Global Economic Overview – October 2024

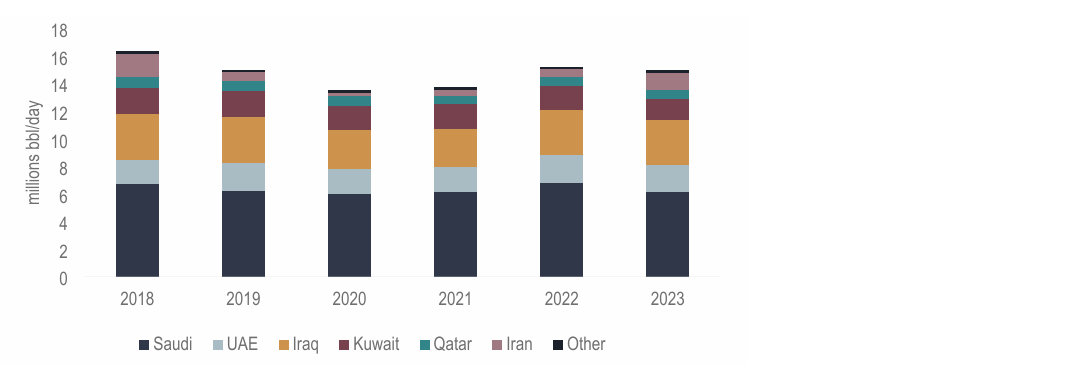

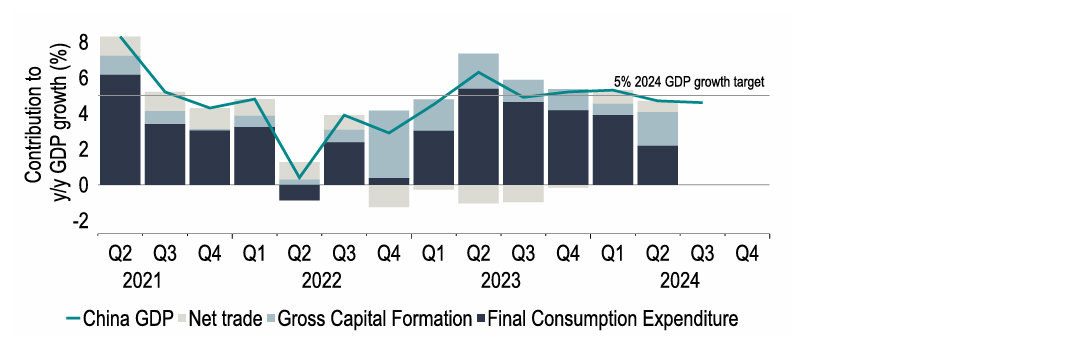

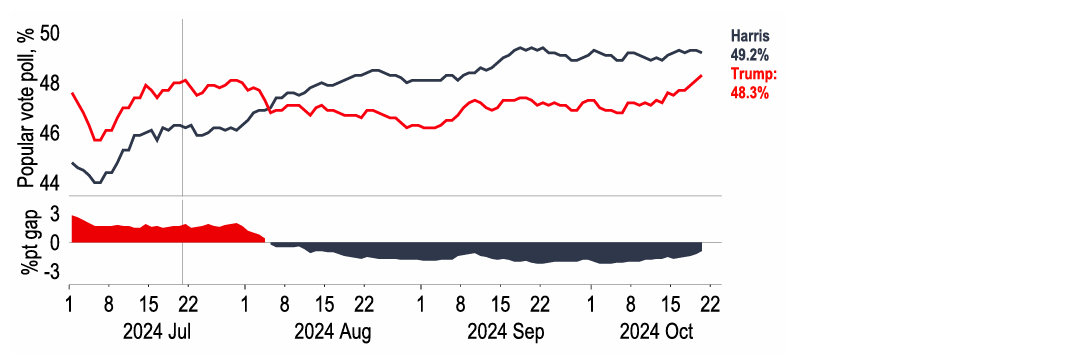

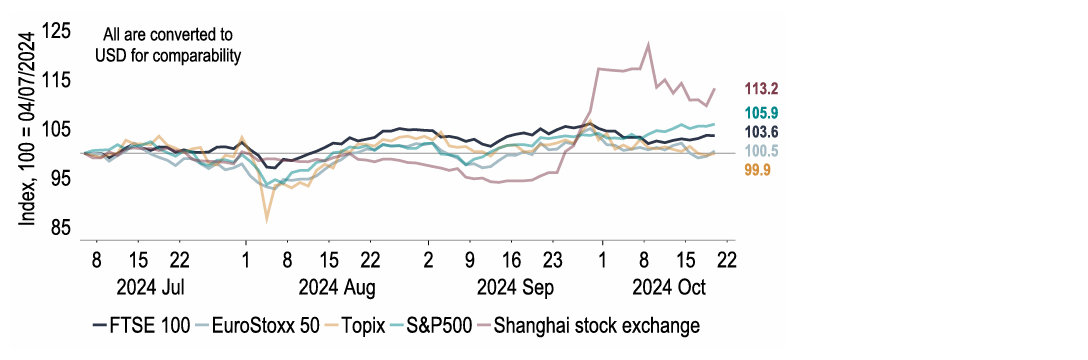

Global financial markets continue to be driven by expectations over monetary policy as more central banks transition to policy easing. But politics also is playing a role too. With the US election on 5 November fast approaching, there seems to be signs of a ‘Trump trade’ playing out in financial markets, as the former President gains momentum in the polls. Meanwhile geopolitics – specifically the conflict in the Middle East – and the impact of stimulus measures in China could influence our global growth forecasts moving forward.

