The airfreight market continues to face new challenges. The continued trend of sea freight orders being converted to airfreight to meet on time deadlines has added extra pressure to the airfreight market.

The real bottleneck has been at the airline handling facilities where numerous hubs have been struggling with labour shortages and storage capacity, therefore cargo backlogs have quickly built up. This has resulted in cargo missing departure deadlines or cargo being routed to alternative hubs which increases the lead times and costs.

The emergence of the new Covid variant, Omicron, has resulted in numerous airlines suddenly cancelling flights and services to and from South Africa. This has caused an immediate retraction in capacity and many shipments have been delayed as agents have had to scramble to find alternatives flight options to move cargo that had already been booked or tendered in.

Capacity

Demand has remained strong, and capacity has recently been negatively impacted for reasons mentioned above. Airlines are under pressure to clear cargo backlogs and hopefully more airlines will re-instate their passenger services to South Africa which will help alleviate some of the cargo backlogs and capacity constraints.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times

Transit times have been impacted due to factors previously mentioned. Trucker and labour shortages in Europe and the USA have also added to the longer transit times. We recommend booking urgent orders on a premium service offering to ensure deadlines are met.

We encourage importers to clearly define their required on-site dates prior to confirming a shipment. Flight and schedule details can often only be confirmed once a booking has been made with an airline.

Freight rates

Rates remain at elevated levels and majority of rates are quoted on a spot basis per shipment.

The recent fuel adjustments have also contributed to the upward rate adjustments, and we expect rates to increase further due to the reduction in capacity into South Africa.

With our expanded network we are well positioned to offer a variety of options to meet your airfreight requirements.

South African port delays

The inefficiencies of our ports have resulted in delays with vessel berthings and the uplifting of containers from the terminals. Additional charges are being incurred for detention and demurrage due to the inefficiencies.

It’s also common for the ports to be windbound at this time of the year meaning that operations within the port get suspended which adds to the congestion and berthing delays. These events are unfortunately beyond our control, and we will always endeavor to deliver cargo at the earliest possible opportunity.

The real bottleneck has been at the airline handling facilities where numerous hubs have been struggling with labour shortages and storage capacity, therefore cargo backlogs have quickly built up.

Seafreight update

This year started with continuous challenges on the Far East trade and very quickly the same challenges were being experienced across all global trades. Who can forget the Suez Canal blockage, equipment shortages, Transnet cyberattack, Covid outbreaks in ports and on vessels, record high freight rates and constant shipping delays? Such incidents forced companies to seek alternative solutions, and in cases, new opportunities were created. Experienced has been gained and so many lessons have been learnt through the chaos of 2021 and this should be seen as a big positive for the future.

Capacity constraints

There have been pockets of space being more freely available over the past few weeks and first week of December, however this is temporary, and demand is expected to surge again as the pre-Chinese New Year shipping rush starts from mid-December.

Global capacity is down approximately 12% mainly due vessels caught up in berthing delays caused by port congestion and bottlenecks at all major ports. Capacity across all trades into South Africa remains tight and bookings need to be made three to four weeks in advance.

Capacity into South Africa ex-Far East has recently been reduced through blanks sailings and shipping lines repositioning vessels onto other trade routes such as Latin America.

The removal of some direct sailing options from South China as well as the limited feeder services from North China and Southeast Asia has forced shipments to be rolled at either the port of load or the transshipment such as Singapore, Hong Kong and Tanjung Pelepas.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

We recommend making bookings as far as possible in advance of your required sailing dates for all trades.

Equipment imbalance

Equipment availability in general remains relatively stable which is encouraging, however as demand starts increasing over the coming weeks, we anticipate supply will not consistently meet demand despite the shipping lines continued efforts to reposition equipment to key areas.

