How to avoid inflation eroding the value of your cash savings

Low interest rates have been the enemy of savers for many years, with the Bank of England base rate sticking stubbornly below 1% since March 2009. Now, though, there is a new threat on the horizon, in the form of rising inflation.

When inflation is high and interest rates remain low, cash savings suffer. Let's look at why, and what you can do about it.

Some savers prefer the certainty of cash

It's well known that higher-risk asset classes, such as equities, tend to deliver greater returns than lower-risk asset classes, such as cash, over long periods. Still, equities can also be subject to sudden, sharp declines in value, such as the 2008/2009 financial crisis or, more recently, the COVID crash in February 2020. That drives a fear of investing. In the UK, more than a quarter of people who don't invest state that it's because they're "afraid of losing everything."

Cash is seen as safe because it offers certainty. If you lock away £100,000 in a cash savings account, it may not grow much in value, but 10 years later, you are still (relatively) certain to have £100,000 in cash. The problem is that your £100,000 won't have the same buying power.

Inflation is more powerful than you might think

You're likely aware of the impact inflation has on prices. You might have noticed, for example, that the price of a pint of milk has doubled since 1990. Since it's still available for around 50p, you might not be particularly concerned. It's only when we're looking at large amounts of cash that the effect is much more profound.

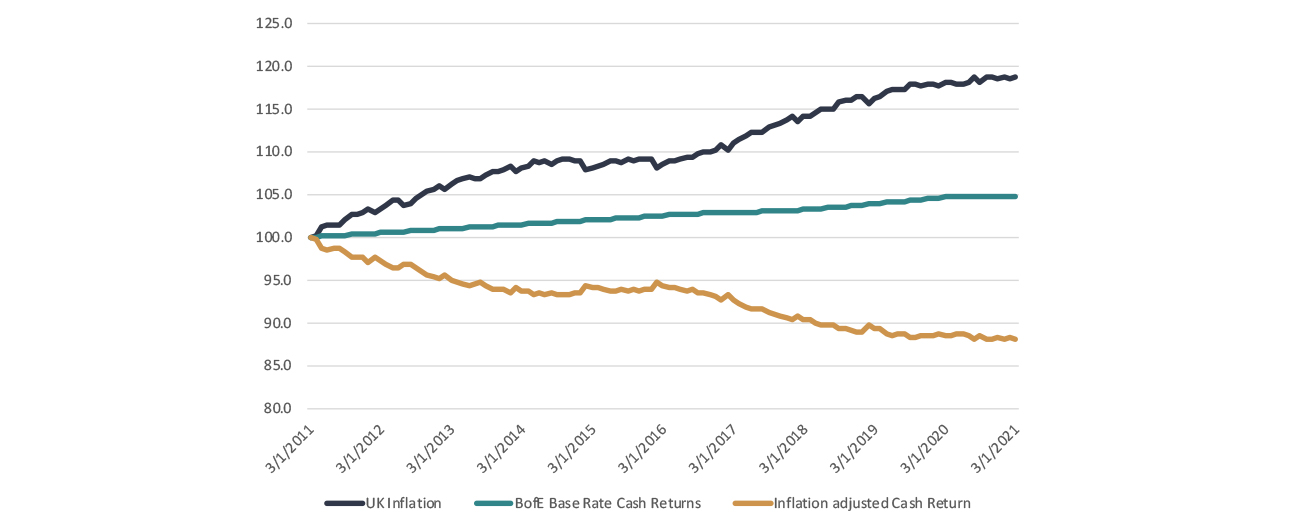

Inflation, as measured by the consumer price index (CPI), has averaged around 2% per year for the last 10 years. That means that £100,000 in cash in 2011 would need to deliver nearly a £20,000 return over 10 years to retain its purchasing power in 2021 (see graph below). In a cash account, earning interest at the Bank of England base rate, this would not be possible. So, the true value of those savings now would be a little over £88,000.

Source: Bloomberg/ONS

A rise in inflation would create tougher conditions for cash

If inflation were any higher than in the example above, cash savings would, most likely, fall further behind. That's why savers should be concerned when economists predict that inflation is rising.

Of course, no one can know for sure which direction inflation will move in in the future. The economy is influenced by myriad factors and can be unpredictable. However, the ongoing COVID-19 pandemic has triggered an unprecedented response from the central banks, with quantitative easing used to counteract the economic impact. We haven't previously seen new money introduced into the financial system at this scale, and some experts foresee it creating the conditions for inflation to spike.

