Against a background of soaring energy costs and the Russian invasion of Ukraine, UK Chancellor Rishi Sunak delivered his Spring Forecast Statement. He appeared calm and measured, with his baptism of fire during the Covid pandemic two years ago giving him a firm grounding for dealing with crises. As in equivalent exercises in recent years, what was supposed to be a forecast update morphed into a mini-Budget. Indeed, helped by a run of better-than-expected data on the public finances and a prior change to the treatment of student loans, Mr Sunak found room for several key measures, including a £3000 increase in the threshold for employees’ National Insurance Contributions (NICs), a 5p reduction in fuel duties and arguably the pièce de résistance, a 1p cut in the basic rate of income tax from FY2024/25.

Against some expectations, Mr Sunak declined to offer help to mitigate a likely further rise in the energy price cap in October. Should the recent pattern of gas futures be maintained, Investec’s utilities team has suggested that the cap could rise by 44% then, in addition to the 54% taking place in April. Clearly though it is difficult to offer specific assistance before there is a clear idea of what the next move will be, another round of measures could be delivered nearer the time. And the Chancellor will argue that he has in any case targeted assistance towards the less well-off via the change to NICs. It is notable though that his measures are directed towards those in work. Neither households receiving benefits, nor pensioners, stand to gain from this key element of the Statement.

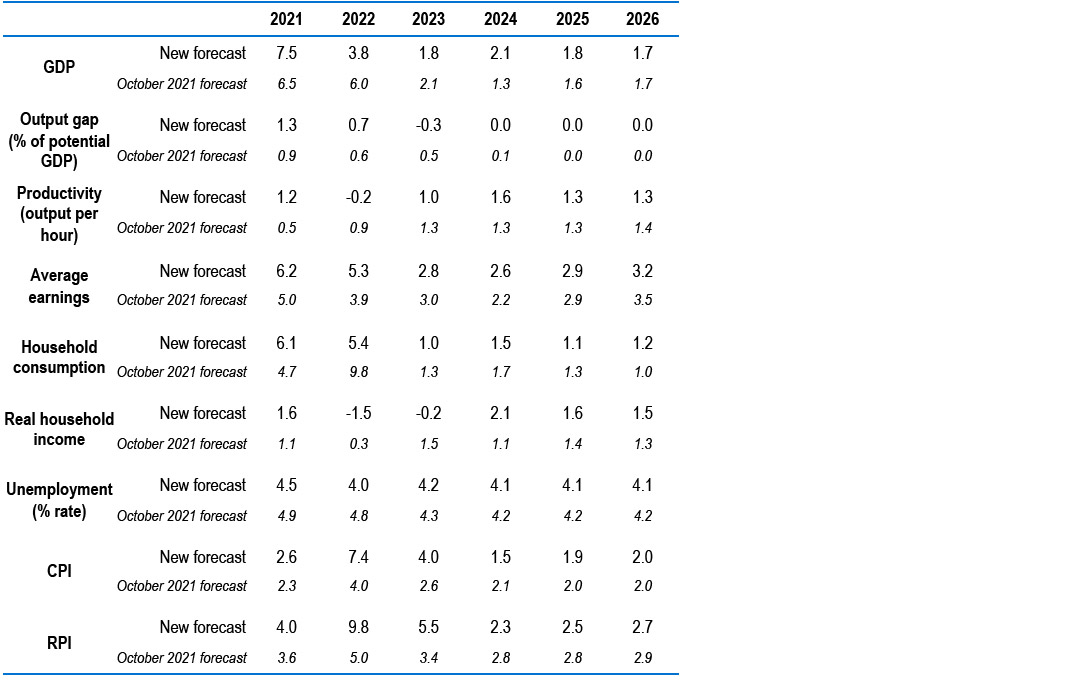

The long game seems to be based on the 1p cut in the basic rate of income tax. This is timed to occur around the likely time of the next general election. Certainly this will bolster the government’s tax cutting credentials and may help to quell disquiet from many backbench MPs, who had accused it of becoming a ‘tax and spend’ government. Meanwhile the OBR has concluded that even when the measures are included, the government meets all of its fiscal rules with a greater margin than envisaged at the time of the Budget last October. Of course the war in Ukraine adds a considerable degree of uncertainty to the outlook. However we judge that the OBR’s GDP forecasts of 3.8% for this year and 1.8% for next look realistic and if anything, a touch conservative as a baseline forecast.

