Get Focus insights straight to your inbox

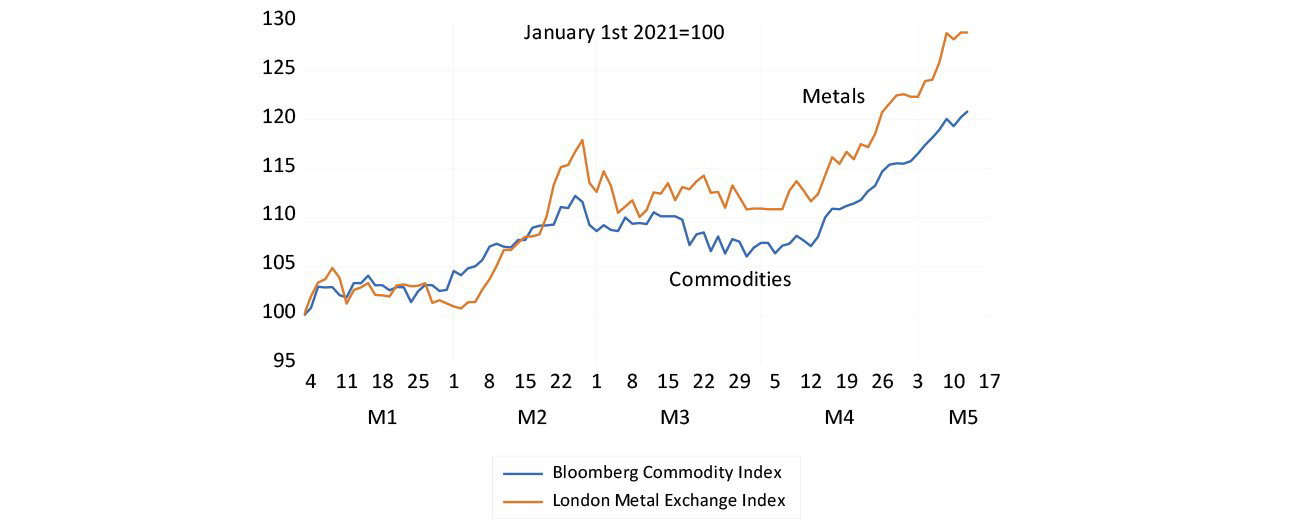

Inflation is busting out all over the world. The US dollar prices of industrial metals traded in London are up 30% and commodity prices are up 20% this year. These higher prices are not a cause of inflation. They are inflation. Larger amounts of money have stimulated demand and supply is struggling to catch up. Too much money chasing too few goods is the obvious explanation of higher prices.

Rising prices and interest rates absorb excess holdings of cash and, sooner or later, will slow down demand and the pace of growth. Governments might respond to this slowdown with yet more money and spending. If that happens, a temporary phase of rising prices will morph into a much longer phase of continuously rising prices. The US jury is out on this and when they return, South Africans should hope for a guilty verdict – guilty of causing more inflation and the rising metal prices that come with it.