Sailing schedules

All schedules have been impacted in way or another, be it port congestion, port strikes, labour, and trucking shortages for example. Shipping lines continue to bypass ports mid-voyage or cut and run due to extensive berthing delays. Global reliability remains below 35%. Its not uncommon for shipments to be delayed by more than four weeks.

Freight rates

Freight rates across the trade routes into South Africa have remained relatively flat the past few weeks with a few welcomed reductions. Most shipping lines extended their November rates to the first half of December. We do expect shipping lines to start increasing rates from mid-December again, especially on the Far East trade.

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

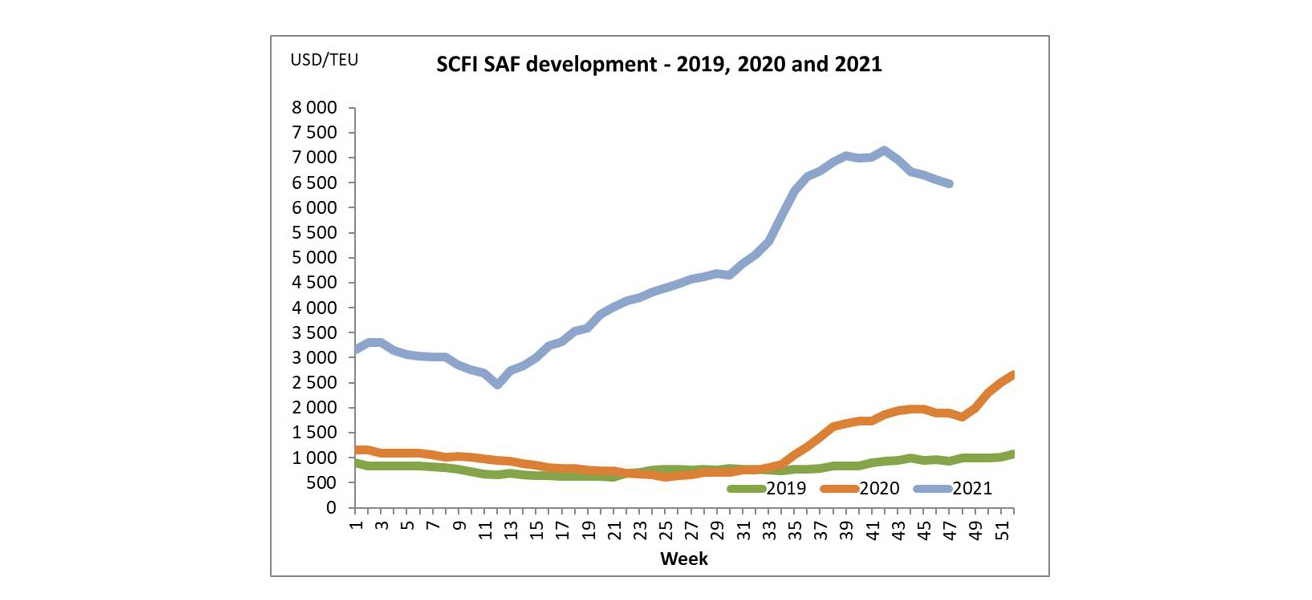

SCFI (Shanghai Container Freight Index):

The below graph demonstrates the freight rate decline per TEU ex-China to South Africa:

Will supply chains stabilize in 2022?

There is no arguing that 2021 has been the most disruptive year on record for global supply chains and everyone needs a well-deserved break and to reflect on how numerous challenges were overcome.

2022 will no doubt also be challenging and hopefully the lessons learnt from this past year will place all stakeholders in a stronger position to effectively handle and circumvent whatever challenges 2022 may hold.

We anticipate global supply chains to be met with a few difficulties in the first half of 2022. The period leading up to the Chinese New Year is likely to be the most challenging as capacity demand for both air and sea will be high which as we all know by now will drive freight rates upwards.

We expect market conditions to slowly start improving post the Chinese New Year period and if stars align, we should look forward to a more stable environment as 2022 progresses.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.