Global Economic Overview – January 2025

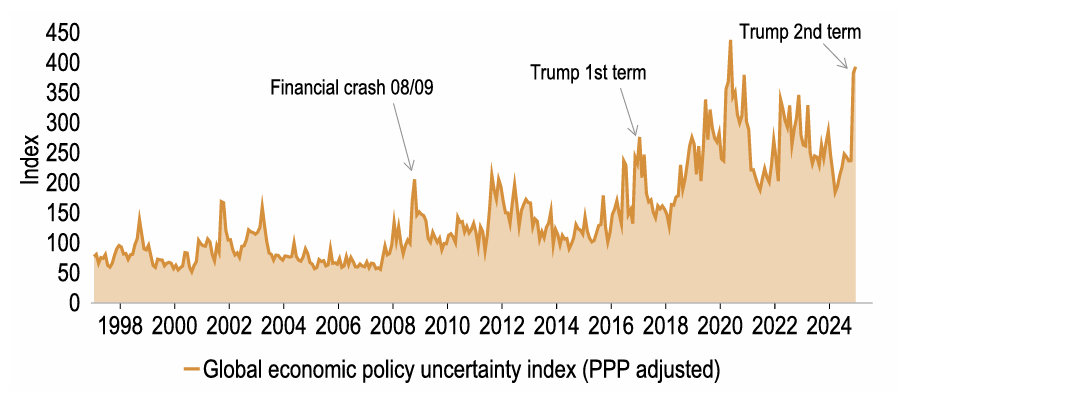

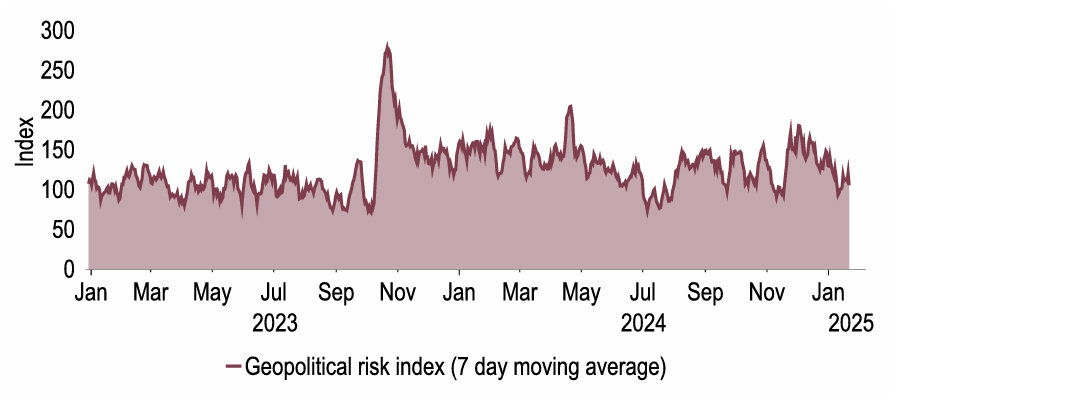

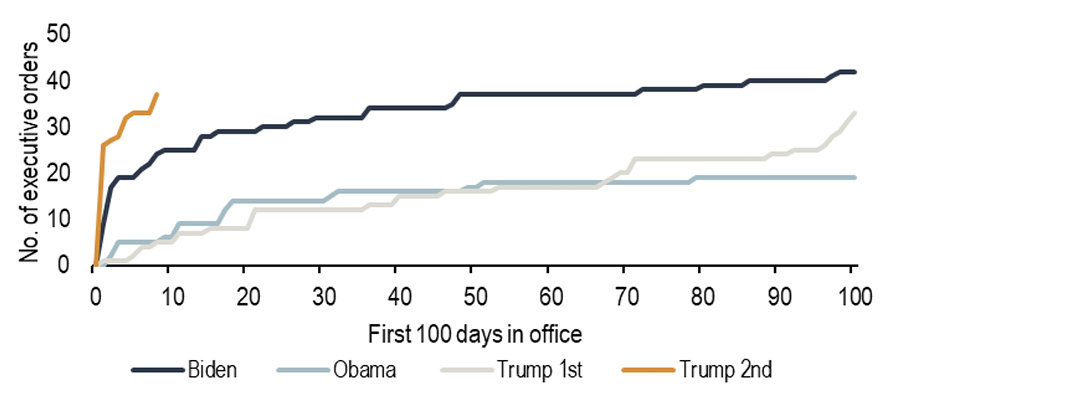

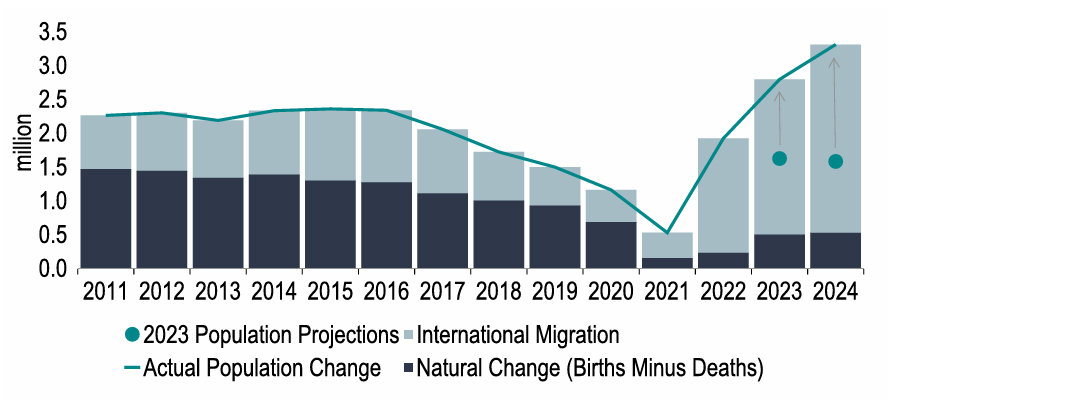

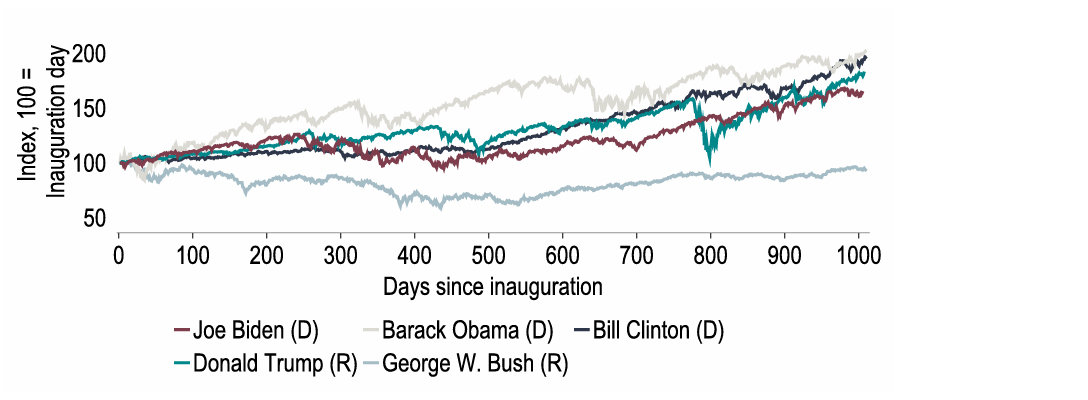

The inauguration of Donald Trump as the 47th president of the US has ushered in a new period of global economic policy uncertainty. Although we are yet to receive the full details of Trump’s policy agenda, there seems to be a focus on tariffs, immigration and creating a pro-business environment. As we explain in greater detail in the Global, we have made various policy assumptions in our forecasts, such as a 10% universal tariff, limited retaliation from trading partners and the Fed remaining independent. But as White House policy evolves, so will our forecasts.

