Global Economic Overview – June 2024

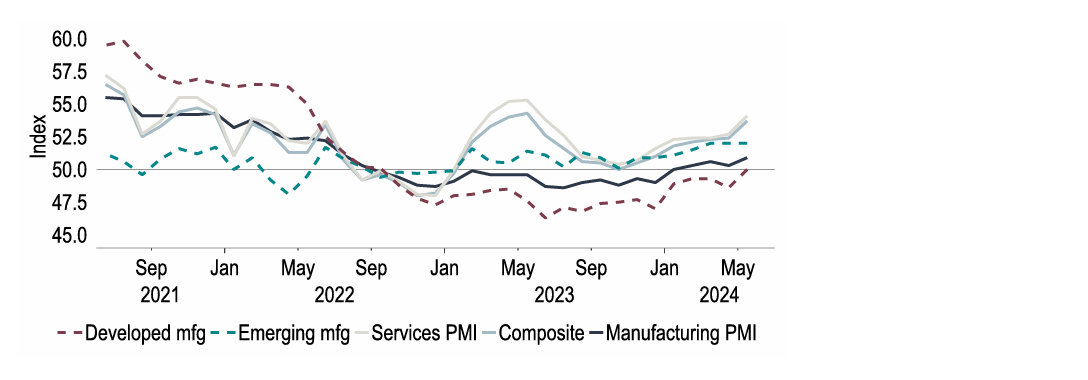

The economic activity has rebounded since the beginning of the year, recovering from the stagnation experienced in many western economies throughout 2023. Consequently, our predictions for global growth remain unchanged at 3.2% in 2024 and 3.3% in 2025. We provide a more detailed analysis of these forecasts below.

