Get Focus insights straight to your inbox

Overview

The Minister of Finance presents the February 2023 Budget Review to Parliament on Wednesday, 22 February. A key objective of the preceding two budgets has been fiscal consolidation, of which an important part has been reducing the growth rate in the public sector wage bill. The revenue windfall from robust mining earnings has provided a stimulus, accelerating the process to reach a primary surplus as early as FY23, a year ahead of target.

The Minister of Finance’s allocation of the surplus revenue between reducing the budget deficit and spending, as well as its unilateral implementation of a 3.5% public sector wage increase, has emphasised the government’s commitment to fiscal sustainability. The sovereign rating outlook has consequently improved, with sovereign rating agencies Moody’s and S&P lifting the outlook on their respective credit ratings to BB+ stable (from negative) and BB- positive, respectively.

The domestic socio-economic and political landscape and the international context in which this year’s Budget Review is presented are rife with headwinds and obstacles. This will require careful steering and fortitude by the Minister of Finance and his team, backed up by political will, if fiscal consolidation gains of the past two years, are to be sustained.

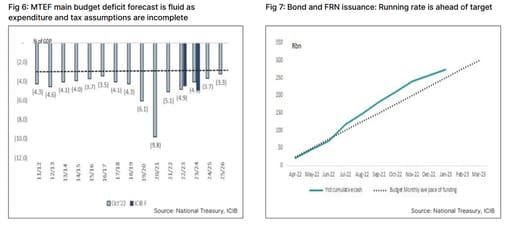

However, the credibility of the February 2023 budget forecast, which would include assumptions for the macro economy, tax receipts and expenditure, could in turn feed into the main budget deficit, and financing of the borrowing requirement, which are likely to be open-ended. Several issues will be left pending, implying that the October 2023 MTBPS could be an event risk.

Key focus points

- Eskom’s debt restructuring plan could consist of a 50%+ transfer of debt to the government’s balance sheet; or involve a staggered debt solution. The latter could see an extension of equity injections.

- The macroeconomic forecast could reveal National Treasury’s load shedding assumptions on the one hand, and its expectations of the implementation of the energy emergency plan, the fiscal relief package of fiscal rebates for residential and corporates, investment in rooftop solar panels, financial assistance to SME’s, emergency procurement and change in regulation under the state of disaster, on the other hand. This holds implications for the projected growth rate.

- The FY23 main budget deficit is expected to improve from a projected 4.9% of GDP in the 2022 MTBPS to 4.5% of GDP. The debt-to-GDP ratio could record a smaller increase from 68.0% of GDP in FY22 to 72.0% compared to the 2022 MTBPS projection of 71.4% of GDP.

- The FY24 fiscal forecast is anticipated to be opened ended, in the absence of firm forecast assumptions for the annual increase in the public sector wage bill.

- Progress in the government’s infrastructure and public-private partnership (PPPs) reform will be monitored given the lack of capacity and competence in many government and municipal departments. The key challenges have been onerous approval processes and the poor capacity of departments to estimate risk-sharing with the private sector. PPPs have declined to R5.6bn in FY19/20.

- Will National Treasury counter concerns about a deterioration in fiscal consolidation with the announcement of a new fiscal anchor?

- Financing of the FY24 budget deficit: We expect a larger rundown in cash balances, an increase in net T-bill issuance, the quantum of weekly nominal bond auctions to remain unchanged, more on SAGB funding duration as the R2030 has reached an outstanding amount of R262bn, a steep maturity profile out to 2030, a possible new long-dated SAGB bond and potential changes to the weekly inflation-linked bond (ILB) auction (which has seen 12 failed auctions) and more about FRNs.

Eskom’s debt restructuring – a staggered approach?

National Treasury is expected to clarify Eskom’s long-awaited debt restructuring. In the October 2022 MTBPS, the Minister of Finance stated that government plans to take over a portion of Eskom’s R400bn debt to enable the utility to restructure. The MTBPS noted that a lower debt burden will enable Eskom to implement a viable unbundling process and make resources available for investment in critical electricity supply and transmission infrastructure. Subsequently, Nersa granted Eskom a material rise in its annual electricity tariffs of 18.65% and 12.70% in FY23 and FY24, which has brought the tariffs about 10% away from levels considered to be cost reflective by 2024.

In early 2023, the Minister of Finance flagged that Eskom’s debt restructuring may be staggered. In this scenario, the approach could be to deal with short-term debt maturities first. This could involve extending part of the maturing bond into a longer-dated issue and a cash payout of the balance, of which the recently matured ES23 is an example. The government could also continue its equity injection, of which R21bn was budgeted in FY24. The corollary is that government’s debt servicing costs are unlikely to witness a structural increase, which would have been the case if more of Eskom’s debt ended on its balance sheet.

