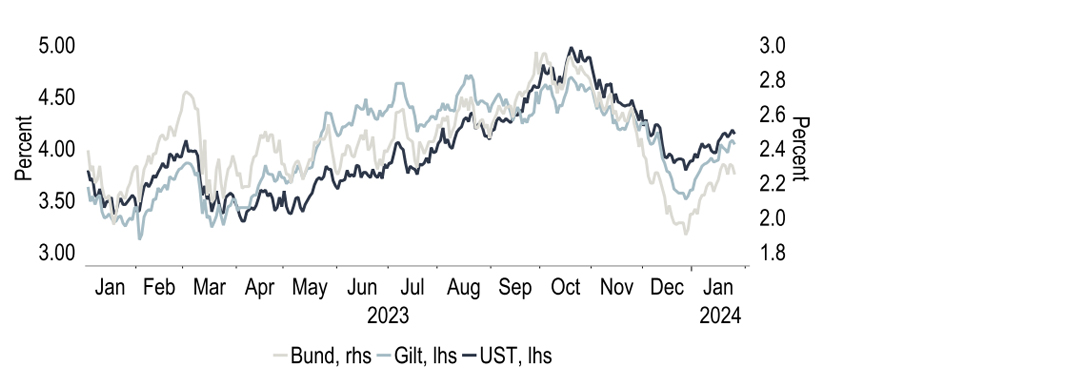

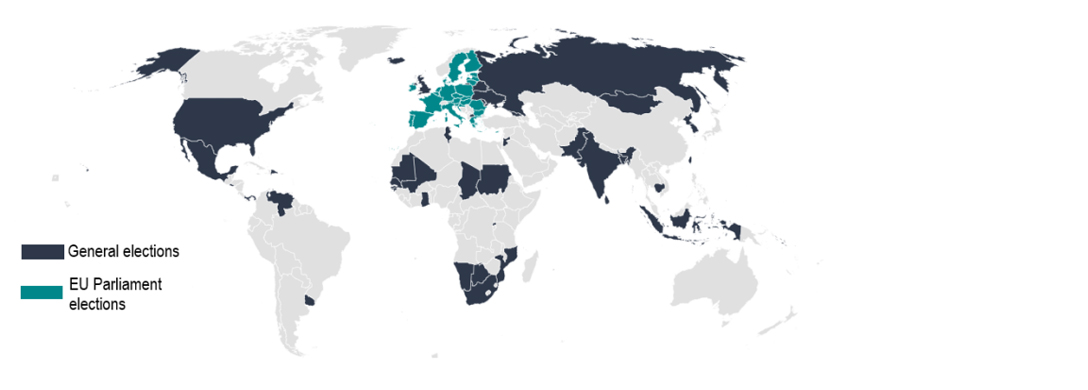

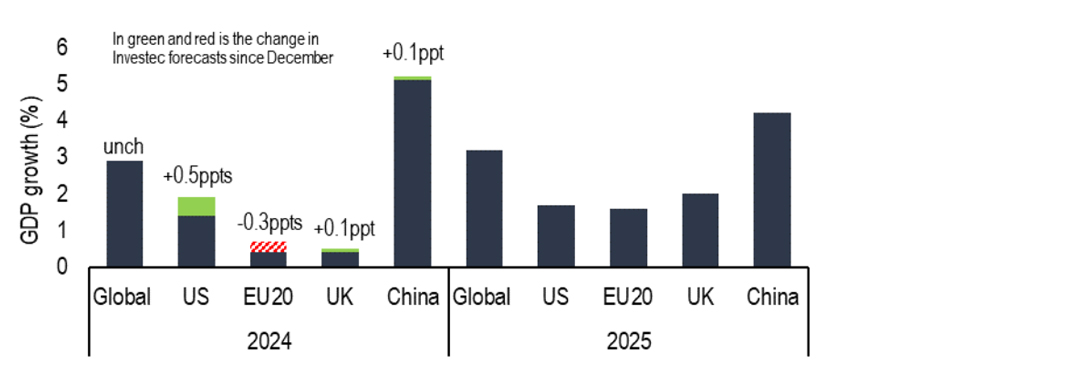

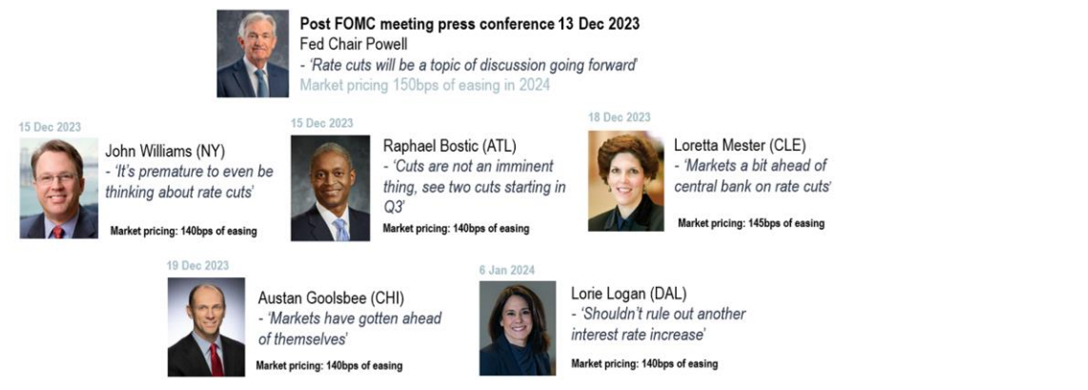

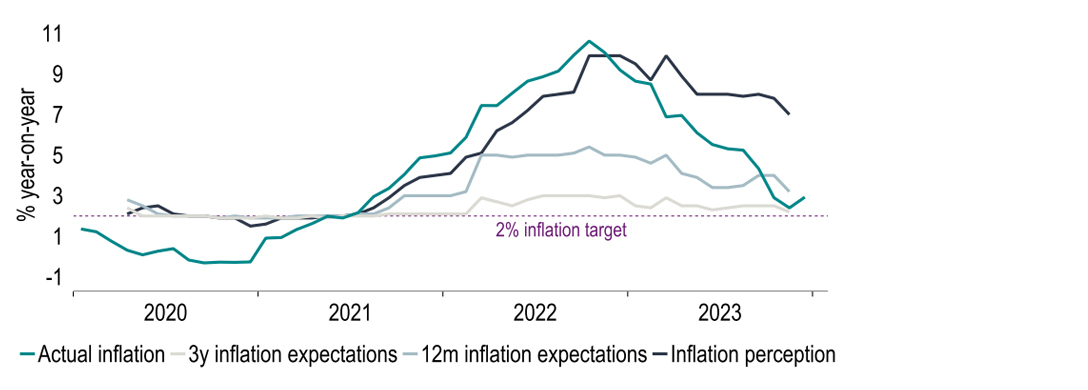

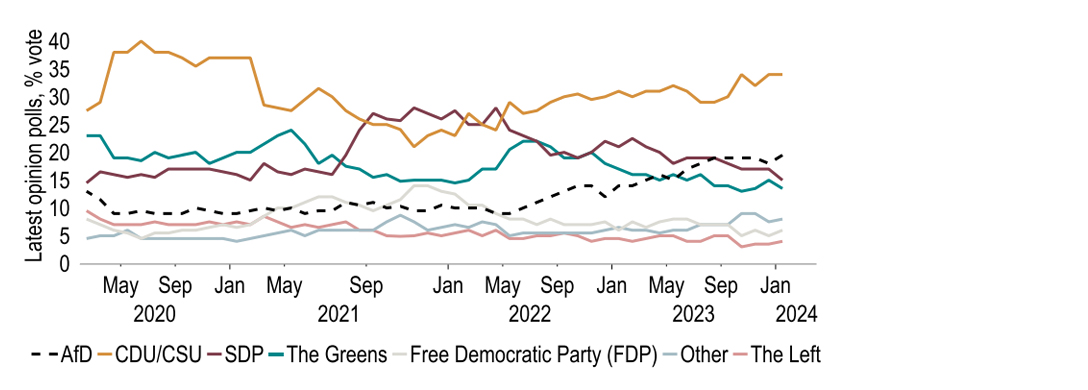

Interest rates are set to remain front and centre in 2024. However, in a departure from the last two years, now the question is not how far central banks will raise rates, but when and how far they will cut. We continue to believe that March/April cuts by the major central banks are less likely and that June will prove to be the month of action from the Fed, ECB and the BoE. Over a two-year horizon we are looking for 175-200bps of easing; this is not too dissimilar to market pricing. However, we diverge on the timing of cuts, believing central banks will be more cautious in easing policy this year than the market thinks but ramp up in 2025. Elections will also feature heavily this year with 48% of the world’s population voting in some form of legislative election. Additional geopolitical tensions and protectionist policies are possible, which would represent a downside risk to our 2.9% 2024 and 3.2% 2025 global growth forecasts.