Fiscal rules

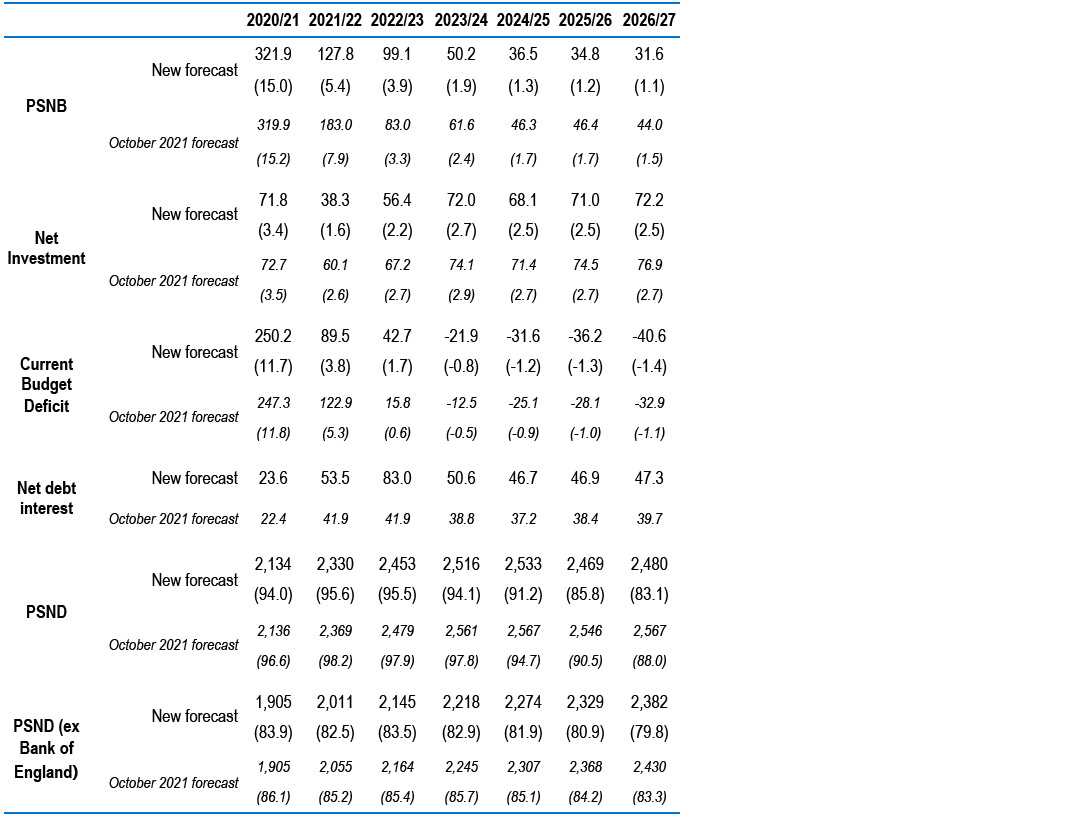

A consistent feature of the data on the public finances over the past year has been a steady stream of relatively favourable outturns, partly via revisions to previous data. Indeed the OBR has made material revisions downwards to its borrowing forecast for 2021/22, to £127.8bn from £183.0bn expected at October’s Budget. In truth we have been somewhat surprised by the scale of the change to the estimate – we had expected a prediction in the region of £150bn. Broadly though it reflects a favourable combination of strong tax inflows and lower public spending, the latter dominated by a £21.8bn undershoot in public sector net investment.