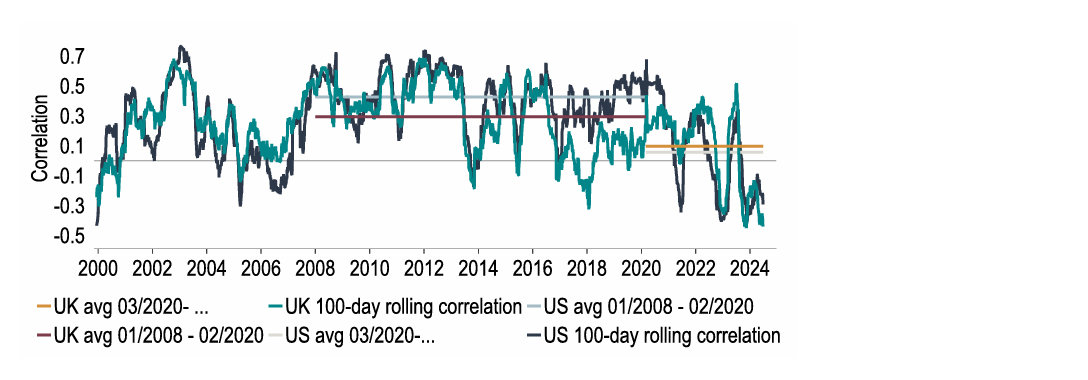

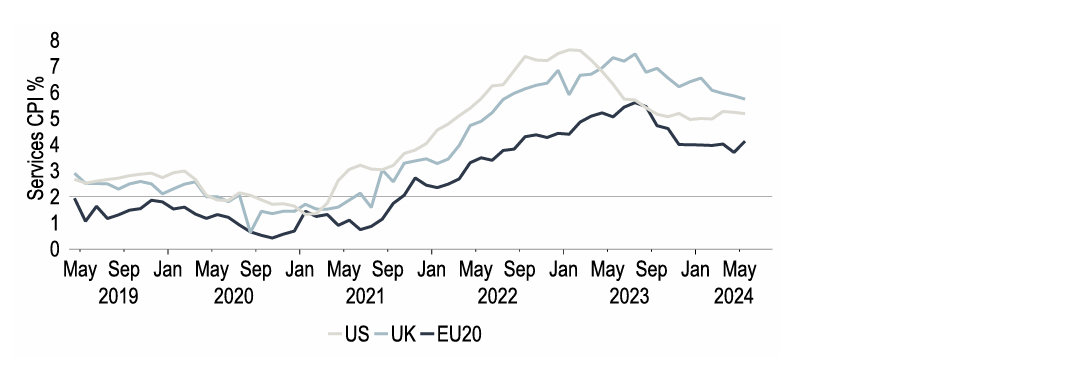

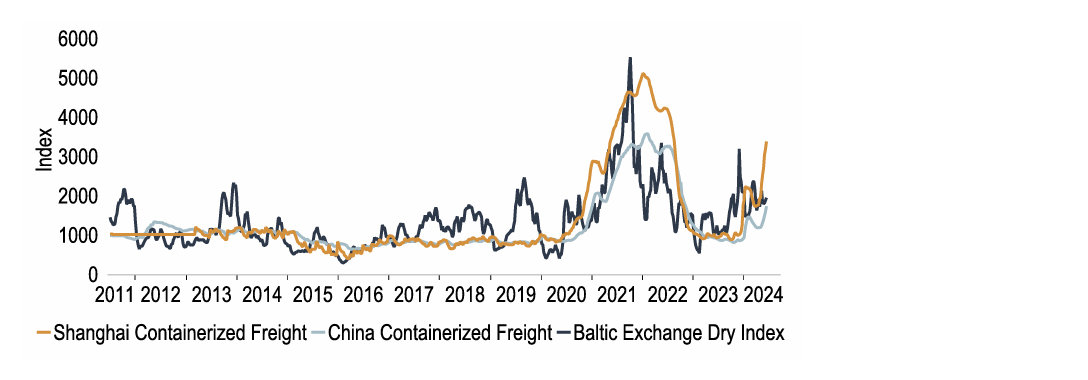

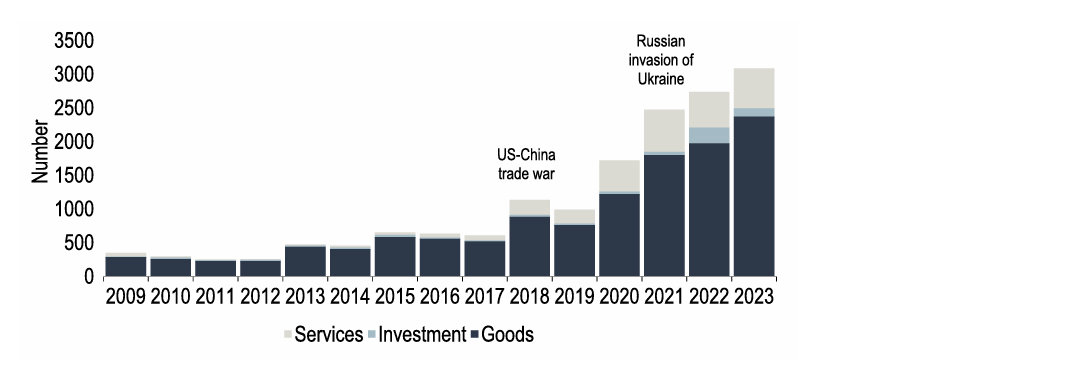

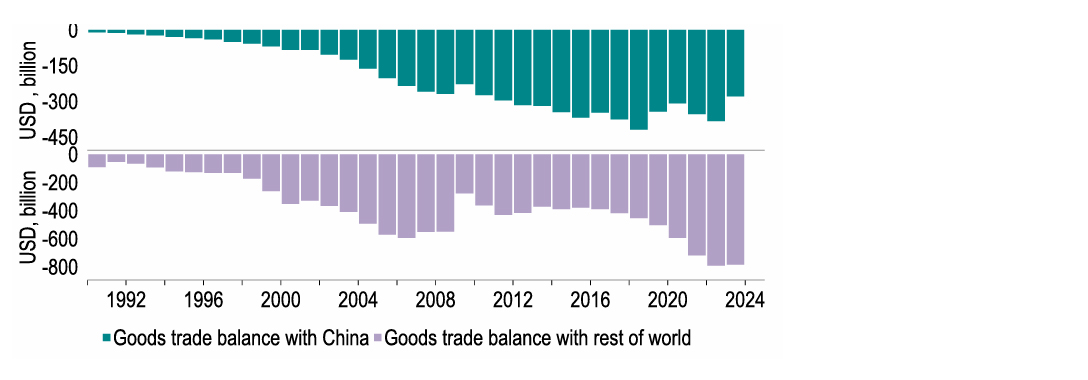

Economic activity since the turn of the year has shown a rebound following the stagnation seen in many western economies over 2023. Indicators for Q2 have largely been in line with our base case assumptions, solidifying our view that momentum has continued to build. As such our forecasts for global growth are unchanged at 3.2% in 2024 and 3.3% in 2025. Easier monetary policy is a key factor underpinning this view and we continue to believe that the Fed and BoE will lower interest rates in H2, joining the likes of the ECB in cutting rates this year. This comes with the caveat that the timing and pace of easing will be dependent on more encouraging news on inflation and wages. But there are downside risks related to elections (France is a case in point) and growing protectionist policies.

