Markets anticipate a raft of rate hikes

As inflationary pressures broaden out from beyond the impact of the war in Ukraine, central banks around the world are bringing forward tightening measures, to which markets are already reacting. In our latest Global Economic Overview, we look at how this could be reversed next year depending on the effects.

The war in Ukraine continues to cloud the economic outlook. Commodity prices remain elevated and energy and food have driven up inflation globally. But core inflation is rising too, which is of great concern to central banks. In response, monetary policy tightening looks set to be frontloaded this year. On expectations of this, bond yields have moved sharply higher, and the Fed funds rate outlook has strengthened the US dollar particularly. Risks to growth remain to the downside, however, and policymakers may be forced to unwind some tightening next year if inflation subsides while demand is supressed by the real income squeeze. For now though, that is not our base case. Our global Gross Domestic Product (GDP) growth forecasts remain unchanged at 3.3% and 3.4% in 2022 and 2023.

Although the US is less exposed to the situation in Ukraine than Europe, economic growth concerns are still present. Our 2022 GDP forecast now stands at 3.1% (down 0.3 percentage point) and 2023 at 2.3% (down 0.1 percentage point). Despite the slightly weaker economic outlook, given the surging inflationary backdrop, we imagine that the Federal Reserve will continue with tightening plans and frontload a series of interest rate hikes to demonstrate its commitment to fighting inflation. As such, we now expect a 50 basis point hike at each of the May and June meetings, followed by 25 basis point hikes at the remainder of the meetings this year, leaving the Federal funds target range at 2.25-2.50% by the end of the year.

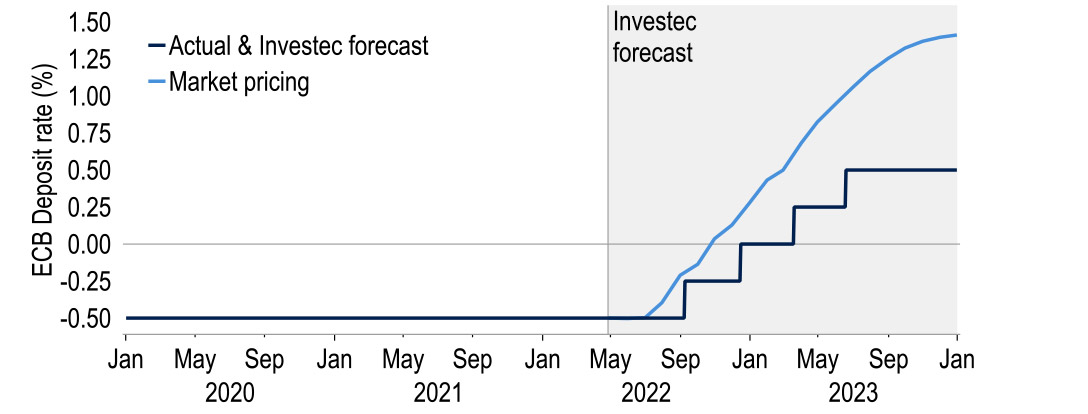

While some indicators have shown resilience so far, clearly the war is set to have a dampening effect on growth, and we have made some further minor downgrades to GDP estimates after our larger cuts in March. Our forecasts for 2022 and 2023 now stand at 3.2% and 3.0% respectively. Inflation remains the key theme, with headline and underlying measures continuing to rise, a fact which is shifting ECB consensus to an earlier tightening of policy – we now see two ECB hikes this year and a further two in 2023, taking the deposit rate to +0.50% by Q4 2023. Meanwhile, we have lowered our euro-dollar profile, given a broadly stronger dollar and an updated Fed view. However, we still see the euro rising, our end-year forecasts now standing at $1.10 (2022) and $1.15 (2023).

