Receive Focus insights straight to your inbox

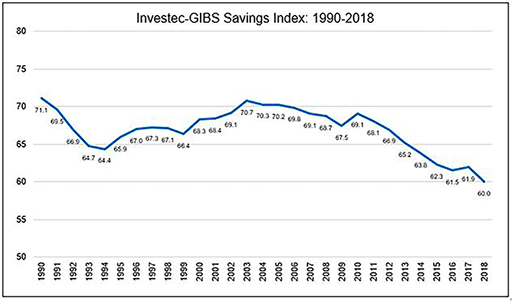

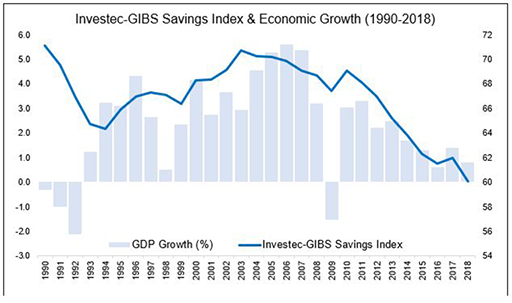

The Investec GIBS Savings Index hit an all-time low in 2018 of 56.6 in the first quarter of the year. Although the index lifted each subsequent quarter, reaching 60.0 in the fourth quarter of 2018, this remains a far cry from the 100 score that corresponds with a healthy and robust savings environment.

Read more: SA savings hit 27-year low, but is relief in sight?

South Africa is stuck in a low savings rut. “This is a sobering number,” says Dr Adrian Saville professor in Economics and Competitive Strategy at the Gordon Institute of Business Science (GIBS), who is responsible for compiling the index.

“Equally as sobering is that, as a percentage of GDP, gross saving was at 14.0% in the final quarter of 2018 and averaged 14.4% for the year, the lowest annual number on record since the index was started in 1990.”

South Africa is stuck in a low savings rut.

The low saving rate at the end of 2018 reflects weaker performance across all three sources of savings, namely business, households and government,” Saville points out.

The index is made up of three building blocks, namely a score for the flow of savings, a score for the stock of savings and a score for the savings environment. Notably, the stock and flow pillars of the index declined year-on-year, although there was an encouraging uptick in the environment pillar measured quarter-on-quarter and year-on-year at the end of 2018.

“However, we need this improvement to be sustained over an extended period before an encouraging print can be turned into optimism about savings behaviour,” argues Saville.

The environment pillar measures how conducive the setting is to encourage and promote savings, while the flow pillar measures the consequent flow of savings that fund required investment to support economic growth and job creation. The stock pillar measures the accumulated stock of savings that is the net result of historical flows.

Along with the modest uptick in the environment pillar, another positive came in the better behaviour of flows of foreign portfolio investment – which is one of the ways in which domestic savings can be supplemented. Specifically, foreign portfolio flows slowed to “functional” levels at the end of 2018, says Saville.

“However overall, the capital formation that was funded by foreign capital fell to just 13.6% (from 19.7%),” he notes, meaning that foreign investors lost some of their appetite for South Africa through the course of the past year.

Saville notes that the decrease in the national saving rate in conjunction with the Index score is concerning as there is a strong correlation between the Index and economic growth. The sluggish economy, high unemployment and rising electricity and fuel costs are just some of the things that make it difficult for South Africans to put away a little bit every month.

René Grobler head of Investec Cash Investments notes that “the factors impacting the individual’s willingness to save are complex. Theoretically, in times of uncertainty, people tend to save more to ensure a buffer for a rainy day”.

On the flip side, the relative ease of access to credit in South Africa creates a disincentive to save. The ease of access to retirement funds when changing jobs has also been a deterrent, with many South Africans “cashing in” on their retirement savings and finding themselves in a predicament at retirement.

Recent strides by National Treasury to incentivise savings, in the form of tax-free savings accounts, could nudge households in the right direction but not provide a “silver bullet” solution at all.

Recent strides by National Treasury to incentivise savings, in the form of tax-free savings accounts, could nudge households in the right direction.

Trust also plays an important role. Following the 2008 banking crisis individuals are more cautious about where they invest, often mistrusting financial institutions or the ‘advice’ they receive and then procrastinating or not savings at all.

The myriad of choices, the complexity of products and lack of transparency around the savings alternatives and fees also adds to the confusion of which product vehicle to choose and research shows that most South Africans still use the most basic products such as bank accounts. Research by the FSCA Financial literacy report indicates that the large majority of South Africans would like to learn more about how to save.

Grobler, further recommends consulting a qualified financial advisor to navigate complexity and assist in making sound investment decisions.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Get the most out of your hard-earned cash

Easy access to your money