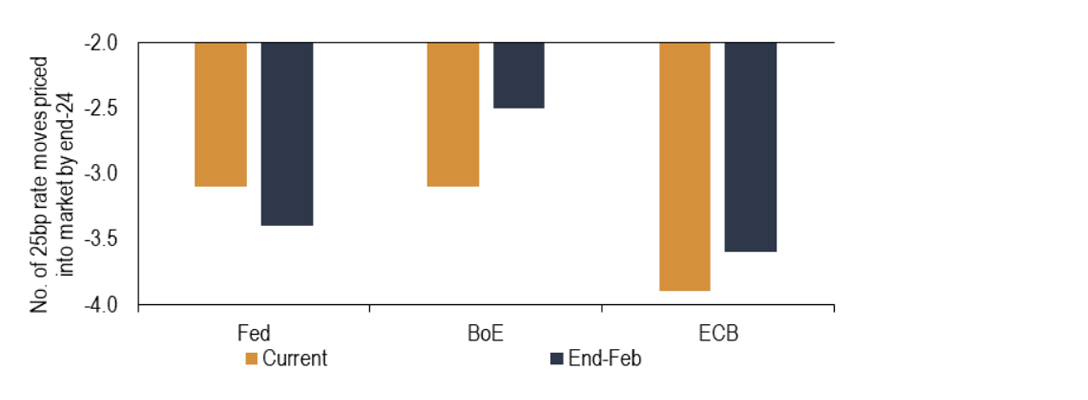

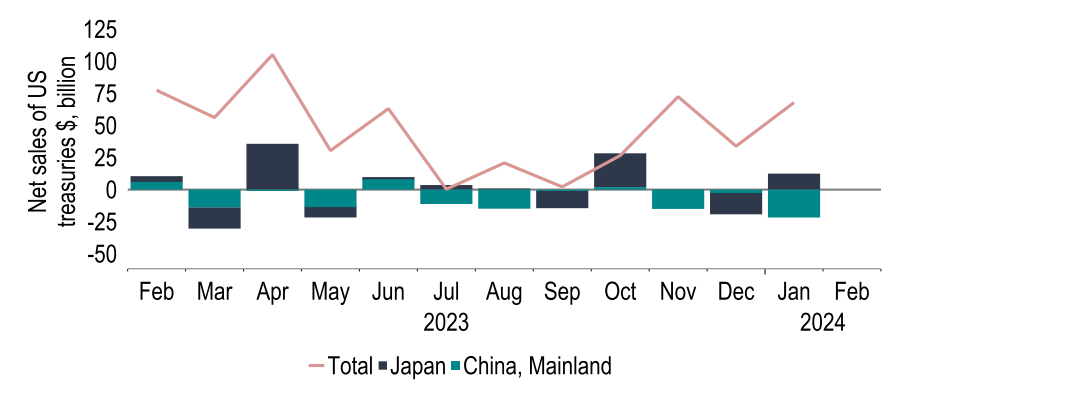

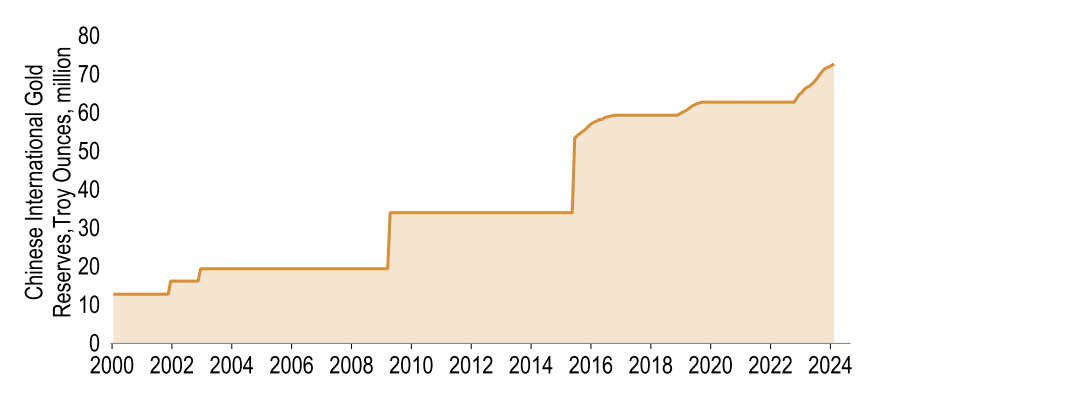

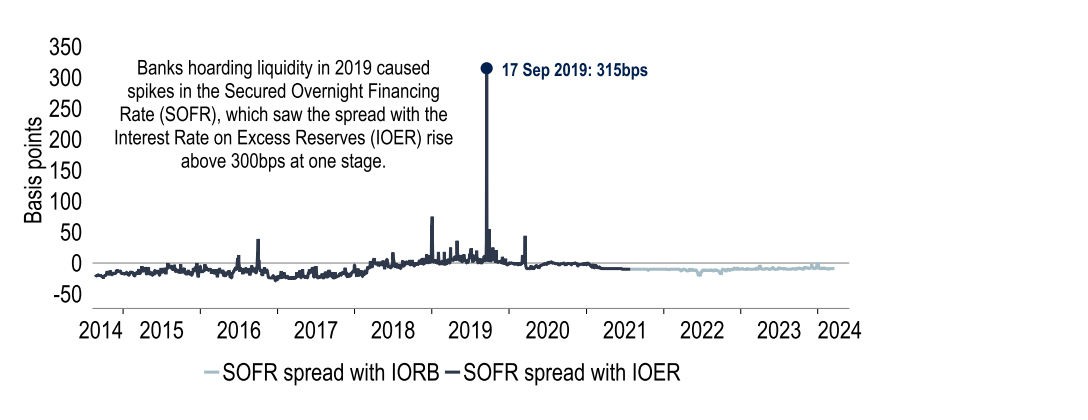

Interest rates in developed markets have been less volatile and more nuanced over the past month, pricing in a little more easing from the ECB and BoE this year but less from the Fed. Although the US economy has remained remarkably buoyant, falling inflation expectations have pushed real interest rates upwards, increasing the restrictiveness of policy