The UK is in the grip of the cost-of-living crisis. Coupled with tax rises, this leaves a rocky road ahead. We believe recession will be avoided, not least due to the build-up in household savings. Still, 3.8 percentage points of the 4.0% 2022 GDP growth we predict is due to helpful base effects. This leaves the Monetary Policy Committee (MPC) in

a bind. We anticipate one more hike of 25 basis points in August to ward off possible second-round effects, then, having front-loaded tightening in this way, a pause to assess the effect of the real income squeeze on activity, before two more hikes in 2023. Rate differentials are not the only driver of sterling. Yet the more aggressive Fed may delay a rebound for the pound; we forecast $1.32 at end-2022 and $1.37 at end-2023.

Global

The war in Ukraine remains central to the global backdrop. Militarily, the situation has shifted to a second phase focused on the east of Ukraine, although attacks on cities have continued across the country. From a humanitarian perspective, it is still fraught. This is evidenced by the displacement of Ukrainians, both internally and externally. An estimated five million refugees have fled the country in just two months, almost the same number that have left Syria in the last nine years. The resulting economic effects will be material but will depend on the extent of the dispersion from the initial host countries. The International Monetary Fund (IMF) estimates a 2.9% decline in GDP this year for emerging and developing Europe.

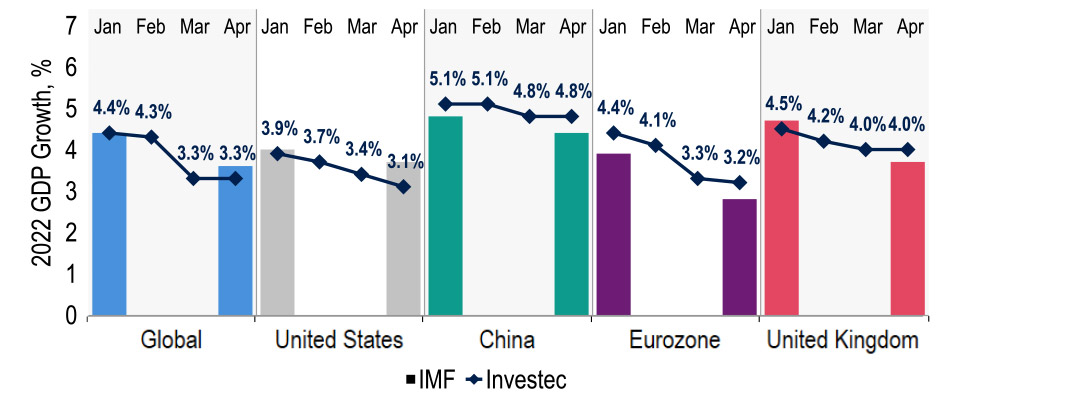

This constitutes part of a 0.8 percentage point downgrade to the IMF’s global growth forecast for 2022, to 3.6%. In its latest World Economic Outlook, the IMF cut growth projections for most nations, aside from some commodity producers such as Brazil and Middle Eastern states. Key calls include 35% and 8.5% drops in Ukrainian and Russian output this year, respectively – which are not too dissimilar to our own assumptions at -30% and ‑10%. Reductions in Russia’s purchasing power parity weight mean a lesser drag on world output. As we apply the IMF’s weights in our own global aggregation, this offsets declines to our US and EU19 forecasts, leaving our global growth projections unchanged from March, at 3.3% in 2022 and 3.4% for 2023.

Chart 1: IMF downgrades GDP growth forecasts following invasion of Ukraine

Sources: Macrobond, IMF, Investec

Key to the outlook going forward is the spike in inflation and the subsequent real income squeeze. This is exacerbated by the conflict, given Ukraine and Russia’s collective importance in global commodity markets. But while it is true that current headline inflation is driven chiefly by commodities in the form of energy and foodstuffs, core inflation – which excludes food and energy – is also up. This is a clear sign of the broadening out of inflationary pressure globally, and one which has strengthened after being initiated by supply chain disruptions in Q3 2021. This is the biggest worry for global central banks going forward, with particular concern over whether this translates into more entrenched inflation through wage rises.

