Get Focus insights straight to your inbox

A supertanker stretches 1,000 feet and can carry up to 250,000 tonnes, the equivalent of 2,000,000 barrels of oil. Those are big numbers. It means that when asked to manoeuvre, these ships need time. Travelling at normal speed it takes 20 minutes for one of these seaborne behemoths to come to a standstill.

That inability to adjust course timeously was tragically demonstrated on the 14th of April 1912 when the Titanic turned too slowly, dooming itself to icy depths.

What does this have to do with our economy? Well, we’re very much like the Titanic moments before impact – we can feel the slightest change in course, but stubbornly high unemployment, languishing business confidence, and a government reeling in debt are all hampering our ability to change tack fast enough.

Listen to the podcast

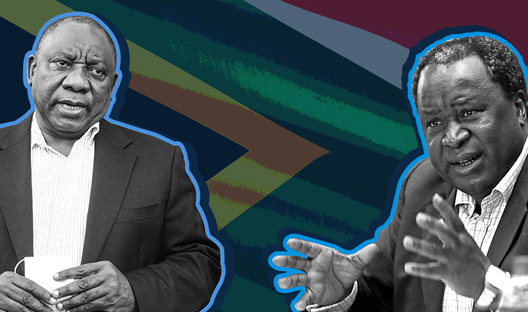

Our panel of Investec experts, Annabel Bishop, Chris Holdsworth and David Gracey, give an in-depth analysis of President Ramaphosa's economic recovery plan and expectations of Finance Minister Tito Mboweni's mid-term budget. The conversation is facilitated by journalist and anchor Cathy Mohlahlana.

Subscribe to Investec Focus Radio SA

The Captain’s orders

Our President has given us new coordinates in the form of the Economic Reconstruction and Recovery Plan, or ERRP. Its successful implementation is non-negotiable if the SA economy is to avoid the fate that befell the Titanic.

The four broad interventions put forward in the plan are as follows:

1. Rollout of infrastructure spending – R1 trillion over the next four years with a focus on schools, water, sanitation, housing and critical network infrastructure (road, rail and port).

2. Expansion of energy generation capacity – 11,800 MW of power to be added by 2022, half of which will be renewable, by fast tracking the Integrate Resource Plan (IRP).

3. Employment stimulus – R100 billion to be allocated over the next three years to create jobs, 800,000, expected be filled in the coming months.

4. Industrial growth drive – R1,2 trillion in new investment by 2023, targeting a re-industrialisation of the economy with infrastructure projects sourcing components locally.

In a recent Investec Focus Radio podcast, hosted by broadcast journalist Cathy Mohlahlana, three of Investec’s figureheads were asked what they thought of the ERRP. There was a common thread that ran through their personal responses: it’s a good plan, but our government has made plans before, and, well, not much came from them.

One of the key points of this plan is a very keen understanding of the problems, issues and current limitations but also the solutions needed to overcome these and of course a very strong will to do that.

Annabel Bishop, Chief Economist at Investec, says the notable changes that Cyril Ramaphosa has effected, across his spectrum of responsibilities, lend this plan an element of credibility that previous iterations sorely lacked. But she remains concerned by the steep rise in government debt and what that means for the implementation of the ERRP.

Chris Holdsworth, Chief Investment Strategist of Investec Wealth and Investment, echoed her sentiments, saying the plan was necessary to inspire confidence. But he stressed that the market will only reward the sentiments of the ERRP when evidence of its implementation comes to the fore.

David Gracey, Head of Foreign Exchange and Fixed Income at Investec, called the plan a ‘step in the right direction’, praising, for example, the intention of the government to work with the private sector to increase electricity supply. But he bemoaned the governments continued fixation with creating jobs rather than designing an environment in which businesses can thrive.

Their collective hesitancy to label the ERRP as a panacea to South Africa’s growth problem stems from one stark reality – this plan needs money that the government doesn’t have and can no longer afford to borrow.

Get all Investec's insights on the latest Budget Speech and SONA

Our economists, tax experts, personal finance and investment experts unpack what the latest fiscal measures mean for income, savings and daily expenses of individuals and businesses.

An iceberg of debt

When debt is used to finance the purchase of an asset, that’s good. When debt is used to fill the hole between what you’re spending and what you’re earning, that’s bad. After a decade of gross economic mismanagement the SA government is now forced to do the latter.

To what extent are they borrowing? Right now, it’s about R2 billion every 24 hours.

With short-term economic growth prospects in the doldrums, and the government spending hand-over-fist to avoid social and humanitarian catastrophes in the face of Covid-19, their expenditure is bounding furiously ahead of their income. Some say unsustainably so.

