How long will your retirement savings last?

How long your retirement savings last depends on various factors, but the two with most influence are:

- The rate at which you withdraw your savings

- The rate at which your savings grow

Disregarding other factors, it’s clear that if your withdrawal rate matches your growth rate, the amount remaining would stay the same. Your pension savings could potentially last indefinitely.

However, this is easier said than done, as the growth rate of your savings isn’t constant, and may not match your spending needs. And while you can choose your investments and risk level, other influences on your growth rate, such as market conditions, investment performance, and inflation, are beyond your control.

Your withdrawal rate is the easier factor to control.

How significant is your withdrawal rate?

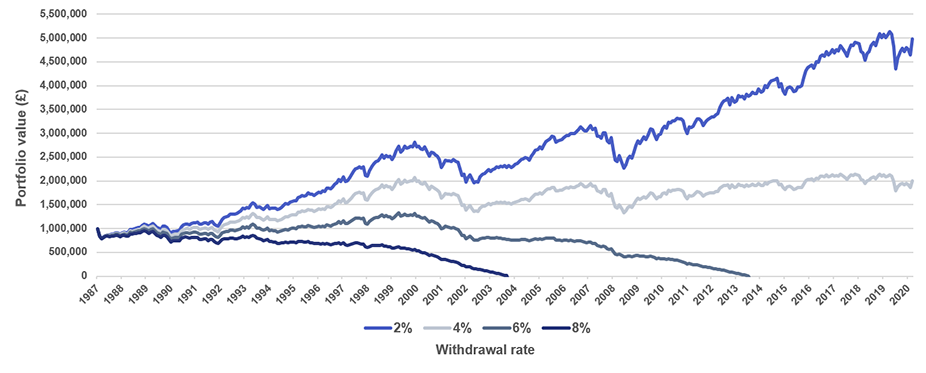

The graph below shows a hypothetical portfolio worth £1,000,000 and how quickly that may have been depleted under real market conditions since just before the Black Monday crash in October 1987.

Source: Investec Wealth & Investment; BlackRock 2015.

The four expenditure lines represent steady withdrawal rates of 2%, 4%, 6%, and 8%. The fluctuations in value reflect the changing growth rate over time.

As you can see, a withdrawal rate of 8% (an initial £80,000 a year in this case, adjusted annually for inflation) results in the portfolio value reducing to zero in under 17 years. In contrast, at a withdrawal rate of 2% (an initial £20,000 a year), the portfolio has doubled in size after 10 years and increased by 300% after 30 years.

Neither of these outcomes is typically considered ideal; the first may lead to financial hardship, while the second represents unnecessarily cautious spending, potentially increasing the size of your estate, which could be taxed severely upon death.

What is an appropriate withdrawal rate?

Looking again at the graph above, an appropriate withdrawal rate for most individuals in this period would have been above 2% and below 6%.

But even within this smaller range, there are vastly different outcomes. A withdrawal rate of 6% in this example depleted the portfolio to zero after a little more than 26 years, whereas a 4% rate resulted in portfolio growth of around 100% over the full period shown. That’s one reason why a bespoke retirement income plan is essential.

However, future conditions are not certain, and investment performance may be better or worse than in the past, so your plan may need to be updated over time.

Can you be sure your savings will last?

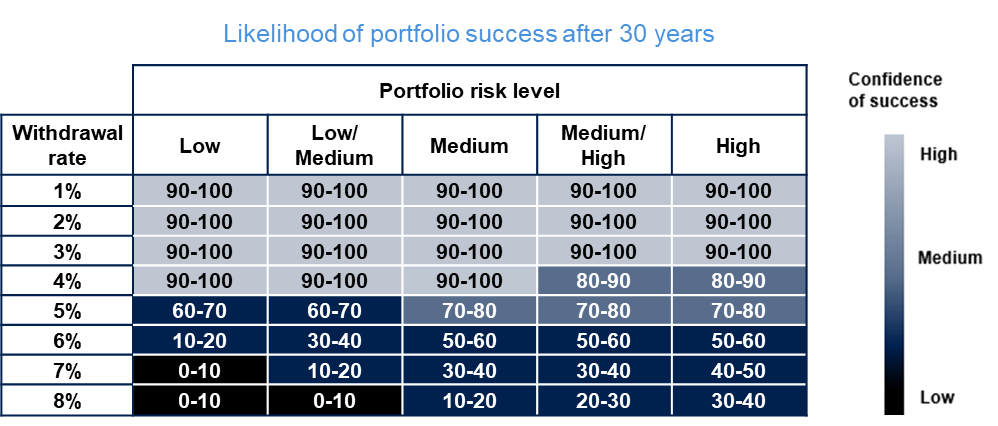

Looking to the next 30 years, we can forecast the likelihood of portfolio success (or in other words, the likelihood that your savings will last throughout your retirement) given varying withdrawal rates and levels of portfolio risk.

Source: Investec Wealth & Investment; FactSet.

According to the above chart, up to a withdrawal rate of 4% there is a high probability that your portfolio will last - but this may not provide the lifestyle you want.

At a rate above 4%, portfolio success is less probable, so to withdraw at this level you’ll need to maintain consistently high growth. Your investment strategy and portfolio management will be crucial.

Something else to consider is that you may wish to change your withdrawal rate at different stages of your retirement, working with your investment manager to make ongoing adjustments to your financial plan

How can you plan your future retirement income?

Everyone’s retirement looks different, but a typical pattern is:

- High spending in your 50s and 60s, to bridge the gap between working and the state pension age while enjoying life to the full.

- Lower spending in your 70s, though gifting is common. The state pension provides additional income, with further capital boosts from inheritance or downsizing.

- Higher spending in your 80s and 90s due to later life care costs. Gifting reduces for inheritance tax liability reasons

To give you more insight into your future spending needs, your investment manager or financial planner can use cash flow forecasting. Based on this and your current wealth, they can determine the minimum return rate required to fund your lifestyle and offer suitable solutions that are intended to deliver that return.

What action should you take now?

Depending on your current financial situation and spending needs, various different solutions may be recommended to you, so seeking expert advice is key.

If you are withdrawing at a low rate:

If your current withdrawal rate could lead to excessive accumulation, it’s essential to review the tax implications.

Savings outside of an investment product that offers favourable tax treatment could be gifted now to reduce the inheritance tax bill for the recipient in future. Or, they could be moved to a different product such as IW&I’s alternative investment market portfolio or a trust or offshore bond. You may also consider a portfolio loan to avoid incurring a capital gains tax bill to take action. Such changes carry varying levels of risk and you should seek advice from your investment manager before making a decision.

If you are withdrawing at a high rate:

If your spending requires withdrawals at a high rate and you want greater certainty that your savings will last, you may wish to structure your portfolio to be more predictable and less volatile.

Your investment manager can recommend appropriate investments for your target return rate. Options include IW&I’s Structured Product Service, which has a strong emphasis on capital preservation and offers the potential for positive returns in rising, flat or falling markets.

If you have significant savings in cash:

Cash savings, which achieve a very low rate of growth due to low interest rates, cannot typically keep pace with the rate of inflation. This means that their spending power will reduce over your retirement.

To maintain the value of your savings you should consider moving cash to the higher growth environment of an investment portfolio. This does not necessarily mean investing your money in higher-risk assets (such as equities). Through bespoke portfolio management, a portfolio can be constructed at a risk level that suits you.

Important information

The value of investments and the income derived from them can go down as well as up and you may not get back your initial investment.

This article does not offer advice and the content and information about potential investments and services are designed for general use, and so cannot be considered personal to your circumstances or your financial position.