The tightness of developed labour markets underpins these fears, with unemployment at or near pre-pandemic lows in most advanced jurisdictions and vacancies high. In general, we do not foresee wage-price spirals ensuing, however, partly as businesses have scope to invest and thus mitigate wage rises with productivity growth. Even so, expectations are for central banks to tighten monetary policy significantly this year to curb price growth, and in most cases the process is already under way. Most significantly, the Federal Reserve looks set to ramp rates up towards a neutral level this year.

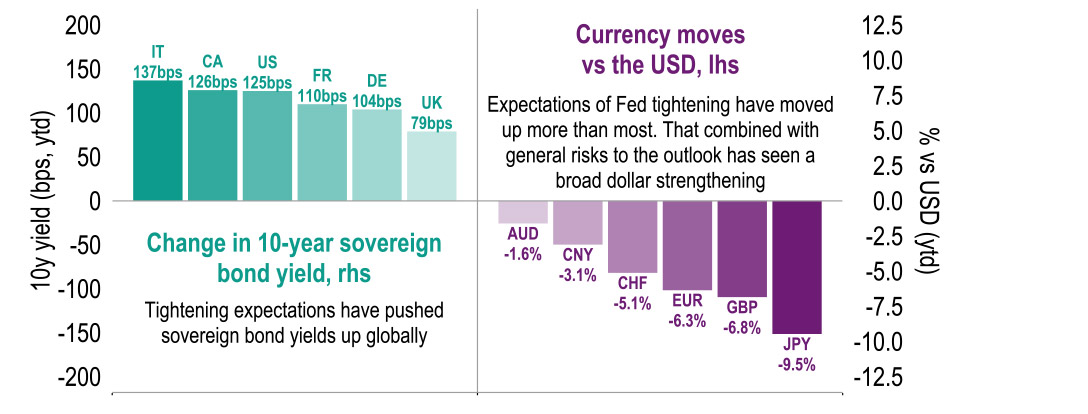

Chart 2: Monetary policy expectations have driven stark market moves in 2022

Sources: Macrobond, Investec

These expectations have triggered large market moves recently. For example, most key sovereign bond yields are more than 100 basis points higher since the turn of the year. We judge these to have risen too far in most cases. Hence, while our end-year forecasts for 10-year US Treasury yields are raised, at 2.75% for 2022 and 2.50% for 2023, they are below current levels. In foreign exchange markets, the dollar has continued its upward trend, driven largely by rate differentials. Notably, the yen weakened to a 20-year low of 129 against dollar as the Bank of Japan defended its Japanese Government Bond yield target. Given the forces pushing against this, the Bank of Japan may well adjust its yield targeting. This will put upward pressure on the yen, which we think will strengthen to 123 and 120 by the end of this year and next, respectively.

Also struggling at the moment is the Chinese yuan. This is again partly due to widening rate differentials, as the People’s Bank of China continues to ease policy against the grain of most central banks. A 25 basis point cut to the reserve requirement ratio this month was aimed at further boosting liquidity in the face of a worsening growth outlook, while key cities such as Shanghai remain locked down. That said, data for Q1 was stronger than expected. The National Bureau of Statistics reported GDP growth of +1.3% quarter-on-quarter despite the renewed Covid-19 concerns. This puts the economy in a better place, but given the downside risks, we have held our Chinese growth forecast for this year steady at 4.8% (and 2023 at 5.0%).

