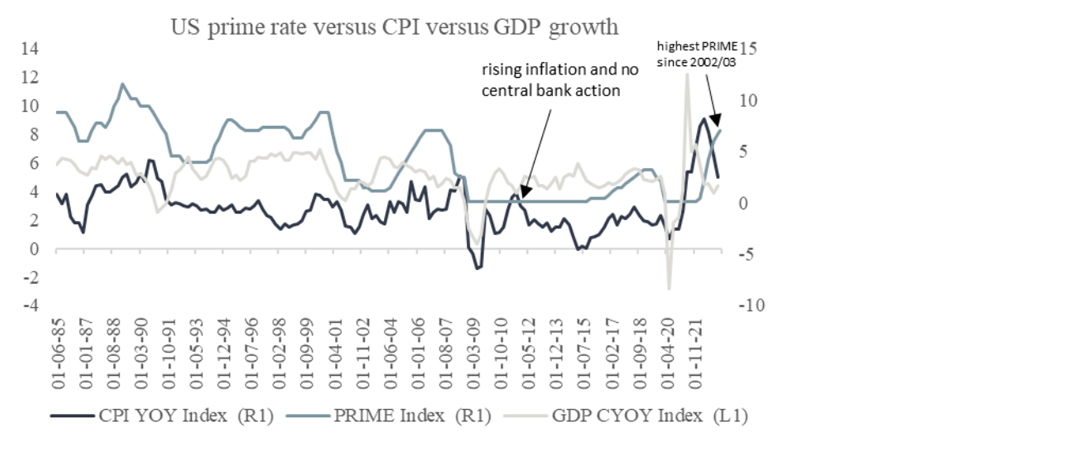

US regional bank failures should worry us. Runs on a bank’s deposits, nowadays performed with a mere click or two on an online banking account, demonstrate the threat and impact of the loss of confidence in the US financial system. Given the rapid rise in US interest rates, short and long, concerns about asset quality, liquidity and capital adequacy are understandable and can have serious repercussions for any highly leveraged financial institution. Banks are highly leveraged, with little protection from equity capital. They rely heavily on trust in their operations and management. Despite a third bank failure in the US this year, the US Federal Open Markets Committee (FOMC) recently opted to raise rates by 25bps again, though it was interestingly ambiguous in guiding the interest rate trajectory. Hopefully, the FOMC will follow market expectations and pause before it cuts its key rates (likely by year-end). From a US perspective, the prime rate is at its highest level since 2002/03 following the steepest and fastest hiking cycle since 1970.

