Receive Focus insights straight to your inbox

The title of this article may have already put a number of readers off. “What is the relevance of computer games to my investment portfolio?” you may ask. You might be forgiven if this was your initial impression but by the end of this piece, you should be wondering why this is the first time you’re hearing anything about it.

eSports, for those unfamiliar with the concept, is professional video gaming, watched by an audience in a stadium, via online streaming or on television. Yes, you read that correctly. There are individuals out there who actively engage in watching others play video games as a form of leisure. In the same way, I enjoy a trip to Craven Cottage to watch Fulham FC, millions of eSports enthusiasts will pay to watch others compete professionally by playing video games. eSports even have commentators contributing to the pre- and post-match hype. Effectively eSports have everything a regular sport does, except that it’s electronic.

Newzoo, a market intelligence provider in the global games, eSports, and mobile markets, estimates that sector revenues in 2018 will reach US$906m, driven by 380 million viewers. These revenues are mostly made up of sponsorship and advertising, while media rights, game publisher fees, and merchandising and tickets make up the remainder. Berenberg Research derives a base case estimate that the industry could generate as much as US$20bn in annual revenues by 2025, with viewership growing at a 10% compound annual growth rate. Analyst forecasts should always be scrutinised, but without getting into the detail of how these numbers were derived, we’ll look at some of the structural trends in the market which suggest the long-term positive growth outlook.

Source: Newzoo

So, how are esports being consumed? Mostly via online streaming through platforms like Twitch (purchased by Amazon in 2014 for US$824m) and YouTube Gaming. As of April 2018, Twitch has 15 million daily active viewers and 2.2 million “creators”, who share their games live for others to watch and interact with. Twitch is able to attract global brands to advertise on their platform.

Esports even have commentators contributing to the pre- and post-match hype.

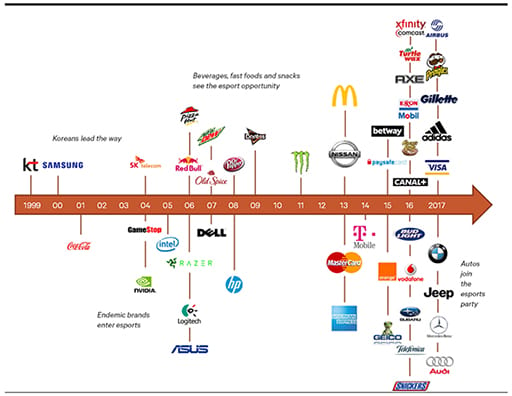

The gaming demographic includes a traditionally difficult-to-reach part of the population, meaning that large companies are jumping at the esports opportunity. The chart below shows how some of the world’s biggest companies have joined the esports party.

Source: Berenberg Research

As well as the millions watching esports leagues and competitions online, it’s startling to see the number of enthusiasts who fill stadiums to watch competitive esports live. These fanatics contribute to ticket sales and merchandising revenues and explain why Adidas, Nike, and others are fighting it out to sign kit deals with various teams. These professional athletes, as they’re formally referred to, are idolised by their fan bases in exactly the same way as traditional sports stars are.

The gaming circles resonate with a family-oriented, socially conscious community with players becoming emotionally invested in the games they play.

Games of influence

Playing computer games fosters a community feeling and a sense of belonging. Gamers are known to dedicate hours to practicing and learning from their heroes, trying to emulate their gameplay. They subscribe to streaming services in order to watch the world’s best players of particular titles, learn how they dominate the games and engage with others to try and improve their skills. These people are called “influencers” and are usually amongst the most respected and top players of various game titles. Influencers attract millions of viewers (streamers) at a time and this presents a further marketing opportunity. Influencer marketing identifies individuals that have influence over potential buyers and orients marketing activities around these people.

A further catalyst for growth in eSports is the confirmation that it will now be an official event at the 2022 Asian Games. There is also every possibility that it will become an official event at the 2024 Olympic Games. Bloomberg reported in March this year that Alibaba, a sponsor of the Olympic Games through 2028, is pushing for soccer, car racing, and other games to be endorsed as official competitive sports.

eSports is dominated by multiplayer online battle arena games such as League of Legends and Dota 2, which are strategy-based with four or five players on each team. First person shooter (Counterstrike and Call of Duty) and sports titles (FIFA, Madden, UFC) are less popular when it comes to professional gaming, however, these games are starting to monetise the tier below professional gamers, referred to as “competitive gaming”.