United States

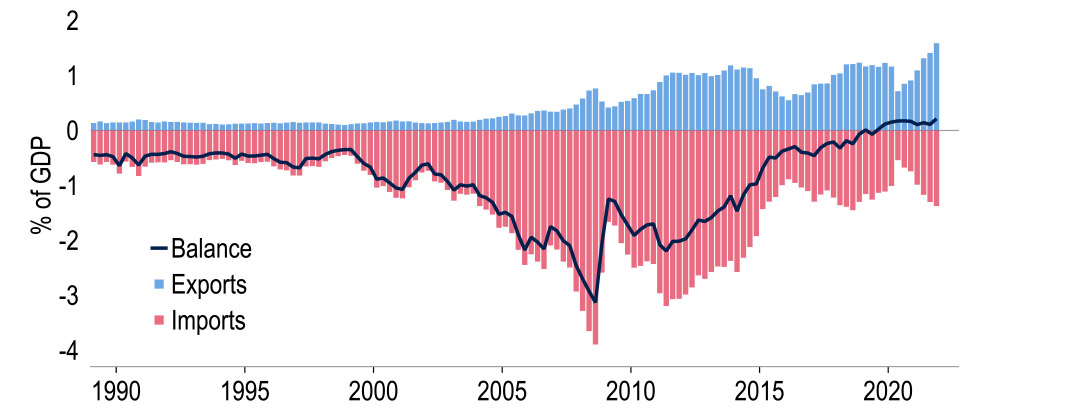

Sharply rising policy rate expectations, exceeding the sell-off in longer-dated bonds, have pulled the US 2-year-10year yield spread down since the start of the year. Indeed, it fell below zero in early-April, although it has now recovered to +22 basis points. This has been noted in markets, with curve inversion being seen by some as a signal of a looming recession. As elsewhere, inflation can squeeze household real spending power unless matched by wages. But one reason why the US appears less at risk of a downturn than Europe is that, through the exploitation of shale, the US now exports slightly more energy than it imports. So, economy-wide, energy price rises are a net plus – if for producers, not consumers.

Chart 3: The US now exports more energy goods than it imports, adding to resilience

Sources: BEA, Investec and Macrobond

Despite this, growth concerns are still prominent. We expect US GDP growth to slow this year. This is based on our view that the sharp increase in inventory build in Q4 of 2021 will not have been repeated at the start of this year, rather than on any fundamental weaknesses in the economy. Further ahead, we expect the US economy to lose some steam. Much of the low hanging fruit from the easing of Covid-19 restrictions has been picked and President Joe Biden’s ability to enact further fiscal stimulus is constrained by party divisions. But this is balanced against a very tight labour market – for every unemployed person, there are two vacancies – resulting in only a slight moderation to our GDP forecast.

In all, we have pencilled in 2022 growth of 3.1% (-0.3 percentage point) and 2.3% for 2023 (‑0.1 percentage point). This weaker outlook also reflects the intensity of inflation: in March, Consumer Price Index inflation hit 8.5% year-on-year, with broad based price rises seen across sectors. Although consumer spending seems to have held up thus far, a hit to real expenditure for many households seems hard to avoid. The difficulty will therefore be for Federal Open Market Committee (FOMC) members to tighten policy aggressively enough to fight inflationary pressures, but avoid choking off economic growth. As President Biden gears up for a difficult midterm election campaign, he too will be hoping for the elusive ‘soft-landing’.

The difficulty will be for FOMC members to tighten policy aggressively enough to fight inflationary pressures, but avoid choking off economic growth.

FOMC members are now referring to getting the Fed funds target range up to ‘neutral’ i.e. the committee’s estimate of the long-run level of rates, 2.25%-2.50%. As with Fed members’ views on the shorter-term path, opinions differ, and currently vary between 2.0%-3.0%. Of course, shrinking the Fed’s balance sheet by up to $95bn per month through quantitative tightening (QT), possibly as soon as May, is also policy tightening – Fed officials suggest this may be equivalent to between one to three 25 basis point rate hikes. However, we note that the economy slowed through 2019 with a 2.25%-2.50% Fed funds target plus up to $50bn per month of QT, resulting in the FOMC easing in H2.

As views on the FOMC have shifted, so have our forecasts. We now expect a 50 basis point hike on 4 May, plus the same in June. 25 basis point increases at each subsequent meeting this year would take the funds target range to 2.25-2.50%. We are also pencilling in a final 25 basis point rise in February 2023. Although we harbour concerns that the Fed’s ‘neutral’ stance will again cool the economy unexpectedly, this ‘frontloading’ monetary strategy should at least help to quell inflation expectations and can once again be reversed if demand slows too rapidly. Indeed, we would not rule out the Fed needing to ease at some stage next year, not least given the uncertain effects of QT operations.