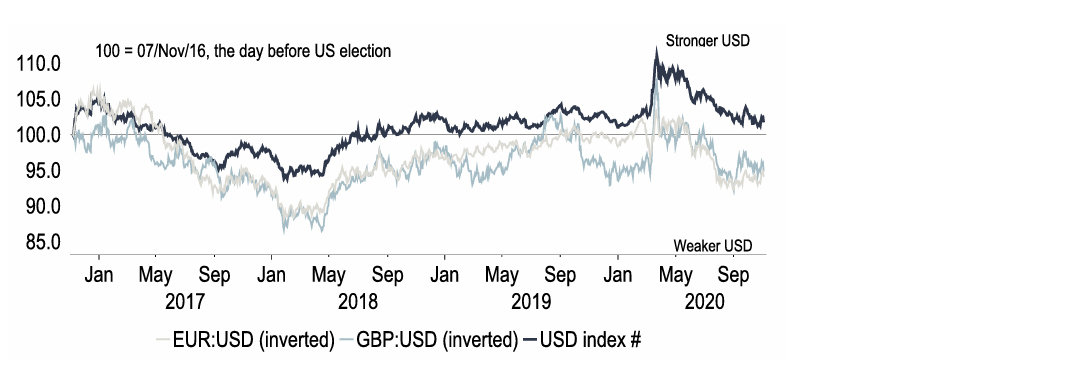

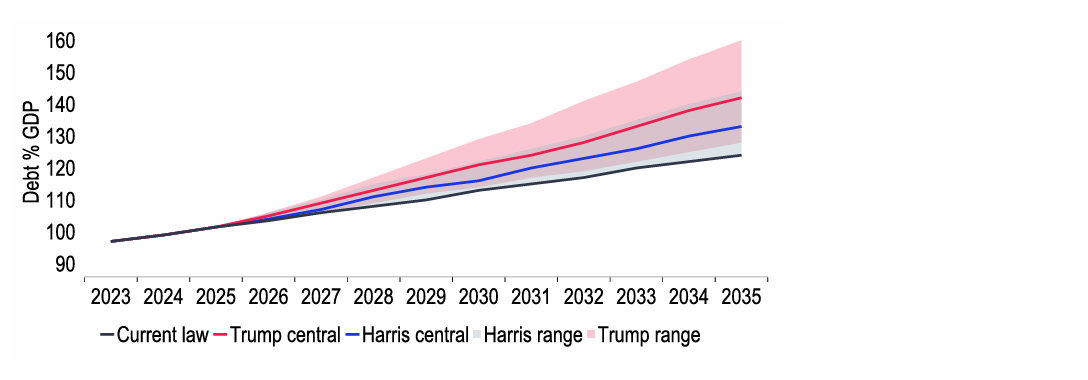

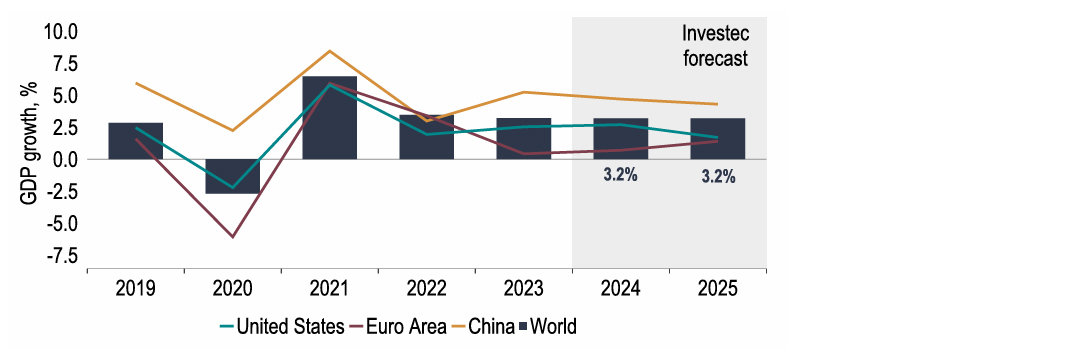

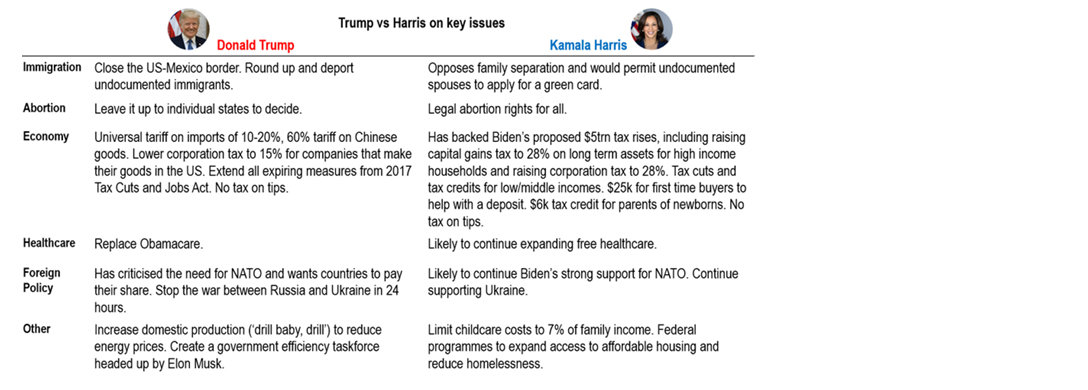

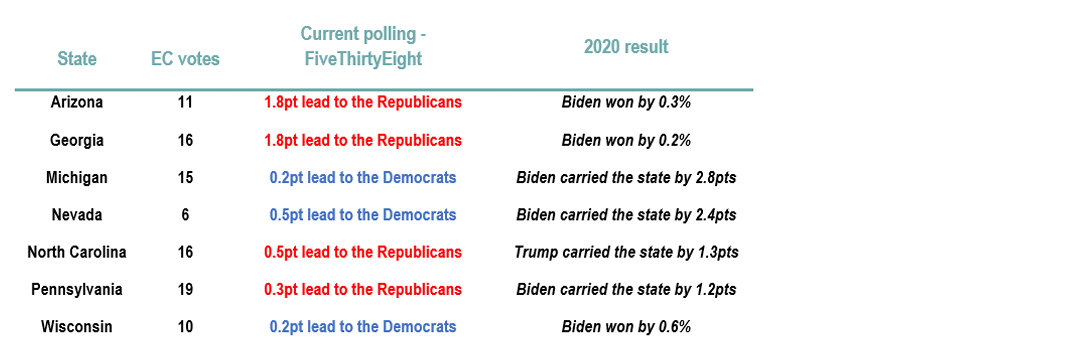

Globally the US remains the focus of market attention given two open questions: the outlook for Fed policy and the outcome of the 5 November election. On the former the strength of recent data has driven renewed volatility in interest rate markets, something which may be exacerbated by the election. With polls now too close to call our forecasts are based on a constant policy approach. However a Trump win is a distinct possibility and under such a scenario we would judge that the USD strengthens, US equities rise, whilst US Treasuries come under pressure. Geopolitics could have an impact on the election too should the Middle East fall into a broad regional war. This is a factor which would also pose a downside risk to global growth, but for now our forecasts are unchanged for 2024 at 3.2%, whilst 2025 has seen a 0.1%pt upgrade to 3.2%.