The risk to the fiscus is that government increases the amount of its equity injection to Eskom. This is in our view, linked to Eskom’s ability to afford more diesel, as the near-term growth outlook is contingent on running OCGTS (open gas cycle turbines) which can reduce load shedding by two stages.

Macroeconomic assumptions: A high level of uncertainty

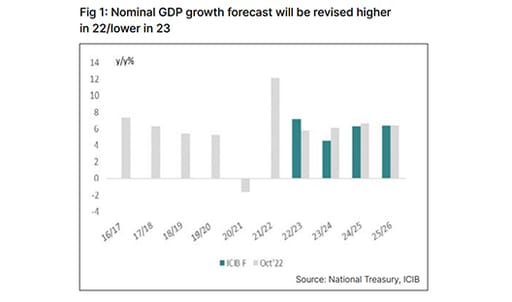

National Treasury’s MTEF macroeconomic forecasts will be closely monitored. The variance in GDP growth forecasts is wide, ranging between 0.3% and 1.9%. Bloomberg’s median forecast is 1.1%. National Treasury will likely revise its 2022 GDP growth forecast from 1.9% to ~2.4%, but lower its 2023 forecast of 1.4%.

National Treasury’s nominal GDP growth forecast will also undergo revisions, e.g., FY23 could be raised from 5.8% (ICIB forecasts 7.2%) and FY24 will be lowered from 6.2% (ICIB 4.6%).

The inflation forecast at 6.8% and 4.7% for the two fiscal years are more benign than ICIB’s forecast of 7.1% and 5.3% and face upward revisions.

Energy announcements

More details on energy procurement, private sector investment and state of disaster: Load shedding and energy investment assumptions are closely tied to the macroeconomic forecast. These include Eskom’s ability to procure more private sector energy (which National Treasury is likely to elaborate on), increasing maintenance and raising the energy availability factor (EAF) of its coal power stations from around 50%. The state of disaster, declared by President Ramaphosa, could also fast-track procurement, amend regulations, allow tax rebates for residential and corporates to invest in solar rooftop panels and feed-in tariffs (for the private sector to sell surplus energy to Eskom). Detailed analysis and timelines will go a long way to revive confidence, which have been dented by the snail pace of economic reforms, and ideology that trumps pragmatism to address the infrastructure crisis.

Fiscal projections

A better fiscal outcome for FY23 relative to the MTBPS.

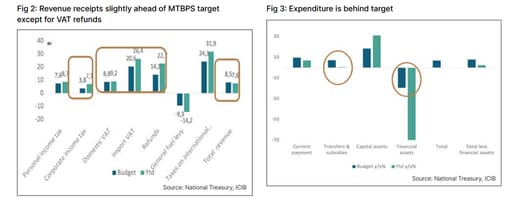

- A combination of revenue receipts ahead of target (ICIB: R10bn), underspending (ICIB: -R15bn) and a faster increase in the nominal GDP growth rate (ICIB: +7.2%) could see a better outcome for all fiscal metrics.

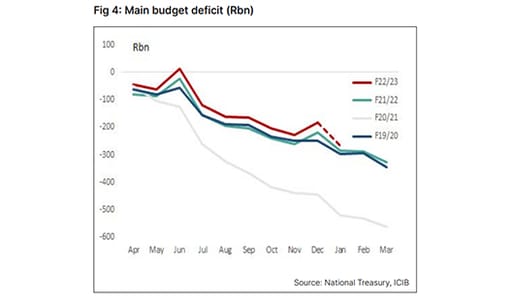

- The main budget deficit could come in lower at 4.5% of GDP compared to a projected 4.9% of GDP in the MTBPS.

- A primary surplus could be achieved in the current fiscal year, one year earlier than anticipated in the MTEF.

- The gross debt-to-GDP ratio could recede to 70.2%, amplified by a larger than expected decline in net T-bill issuance projected in the MTEF (-R24bn vs -R3.4bn).

- The closing cash balance could be ~R20bn more than the MTBPS forecast.

Open-ended fiscal projection for FY24

The fiscal projections for FY24 and the MTEF period will be fluid. National Treasury’s sense of the economy’s resilience in the face of the electricity crisis, and fixed investment forecast, will be revealed in its tax revenue forecast. The assumptions could also provide estimates of the cost of rebates to the fiscus. On the expenditure side, additional spending could include inflation adjustments to departmental and provincial budgets, and financial support to agriculture where flooding in several provinces has precipitated the government to declare a national state of disaster.

Issues likely to be rolled over to the October 2023 MTBPS

- Compensation bill forecast: At the time of writing, public sector trade unions are again embarking on strike action in the wake of a unilateral implementation of the FY23 3.5% increase in the public sector wages by National Treasury. The compensation increase assumption for FY24 has not factored in an annual increase over and above a pensionable increase of 1.5%, and a carryover of the 3.5% annual increase in the baseline forecast. The non-pensionable cash gratuity of R20.5bn ends in March 2023, having been extended for two years.