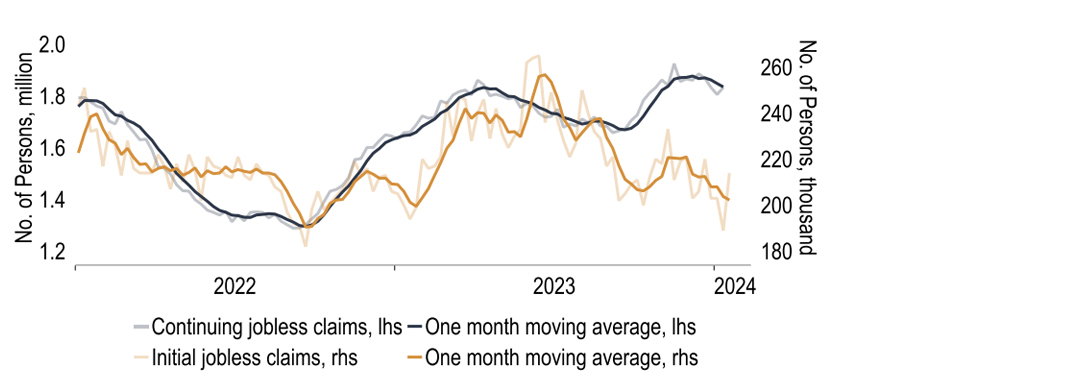

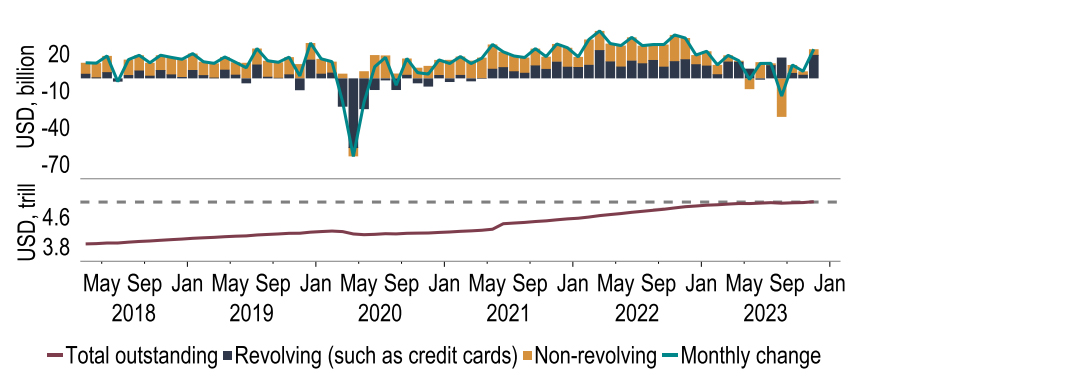

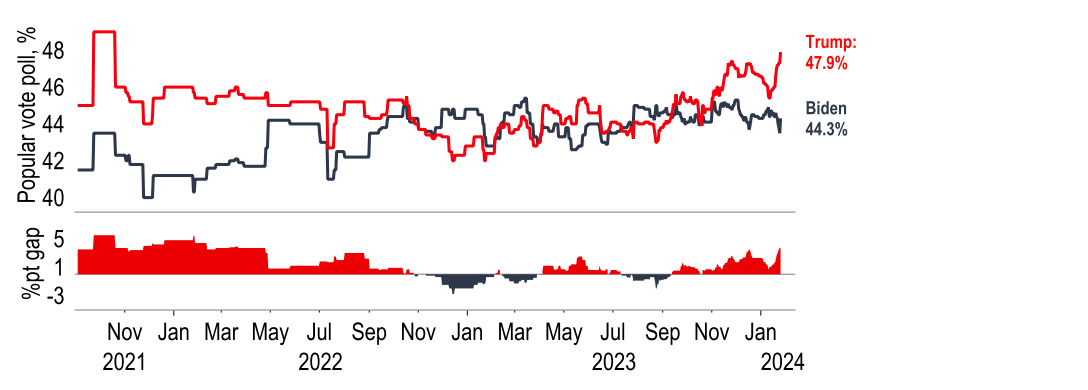

The US economy had a stellar performance in 2023, with output expanding by 2.5% on the year, despite one of the most aggressive monetary tightening cycles in recent history. However not all of that tightening has hit the real economy yet, whilst economic growth last year was supported by more expansionary fiscal policy; IMF projections suggest that fiscal policy is in contrast set to be a slight headwind to growth this year. As such we expect economic momentum to weaken slightly, pencilling in GDP growth of 1.9% and 1.7% this year and next. Under weaker growth, we expect the US dollar to lose some steam, with end-‘24 EURUSD at $1.14. But shifts in the greenback are also dependent on the outcome of the US election, on 5 November.

