When will US inflation (which hit 9.1% in June) peak? My answer is about now. The surveys of inflation and the state of financial markets support this proposition. If month-to-month increases in the US consumer price index (CPI) revert to something like the 20-year average, inflation should be trending well below 7% by year-end and fall back to 2% by late 2023. Bloomberg surveys conducted in July indicate that inflation in Europe, now over 8% year-on-year, will recede to 2% by year-end. Inflation in SA, currently at over 7%, is expected to decline to 5% by late 2023.

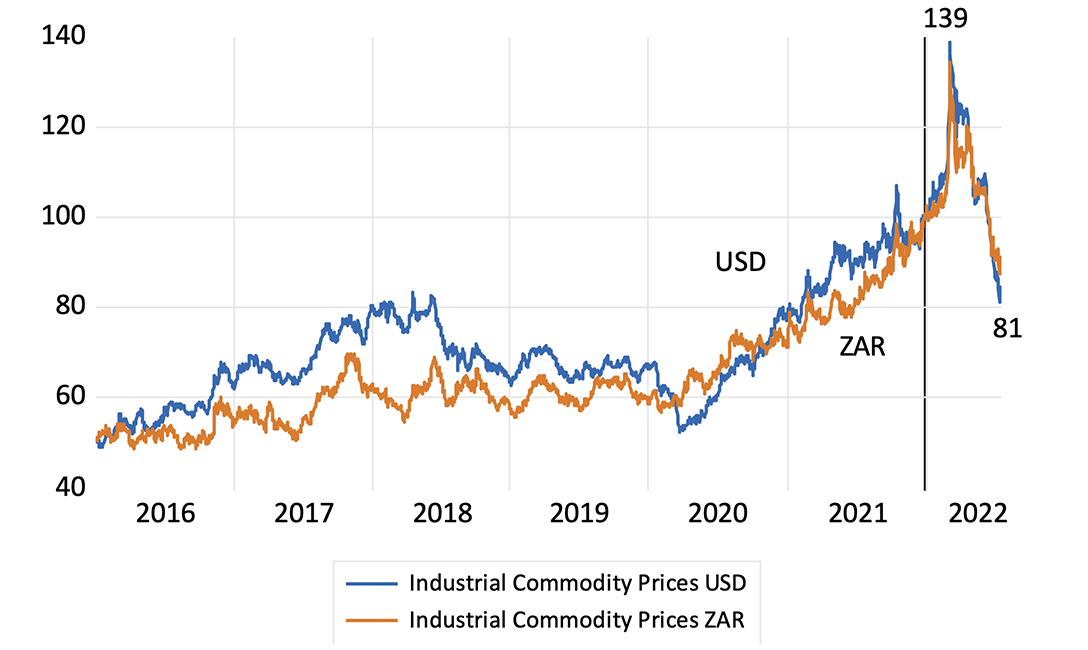

The supply-side disruptions that ramped up oil, grains, shipping costs and metal prices have abated. They are all well off their recent peaks. Industrial commodity and metal prices are 50% lower than their peak values of January 2022. These prices may remain at high levels, but they are no longer rising to force inflation higher.

Industrial commodity price index (January 2022 = 100)

Source: Bloomberg and Investec Wealth & Investment, 20/07/2022

Prices have their supply and demand causes, as they have had in our post-Covid, post-Russian invasion world. They also have their intended effects. They have helped depress demand for goods, more than for services, in the developed world and South Africa. Inflation is properly defined as a continuous increase in the CPI. It takes more than temporary supply-side shocks for inflation to proceed at persistently higher levels. Inflation can only be sustained with continued stimulation of demand. Without additional demand, higher prices cannot be sustained. Without support from the demand side of the economy, stimulated by central banks and governments, the marketplace will not be able to absorb higher prices. In the absence of supportive demand, prices will, though perhaps gradually, adjust lower in response to help sustain sales revenues and bottom lines.

Prices are not what firms would like them to be (they usually want them to be higher), but are conditioned by what their customers will bear. Expecting more inflation and setting higher prices accordingly, regardless of the state of demand, cannot be allowed to become a self-fulfilling prophecy. It is not consistent with economic rationality.

