What inflation gives South Africans by way of higher prices, revenues or incomes, weaker exchange rates might be expected to reduce their value abroad. If this was fully the case, and the move in exchange rates was equal to the difference in inflation rates, the different fields on which we work or play across the globe would be a level one. The rand, when exchanged at market exchange rates, would then have more or less the same buying power everywhere.

Our rands almost always have bought us more at home than they do abroad – when exchanged at the prevailing exchange rates.

Clearly economic life does not work that way. Our rands almost always have bought us more at home than they do abroad – when exchanged at the prevailing exchange rates. The difference between what our rands can buy at home or abroad can be calculated as the difference between the market rate of exchange and its purchasing power equivalent, as determined by differences in inflation rates.

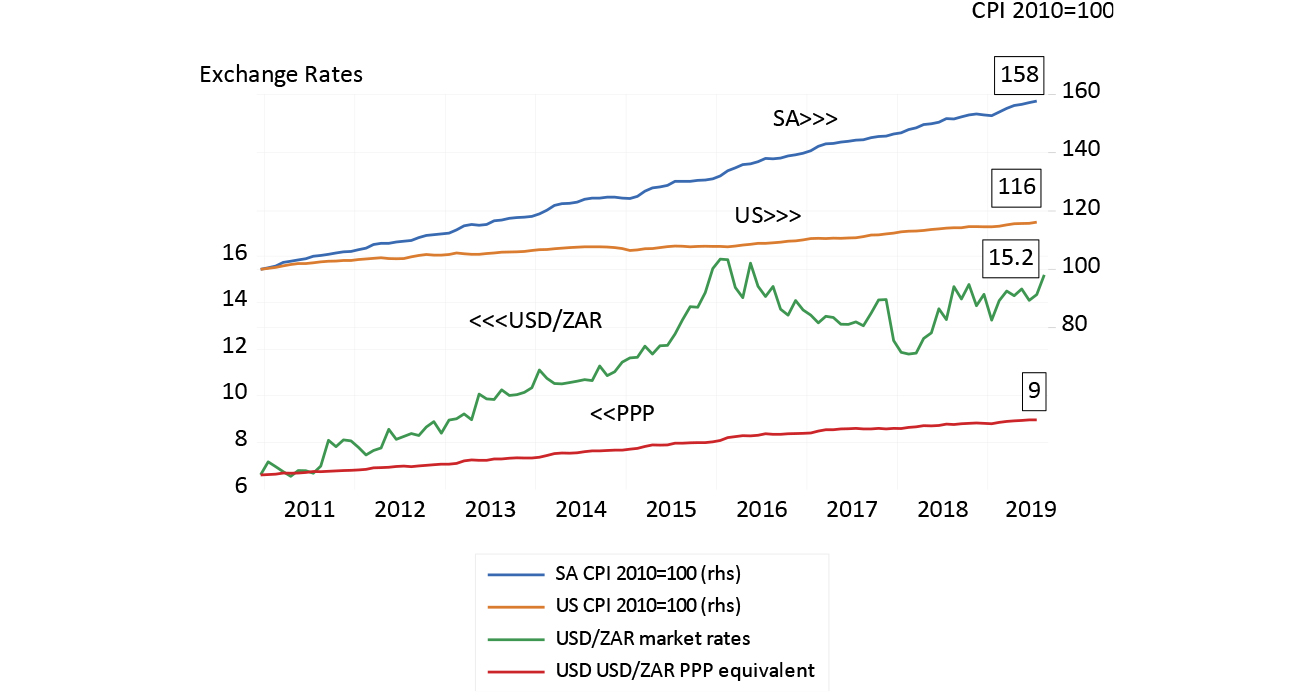

Since December 2010, when a US dollar cost R6.61, consumer prices in SA have increased on average by 58%. In the US, average consumer prices are up by a mere 16% over the same period. If the USD/ZAR had moved strictly in line with the changing ratio of consumer prices in the two economies (168/116 or 1.36) the dollar would have moved from R6.61 rands per dollar in December 2010 to R9 in August 2019. (9/6.61 = 136). An exchange rate of 9 rands to the US dollar would have levelled the playing field (see chart below).

2010 is a good starting point for such a calculation. The rand then was very close to its purchasing power parity (PPP) equivalent, were you to use 1995 as a starting point for the calculation. It was in 1995 that the rand became subject to largely unrestrained capital flows, after the abolition of the financial rand and the lifting of exchange controls on non-residents. Until then, the (commercial) rand traded consistently close to its purchasing power value.

The reality is that exchange rates are determined by forces that may have little to do with actual price changes in the markets for goods and services. They move in response to global capital flows between economies, rather than to the flows of exports and imports.

If an economy becomes a riskier destination, capital tends to flow away, exchange rates weaken, and interest rates rise to balance supply and demand for the local currency

As a particular economy becomes a riskier destination, capital tends to flow away, exchange rates weaken, and interest rates rise to balance supply and demand for the local currency. If the shocks to the exchange rates in one or other direction are sustained, the inflation rate will respond as the prices paid for imported and exported goods in the local currency increase – but with a time lag. This time lag determines the degree to which exchange rates diverge from PPP. The exchange rate leads, and inflation follows.

Converting your SA wealth or incomes from rands into the equivalent purchasing power in the US at August month-end would, therefore, have required the following adjustment: to reduce the 6.6 dollars received for R100 at market exchange rates by about 60%, this being the ratio 9/15.2. That is to say, R9 that would have represented the difference between faster inflation in SA compared to the US to net out pure inflation effects – rather than the R15.2 you actually had to give up for an extra dollar to spend in New York (9/15.2 x 6.6 = 3.9).

Therefore, any R100 of spending power in SA would have provided the equivalent of less than US$4 of roughly equivalent spending power in the US. In other words, what would be regarded as a substantial fortune of R100m in SA would have provided the equivalent of a mere US$4m of buying power in the US, perhaps not enough to live as well as you could live in SA off your capital.

Consumer prices in SA, US and exchange rates (2010-2019):

Source: IMF World Economic Outlook database, StatsSA, Federal Reserve Bank of St Louis and Investec Wealth & Investment

This purchasing power discount of 40% (((6.6-3.9))/6.4) x 100 = 40%) is a significant deterrent to the relocation of wealthy and skilled South Africans with only rands to convert. For mobile younger South Africans, with a life of income-earning opportunities ahead of them, we could undertake a similar calculation. That is, multiply the prospective hard currency salaries they might be offered abroad, when measured in current exchange rates, by approximately six tenths to account for their lesser purchasing power. Earning and saving rands at home (and perhaps investing abroad) might yield improved lifetime consumption.

We should be relying more on better economic fundamentals, than on an undervalued exchange rate. If SA could play the economic growth cards more effectively, it would reduce its risk premium and attract more capital on better terms. The nominal rand could then again approach its PPP value and the cost of borrowing rands (and dollars) would come down with less expected inflation. SA incomes after inflation could grow at a much faster rate – encouraging immigration rather than emigration, through better economic policies.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Receive Focus insights straight to your inbox