Table 1: OBR Spring 2021 fiscal forecasts*, £bn (figures in brackets are % of GDP)

*New 2020/21 estimates are outturns, not forecasts

Source: Office for Budget Responsibility

Thereafter borrowing is envisaged to continue on its downward path, but at £99.1bn the forecast for 2023/23 is some £16bn higher than October’s forecast, principally on a much higher path for debt interest, but also reflecting the cost of various measures in the Statement. This is partly offset by the continued buoyancy of tax receipts, but also reforms to student loan packages which result in lower government outlays throughout the forecast horizon.

Looking further ahead towards 2026/27, the deficit bottoms out at £31.6bn, or 1.1% of GDP, at the end of the horizon. This compares with a peak of £321.9bn (15.0% of GDP) last year, although this number was revised modestly lower to £317.8bn, in the ONS’s release of February’s public finances figures.

The OBR concludes that the government is on track to meet its various fiscal targets and each by greater margins than in October, despite a number of measures which combine in a net fiscal giveaway (see below). Most importantly it is expected to meet its fiscal mandate (ex-BoE debt to GDP ratio to be falling in the third year of the forecast). This is expected to be met by £27.8bn, compared with a forecast of £17.5bn at the time of the Budget. Similarly the government also attracts ticks on its scorecard on its rules on the current budget, public sector net investment and the welfare cap.

However the OBR underlines the uncertainty of the outlook in its probabilistic exercise. It does conclude that there is a decent prospect of the debt and current budget rules being met individually (58% and 66%, respectively). Nonetheless it calculates that the chances of both targets being met at the same time in 2024/25 are less than fifty-fifty, at 46%.

A final note concerns what we consider to be the most eye-catching set of figures in Table 1, namely debt interest payments. These have been revised sharply higher, by £11.6bn to £53.5bn during the current fiscal year and by a whopping £41.1bn to £83.0bn in 2022/23. The main contributor here is higher-than-expected RPI inflation, which results in a material increase in the cost of uplift to index linked gilts. By 2023/24, debt interest is expected to decline to £50.6bn, whereupon the profile is relatively stable. The new figures however remain above those forecast at Budget time last October.

Personal taxation measures the key response to price squeeze

In upping his response to the cost-of-living crisis, the Chancellor has chosen to focus on personal taxation, which will primarily benefit working households. The key additional measures announced in this respect were twofold:

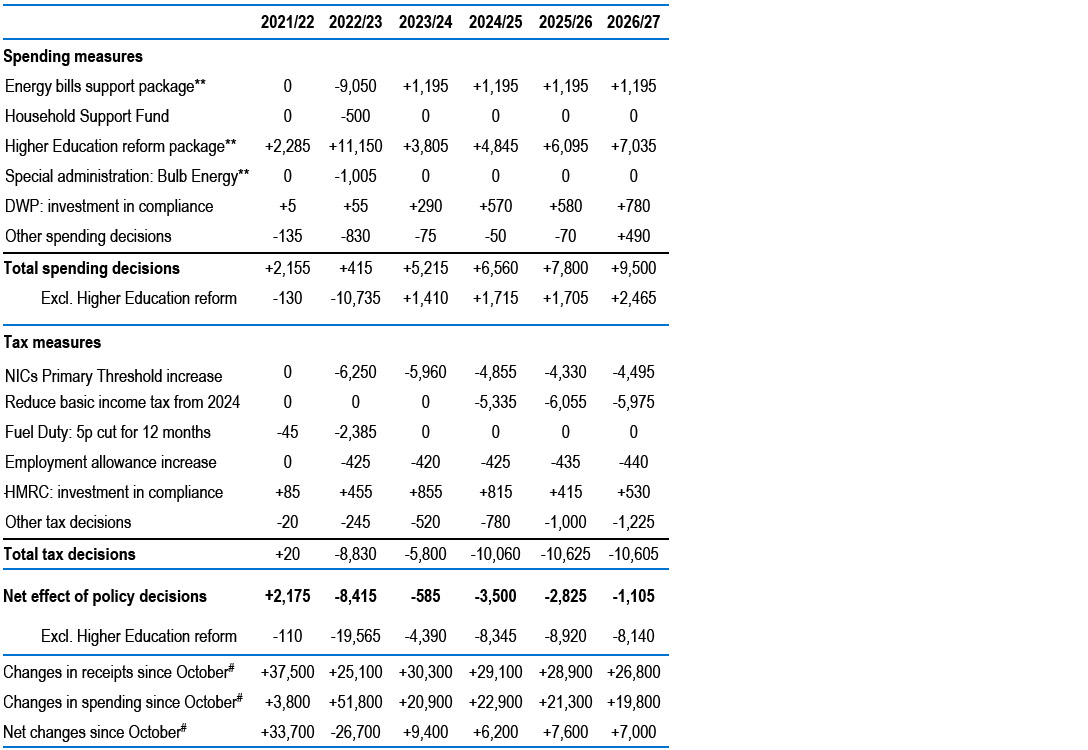

First, Mr Sunak announced a substantial rise in the NIC primary threshold and lower profits limit of £3,000 to £12,570. This will take effect from July 2022 and bring it in line with the threshold for income taxes, as the Conservative Party manifesto of 2019 had set out to endeavour. This stands to benefit nearly 30m taxpayers, to the tune of £290 each on average. The OBR estimates that this will come at a cost of £6.3bn for FY 2022/23, but decline thereafter as the threshold is frozen at this higher level.

Second, from April 2024 onwards, the basic rate of income tax is to be cut, from 20% to 19%, also benefitting about 30m taxpayers, at around £170 a year each. The OBR has factored in an initial annual cost of £5.3bn for this, rising slightly in subsequent years.

From April 2024 onwards, the basic rate of income tax is to be cut, from 20% to 19%.

These measures have to be set against the increases that will come in the personal tax burden through previously announced measures, in the form of the National Insurance tax hike (soon to the rebranded as the ‘health and social care levy’) that will kick in shortly as the 2022/23 tax year starts on 6 April, as well as the freezing of income tax thresholds that was announced in March 2021. Jointly, by FY 2026/27, the OBR assumes, the personal taxation measures announced in the Statement will reverse around 28% of the rise in the tax burden. The benefit will however be unevenly distributed: as Mr Sunak noted, 70% of people will see a bigger tax cut than the burden from the health and social care levy. (Note, however, that this comparison puts to one side the impact of the freezing of income tax thresholds, which the OBR anticipates will be a bigger burden by FY 2026/27 than the new levy itself.) Also notably, people whose income falls short of the personal income tax threshold – which will include many people on benefits – will not be aided by these measures.

Separate to these permanent changes to personal taxation, the Chancellor also offered some further temporary support to counter the surge in energy prices. Rather than tackling utility bills, however, this was targeted at petrol and diesel bills - there is a one-year cut in fuel duty by 5 pence, which will come at an estimated cost of £2.4bn in FY2022/23.

Table 2: Policy decisions taken at 2022 Spring Statement (£, million)*

*negative numbers indicate a cost

**announced prior to Spring Statement

#rounded to nearest £100 million

Source: Office for Budget Responsibility

Just as noteworthy, perhaps, as what was announced is what was not. Although the OBR expects a further £830 rise in the energy price cap in October, no further assistance for most households was offered to target spiralling utility bills directly beyond the £150 council tax rebate and £200 loan scheme already announced in February (except for a doubling in the household support fund to £1.0bn for the most vulnerable). Moreover, benefits and public-sector wages were not uprated to address the cost-of-living squeeze. And finally, there was no direct help for businesses dealing with surging costs at this stage, although the Chancellor suggested his intention was to cut tax on business investment at the Autumn Budget. This sent the clear implicit message that the government wants to encourage more people into the labour market, by raising the cost of not participating – and that, as the Chancellor himself had noted in recent days, the government cannot and will not attempt to protect people fully against all shocks hitting the economy.