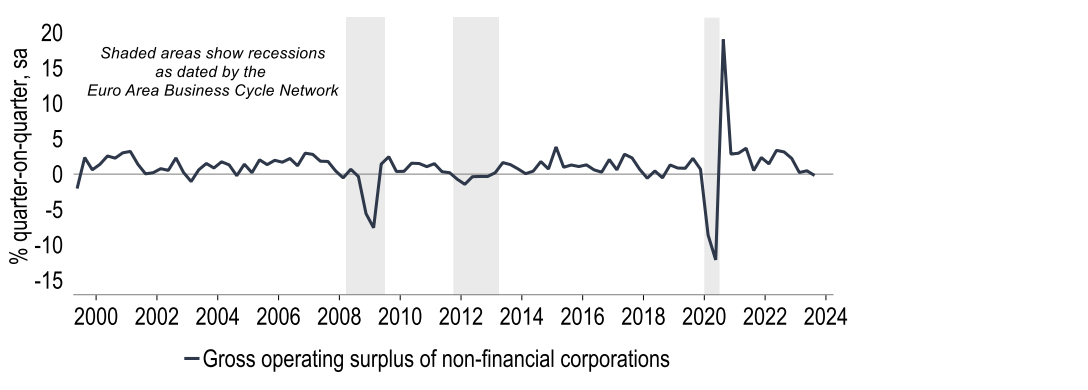

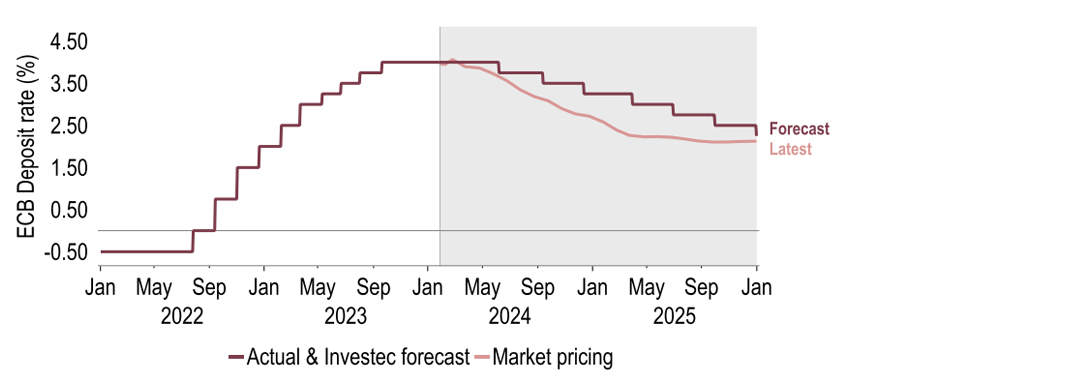

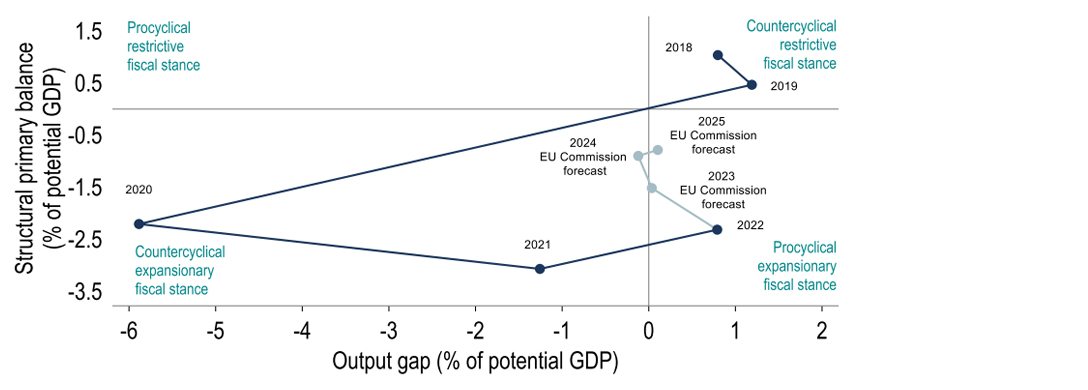

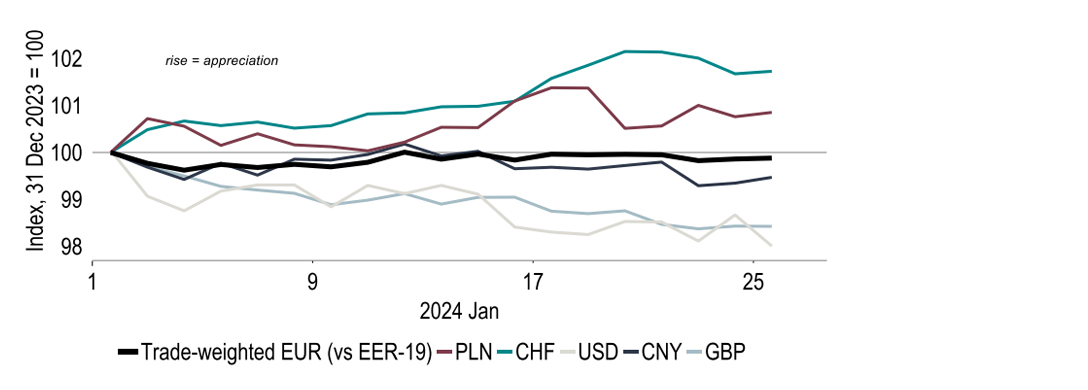

Whether or not the EU20 entered a recession in H2 ’23, momentum currently looks subdued, and the tightening in fiscal policy this year as energy support is phased out will act as a drag too. The better news is that inflation has eased faster than the ECB had expected and that the jobs market is still robust. Provided both factors remain in place, rising real incomes should lay the groundwork for faster growth later in ‘24 and into ‘25, reinforced in due course by rate cuts incentivising more investment. Our GDP growth forecasts are 0.6% and 1.6%, respectively. As regards ECB policy, we expect policy rate cuts to begin in June, proceeding more slowly this year (75bps) but faster in ‘25 (100bps) than priced in as inflation persistence fears are gradually dispelled.

