Get Focus insights straight to your inbox

Key takeaways

- Eskom’s cash flows improve as National Treasury provides R254bn of debt relief over the MTEF period, allowing for more maintenance and diesel.

- Tax incentives for households and corporates amount to R4bn and R5bn, respectively.

- Tax relief is provided through adjustment of tax brackets.

- Expenditure is targeted with social grants adjusted for inflation.

- A primary surplus of 0.1% of GDP is recorded in F23, a year ahead of target. Accounting changes to deal with Eskom’s financial assistance keep the primary balance in surplus in coming fiscal years.

- Risks to fiscal consolidation are provided through the primary surplus and contingency/unallocated reserves in the outer years. Upside risks to expenditure in F24 are likely to see the main budget deficit closer to 5.0% of GDP than the 4.4% projection.

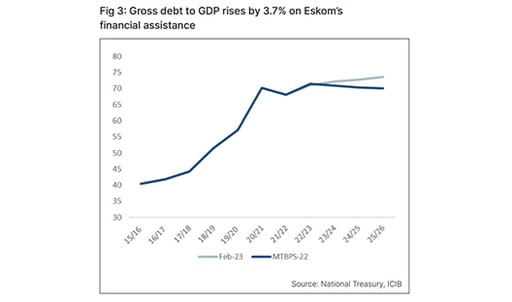

- Gross debt to GDP rises by 3.6% to 73.6% in F26, owing to Eskom’s financial assistance but risks are to the upside.

- Financing of the FY24 budget deficit: The supply of T-bills rise, with a net increase of R48.0bn; cash balances are rundown by R93.3bn and cash raised from ILBs, SAGBs, FRN and a new rand Sukuk bond is targeted at R329.9bn from R310.9bn. A sens announcement will be released on 23 February. We think the size of the SAGB auctions could remain unchanged but will likely be raised in the October 2023 MTBPS.

Dealing with the electricity crises

Eskom – lifting pressure on Eskom’s operational cash flows

National Treasury has announced that Eskom will receive financial support to the value of R254.0bn over the next three years to deal with its R426bn debt burden. The support measures surprised on the upside. Eskom’s capital and interest payments will be covered in full. The measures consist of zero-interest subordinated debt of R70bn, R66.1bn and R40.0bn per annum, to be converted into equity on a quarterly basis when conditionalities have been met, and a debt transfer of R70bn in F25/26. Eskom’s government guarantees of R350bn expire at the end of March, and they will not be allowed to borrow over the next three years unless the Minister of Finance gives special permissions.

This will allow Eskom to proceed with its unbundling into three entities, according to timelines. The measures free Eskom’s cash flows from debt repayments, enabling Eskom to undertake critical maintenance, accelerate procurement of parts and purchase diesel. Eskom requires approximately R20bn per annum to run its Open Cycle Gar Turbines (OCGTs) to reduce load shedding by two stages. Nersa has only allowed Eskom a 6% and 9% load factor over the next two years, which leaves a balance of nearly R14bn. This, coupled with electricity tariff increases of 18.65% and 12.70%, is highly beneficial to improve the operational performance of the coal power fleet and new investments.

Incentivising households and businesses to install more renewable energy

Households will receive a R4bn tax rebate to install solar panels, but not for inverters or batteries, and can be used to offset the personal income tax liability for F24 up to a maximum of R15 000 per individual. The incentive to companies totals R5bn, as the expanded incentive will allow businesses to claim a 125% deduction in Yr 1 for all renewable energy projects, with no thresholds on generation capacity.

Manufacturers of foodstuffs have been added to the diesel refund system to provide full or partial relief for the general fuel levy and the RAF levy to primary sectors – will be extended to the manufacturers of foodstuffs and will be in place until 31 March 2025.

Macroeconomic assumptions in line with market consensus

National Treasury revised its GDP growth forecast to 0.9% and 1.5% in 2023 and 2024. This is more in line with market consensus expectations of 1.1% (ICIB 0.7%) and 1.7%. We think that the ability of Eskom to run its OCGTS has improved, and this reduces downside risk to our growth forecast. But the forecast also factors in weaker global growth, Transnet transport bottlenecks and less consumer spending due to high inflation and interest rates. The adjustment of tax brackets for fiscal drag will add R15.4bn to household income. Social grant values, excluding the social relief of distress grant, will be raised by 5.0% (5.9%), and SRD payments of R35.7bn will be extended to 7.5m beneficiaries.

National Treasury provided three scenarios depending on the expediency and whether NECOM interventions are implemented.

- In the upside energy scenario, where load shedding could end by the end of 2023, growth averages 1.8% from 2023 to 2025.

- Were power cuts to intensify in 2023 and 2024, with further delays in procuring new generation capacity, growth slows to 0.2% in 2023, and recovers only to 1.3% in 2025.