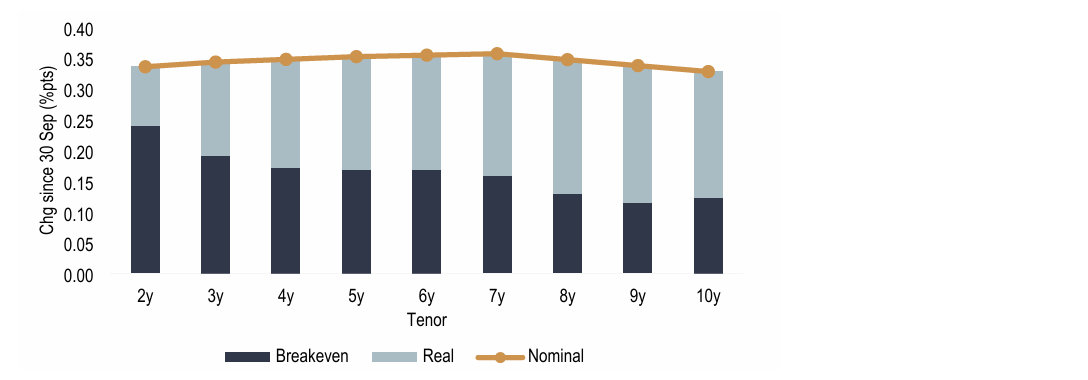

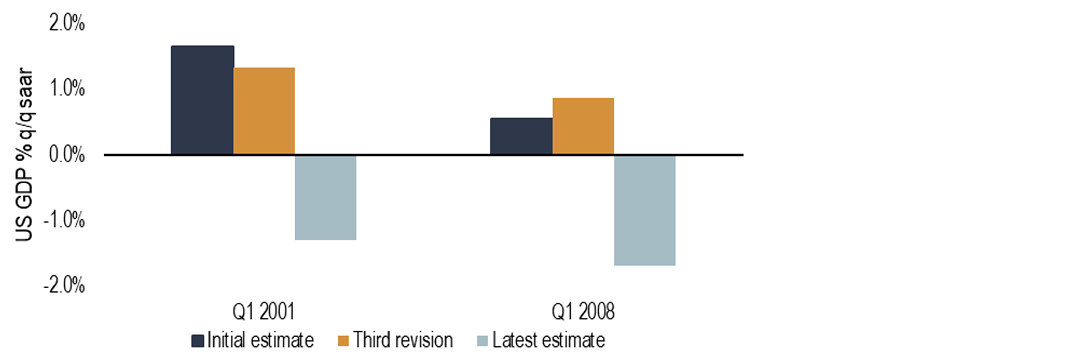

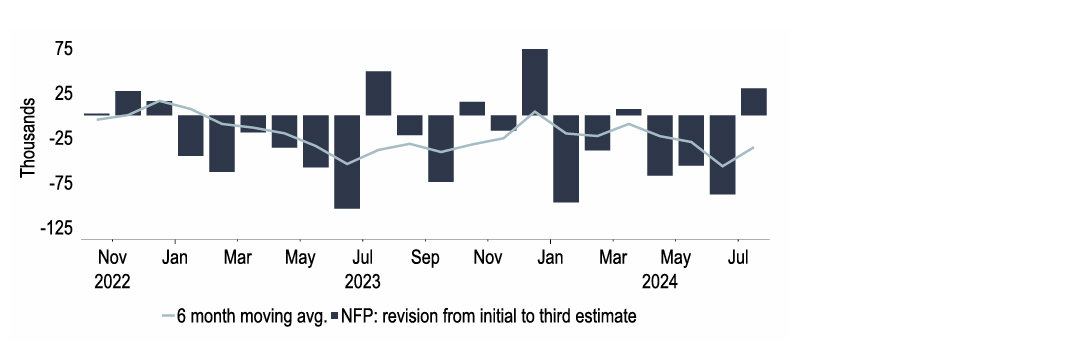

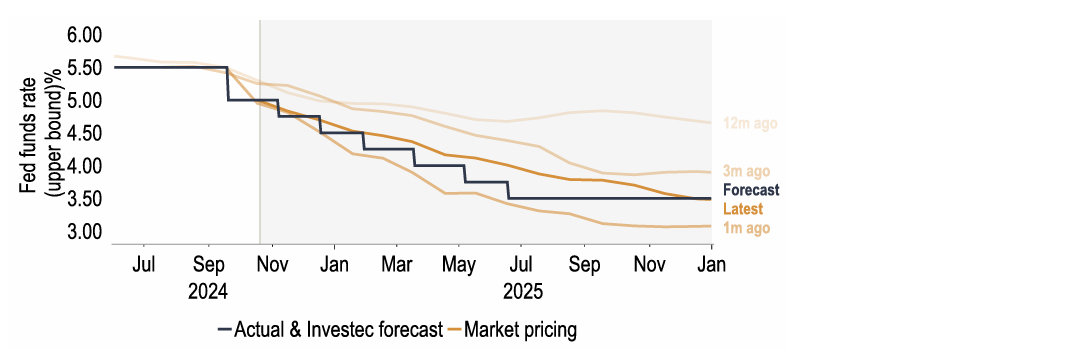

The FOMC’s jumbo 50bp cut in rates last month was promptly followed by a much stronger than expected employment report, including a 254k gain in non-farm payrolls. Complicating the Fed’s task though is that early GDP figures missed downturns in 2001 and 2008 and payrolls have tended to be revised down over the past year. Our forecasts still see the Fed funds target range reaching 3.25%-3.50% by mid-2025 from 4.75%-5.00% now, broadly in line with market pricing. As the 5 November elections approach, Donald Trump has enjoyed positive momentum in the polls recently and leads Kamala Harris in most of the swing states, although these findings are well within the margin of polling error and could still change over the final two weeks.