Meanwhile, sovereign yields have rocketed over the past month, mainly as markets have reassessed the Fed’s policy response. 10-year yields have risen by 35 basis points, coming close to 3.0% at one point and with real yields almost in positive territory for the first time since Mar 2020. Our new monetary policy call has led us to reassess our Treasury forecasts. We now see 10-year yields a little above current levels of 2.75%, at around 3.0% for most of the rest of 2022. But we now take the view that they will come down again later this year and over 2023 as the prospect of limited policy rate hikes becomes clearer and, we hope, inflation outturns begin to reassure. We note that in the previous tightening cycle, 10-year yields peaked a month or so before the Fed’s final hike in Dec 2018. Our end-year targets are 2.75% this year and 2.50% next.

Eurozone

Euro area GDP rose by 0.3% quarter-on-quarter in Q4, supressed by the emergence of the Omicron variant and social restrictions. However, whilst Covid-19 has subsided, the war in Ukraine has now risen to be the key risk. Whilst we do see economic activity being dampened by this, we note that indicators thus far have not seen a material deterioration, with outturns ahead of expectations: Citi’s economic surprise index stands at +52. Reference points include April’s solid Composite Purchasing Managers' Index (55.8), although this hid a two-speed economy. Services rebounded on higher post-restriction spending, but manufacturing output almost stagnated. Notably, supply disruptions on account of the Ukrainian conflict were cited.

A question that has been posed recently is whether a recession is on the horizon. This is not our central case, with GDP growth of 0.2% quarter-on-quarter expected in Q1, whilst our full-year 2022 and 2023 forecasts stand at 3.2% and 3.0%, just 0.1 percentage point lower than in March. Investment should prove a supporting factor. For one, NextGenerationEU funds are still being distributed. Meanwhile, in response to the war in Ukraine, there is potential for large-scale infrastructure spending if the EU is to meet its objectives of diversifying away from Russian energy. Increased defence spending is also likely, as states strive to meet the NATO spending target of 2% of GDP. But there are risks to the outlook; inflation is the key worry, but a worse scenario could ensue, were for example Russia to curtail gas supplies.

There is potential for large-scale infrastructure spending if the EU is to meet its objectives of diversifying away from Russian energy.

On the basis that the euro area weathers the Ukraine crisis, the critical issue facing the economy is inflation. The most recent figures for March recorded an all-time high Harmonised Index of Consumer Prices rate of 7.4%. Clearly energy has been a significant factor, contributing 4.4 percentage points to inflation in March. However, stripping out volatile items, the main gauge of ‘core inflation’ stands at 2.9%. Moreover, the European Central Bank (ECB) looks at a variety of underlying inflation metrics, all of which paint an uncomfortable picture. Combined with the current tightness of the labour market – unemployment stands at 6.8% – there does appear to be a growing worry over the inflation outlook at the ECB and seemingly more urgency over policy.

Certainly the hawks have been evident on the Governing Council for a while, but we have recently seen opinions on an early end to quantitative easing (QE) and the first move on rates shift for typically more dovish members. Of these, Vice President Luis de Guindos was the most notable, echoing comments from other members that QE could end in July and not denying that a July hike was possible. As such, we judge that there is sufficient consensus for an earlier tightening and have brought forward our view of a first 25 basis point deposit rate hike to September, followed by a second in Q4, which would see rates reach 0% at the end of this year. Beyond that, we still anticipate a gradual but front-loaded pace of ECB rate rises, but not as aggressive as the curve is pricing, which sees the deposit rate close to 1.5% by the end of 2023.

Chart 4: The ECB is likely to raise rates this year, but market pricing still looks too aggressive

Sources: Macrobond, Investec

By comparison, our forecast stands at 0.50%. Interest rate differentials remain a key driver of foreign exchange, with the hawkish Fed tone pushing euro-dollar to $1.059, a five-year low. Reflecting our updated Fed and ECB views, we have lowered our euro-dollar rate forecast. Nonetheless we still envisage the start of the ECB’s own tightening cycle will support the exchange rate looking forward, our forecasts now standing at $1.10 (1.15) for Q4 2022 and $1.15 (1.18) for Q4 2023. Meanwhile, our other market forecasts see our bund yield estimates uplifted by 25 basis points across the forecast horizon, our end of 2022 and 2023 targets now standing at 1.00% and 1.25% respectively.