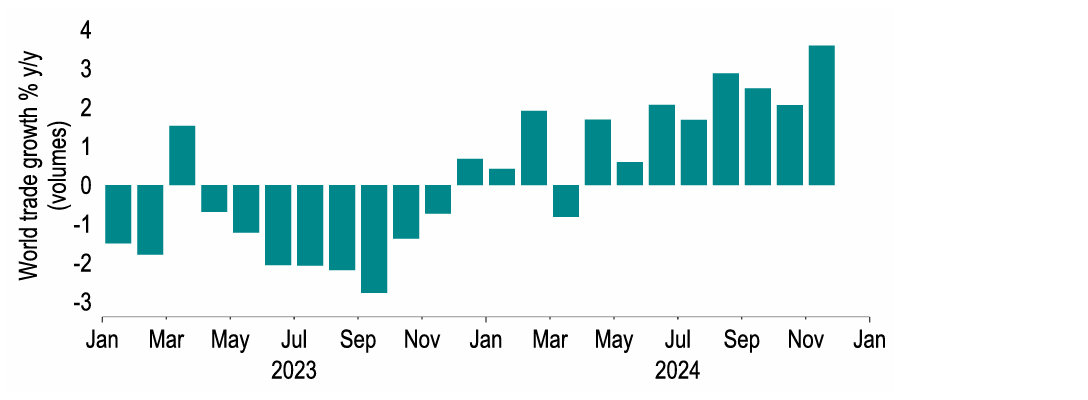

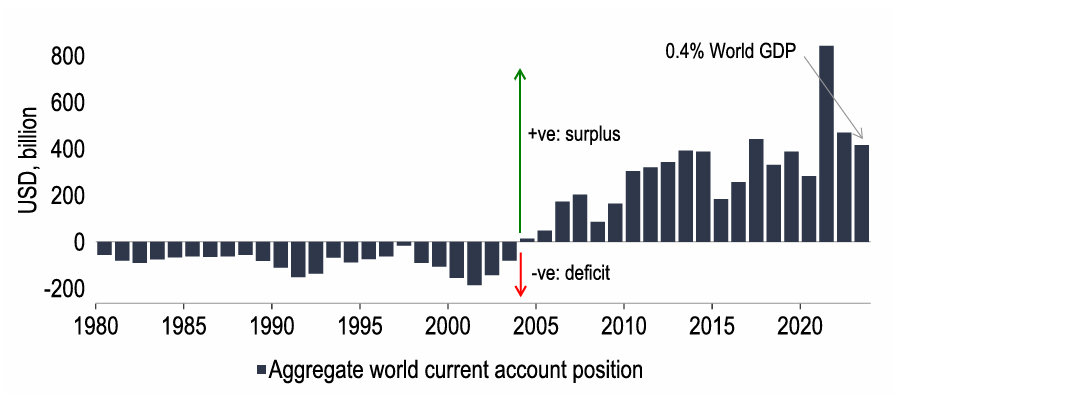

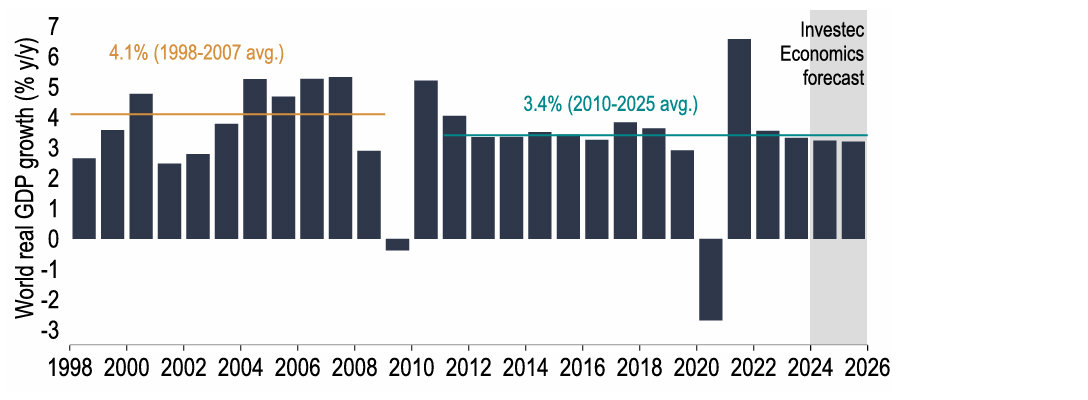

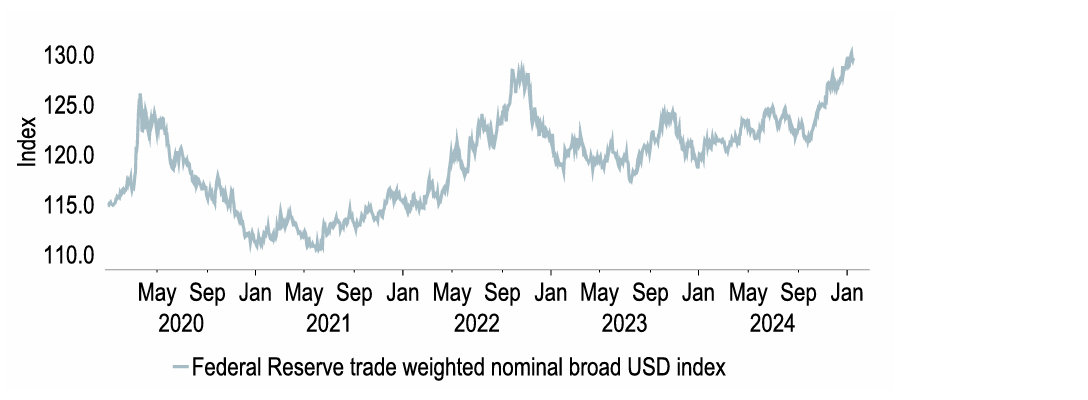

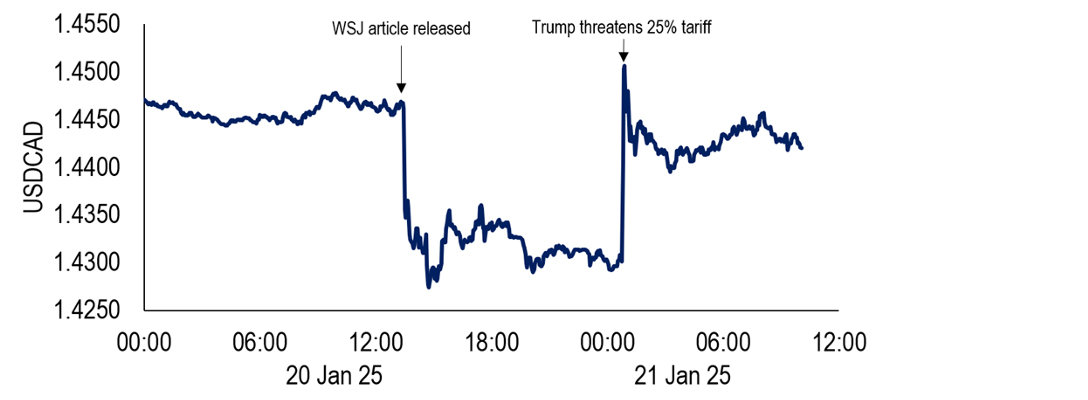

The inauguration of Donald Trump as the 47th president of the US has ushered in a new period of economic policy uncertainty, especially concerning tariffs. There is lots of noise over universal tariffs and perhaps their phased introduction, but although the US administration's exact plans are not yet clear, the direction of travel is obvious. For now we maintain our assumption of a 10% universal tariff, which we will revise as and when appropriate. We maintain our end-year 10y Treasury yield target of 5.0% and that the US dollar will see further near-term strength, although market rates will of course ebb and flow with the news on tariffs. Our global growth forecasts are 3.2% for this year and 3.1% for next, lacklustre compared with longer-term benchmarks but in the same territory as the IMF's recent updated projections.