- A more challenging global growth backdrop leading to lower imports could see growth slow to 0.6% in 2023 before reaching 1.7% by 2025.

Fiscal projections and buffers for expenditure risks

A better fiscal outcome for FY23 and a primary surplus

- A combination of revenue receipts ahead of target by R10bn and net underspending of R13bn, lowered the main budget deficit to 4.5% of GDP from a projected 4.9%. Indeed, underspending and downward adjustments were ahead of our forecast, amounting to R19.4bn and R34.6bn. However, of this, R23bn was reprioritised and allocated to SAA (+R1bn), SAPO (+R2.4bn) and the Land Bank (+R5.0bn).

- Faster growth, the tax revenue fillip and spending constraints have culminated in a primary surplus of 0.1% of GDP, a year ahead of target.

FY24 tax revenue forecast reliant on a solid performance from SARS

- Contrary to ICIB’s downward adjustment to FY24’s revenue forecast of R35bn (which factored in tax rebates and lower growth), National Treasury left its forecast in absolute terms unchanged. However, the growth rate has moderated to 3.3% from the MTBPS forecast of 3.6%. Budget targets have been raised for personal and corporate income tax growth rates (+R3.2bn and R2.4bn) but revised for VAT (-R2.4bn). The tax buoyancy forecast has also been raised to 1.06 from 1.03, as the tax revenue for the level of growth is expected to be slightly higher. This can most likely be ascribed to SARS ability to widen the tax base and enhance efficiencies.

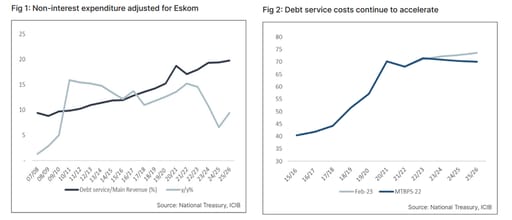

- The expenditure forecast has been impacted by accountingrelated issues related to Eskom. Previously, National Treasury included Eskom’s equity injection in the baseline expenditure forecast, impacting non-interest spending. This has now been moved to the financing requirement, implying that non-interest spending declines by R66bn over the MTEF framework, lowering the growth rate in non-interest spending to an average of 1.5% over the MTEF (previously 3.3%). Debt servicing costs, however, continue to accelerate, growing by an average rate of 8.9% over the MTEF period (previously 7.4%) on account of the higher funding requirement associated with the financial support provided to Eskom. This budget also saw National Treasury moving from a general inflation-adjusted increase in spending to more targeted support and increases.

Open-ended fiscal projection for FY24

We flagged the risk that the fiscal projection for FY24 and the MTEF period will be incomplete. The increase in compensation is outstanding as this will only be included in the October 23 MTBPS. The forecast allows for a 1.5% increase in pay progression, a carryover of the F23 3.5% annual increase and excludes the non-pensionable cash gratuity of R20.5bn. A permanent form of the Social Distress of Relief grant (SDR) is still debated but has been included as an allocated reserve to the amount of R35.7bn and R44.5bn in the latter part of the MTEF period.

Main budget deficit forecast: The F24 projection of the main budget deficit has been raised to 4.4% of GDP (previously 4.1%) but less than ICIB’s projection of 5.0%, which factors in spending assumptions. Over the MTEF period, risks to expenditure are protected to some extent by a build-up in buffers through the primary surpluses and contingency/unallocated reserves.

Main budget deficit and financing strategy of the gross borrowing requirement

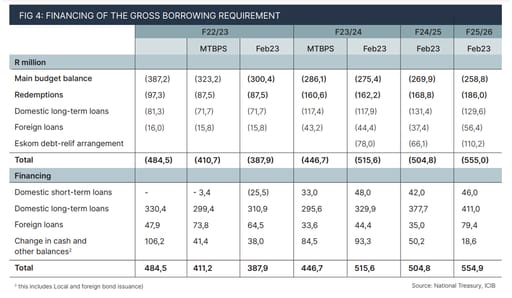

FY24 financing requirement and strategy: The inclusion of Eskom’s financial assistance into the borrowing requirement has raised the funding requirement from R446.7bn to R515.6bn in FY24. The main budget deficit of R275.4bn (previously R286.1bn) will likely be revised higher in the October 2023 MTBPS.

- T-bill issuance: Following a net decline of R25.5bn in F23, net T-bill issuance will be raised by R48.0bn.

- Bond market: Cash raised in the bond market is projected to increase from R310.9bn to R329.9bn, which will likely be revised higher in October. There was very little detail provided about the mix of funding, aside from flagging that there will be new FRNs and a rand Sukuk bond. A sens announcement will be released tomorrow. We think that the size of the SAGB bond auctions may remain unchanged, although we anticipate an increase in the latter half of the fiscal year.