Rates, inflation and growth

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

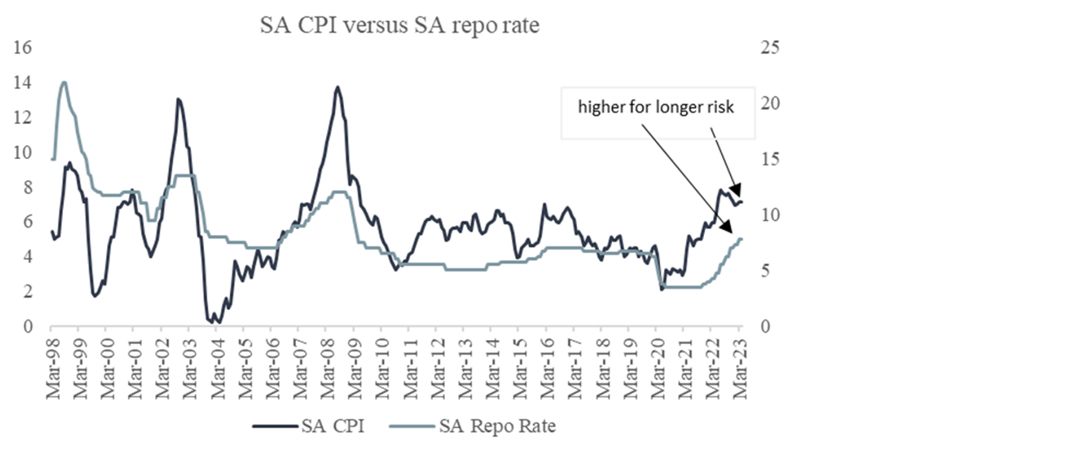

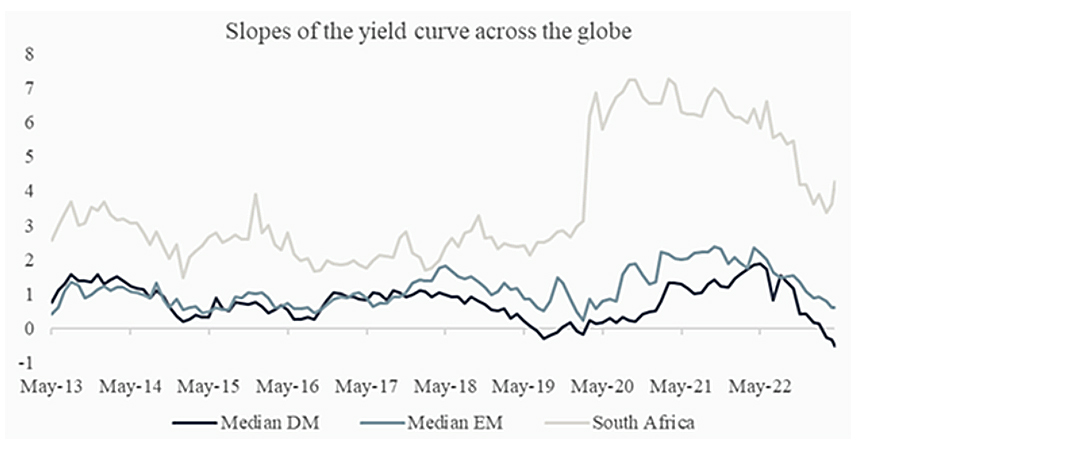

The South African Reserve Bank surprised many with its decision to hike interest rates by 50bps in April. The broad consensus among economists had been that the Bank would opt for a hike of 25bps. The Bank itself estimates that headline inflation will be within its target range by the end of the year with little economic growth, as the Bank calls for reforms of government policies that have undermined confidence and performance. The efficacy of higher interest rates, given the state of the economy and given where the pressures on prices are coming from, is questionable, although the recent news alleging South Africa sold weapons to Russia has led to a re-anchoring of inflation expectations, with implications for monetary policy in South Africa.