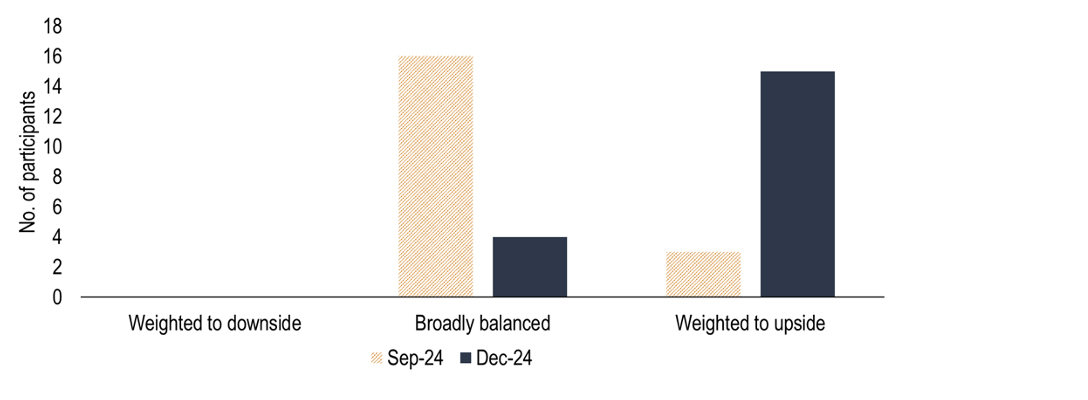

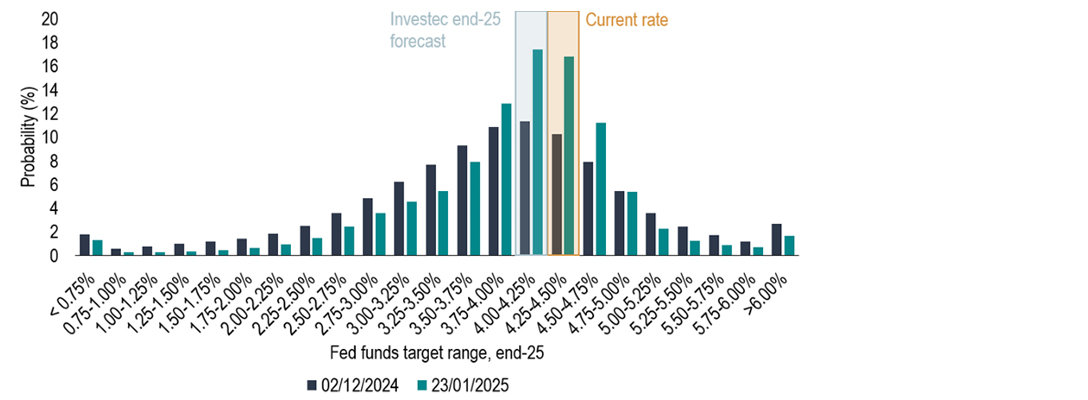

Mr Trump has been handed an economy that defied expectations in 2024, expanding at a robust pace, despite interest rates being in restrictive territory. But this has also coincided with inflation remaining stuck above the 2% target, increasing speculation that the Fed will pause or even reverse its easing cycle. Supporting this case further is the expectation by some – including us – that Mr Trump's policy agenda will on net be inflationary. As such we think that the Fed will deem it appropriate to pause its easing cycle after one cut this year, possibly in March, before resuming a gradual pace of interest rate reductions in early 2026. But this is based on a series of policy assumptions – including a 10% universal tariff and Fed independence – which could prove to be incorrect. For GDP, we look for 1.9% growth this year and 1.5% next. However, as White House policy evolves, so will our forecasts.

