can emerge stronger and must also prepare to defend themselves.”

Bourne says that as we move back to normality, companies must cultivate balance sheets that will enable them to capitalise on growth opportunities and navigate further disruption.

“We are looking into an altered landscape, companies will need to demonstrate their business models have evolved and adapted.”

He also warns companies must ensure they have the capacity to respond to a bounce-back in demand as signalled by short-term high-frequency indicators. Companies that have used the pandemic to create more efficient, leaner business models will be in the box seat.

Bourne also argues companies must increasingly be ESG compliant. A broader move toward sustainability was already inevitable, but he says this will be accelerated with policy-makers keen to use the pandemic as an opportunity to hasten the green revolution.

“We are looking into an altered landscape, companies will need to demonstrate their business models have evolved and adapted.”

The separation from Europe has long been a threat for UK specialist engineers with substantial UK fixed assets. Fortunately, the long flash to bang has given them ample preparation, says Bourne. The Christmas Eve trade deal has removed the key domestic risk.

“Furthermore, these are world leaders in mission-critical niches, from steam traps to valve actuators. As leaders in their field, their clients are unlikely to turn to less-proven competitors.

“If we see demand shocks, component shortages and increases in freight prices, for example, product prices will likely go higher than rising input costs”

Unfortunately, after we have passed the pandemic, the economic cost will only begin to be counted, Bourne says. “Looking forward, we see the ultimate threat to global growth coming in the form of increased taxes and the potential for a spike in interest rates.

“We have seen a Christmas hangover from higher infections rates that translated into lockdowns in the UK and around the globe. However, investors are willing to raise their vision. The sector tends to benefit among the most in a reflationary environment. China is already back up and running, thriving and hunting market share – the West now needs to catch up.

Against this backdrop, Bourne believes businesses must evaluate whether their business models and balance sheets have evolved to navigate the new normal.

“A return to global growth underpinned by a combination of fiscal and monetary easing will lift all ships. But we do not expect it to be plain sailing,” he adds.

I have 20 years of experience in equities. I joined Investec in 2018, to lead the Capital Goods team. The Capital Goods research team is ranked first in the SMID II survey and I have been ranked first for the last three years. My coverage has encompassed companies in Aerospace & Defence, Industrial Engineering, Electrical Equipment, Alternative Energy and Tech Hardware sectors. I am an Oxford Brookes University graduate with a BA (Hons) degree in Business & International Management. Among other interests, I enjoy skiing and tennis.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.