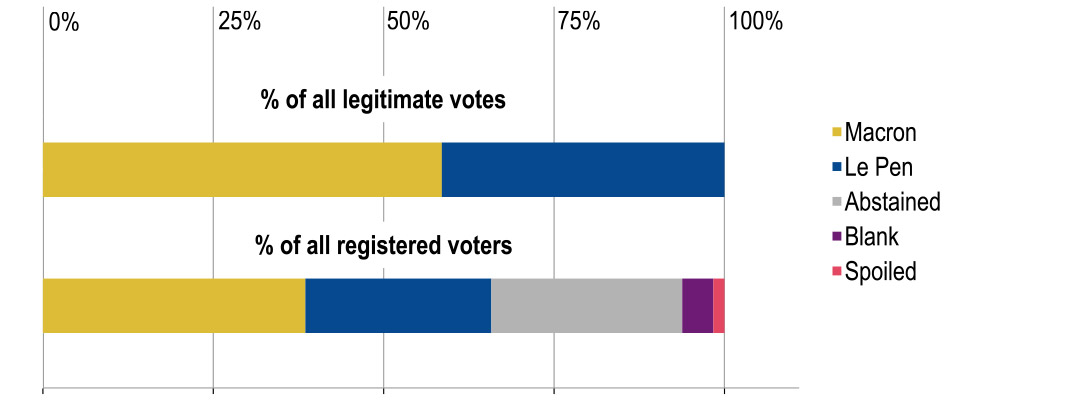

In politics, the French elections on 24 April saw Emmanuel Macron re-elected president, beating his far-right opponent Marine Le Pen 58.6% to 41.4%. Clearly, the European establishment will welcome the news, given the need for EU political solidarity in the face of Russian aggression. However, for Macron the job is not yet done, with National Assembly elections on 12 and 19 June. Here, the president faces a tougher proposition in maintaining his group’s majority. This weekend’s poll highlighted voter disenchantment with both candidates, with abstentions at the highest level since 1969 (28%). Macron actually only won the support of 38% of registered voters and, with leaders of both the far-right and far-left parties calling for voter mobilisation, the La République En Marche! party will face a tougher battle.

Chart 5: Abstentions at the French Presidential elections hit a multi-decade high