Investments offer the potential to beat inflation

While cash returns tend to be lower than inflation, investment returns can be much higher. With investment, your capital is at risk and can go down as well as up in value. However, it is only by taking that risk that beating inflation becomes possible.

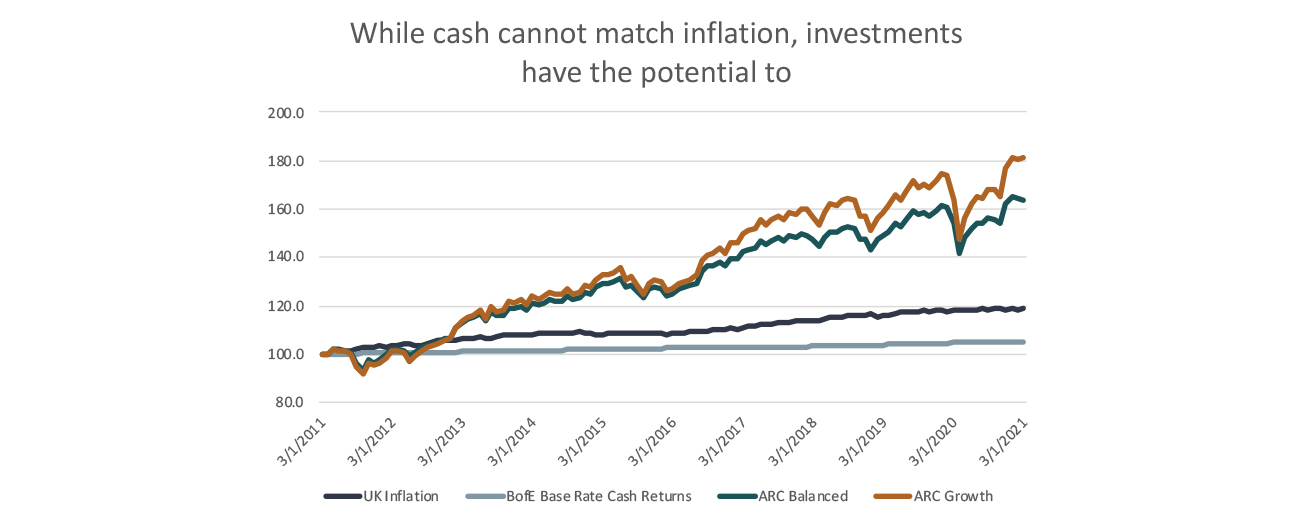

In the graph below, the line in Navy blue shows UK inflation over the last 10 years. To put it simply, for your wealth to retain its value, the rate of growth must fall at or above the blue line.

The line in grey, which shows the actual growth that cash savings would have achieved at the Bank of England base rate, falls steadily below the blue line. Meanwhile, the lines in amber and teal (which represent example Investec portfolios) fluctuate in value and occasionally drop below the blue line, but after 10 years, both are significantly higher.

While past performance is not necessarily an indicator of future performance, this example can be helpful in understanding a possible growth trajectory, which includes some falls in value.

Source: Assets Risk Consultants (ARC) and Investec Wealth & Investment (31st March 2021)

Both the amber and teal lines show actual returns from example Investec portfolios at different risk levels, monitored by Asset Risk Consultants (ARC), an independent research firm. The portfolio represented in amber is primarily invested in equities, while the portfolio represented in teal is invested in a lower-risk mix of assets, including a higher proportion of bonds.

Following their biggest drop in value (February 2020), these lines remain well above inflation. And even if inflation had risen at twice the rate, these lines would remain above it now.

Choosing the right investment strategy

While there are strong arguments for the advantages of equities over cash, I would not urge you to simply move your wealth from one to the other. There are various considerations, including what portion of your wealth you're willing to put at risk, what level of risk you can accept, whether you need an income, and how long you're prepared to commit your money for.

In the graph above, you'll notice an initial two-year period in which neither investment portfolio exceeded the rate of inflation. I typically recommend that clients only commit money to an investment portfolio that they can lock away for a minimum of three years, to allow their investments time to recover from any early drops in value.

If you're among the non-investors for whom fear is a barrier to investing, note that over three in four UK investors who work with an adviser report a "positive sense of wellbeing." An adviser or wealth manager can give you the confidence that your investment strategy aligns with your financial goals, at a risk level you're comfortable with. If you'd like to discuss how you can beat inflation, or any other aspirations you have, then please feel free to get in touch with me.

About the author

To contact or read more about Matt Green, visit his biography here.