Get Focus insights straight to your inbox

There is some very good news to cheer up South African investors. They are, on average - in respect of their local investments anyway - a lot better off than they were when the lockdowns were announced in March, and where they were on January 1 2020.

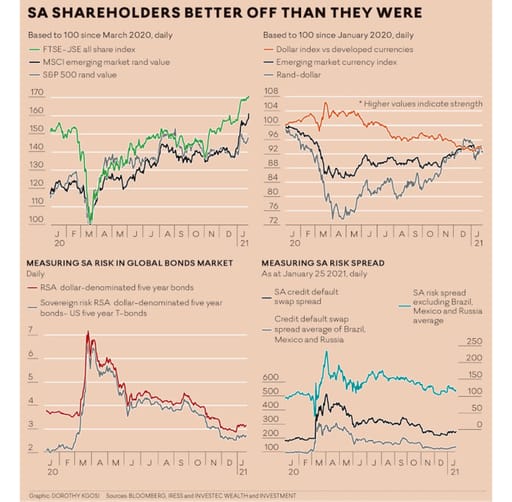

If their wealth has been diversified through the JSE, average shareholders will be 70% better off than they were in March 2020 and 13% up on their portfolios of January 1 2020.

The All Bond Index has returned 31% since March and 9% since January 2020.

Those with shares offshore would also have done well, but not as well. They would be up 59% if they held an MSCI EM benchmark tracker, or 46% if they had tracked the S&P 500 in March. That foreign holiday plan sadly disrupted in March would now be about 16% cheaper in dollars. Since the rand-dollar bottom of April, the mighty rand has also done a lot better than the average emerging market currency.

To what should SA wealth owners attribute their much-improved financial condition?

The usual global suspects can be interrogated. A weaker dollar in a more risk-on environment and so buoyant emerging stock markets, to which the JSE is umbilically attached, is a large part of the explanation. A rising S&P 500 is a tide that lifts all boats, though some higher than others, as we have seen of the JSE and the rand.

But there are more than global risk-on forces at work

SA-specific risks, as measured in global bond markets, have declined, notably since October. They have also declined relatively, by more than the risks attached to Brazilian, Mexican and Russian bonds of the same duration.

In April, at the height of market turbulence, the yield on RSA dollar denominated five year bonds had risen to more than 7% a year. And the risk spread, the extra yield over US Treasuries, was about 6.5% a year. These bonds now offer 3.1% and an extra 2.7% over T-bonds, less than half their levels in March 2020 with much of the improvement also registered after October.

Insuring RSA Yankee bonds against default now costs but 1.1% a year more than it would cost to insure the average of Brazilian, Mexican and Russian debt. This extra insurance premium to cover SA default was 1.5% in October.

The reasons for lower SA risks are not at all as obvious as the benefits. By reducing risk and helping add to the wealth of South Africans they encourage more spending needed to encourage output and employment. Moreover, lower risks reduce the returns required of businesses adding to their capital stock in SA, so much more of which is needed to permanently raise output employment and incomes. And tax revenues rise with income.

What an additional wealth tax will mean for investors

Such improved prospects will be reversed completely by an additional wealth tax. It will not be expected to be a one-off event. It will mean more SA risk and demand for higher returns on the cash firms invest, meaning still less capex.

It will reduce the value of SA companies so they can meet such higher required risk-adjusted returns for investors and immediately reduce the rewards for saving and the value of pensions.

It will encourage the export of the savings of taxpaying wealth owners and the emigration of skilled taxpayers. Tighter controls on capital flows would inevitably have to follow, which would undermine the depth of our capital markets.

Have those who suggest wealth tax increases estimated how much collateral damage will be done to tax revenues over the longer run?

The sensible way to fund an unavoidable increase in government spending is to call further on the R160bn of Treasury cash held at the SA Reserve Bank. And to raise a temporary overdraft from the Bank to supplement this cash balance, should this become at all necessary.

Adding more money to the wealth portfolios of South Africans, including to their deposits at the banks, created this way, would further stimulate spending, income growth and tax revenues. It would be growth enhancing and therefore risk reducing.

This article originally appeared in Business Day

Get Focus insights straight to your inbox