# LREM- La Republique En Marche!

Sources: French Interior Ministry, Macrobond, Investec

United Kingdom

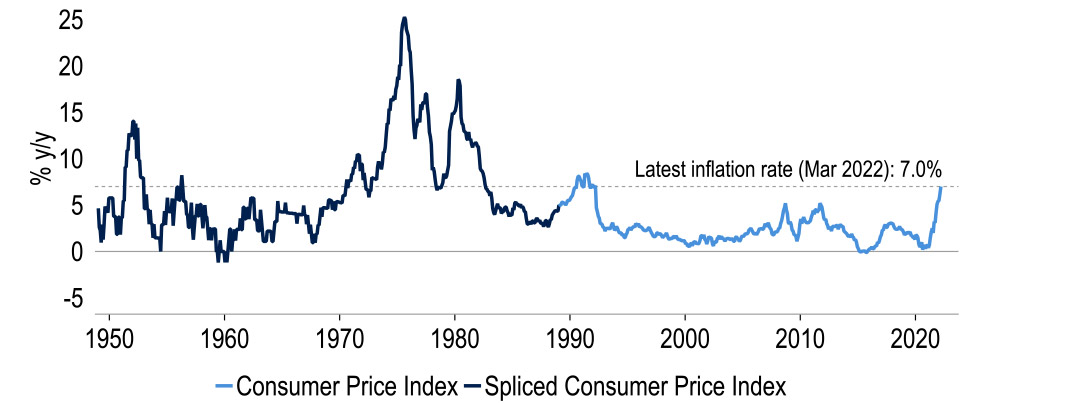

As elsewhere, UK inflation has soared. On the CPI measure targeted by the Bank of England, it jumped to 7.0% year-on-year in March. Further rises from here are virtually certain. April’s 54% utility cap hike alone stands to add 1.6 percentage points to the annual rate, and there could be a further significant rise in October, following the next utility cap review. Our current estimates are for inflation to peak then, at 9.7% year-on-year. The Office for National Statistics (ONS) series, which starts in 1988, has never reached such levels. It was only in the early 1980s that backcast numbers last were as high. High inflation is already denting real purchasing power, as per retail sales data. That, along with the effect of the National Insurance hike, is underpinning fears that the economy may be headed for a downturn.

Chart 6: CPI inflation is likely to reach levels not sustained since the early 1980s

Sources: ONS, Macrobond and Investec

We concur that a rocky period will be hard to avoid. Indeed, coupled with distortions from the extra bank holiday for the Queen’s Platinum Jubilee, we anticipate a fall in GDP in Q2. But the extremely tight labour market – vacancies now match unemployment – should support wages. Moreover, income need not equal spending growth, as the savings ratio has room to fall and excess pandemic savings could be run down, as could firms’ excess corporate deposits. Hence, we expect a rebound in Q3. Our 2022 growth forecast stays at 4.0% – although 3.8 percentage points of this reflect base effects from the recovery to date. We forecast 2.4% growth in 2023.

Weighing up inflation against growth risks will be very challenging for the MPC. The upside surprise in the latest inflation figures, and perhaps most so its broad-based nature, may tip the balance towards a fourth successive rate hike to 1.0% at the May meeting to keep inflation expectations in check. This would also trigger active gilt sales from the BoE’s balance sheet, adding to the policy tightening. But to assess carefully how activity is weathering the real income squeeze, we anticipate the MPC will raise rates only once more in 2022, by 25 basis points to 1.25%, at the August meeting. Having front-loaded tightening this way, we expect fewer rate rises in 2023, to 1.50% in February and 1.75% in November.

Covid-19 is not ‘over’ – even if vaccinations leave its burden manageable without restrictions with the current variants.

Politically, attention in the UK turns to local and regional elections on 5 May, including voting for the Northern Ireland Assembly. At the centre of voters’ concerns in both cases is likely to be the spiralling cost of living. In England, Wales and Scotland, the extent to which ‘Partygate’ harms the Conservatives will be closely scrutinised. In Northern Ireland, it is Sinn Féin that leads the polls, a first for the nation. In its campaign, it has placed little emphasis on its long-standing goal of a united Ireland, of which only a minority of voters are in favour. In the event of a Sinn Féin win, the DUP may refuse to partake in the power-sharing government, sparking yet another crisis.

It is not clear though that the elections will have much of an impact on the pound, especially given the global background, at least for now. After all, in the event of a poor showing for the Conservatives at the local elections, the pressure for Boris Johnson to be replaced as leader may mount; but his successor as prime minister would still come from the same party, until the next general election at least. More generally, interest rate differentials will remain an important FX influence. With rate expectations in the US perhaps having more scope to fall, this leaves room for sterling to rise. Our year-end cable forecasts for 2022 and 2023 are $1.32 and $1.37; for the euro-pound rate they are 83p and 84p.

Far less prominent in the public discourse than in the past two years is Covid-19. Official daily infection data showed a resurgence in cases in March, coinciding with the dismantling of remaining restrictions, but also a subsequent plunge to relatively low levels. We suspect these numbers are inaccurate and that much of the fall reflects lower testing, resulting in more unreported cases. The alternative weekly ONS infection survey should be the ‘gold standard’ in Covid-19 estimates. These point to a surge to record (if milder) infection levels in early-April, before easing back recently. Covid-19 is not ‘over’ – even if vaccinations leave its burden manageable without restrictions with the current variants.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.