Metal and commodity prices in 2021

Source: Bloomberg, Iress and Investec Wealth & Investment, 17 May 2021

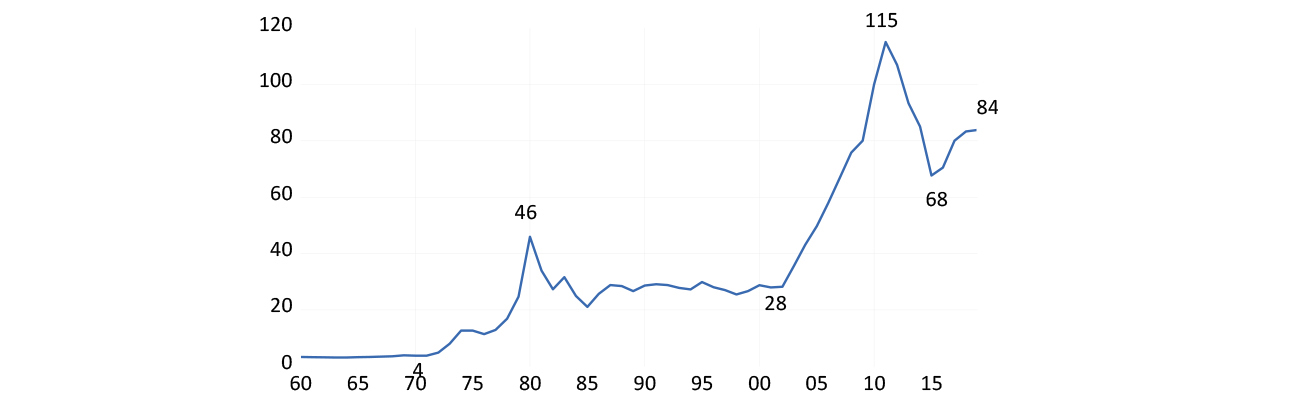

Converting the SA mining sector price index (the mining deflator) into US dollars helps identify these important global forces at work on our economy. In the 1970s, the dollar prices of the metals we produced (then mostly gold), increased by 10 times. Metal prices then fell away sharply after 1981 and remained depressed until the early 2000s. Thereafter they exploded by nearly five times, in what was a super cycle, until rudely interrupted by the Global Financial Crisis (GFC) in 2008. Hard times for SA followed the consistent downward pressure on metal prices after 2011. The recent modest recovery of SA metal prices, off what became a low base, is thus especially welcome.

The South African mining deflator in US dollars (2010=100)