This segment includes players who dedicate substantial time and money to becoming better gamers but don’t necessarily have expectations of going pro. This part of the market includes a much larger base and players who are willing to spend on the game. Electronic Arts’ FIFA Ultimate Team, which enables you to build bespoke teams using players from all over the world, and play against others online, is gaining popularity, although it’s yet to break into a fully-fledged eSports league. So where do these incremental sales go?

Sectors to watch

A number of sectors will benefit from continued growth in esports. Technology, PC hardware, and gambling companies are a few examples. Game publishers such as Activision Blizzard, Electronic Arts, Ubisoft, and Take-Two stand to be the biggest beneficiaries of the trend. These companies develop and publish the games that stand to benefit from increased user engagement in various esports leagues and competitions. Activision has recently launched its very own franchised league for its popular game title “Overwatch”. The cost was US$20m for an initial team entry into the franchised league and rumours suggest additional teams in later years will have to cough up at least US$35m for the privilege of joining the league.

A further catalyst for growth in esports is the confirmation that it will now be an official event at the 2022 Asian Games.

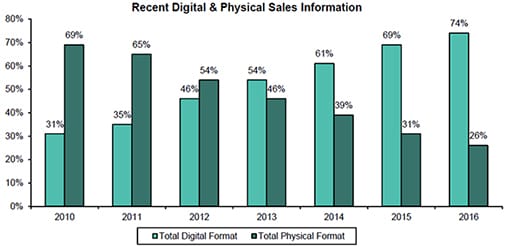

Separate from the potential benefit from esports, publishers have transformed from cyclical, hit-based businesses into service-based companies. “Games as a service” is a popular phrase among investors and executives in the industry. In the past, sales were pushed through physical retail channels and exposed to piracy risk within a month of release. Today, most game sales are made online. The cyclicality of the past is evident when observing the historic return profiles. Bernstein shows below how the digital format has overtaken physical since 2010. Over the same period, we’ve noted vast margin improvement in the game publishers.

Source: ESA, Bernstein analysis

Reliable revenue sources

Expansion packs, downloadable content, and micro-transactions within the games have created additional, and reliable, revenue sources for game publishers.

Separate from the potential benefit from esports, publishers have transformed from cyclical, hit- based businesses into service-based companies.

In the past, a new version of the game with improved features had to be released on disk. The current model allows for updates and enhancements to be released online and the content is paid for by gamers. In most instances, it’s important to have the most recent version of a particular game for compatibility with other users. In other instances, the content and microtransactions are mostly aesthetic, but the contribution to returns is substantial from these streams.

Source: Factset Data

In the third quarter of the fiscal year 2018, EA grew its live services revenues by 39% to US$787m, while full game downloads fell 27% to US$260m. The split between the two is stark, especially comparing this to 2016 where live services generated US$450m and full game downloads US$195m. The appeal of a new “skin” is too much temptation for some players to pass up, and they are willing to pay up.

The recently released Raven skin in Fortnite cost players the equivalent of US$20.

Game publishers are content providers (like the skin above) but this expands into areas like new arenas, characters, weapons, stadiums, clothing, music and much more – most of which are paid-for privileges. The publishers service the demands of the gaming public and they engage with them continuously in order to deliver a high quality, enjoyable gaming experience through the delivery of new content. Referring back to the influencers mentioned earlier, when gamers observe them play, the influencers are advertising the game companies’ own content – genius!

It has to be noted that mobile gaming has not been mentioned in this article, which is an area the game publishers are exposed to and which is beginning to contribute meaningfully to revenues. Mobile has its own characteristics which make it less important at this stage for the game publishers. Mobile gamers are more fickle than the traditional console and PC users, however, there is upside from releasing a number one hit title in the mobile market (think Candy Crush). The downside is, as mentioned, that mobile gamers tend to lack loyalty, so ongoing revenues are less certain from this space.

The true benefit of esports still needs to be realised, but there is enough evidence to suggest it could be a significant win for the publishers.

While this article does not constitute any kind of investment recommendation, it’s important that we’re aware of high-growth areas in global markets. Unfortunately, these companies carry eye-watering valuations, so buying them at this point in the cycle comes with little margin of safety. Looking at the glass half full scenario, publishers have a number of potential positive catalysts which may see them deliver further impressive growth, which could justify their ratings longer term.

Nonetheless, as Bernstein summarised so well, publishers service a truly global market, their business models are much improved from the past and they have increased barriers to entry through the network effect of popular games. The true benefit of esports still needs to be realised, but there is enough evidence to suggest it could be a significant win for the publishers.

Watch this space.