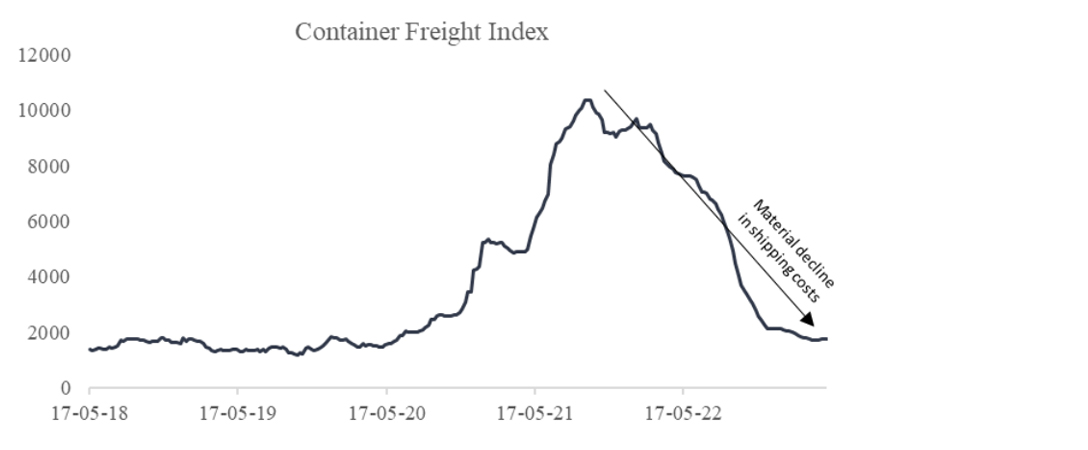

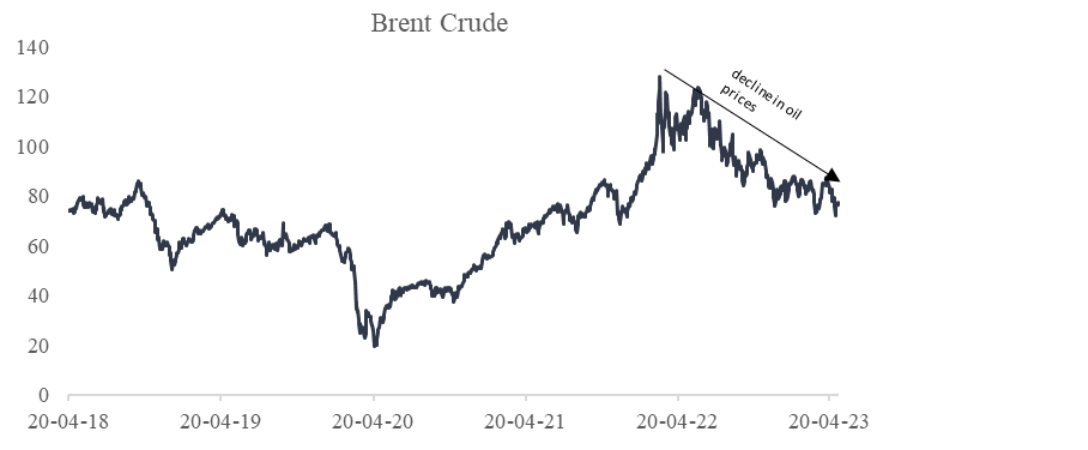

The Russian invasion of Ukraine brought havoc to global supply chains, pushed up food prices, and threatened energy security in Europe. This took place while the global economy was beginning to recover from the Covid-19 pandemic, which added demand-side pressure to supply-side shocks on prices. These supply chain issues resulted in soaring oil and natural gas prices and elevated shipping costs. Inflation, until recently, had primarily been driven by supply-side forces. This is particularly true of inflation in South Africa, where income relief to overcome the lockdowns was of a much smaller order of magnitude when compared with the scale of relief provided in the developed world in 2020-2021. Weak retail sales and supplies of bank credit indicate that there has been no demand-side pressure on prices. Load shedding is a supply-side shock that constrains spending, in addition to the negative impact of higher prices themselves on the willingness of households to spend more.

Rand weakness is a further supply-side shock on prices, including on the cost of imports. A saving grace in this respect has been the reversal of oil prices, which has compensated for the weaker rand. So-called cost-push forces on prices and operating margins encourage firms to seek higher prices at the retail level, which consumers resist by buying less and trading down and thus discourages producers from hiring and investing in new plant and equipment.