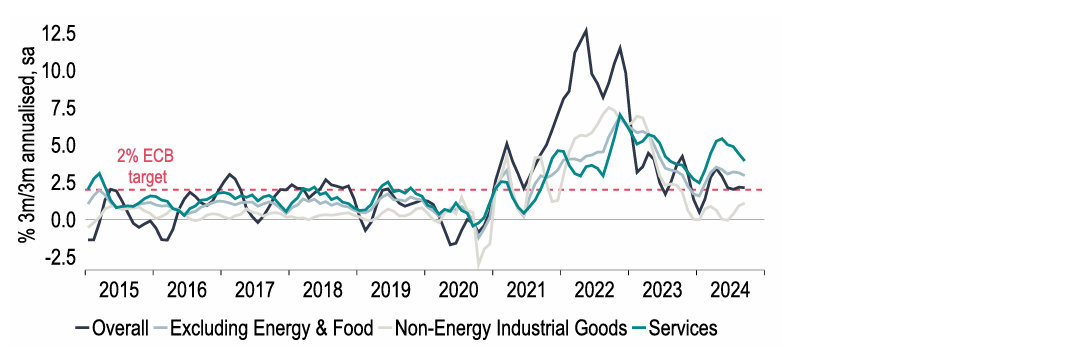

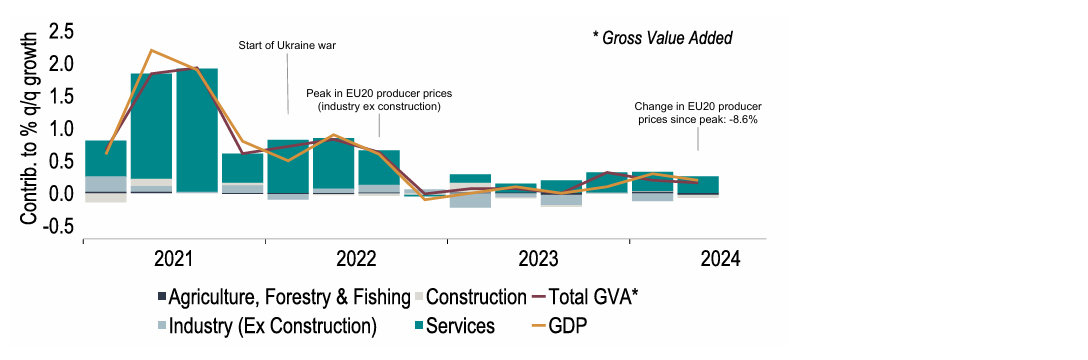

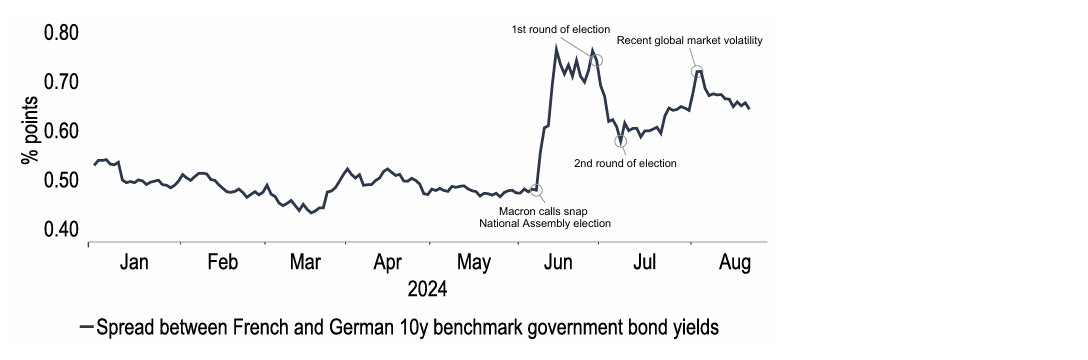

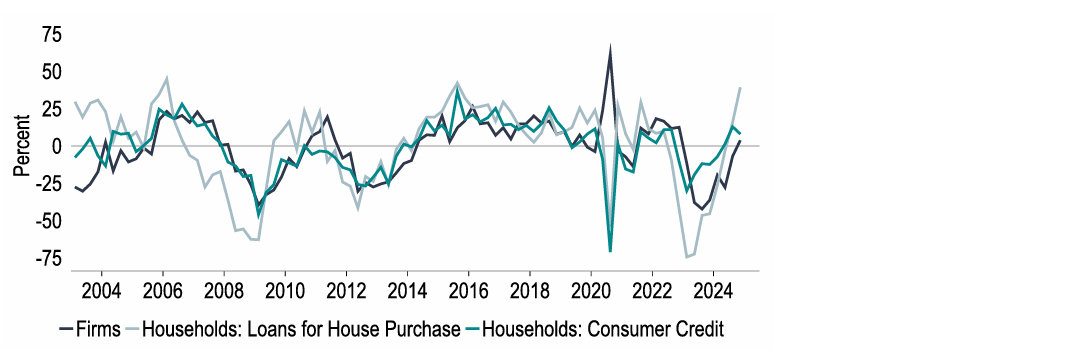

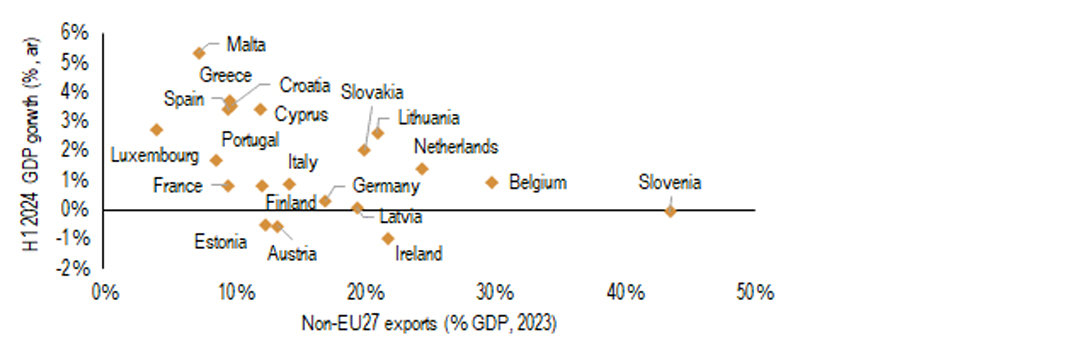

Weaker than expected inflation and growth have prompted the ECB to cut rates back-to-back this month. A sustained return to target inflation could indeed come as soon as in Q1 2025. On the activity side, surveys paint a fairly gloomy picture. But it seems that the drag from interest rates on loan demand of firms and households has already peaked, and households are benefiting from strong real income gains and high savings. We have therefore kept our growth forecasts unchanged at +0.7% for this year and +1.4% for next year. Our policy rate and FX forecasts are also unchanged. But we acknowledge the risks, largely of a political nature. Domestically the passage of the French Budget is all but certain, and internationally, a Trump victory with yet another step up in protectionism could be a headwind to EU20 growth and to the euro.