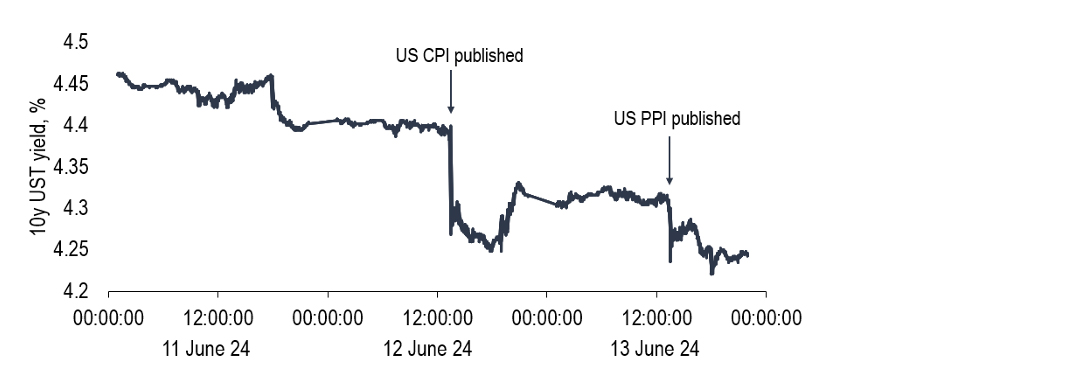

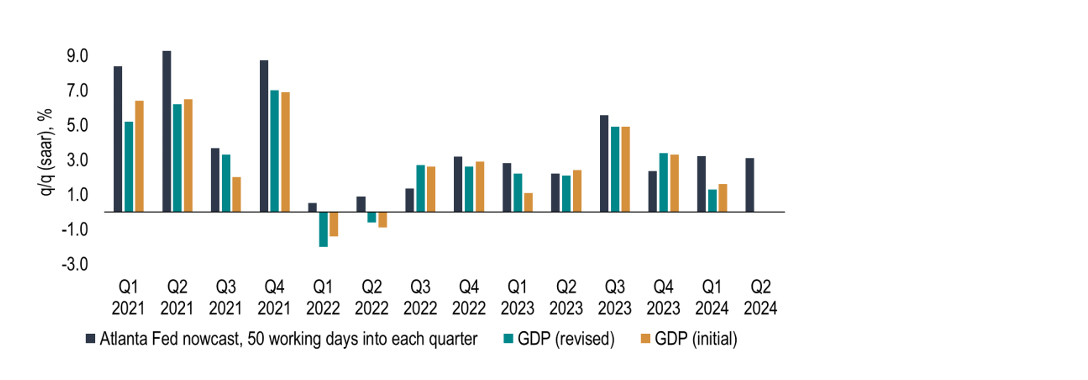

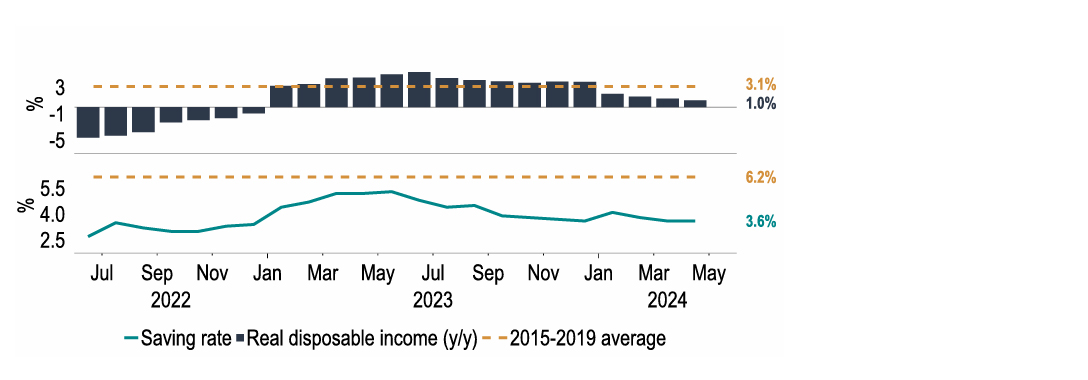

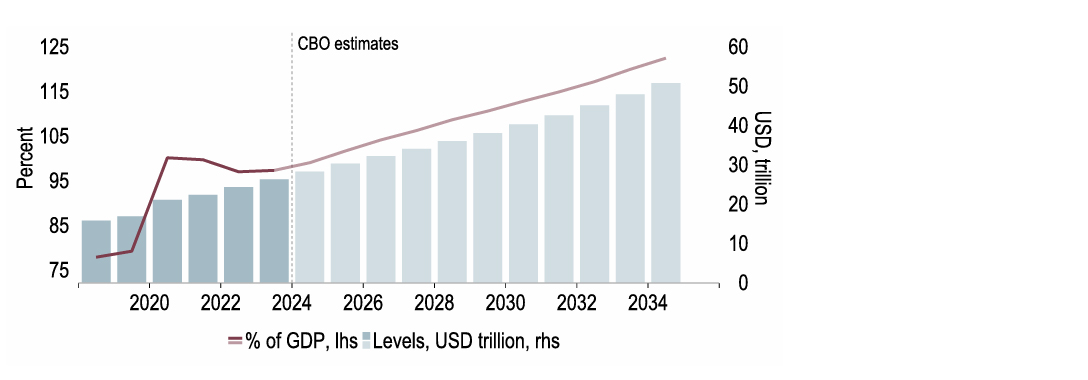

The latest FOMC meeting saw rates held at the current target range of 5.25-5.50%, as expected. The accompanying projections garnered interest though due to a shift in the ‘dot plot’, with the median view on the committee being for just one interest rate reduction this year (prior: three). This hides a more nuanced picture though: it was close between one and two cuts, and the end-26 point remained unchanged, suggesting merely a delay to easing, rather than a fundamental change in the outlook for policy. We maintain our view for two 25bp rate cuts this year, with the first in September, followed by four reductions next. Our expectations for a slowing in economic momentum coincides with this view. We pencil in GDP growth of 2.4% this year, and 1.6% next.