Energy peak, food peak, shipping costs peak

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

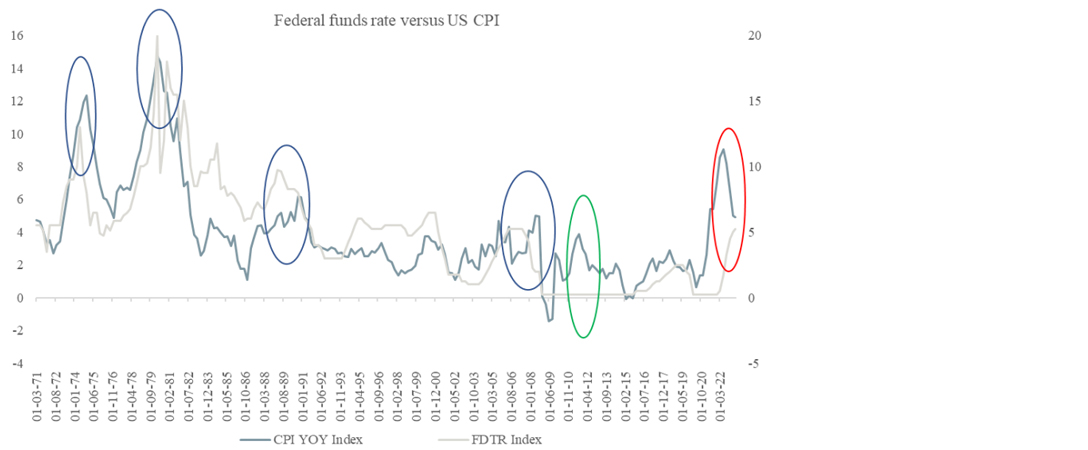

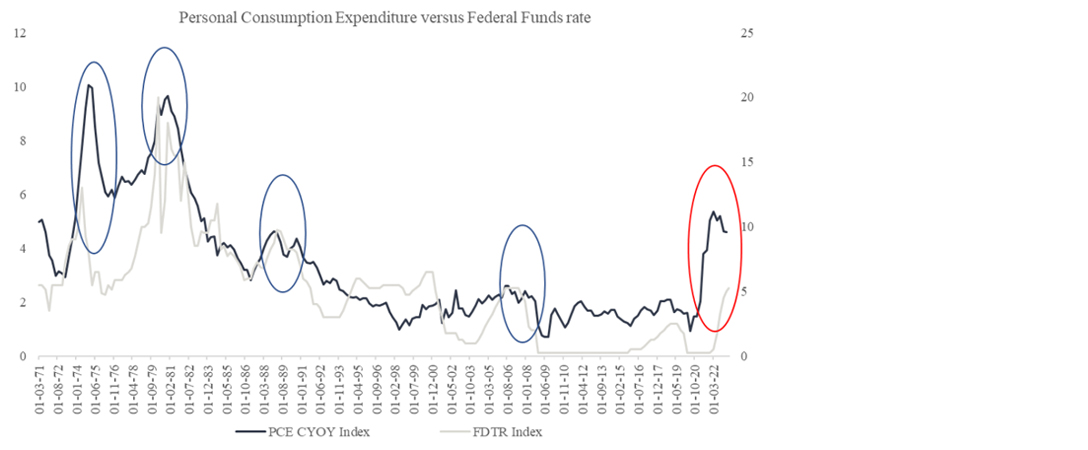

The charts below indicate the typical impact of demand-pull and cost-push inflation. Typically, US CPI and personal consumption expenditure (PCE) peak after the peak of the Federal funds rate (interest rates in the US). This is true for most periods of high inflation post-1970, except for 2012 when cost-push inflation and rates were kept low in the wake of the Global Financial Crisis. Recently, the annual change in CPI and PCE have both peaked before the peak of the Federal funds rate. Yet inflation rates, though a lagging indicator, remain elevated even after demand side pressures have abated. This makes it harder for the Fed to reverse course on its interest rate course.

It may therefore take longer for the Fed to recognise that further increases in interest rates are not called for and that lower rates may be needed to avoid a recession. Capital markets are pricing in lower short-term interest rates by year-end.

Federal funds rate, CPI and PCE

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

Date sampled: 10 May 2023

Source: Investec Wealth & Investment, Bloomberg

It is therefore somewhat counter-intuitive and also counter-productive for central banks to respond so aggressively in response to rising inflation that’s driven by supply-side phenomena. Higher food and petrol prices have a material impact on the well-being of the consumer. Why then exacerbate the situation by hiking rates when demand isn’t the issue? The price of Brent crude peaked in June 2022, while the broader basket of food and agricultural products peaked in October 2022. This indicates that these higher prices have already taken effect on consumer consumption, independent of central bank intervention.