One of Annabel Bishop’s primary concerns is the trajectory of South Africa’s debt-to-GDP ratio and where the government sees that ratio stabilising, i.e. the point at which our government starts to earn more than it borrows.

Tito Mboweni will give us guidance on these figures in the Medium Term Budget Policy Statement (MTBPS) due on the 28th of October. The last time the debt-to-GDP stabilisation ratio was adjusted (during a special budget review earlier in the year), it was a big move – from 65% to 87%. The concern is that the next move takes us closer to 100%, a level that David Gracey thinks borders on unsustainable in the context of an emerging market.

When asked whether South Africa is experiencing a debt crisis, Chris Holdsworth offered the following: “A country like Argentina is in a debt crisis, and I don't think we're there yet. Could we end up there? Yes, but our current view (Wealth & Investment) is that the SA government will meet its debt repayment obligations, and as a result, we quite like the high yields on the bonds they’re issuing.”

But the threat of a debt spiral – where the amount borrowed and the cost of borrowing escalate simultaneously, usurping vast swathes of money that could be used to spur the growth SA so desperately needs – looms large. Once caught in that spiral, defaulting on outstanding debt becomes a real probability. This is the iceberg we need our country to steer clear of.

It's all well and good coming out with a plan and South Africa is rife with good plans, the problem is implementation and at this point it's probably not sufficient to make the right noises we need to see evidence of delivery.

We’re not the only ones at the helm

It’s an uncomfortable truth that the fate of our economy is not entirely in our hands. Like most emerging markets, much of our growth is dependent on the foreign demand for the goods and services we produce. For example, we’ll struggle to grow without the significant Chinese demand for our resources – the Asian powerhouse has returned to a strong clip of growth, so this support remains in place for now.

But perhaps our biggest vulnerability is the fickle and flight-prone nature of foreign investment into our debt and equity markets.

The COVID-19 pandemic is a good example of how fear and uncertainty can spur huge withdrawals of foreign capital, negatively impacting our domestic asset prices. This has knock-on effects: diminished savings levels hurt consumer confidence; rising yields on bonds make it more expensive for the government to borrow; and a sharply depreciating currency increases our import costs and decreases our global purchasing power. All of these create drag for our economic growth.

So, we must do what we can to turn our ship; the successful implementation of the ERRP will attract stickier foreign investment. But be aware that external forces we can’t control might undermine our

It's very difficult in the current environment to look at a nation in isolation. We are vulnerable to both external shocks and also the massive amount of stimulus that we're seeing coming through globally.

Hit, but not sunk

When the Titanic hit its iceberg, it tore open six of her sixteen compartments below the waterline. If that number had been just two less, lives would have been saved and Leo DiCaprio may not have been famous.

Given our government’s undesirable trait of over-promising and under-delivering, their empty coffers and penchant for wasteful spending, and the layers and layers of bureaucratic complexity they’ve inflicted on themselves and the economy they’re responsible for, it seems unlikely we’ll miss the iceberg entirely.

In a note from Annabel Bishop post the tabling of the ERRP, she predicts another credit rating downgrade post the MTBPS – if the debt-to-GDP stabilisation rate rises to 100%, they could move us two notches lower. If that happens, it’ll be another move deeper into the debt spiral, and a step closer to the SA government defaulting on its debt in the not too distant future. Any efforts to create the kind of growth needed to fix the myriad of socioeconomic ills in our country would be undermined by this outcome.

Toward the end of the Focus Radio podcast, Cathy Mohlahlana asked her guests for evidence that our ship might be turning enough to avoid complete disaster. The salient points of their collective answers, some of which come from the ERRP, were as follows:

- Cyril Ramaphosa proving he can push through critical policy changes

- Government showing it’s serious about procuring power from the private sector

- Wheels of justice turning rapidly for those implicated in corruption

- Load shedding to be put on hold indefinitely within two years

- Release of high frequency spectrum scheduled for March 2021

- Timeframe for granting of mining licenses to be halved

- Electricity demand back to where it was a year ago

- 2020 GDP contraction not as bad as originally feared

- Third party access to be granted to the rail network

- Improved labour relations have reduced crippling strikes

There’s little doubt that next week’s MTBPS will cause anxiety. But the numbers are the numbers and fretting about them won’t change them. What we need to focus on – as citizens, business leaders and investors – is the progress made on the initiatives put forward in the ERRP. If they turn out to be hot air again, we’re on course to tear an irreparable hole in our economy.

But if we build on some of the momentum we’ve managed to gather so far, maybe we suffer a glancing blow and stay afloat to sail another day.