Unknowns over the MTEF

- Gauteng’s portion of Sanral’s debt redemption: The long-outstanding saga of Sanral’s e-tolls on GFIP Phase 1 (Gauteng Freeway Improvement Project) headed to some form of conclusion in the October 2022 MTBPS. National Treasury allocated R23.7bn to redeem outstanding government-guaranteed debt to strengthen its balance sheet. Gauteng must provide the balance of R14.1bn and finance annual maintenance of ~R2.0bn. However, it is unclear at the time of writing if a long-term revenue solution between National Treasury and Gauteng has been reached. The risk is that Gauteng’s liability will be financed by the fiscus and lead to an increase in spending.

- A permanent income grant: The Social Distress of Relief grant (SDR) had been extended in F24 to R44.0bn. It is widely expected to be adopted permanently in FY25, although the form and amount are still debated. National Treasury set aside R41.0bn in an unallocated reserve. However, National Treasury has stressed that the effect on the fiscus should be deficit neutral. This implies a structural increase in revenue receipts, consisting of an increase in direct or indirect taxes. This will be closely monitored as 2023 unfolds.

- Bailouts to dysfunctional municipalities and SOEs.

- Impact of load shedding on the economy, private sector fixed investment to become energy self-sustainable, and inflation.

Revenue forecast

Tax changes: We don’t envisage any significant tax changes. In addition to the annual increase in sin tax, there is a possibility of some alleviation for fiscal drag.

- FY24 tax revenue forecast: ICIB forecasts a downward revision of R35bn in National Treasury’s FY24 projections. This consists of a R3bn carryover from FY23, a R23bn decline in gross tax receipts and an assumption of a net decline of R15bn for tax rebates on the investment in solar rooftop panels. Investec’s quants strategist, Nadeem Dawood, estimates that solar tax investments could impact corporate income tax (CIT) and personal income tax (PIT) by 5% and 2-3% respectively. Still, the net effect could be lower due to increased output, higher receipts on VAT and import duties from imported solar panels and equipment.

- Corporate income tax (CIT) projections have been shaved by R10bn to show the effect of lower growth and higher investment in energy on earnings growth.

- Personal income tax (PIT) receipts have been lowered by R6.0bn. We assume that the 2023 slowdown is unlikely to be accompanied by material job losses in the private sector and that remuneration could increase by between 6 – 7%.

- A slower nominal GDP growth rate increase will impact value-added tax (VAT). We have pencilled in a decline of R7bn.

Main budget deficit forecast:

The F24 projection of the main budget deficit is not expected to reveal the true fiscal picture, as discussed above. ICIB forecasts the main budget deficit to widen to increase to 5.0% of GDP and a small primary budget deficit to return.

Main budget deficit and financing strategy of the gross borrowing requirement

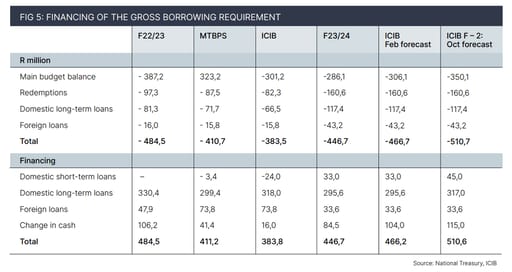

FY23 funding mix: The main budget deficit is estimated to be ~R22bn less at R301bn compared to R323bn in the MTBPS. There appear to have been changes to the funding mix, with National Treasury opting to have a higher year-end closing cash balance by allowing a larger amount of T-bills to mature:

- The net decline in T-bills of ~-R24bn has exceeded the MTBPS projection of -R3.4bn by a wide margin.

- The closing cash balance could be R25bn higher. This includes a rundown of the sterilisation deposit of R30bn.

- The current run rate of cash raised in the bond market is estimated at R318bn, which is R18bn more than the MTBPS projection. The current run rate of SAGB and ILB issuance is ~R267bn. The 5yr FRN issues raised R51bn.

FY24 scenarios: We have developed two funding scenarios because of an incomplete February 2023 budget forecast, as key expenditure assumptions may only be finalised at the October 2023 MTBPS. Depending on Eskom’s debt restructuring profile, there could be implications for cash flows.

- “Feb forecast”: The main budget deficit is projected to rise from R286bn as presented in the MTBPS to R306bn. The quantum of nominal bonds issued at the Tuesday auctions is expected to remain unchanged, amplified by an FRN issuance. The net T-bill issuance is forecast to rise to R33bn and there could be a larger drawdown in cash balances.

- “Oct forecast”: The main budget deficit could rise to R350bn. The funding mix could consist of an even larger increase in net T-bill issuance of R45bn, cash raised by SAGB, ILB and FRN issuance of R317bn (we assume bond auctions to remain unchanged and a larger FRN issue) and a bigger drawdown in cash balances. The gross debt-to-GDP ratio rises to 72% of GDP.