Source: SA Reserve Bank and Investec Wealth & Investment, 17 May 2021

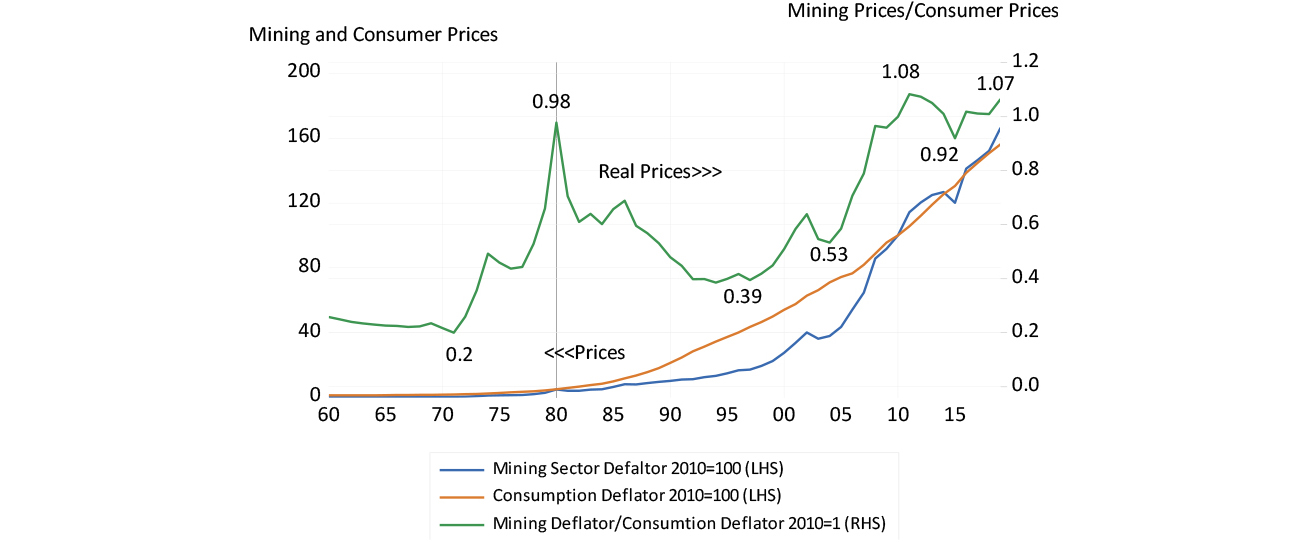

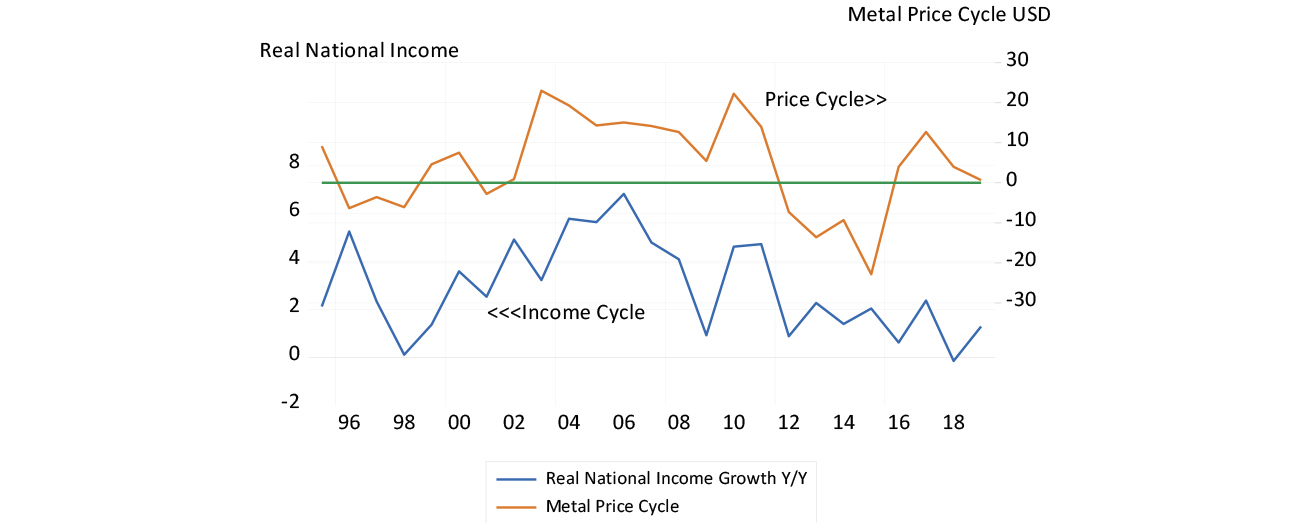

Good times for the SA economy follow when metal prices rise much faster than prices in general – as they are doing now. The extra income earned by mining in SA, the profits earned, the dividends, wages and royalties and taxes paid, rise faster and (conversely) fall further with this cycle. In the 1970s, the real price of SA metals, the ratio of the metal price index over consumer prices, increased by nearly five times. Between 1981 and 1996, it then more than halved, damaging the economy severely in the process.

The one genuine recent SA boom between 2003 and 2008 followed a doubling of SA’s real metal prices. Real national incomes grew on average by 5% a year over these six years, until interrupted by the GFC. Chinese stimulus helped hold up metal prices until 2011 but their decline until 2016 made for more difficult local economic conditions. A degree of relief came from a recovery in metal prices after 2016, a prospective recovery that was overtaken in turn by the lockdowns of 2020. The advances on the metal front make the outlook for the coming years promising for the SA economy.

Metals, consumer goods and services prices in SA and their relationship (2010 = 100 or 1)

