Receive Focus insights straight to your inbox

I was inspired to write this article after receiving an email from a client, who was enquiring about the performance of his portfolio, and asked me this question: "I see Q1 hasn't done very well. Should we be allocating more to cash with the expectation that the market is going to go down?"

In a brilliant Twitter thread posted by Jim O’Shaughnessy in May, he offered these sage observations:

READ MORE: Why it doesn't pay to time the market

At a time when the round-the-clock news cycle and the ubiquity of social media makes it possible not only to read the stories, but also to feel like you can influence the news – or at least the thinking of others who have seen the same stories – it's hard to believe there will ever be enough agreement between the bulls and bears to offer an overall sense of optimism.

They're no more likely to get together and see the situation in a remotely similar way than impassioned DA supporters and members of the EFF would be to suddenly see key issues the same way, which would allow for fast, easy progress.

I also have to mention a hot topic that is fake news (not the Trump kind!), wherein the authenticity of information has become a longstanding issue affecting businesses and society, both for print and digital media. On social networks, the reach and effects of information spread occur at such a fast pace and are so amplified that distorted, inaccurate or false information acquires a tremendous potential to cause real-world impacts – within minutes for millions of users.

On social networks, the reach and effects of information spread occur at such a fast pace and are so amplified that ... false information acquires a tremendous potential to cause real-world impacts.

What follows is an excellent piece on the irrelevance of the 24-hour news cycle, written earlier this year by John Duncan from True Financial, an Australia-based financial planning firm. I have adapted the chart below for South Africa-specific purposes:

Recently, the New York Times profiled a man named Erik Hagerman. A former corporate executive, Hagerman is a regular guy who lives alone in rural America. So why was the New York Times so interested in him?

Turns out he's deliberately ignored the news since 8 November 2016 – the day Donald Trump was elected president. As you might imagine, Hagerman is from the left or progressive side of politics and this is a personal response or silent protest against the election of Trump.

While Hagerman’s story has attracted ridicule from Trump supporters, it's those on his own political side who've heaped on the most scorn – the overriding theme being he's an out of touch fool with no sense of social responsibility.

Yet Hagerman might be on to something. With news constantly available and no more than a swipe away, too much time can be spent agonising over the latest political or financial titbit that we have absolutely no control over.

Does the latest White House hiring or firing really matter or affect our daily lives? Does the latest market-moving Trump tweet really matter? Especially if the inevitable next day clarification by Trump, or a member of his administration, returns markets to their previous place.

Not that it's just a news blackout. This point in the story notes how Hagerman deals with his finances.

A financial adviser in San Francisco manages his investments and Hagerman says he throws away quarterly updates without reviewing them.

No doubt said financial adviser appreciates his client's lack of interest in the short-term returns, but interest or lack of interest, the outcome is the same. Things don't change just because they're given more attention. With an investment portfolio in place, someone's future financial destination will always be the same, whether they check that portfolio monthly or every second year.

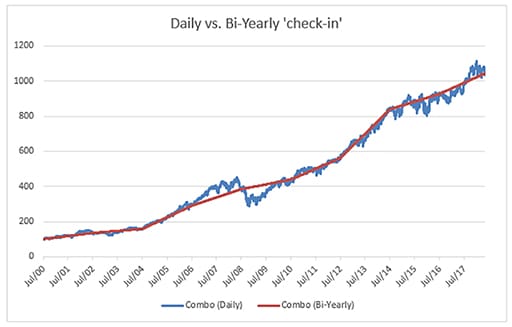

Looking back on a financial journey, this becomes even more obvious, as the following chart shows:

Source: Investec Wealth & Investment

Had you invested R100,000 into a 70/30 portfolio (70% JSE All Share Index; 30% All Bond Index) in July 2000, it would have grown to over R1m by May 2018. How you felt about your portfolio then, about investing in general (and about your adviser) throughout that timeframe, may have varied – depending on how often you checked your balance.

Duncan continues:

The chart shows daily movements (jagged line) versus bi-yearly (every two years) movements (smooth line) in the same portfolio. Imagine both intervals as check-in points by the portfolio owner. The monthly check-in suffers many falls along the journey, while the bi-yearly check-in is decidedly free of turbulence.

The daily check-ins reveal a portfolio consistently in the red during 2008/09, when the financial crisis was in full swing. The bi-yearly wasn't checked again until 2010, when it was back in positive territory – so nothing to worry about, right?

The message? The happenings of those years are largely irrelevant. No matter how many things the media told us to worry about, or what information we filled our heads with, it wouldn't have changed the outcome. The result for this portfolio would always be the same.

Agonising over the minutiae? Pointless. We've got lives to lead. Take it from our subject.

"I had been paying attention to the news for decades,” Hagerman said. “And I never did anything with it."

"I’m emotionally healthier than I've ever felt."

Conclusion

Reading the analysis and looking at the headlines is fine; it makes you a more informed investor. Acting on it is where investors get themselves into trouble.

If you've been changing your actions based on the news, the headlines or the websites you favour, and it hasn't been improving your investment results, it may be time to disconnect your portfolio from what you are reading and listening to.

About the author

Patrick Duggan

Wealth manager: Investec Wealth & Investment

Patrick is a senior private client wealth manager with Investec Wealth & Investment, specialising in providing holistic investment planning advice to some of South Africa’s high net worth and ultra-high net worth individuals, families and their associated entities.