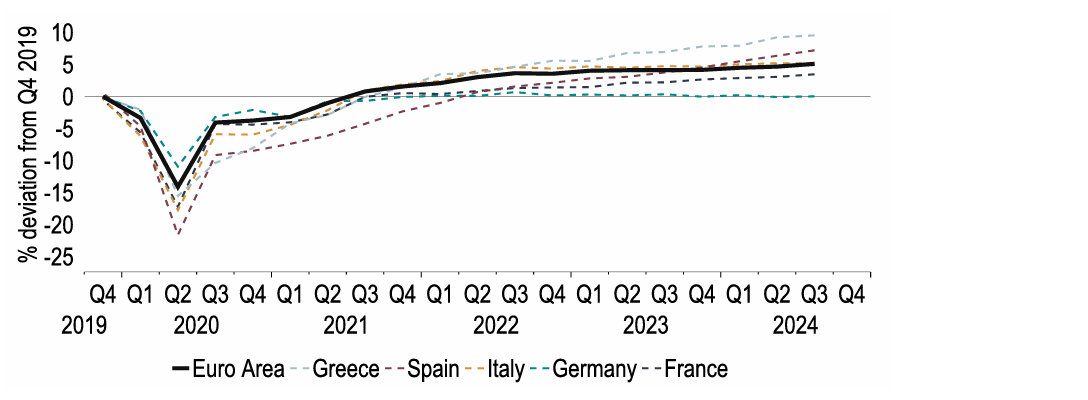

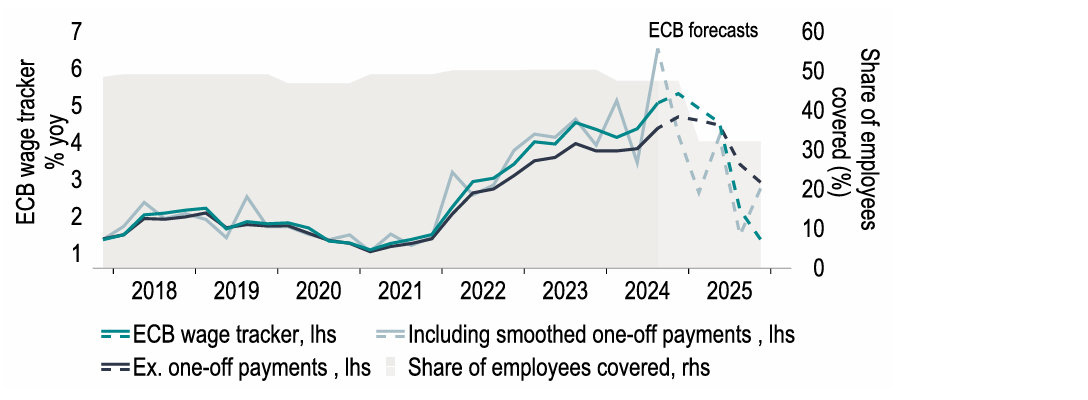

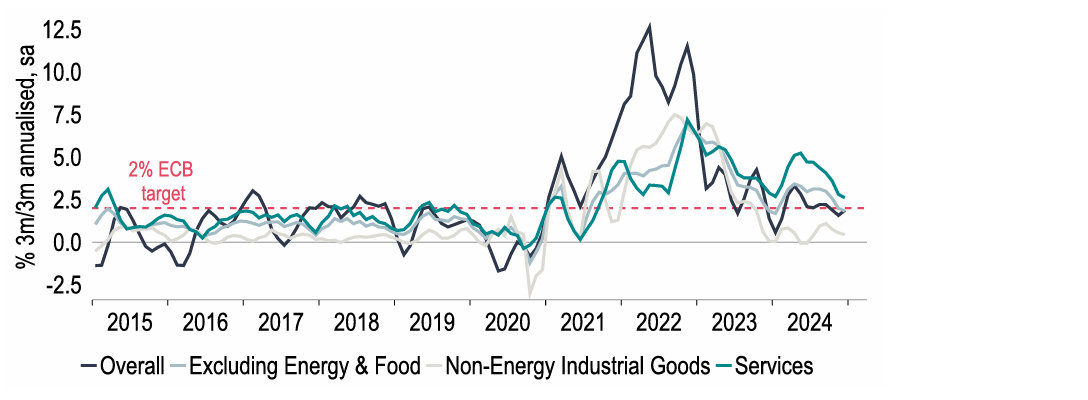

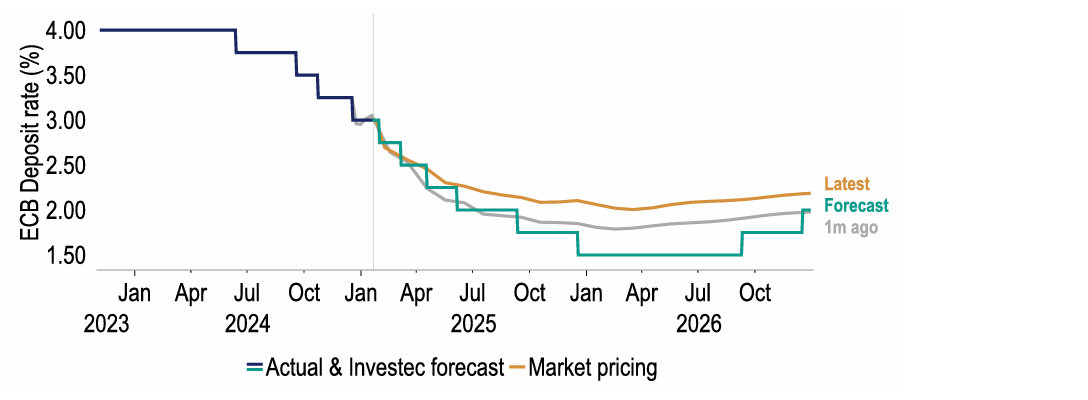

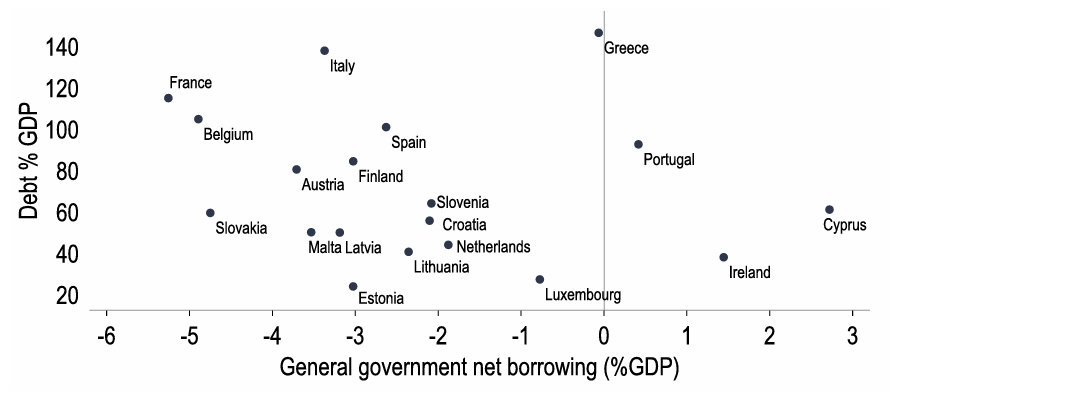

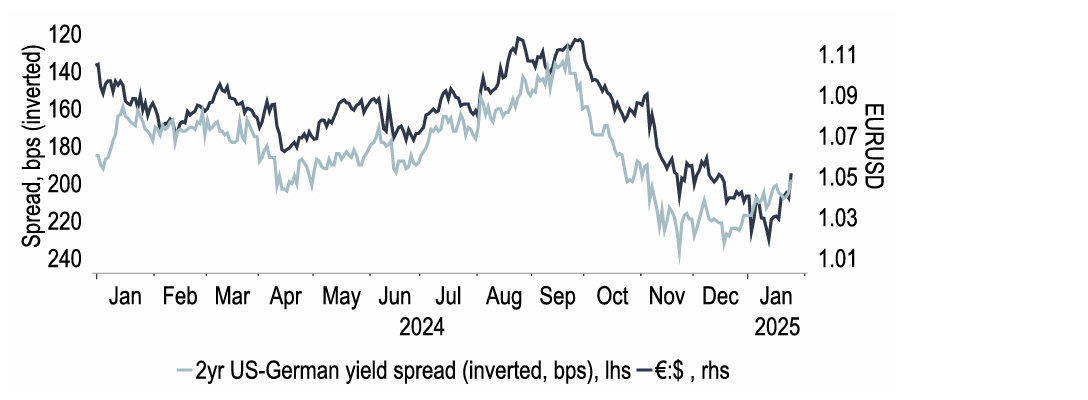

The Euro area looks to have recorded subdued growth in ‘24 (0.7%), with momentum weakening through H2. We expect that many of the headwinds that restrained growth last year will be present this year too, but with the added uncertainty stemming from White House trade policy. Our GDP forecasts are 1.1% for 2025 and 1.2% for 2026, but risks are clearly skewed to the downside. Consequently, we judge that the ECB will likely need to take policy into accommodative territory, our Q4-25 Deposit rate forecast standing at 1.50%. Taking such a path should be aided by some indications that wage growth is easing, reinforcing the ECB’s view that the 2% inflation target will be sustainably met this year. As for the Euro, we remain bearish on its near-term prospects given weak fundamentals, a divergent monetary policy trajectory with the US as well as political and fiscal risks. As such we see €:$ hitting parity this quarter.