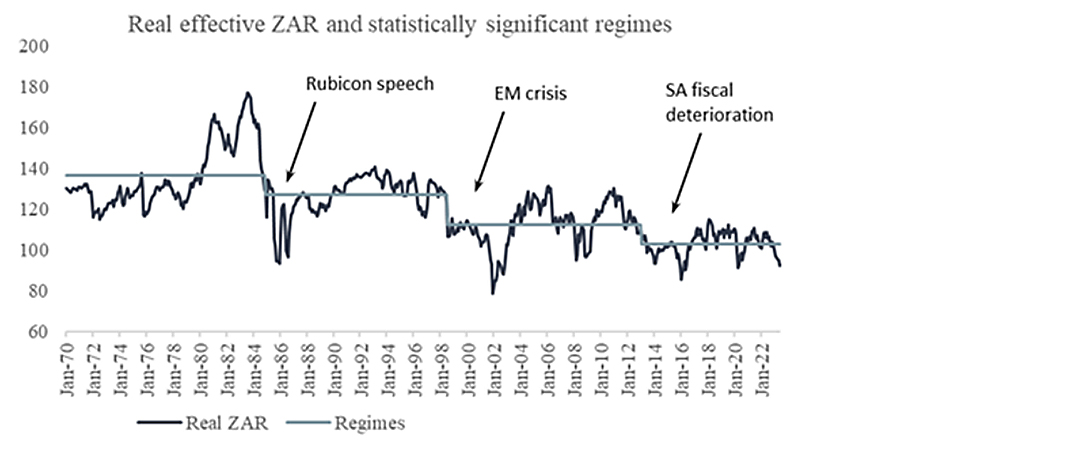

CPI and PCE in the US peaked before peak interest rates

The chart below looks at the relative performance of the rand against the dollar (currently about R19.30/USD) during instances of seismic (or regime) shifts in its valuation. It is somewhat discouraging to look at the performance of the rand in recent months and it seems implausible that the exchange rate should carry such weight in the central bank’s assessment where the currency continues to depreciate despite the counter-offensive of the Reserve Bank through interest rate hikes. Currency control is not the mandate of the Reserve Bank, although it is a crucial input for price stability. Increases in South Africa-specific risks have resulted in a weaker rand and further supply-side pressure on inflation. Higher interest rates in such circumstances will do little to reverse supply-side pressures on prices – they will however further depress demand and make it impossible for the economy to grow incomes and output.

The rand under different regimes

Date sampled: 7 March 2023

Source: Investec Wealth & Investment, SARB & Bloomberg

A potential seismic shift in the value of the rand lurks following the allegations that South Africa supplied arms to Russia. If these allegations prove to be correct, South Africa will potentially a) be suspended from the AGOA agreement and b) face sanctions from the US and other countries. This would lead to a currency regime change, in which our fair value estimate for the rand, which is the trade-weighted and inflation-adjusted rand value, would depreciate by between 10% and 15%. This would anchor inflation expectations higher for longer, and this would have negative consequences for the direction of monetary policy in South Africa.