Equally omitted from Mr Sunak’s statement, because it was pre-announced on 24 February, was the significant contribution to funding that reforms of the higher education student loan system will make. A number of changes were made. Most helpful to the public purse, and most costly for many individual students, was that the repayment terms for borrowers who would previously have loans written off after 30 years will be extended to 40 years (upping the marginal tax rate by 9%pts for up to a decade for them), and that the repayment threshold will be lowered and then frozen until 2026/27 (for new borrowers). That interest rates for new borrowers will be cut from RPI inflation plus 3% to equal RPI inflation alone and that maximum tuition fees will be frozen until 2024/25 will be only partial offsets. Because of the way the public accounts treat these reforms, this will raise significant revenue for the government upfront, to the tune of £11.1bn in FY2022/23 alone.

Macroeconomic forecasts: challenges lie ahead

Underpinning the public finances outlook is a new set of economic projections from the OBR. The underlying message from this updated set of forecasts is of a more challenging economic backdrop than was envisaged in October. Indeed, the OBR now expects annual GDP growth to be 3.8% in 2022, a 2.2%pt downgrade relative to October. This downward revision largely reflects the expected spill-over effects from the invasion of Ukraine, which has intensified global supply bottlenecks and inflationary pressures. Accordingly, global growth for this year has also been pushed down, but only by 0.5%pts, which we view to be on the conservative side when factoring in the sharp expected contractions in Russian and Ukrainian GDP.

Considering the large pick-up in commodity prices since the October forecasts, the most substantive changes are, unsurprisingly, those for the inflation outlook. The forecasts by the OBR are conditioned on future market pricing from 24th February to 2nd March, excluding the subsequent volatility (Brent crude peaked at $130 per barrel on 7th March, but has since fallen back). Using such pricing, an assumption of a further 40% increase to the Ofgem energy price cap in October was factored into the forecasts, which has resulted in inflation projections being higher for longer – the OBR now expects CPI inflation to peak at 8.7% in Q4 of this year, its highest in 40 years. For the RPI measure, which is important for the government's index linked debt and student loan repayments, this is predicted to top out just shy of 11%, reflected in the sharp upward revisions to debt interest expenditure over this year and next.

As Chancellor Sunak highlighted to the Commons, the unemployment rate is now lower at every period of the forecast horizon, with the largest revision to 2022.

In contrast to the inflation and output outlook, there were more favourable revisions to the projections for the labour market. As Chancellor Sunak highlighted to the Commons, the unemployment rate is now lower at every period of the forecast horizon, with the largest revision to 2022. The OBR now expects the unemployment rate to average at 4.0% across the course of the year, reflecting the high volume of vacancies and the unexpected resilience of the labour market to the expiry of the employment support schemes. Although an encouraging set of forecast revisions, it is worth balancing this against a shrinking labour force – the OBR now assumes that relative to forecasts made prior to the pandemic, 400k fewer people will participate in the labour force across the forecast horizon than was assumed pre-pandemic (split: 190,000 due to a smaller population, mostly from net migration trends, and 210,000 due to a higher inactivity rate).

In all, the updated macroeconomic projections present a challenging outlook for households. Inflation is set to outpace nominal wage growth, and net taxes are planned to increase with the hike to the NIC in April. Although Chancellor Sunak announced various measures to support households, on OBR projections these will only offset around a third of the fall in expected living standards in absence of such support. Indeed, according to the OBR, households will have to brace for a 2.2% decline in real living standards per person in the current financial year, which would amount to the largest fall in a financial year on record (ONS data began in 1956-57).

Table 3: OBR Spring 2022 macroeconomic forecasts* (annual % change unless stated)

*New 2020 estimates are revisions to outturns, not forecasts

Source: Office for Budget Responsibility

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.