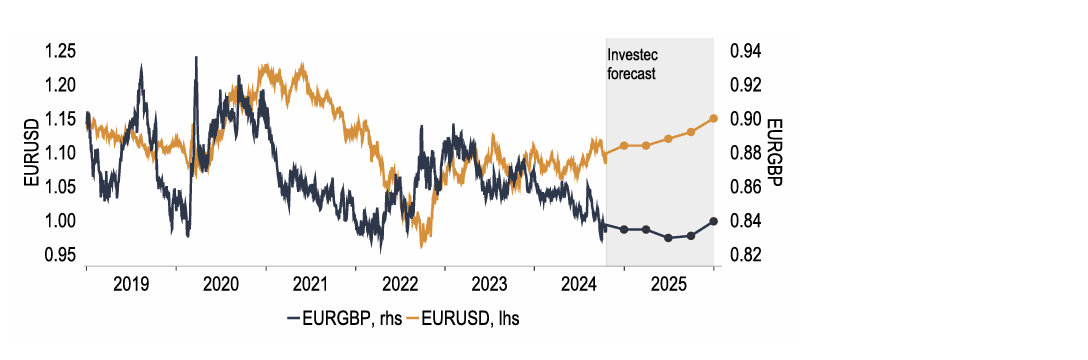

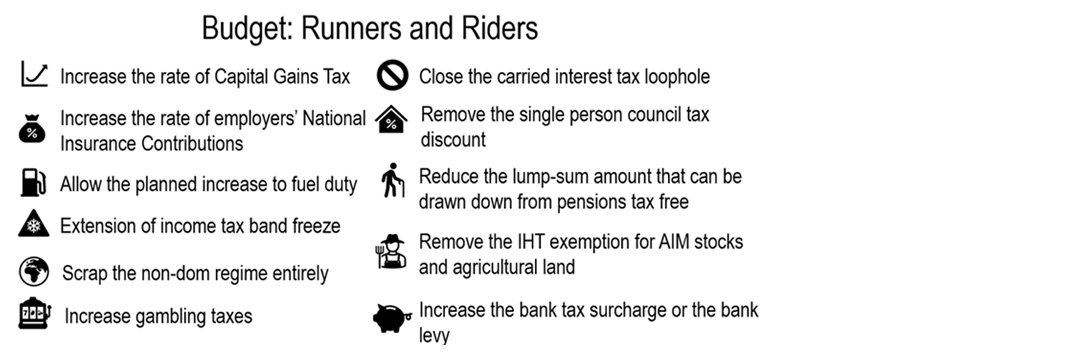

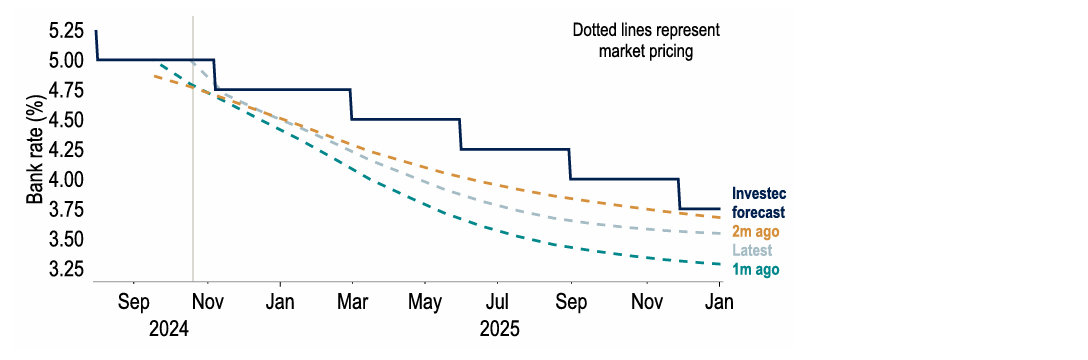

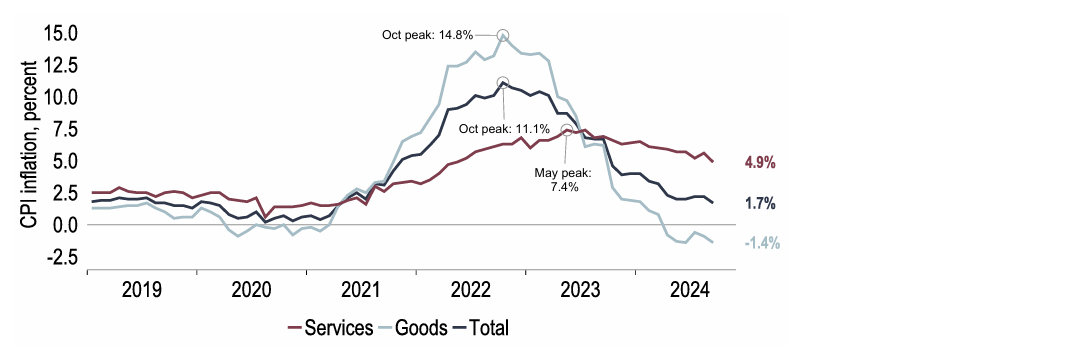

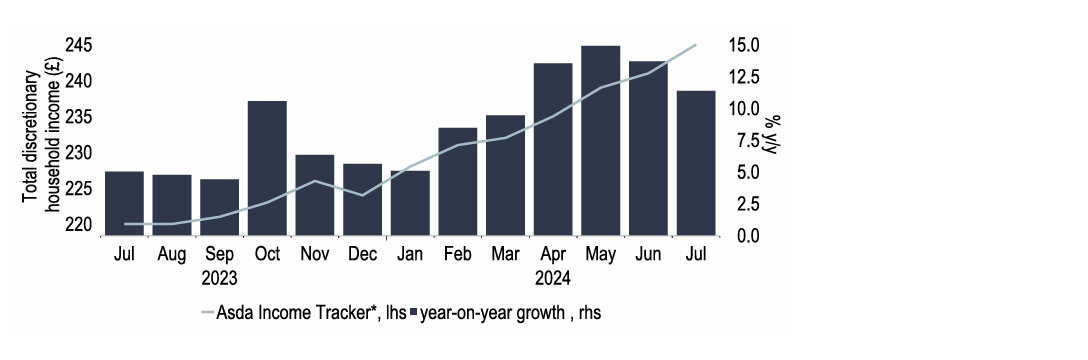

The first 100 days of office have not been the smoothest of rides for new PM Starmer and his team, with the warnings of ‘difficult decisions’ in the upcoming 30 October Budget reportedly dampening sentiment across the UK. But despite economic momentum stalling in the last few months, thanks to an impressive start to the year the economy looks set to expand at a healthy pace for 2024 as a whole. If the added tax burden in the Budget does not turn out to be as severe as some are expecting and interest rates continue to be lowered as we envisage, then there are foundations for steady economic growth in 2025, too. We have pencilled in GDP growth of 1.0% this year and 1.8% next. On currencies, while we expect sterling to gain against a weaker dollar, to $1.37 end-25, we forecast it to struggle to make gains against the euro.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.