Source: SA Reserve Bank and Investec Wealth & Investment, 17 May 2021

Real growth in SA national income and the metal price cycle in US dollars

Source: SA Reserve Bank and Investec Wealth & Investment, 17 May 2021

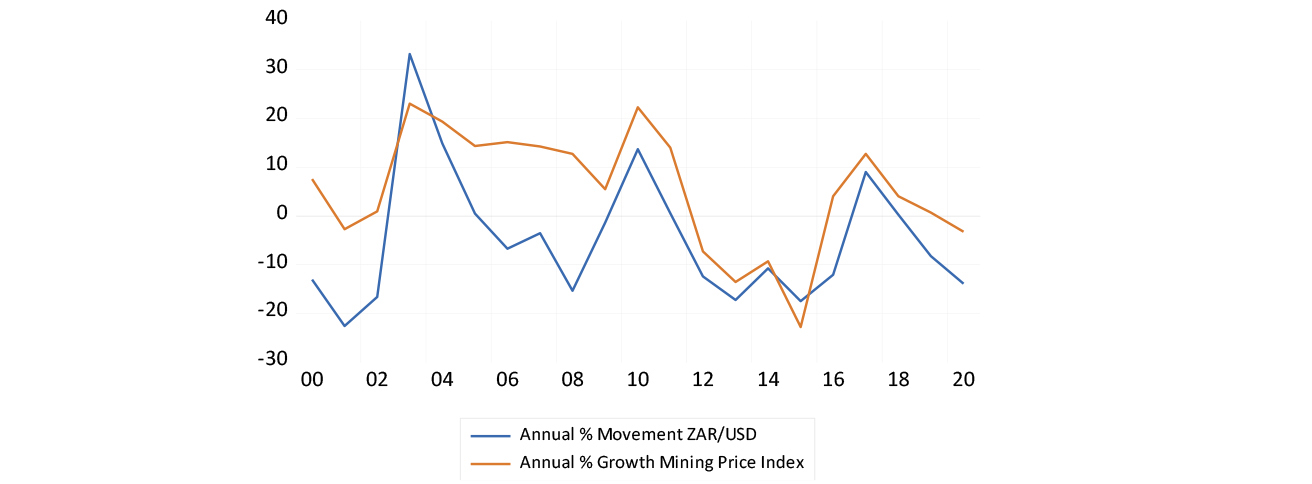

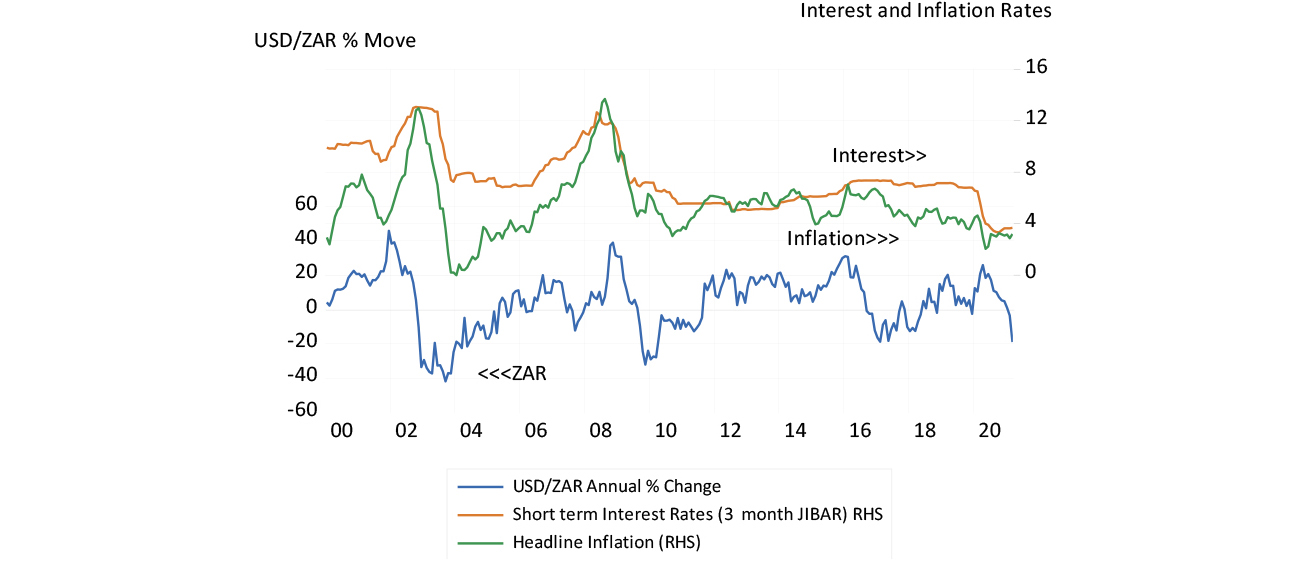

The exchange rate takes its cue from the global forces that drive metal prices. And the inflation rate in SA, with variable lags depending on global prices (especially the oil price), follows the exchange rate. Interest rates follow inflation – in both directions. These forces strongly reinforce the metal price effects on the direction of the SA economy.

The SA mining price cycle (US dollars) and the rand cycle

Source: SA Reserve Bank and Investec Wealth & Investment, 17 May 2021

The exchange rate cycle, interest rates and inflation in SA

Source: SA Reserve Bank and Investec Wealth & Investment, 17 May 2021

Much of what drives the SA business cycle, metal prices, our international terms of foreign trade and the exchange rate is unpredictable and beyond our control. What matters is how we react to such circumstances. Our policies should be anti-cyclical and focus on moderating the direction of spending.

Exchange rate strength both stimulates domestic demand and dampens prices, led by the price of imports. Exchange rate weakness does the opposite. It weakens demand by pushing up prices.

Interest rates should not respond to exchange rate shocks on inflation in either direction: they work themselves out over a year or two. The stagnation of the economy post-2014, the depressing effect of lower metal prices and a weaker rand, was intensified by exchange rate weakness. This weaker rand led to higher prices and to higher interest rates, which in turn were kept consistently too high, given the weakness of demand.

The cause of higher prices was a weak rand and the effect was to depress spending and interest rates. This placed further pressure on demand. The economy paid a high price for countering an inflation rate that had nothing to do with the demand side of the price equation, in fighting so-called second round effects of inflation for which there is no evidence. Economic actors are more than capable of differentiating between temporary and permanent increases in inflation. The permanently higher rates of inflation come from too much demand, not too little supply. They are waiting to make that judgment about inflation in the US.

Hopefully the next phase will be one of faster growth with low inflation that will accompany a strong rand. The risk then may then be of interest rates being kept too low for too long. This was possibly a monetary policy error committed between 2005-2008, a case of too much rather than too little stimulus. It will however be a much higher-level problem to have to deal with in the years to come. Let us hope for such a challenge.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Get Focus insights straight to your inbox