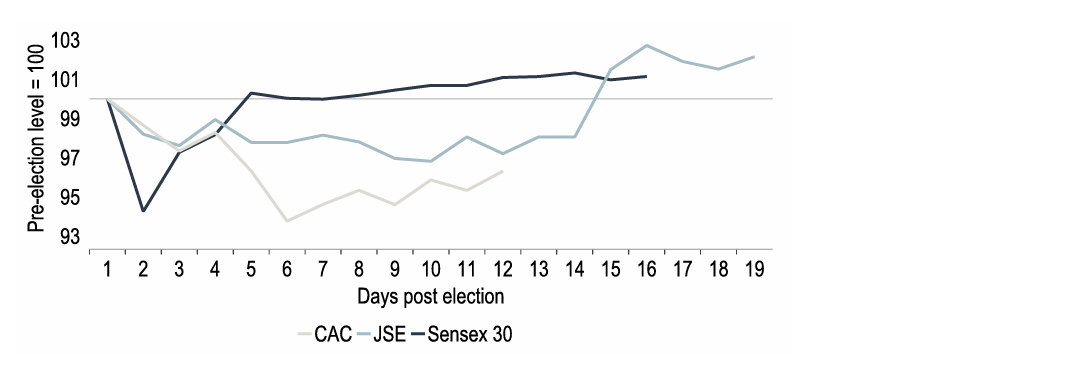

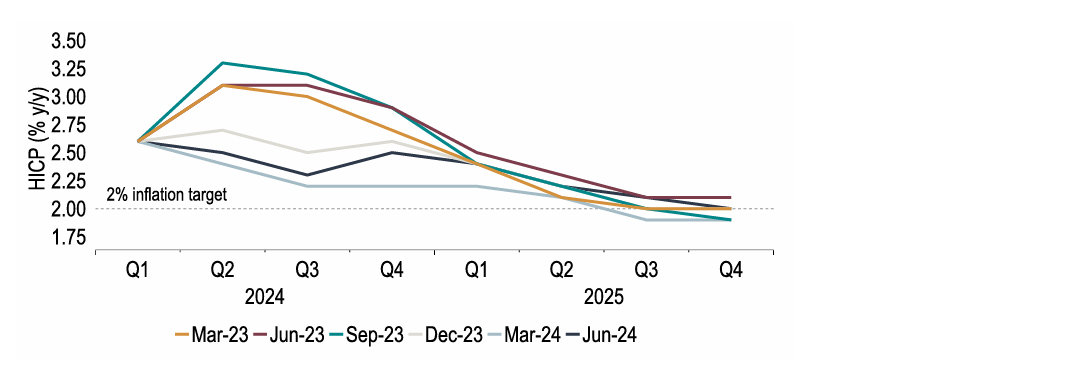

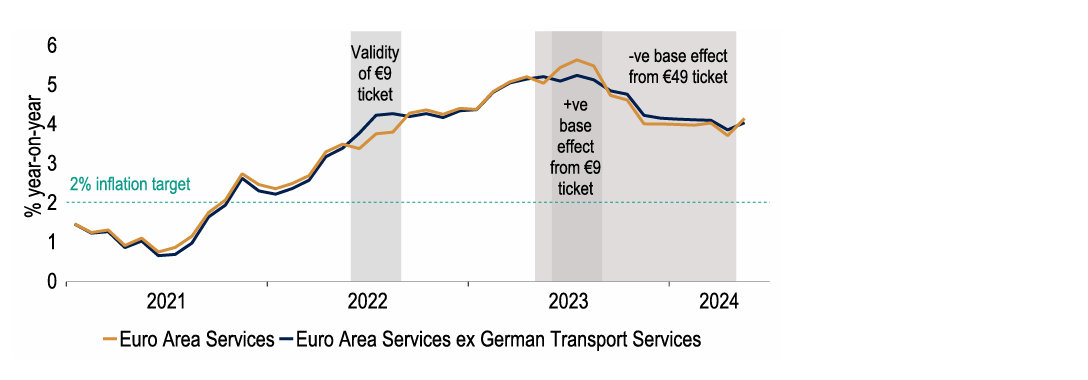

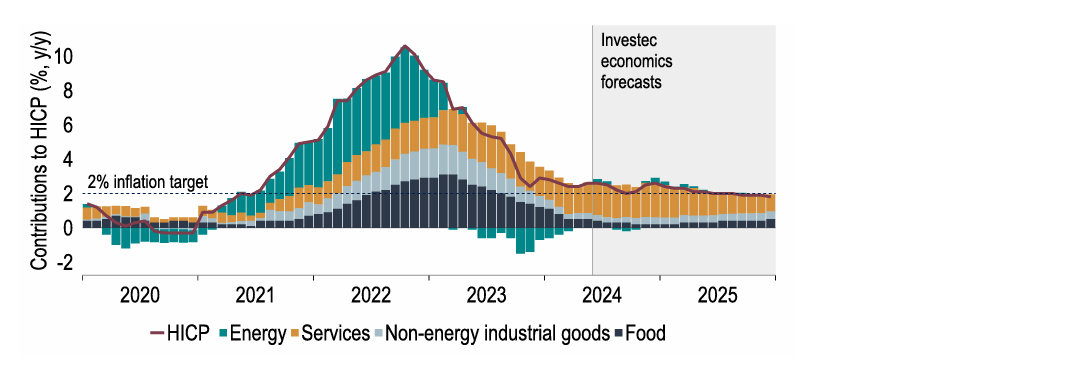

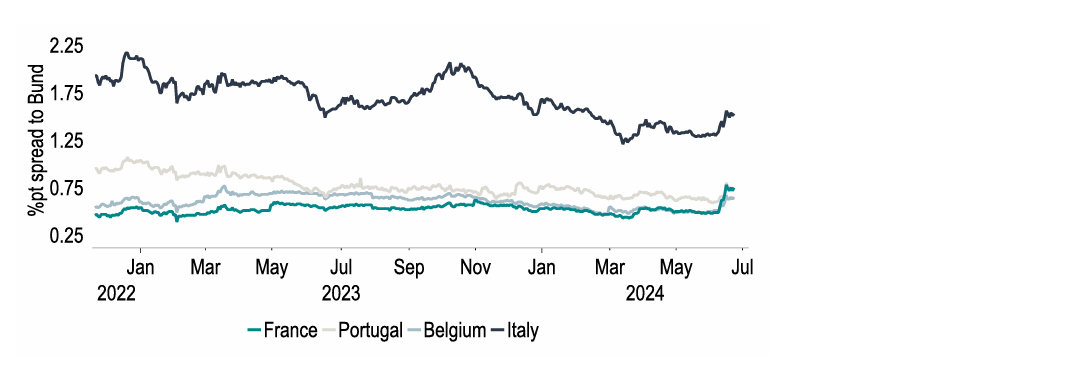

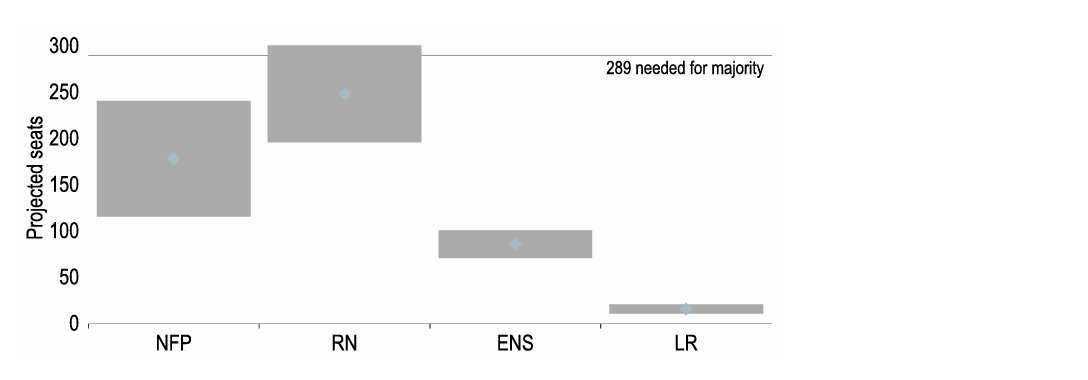

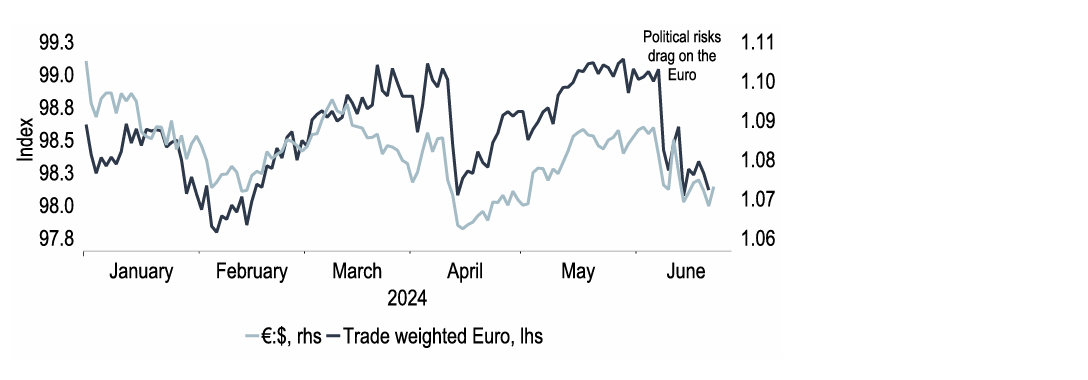

The ECB delivered what we think will be the first of a series of measured rate cuts. Some niggling concerns relate to wage and services price data, which did not fit the disinflation narrative as neatly. But although the ECB did not outline a path for future policy, 25bp rate cuts at each Staff Projections meeting still look plausible this year and next. The main focus though is on French politics, after President Macron called a snap National Assembly election following a heavy defeat for his party in EU Parliamentary elections. The two-stage voting process and strong polling for the far-left as well as the far-right makes the final outcome uncertain. Political worries may hold back EUR in the near term, but for now we foresee only a limited GDP impact, keeping our forecast for ‘23 at 0.8%, but cutting our ‘24 forecast by 0.1%pt to 1.6%.