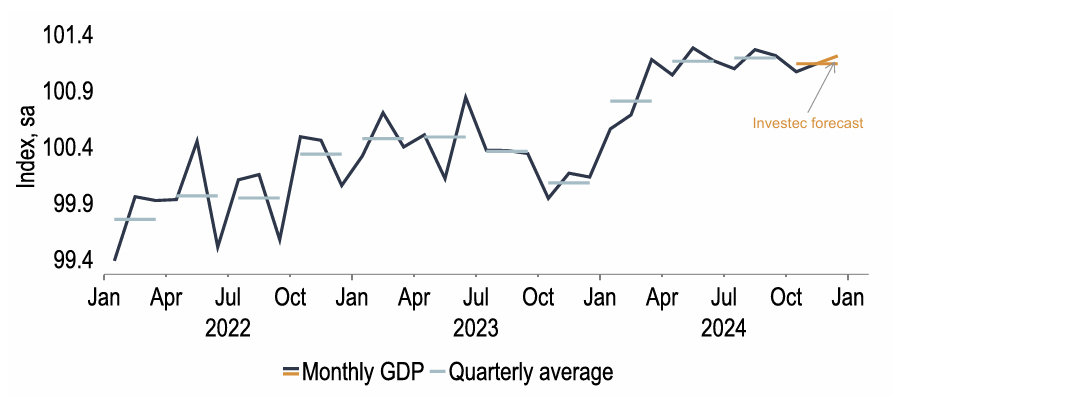

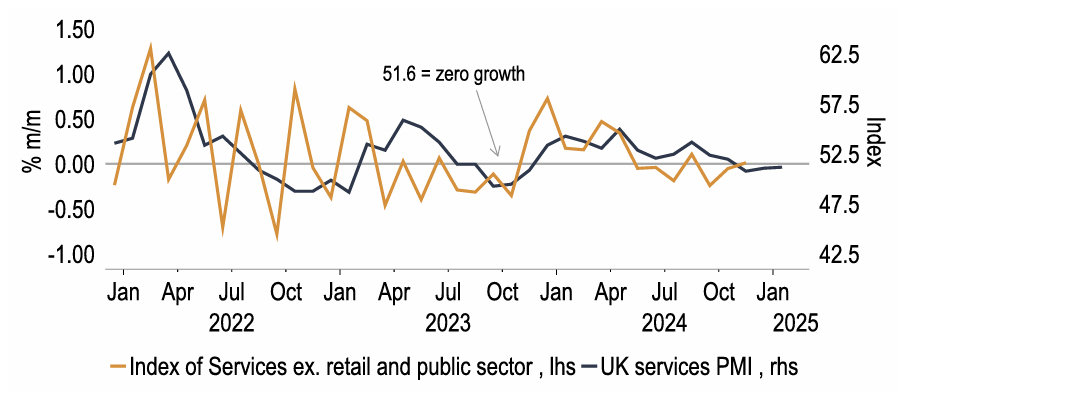

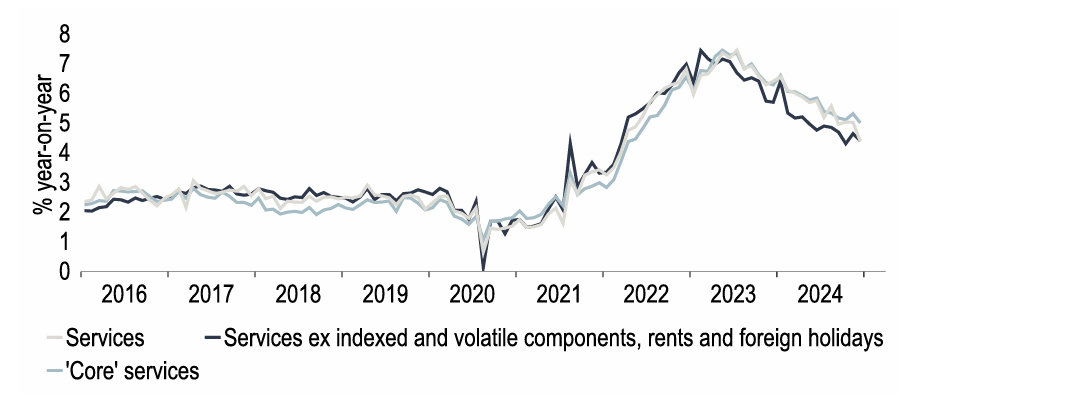

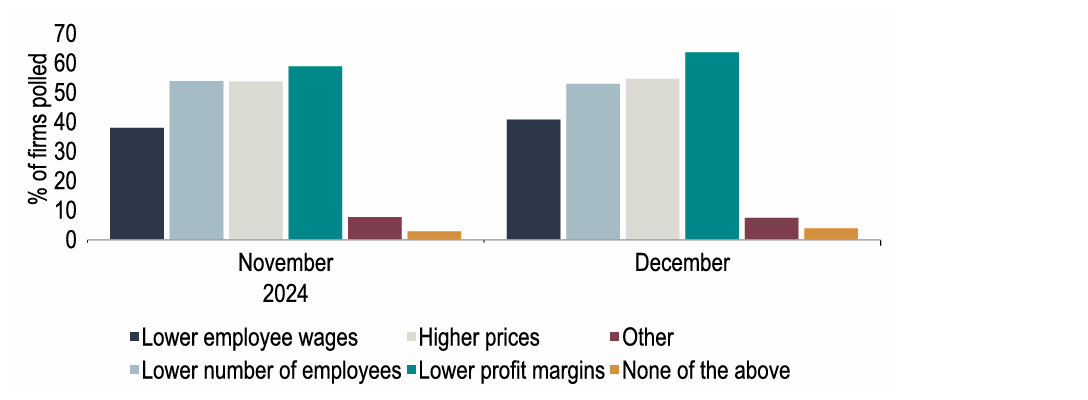

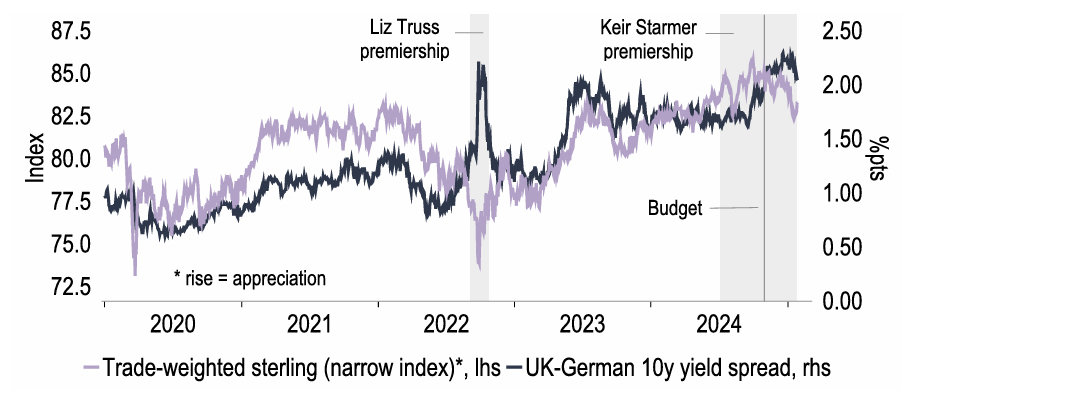

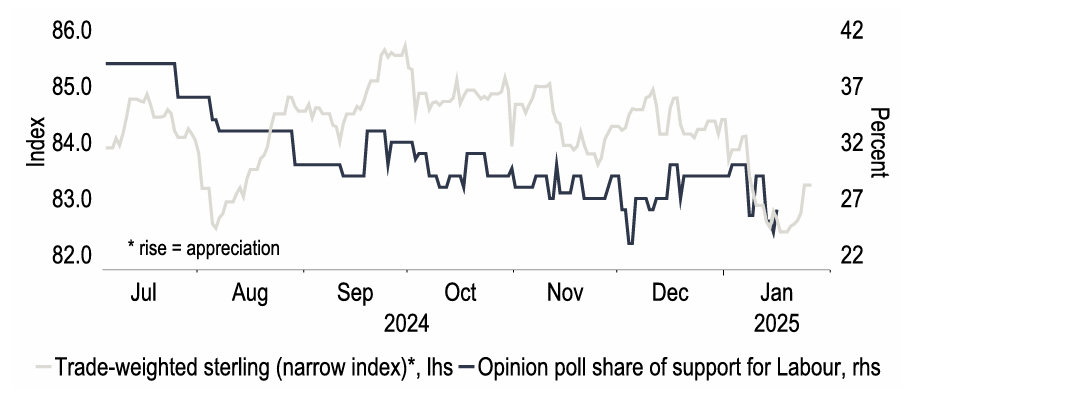

UK economic activity has disappointed. It would not take much to tip into a technical recession, although the more accurate description is that output has flatlined since last spring. As a result, spare capacity has built up. Employer NICs rises look unlikely to trigger significant price hikes in this environment. That should make it easier for the Bank of England to look through a near-term rise in inflation and deliver more rate cuts than currently priced in, to 3.75% by end-’25 and 3.00% by end-‘26. On our assumption of no material retaliation to the above US policy shifts we expect the UK economy to overcome weak momentum and headwinds from weaker US exports: investment looks set to benefit from planning reform and rate cuts, and consumption should benefit from rising real incomes. Our GDP growth forecasts are 0.8% for ’25 and 1.7% for ’26.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.