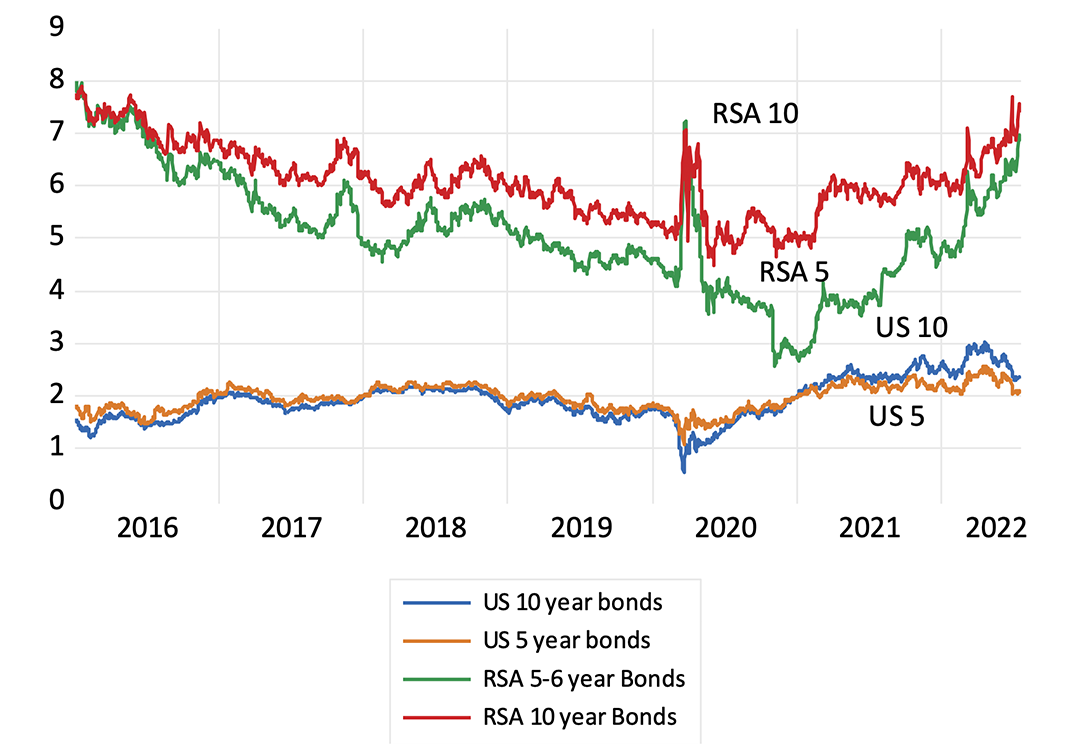

Indeed, the clear evidence from the recent surveys and the bond markets is that economic actors are not naively extrapolating recent inflation into the distant future. They are wisely seeing beyond current inflation to the longer-term demand and supply forces that will act on prices, including the role expected to be played by fiscal and monetary policy. As with the surveys, expected inflation, as priced in the market for US Treasury bonds, in the form of so-called break-even rates, has receded in the past week, despite higher realised inflation.

The US bond market expects inflation to average 2.1% a year over the next five years and 2.3% over the next 10 years, very close to the 2% Fed target for inflation. The SA bond market is now offering still higher rewards for bearing inflation risk, despite the inflation-fighting zeal of our Reserve Bank. The money and bond markets in the US are priced for a reversal in the direction of interest rates next year, with the peak in short rates having been brought sharply forward to January 2023, at 3.25%. The South African money market predicts higher interest rates for a more extended period – one hopes wrongly, given the absence of demand-side pressures on prices and the state of the economy.

Inflation expectations revealed in the US Treasury and SA government bond markets

Source: Bloomberg and Investec Wealth & Investment, 20/07/2022

The best reason to expect inflation to subside in the US, Europe and South Africa is that the demands for goods and many services are already well depressed, thanks to higher prices. Spending is no longer being supported by additional income subsidies or by rapid growth in money supply and bank credit.

The money supply in the US (M2) has ground to a halt. The essential question, therefore, is still to be answered: are the US and Europe heading for recession, aided and abetted by central banks intent on raising interest rates too aggressively (and indeed unnecessarily) to fight the last war? Central banks should know better than to lead their economies into recession while inflation moves in the right direction and their economies head in the wrong direction.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Get Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262