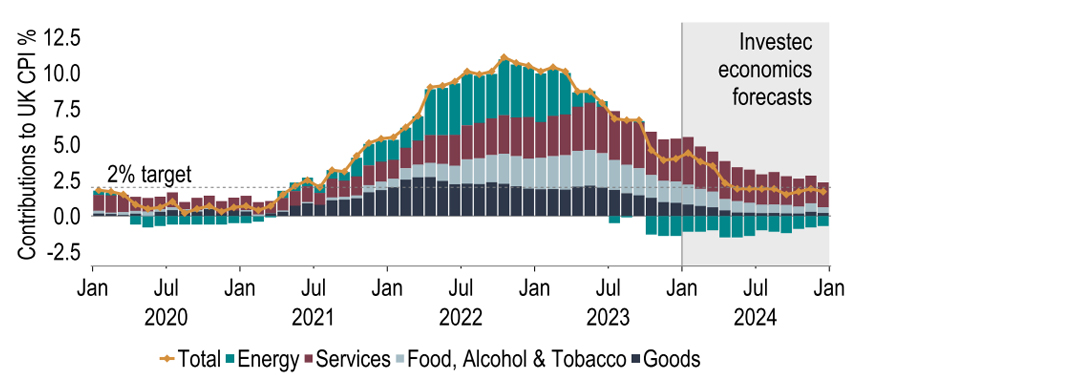

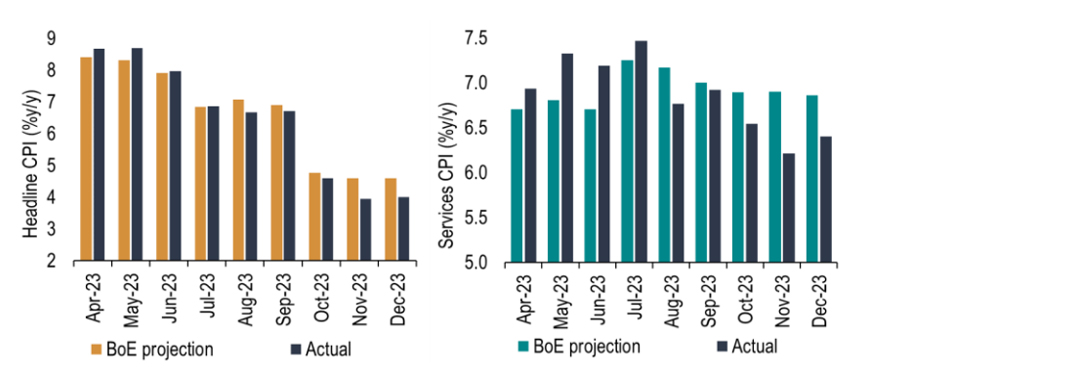

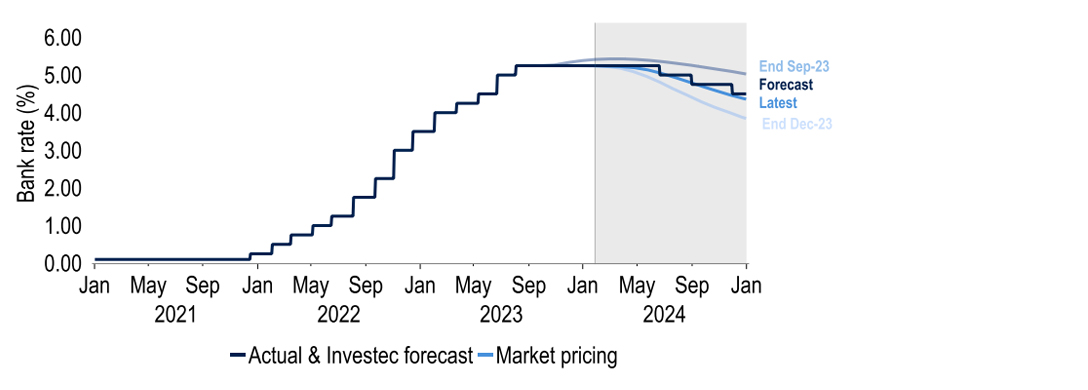

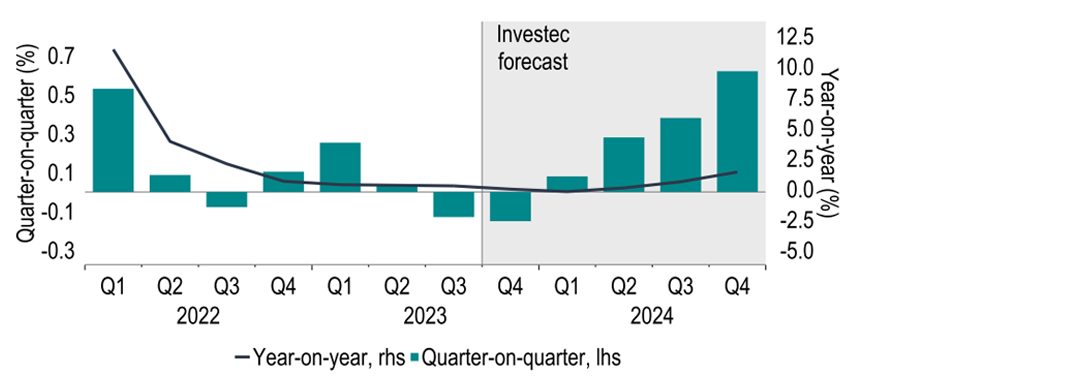

The MPC has overpredicted both headline and services CPI inflation for five straight months, a fact that is not altered by increases in December’s readings. This lowers the barrier to the MPC cutting rates at some stage, but the MPC’s assessment of the labour market is currently hamstrung by a paucity of reliable labour market data, in particular via the effective suspension of the Labour Force Survey. By Q2 we should see the ‘Transformed Labour Force Survey’ which would enhance the committee’s line of sight of whether conditions in the labour market are loosening sufficiently. Our baseline case is that members will judge there is sufficient progress on reducing inflation pressures more widely around the middle of the year and we still see the first cut in June. We judge that the MPC will proceed cautiously to start with and so see the Bank rate falling 75bps to 4.50% by end-year, against the 100bps currently priced into the yield curve. We concur with markets though that rates will end 2025 around 3.25%. Hence our disagreement with the curve is one of timing rather than substance.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.