Last week we saw the government order and prepare for a shutdown of much economic activity, in order to deal with the health crisis. We also saw the SA Reserve Bank moved from conventional to unconventional monetary policy.

Everyone, including participants in capital markets, have tried to come to terms with the evolving realities at home and abroad.

The Bank, at its monetary policy proceedings the previous week, reported in an explicitly conventional way of tackling the issue. It cut its key repo rate by an unusually large 100bps (one percentage point) on an improved inflation outlook. By 25 March, it was practising quantitative easing (QE), by announcing that it would be buying government bonds in the market to reduce “excessive volatility in the prices of government bonds” and freely providing loans to the banks of up to 12 months.

The Bank is therefore creating money of its own volition. Cash reserves, that is deposits of the private banks with the Reserve Bank, are created automatically when the Reserve Bank buys government bonds and shorter-term instruments from the banks or its customers. These deposits with the Reserve Bank most definitely serve as money – and are created without any cost to the issuer (the central bank) acting as the agent of the government. They support the balance sheets of the banks and this should lead to extra lending by banks, as intended.

Had the Reserve Bank not done so, the bond market would surely have remained volatile. More importantly, it might not have been able to absorb a deluge of bonds and bills that the government would be issuing to fund its emergency spending. This includes coping with a drawdown of R30bn of bonds sold by the Unemployment Insurance Fund to generate cash for the government to spend on income relief.

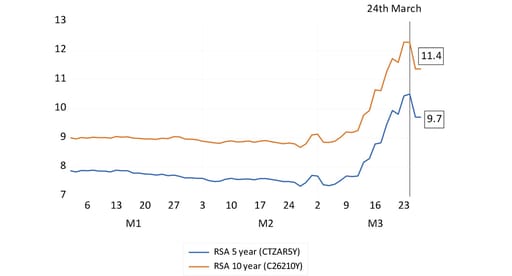

The yield on 10-year government bonds was about 9% in early March. By 24 March it was over 12%. It has receded slightly since in response to Reserve Bank action (see figure below). The derating of SA credit by Moody’s had become inevitable in the circumstances and fully expected before the announcement on Friday evening.

SA government bonds: Five and 10-year bond yields to 26 March

Source: Bloomberg and Investec Wealth and Investment

Central banks all over the world are also doing money creation – in great quantities. Doing so is a predictable response to their own lockdowns, collapse of economic activity and threats to financial stability. But in the developed world bonds and other securities trade at much lower interest rates, though no doubt the scale of their bond and other asset buying programmes (QE) is part of the explanation for very low yields. Yet despite money creation on a vast scale, more inflation is not expected in the developed world.

Not so in SA and in many other emerging markets. Issuing longer-dated government bonds in their own currencies is a very expensive exercise for governments and their taxpayers and has become more expensive.

Lenders to emerging market governments, in their own currencies, demand compensation for high rates of inflation expected, and receive compensation for the inflation risks they take in the form of high interest rates for long-term funding commitments. There is always the chance anywhere that the purchasing power of interest income contracted for, and the real value of the debt when repaid, will be eroded by inflation of the local currency.

The danger is that fiscally strained governments will one day yield to the temptation to inflate their way out of the constraints imposed by bond investors by turning to their central banks, rather than the bond market, to fund their spending. Issuing money to finance spending carries no interest cost. It can be highly inflationary, depending on how much money is created and for how long.

The growing risk that SA could get itself into a debt trap and create money to get out of it, has been the major force in recent years driving long-term yields higher. Bond yields have risen out of fear that SA would create money for the government to spend in response to ever growing budget deficits and a fast-growing interest bill. This is what the government is now doing, though in truly exceptional and justifiable circumstances.

Avoiding the debt trap, controlling budget deficits and convincing investors and credit rating agencies that the country can fund its spending over the long term without resorting to money creation, is the task of fiscal policy. In current circumstances, regaining such a reputation is more unlikely than it was when a promisingly realistic Budget was presented in February.

The Reserve Bank may hope to control domestic spending and inflation through its interest rate settings. It does not control inflation expectations though, nor the interest rates established in the bond market. The link between long and short rates is via expected inflation. Expected inflation over the long run is dependent on the expected fiscal trends, not necessarily on recent inflation. These fiscal trends have deteriorated almost everywhere, thanks to Covid-19.

How therefore should the government and the Reserve Bank react to the current circumstances when long-term yields are unlikely to recede significantly? Particularly when the yield curve is likely to get steeper, should the Reserve Bank reduce its repo rate further?

The government should and probably will fund as much as it can at the cheapest, very short end of the capital market. It could issue more short-dated Treasury Bills to fund spending and to replace long dated bonds as they mature with shorter term obligations. It will save much interest this way. The actions of the Reserve Bank adding liquidity (cash) to the money market through QE will have made it much easier to borrow short from banks and others.

And when the economic crisis is behind us it will remain essential to strictly control government spending to regain access to the bond market on more favourable terms. Only the consistent and expected practice of fiscal discipline will deserve and receive lower longer-term borrowing costs.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Get Focus insights straight to your inbox