SA inflation and interest rates

Date sampled: 12 May 2023

Source: Investec Wealth & Investment, Bloomberg

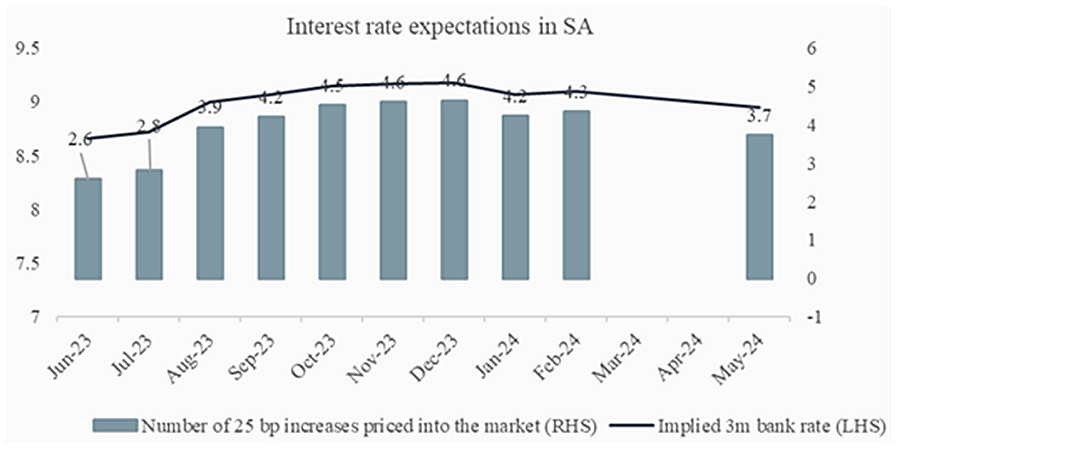

The market has already responded to the news and now expects a 50bps hike in interest rates following the Monetary Policy Committee (MPC) meeting on 25 May 2023. The MPC is similarly expected to hike by another 75bps over the next few months through to November. This will lead to an incremental increase in the cost of living for ordinary South Africans who are already in crisis. This would be catastrophic for consumers. Control of the currency should not be left to the whim of the central bank. The weakness in the currency is the result of bad decisions by the state and should be left to the state to rectify.

Date sampled: 12 May 2023

Source: Investec Wealth & Investment, Bloomberg

Incremental improvements in the operations of Eskom and Transnet would incrementally reduce the risk premium attached to South Africa, which would be positive for the currency, and provide the margin of safety (or rand strength) the central bank is desperate to protect. For investors to find comfort in investing in South Africa, the risk premium must compensate for that risk. We cannot guarantee power and the flow of goods, and therefore cannot guarantee sustainable economic activity, GDP growth and tax revenues.

Date sampled: 12 May 2023

Source: Investec Wealth & Investment, Bloomberg

A few weeks ago we released an article on exports, highlighting how South Africa has benefited from a better-priced commodity basket relative to emerging market peers, but has performed poorly when it comes to volumes. Another risk for the rand is the potential start of a commodity price down cycle and its impact on tax revenues. There is already anecdotal evidence that tax revenues are under pressure due to the relative impact of load shedding on economic activity. A commodity price down cycle, coupled with the issues at Eskom and Transnet, are net negatives for the currency.

A stronger currency as a result of South Africa improving its structural issues would be disinflationary, specifically as far as imported inflation is concerned. Deflationary momentum would be compounded by the pace at which food, oil and shipping costs have fallen globally and would be a net positive for South African inflation. Remember, South African petrol prices are sensitive to the international price of oil, given that we do not have local reserves and therefore transportation costs will impact consumers and businesses alike. We also import 80% of our fertiliser and this means that the currency is important from an agricultural production perspective.

Therefore, by hiking rates this aggressively, the real risk is engineered and self-destructive demand destruction, which hurts corporate revenues and adds higher interest costs for corporates, which inevitably impacts their profitability.

The demand destruction as a result of a combination of rising costs and rising interest rates would depress the economic system, both for consumers and businesses. The interest-rate sensitive sectors are primarily at risk, as consumers struggle to manage debt and simultaneously do not have access to additional debt to use to keep afloat.

Inflation expectations would be materially lower if there were sufficient confidence that the economy would improve its underlying performance and raise its output and employment potential. A stronger rand would follow, to offer further extra supply-side relief for prices.

The Reserve Bank, and central banks globally, should think long and hard about how aggressively they pursue interest rate hikes, or more importantly how soon and at what pace to start cutting interest rates. The supply-side shocks that have driven prices higher have abated and there is little demand-side pressure. If anything, demand is too weak to sustain satisfactory growth.

In short, circumstances have changed, partly because of aggressive increases in interest rates imposed by central banks. It is time for central banks to recognise the new realities and to communicate these new insights to the market.

Get Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.