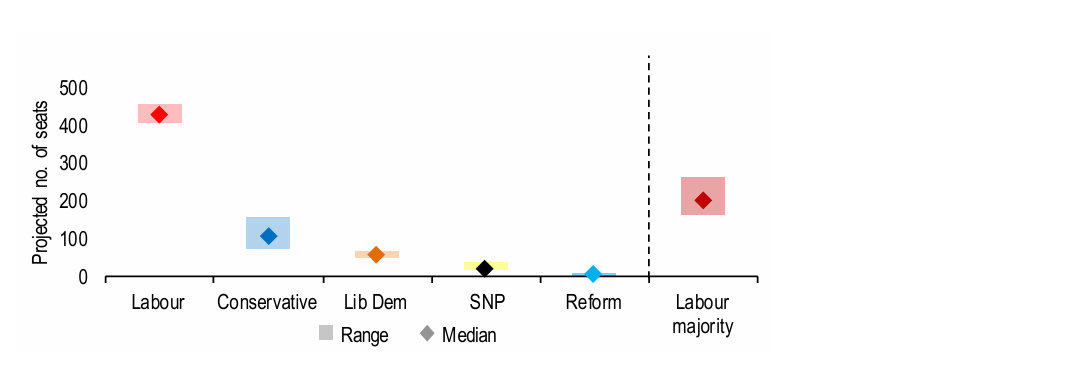

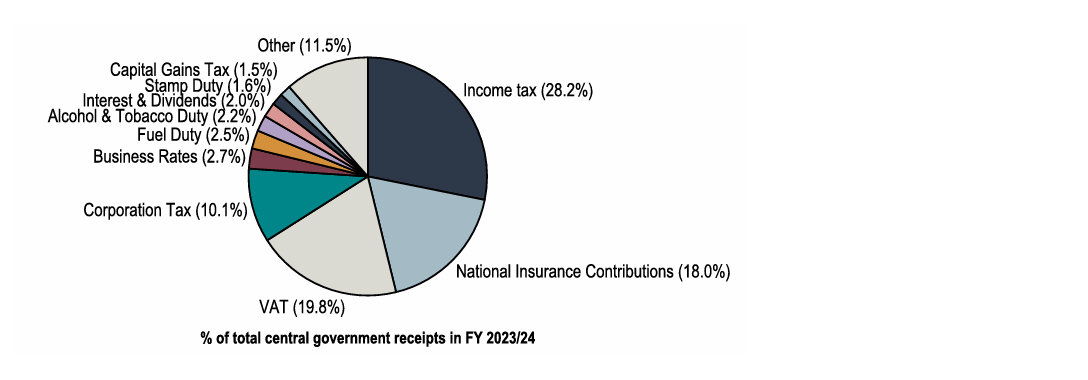

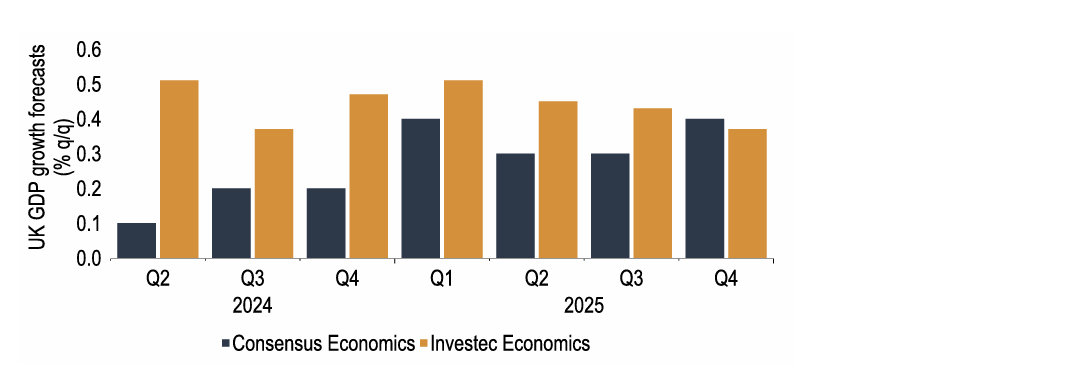

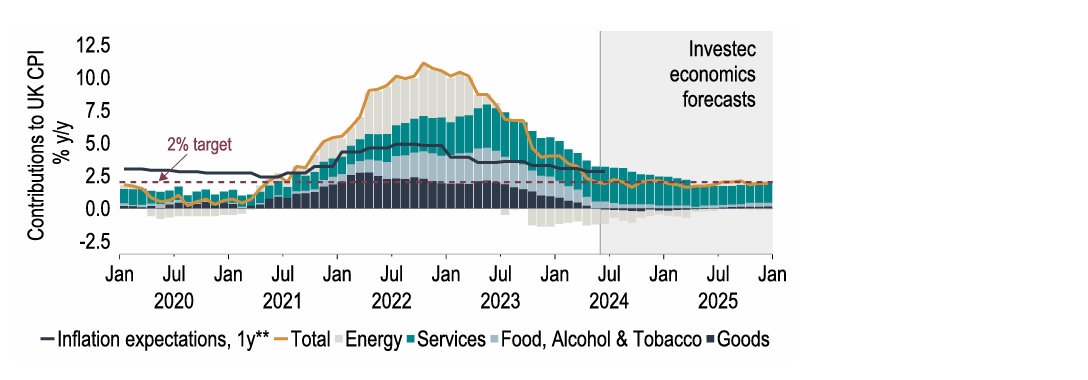

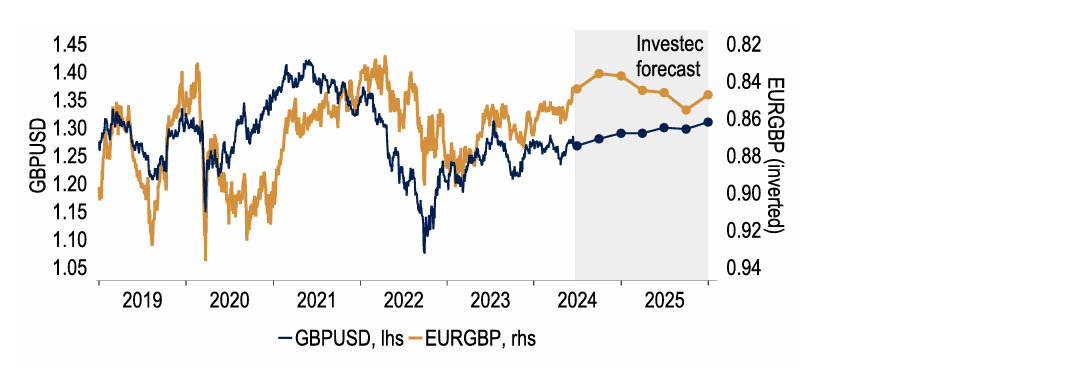

Judging by opinion polls, Labour looks almost certain to sweep into power with a landslide win on 4 July. What is outlined in its election manifesto is a very conservative (with a small ‘c’) approach to fiscal policy, raising borrowing by just £3.5bn thanks to extra expenditure on its Green Prosperity Plan. Labour has committed to not raising tax rates for its four major revenue streams, but the need to boost funding via some other tax rises may well arise. Still, for now, inflation falling faster than wage growth is a boon to the economy, supporting our call for above-consensus GDP growth of 1.0% and 1.8%, respectively, in 2024 and 2025. We continue to see scope for a first MPC rate cut as soon as at the next (August) meeting, and a gradual path of 25bp per quarter of Bank rate cuts over the remainder of this year and next as inflation expectations fall.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.