and providing a case for lower policy rates at some stage. Against the grain, the Bank of Japan raised interest rates back into positive territory. We wonder whether this process may begin to result in Japanese buyers ‘reshoring’ their financial assets. China already appears to be a net seller of US Treasuries and a greater buyer of gold, and this sort of reserve diversification could put downward pressure on USD at some stage and possibly upward pressure on Treasury yields.

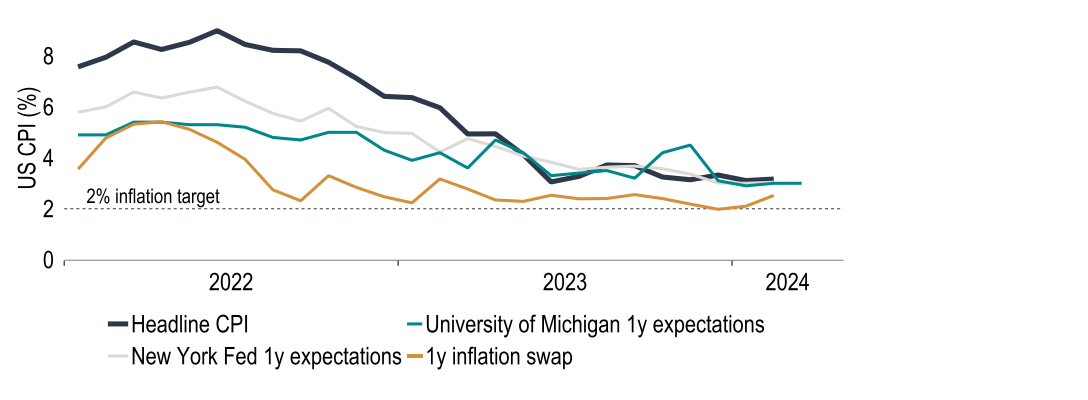

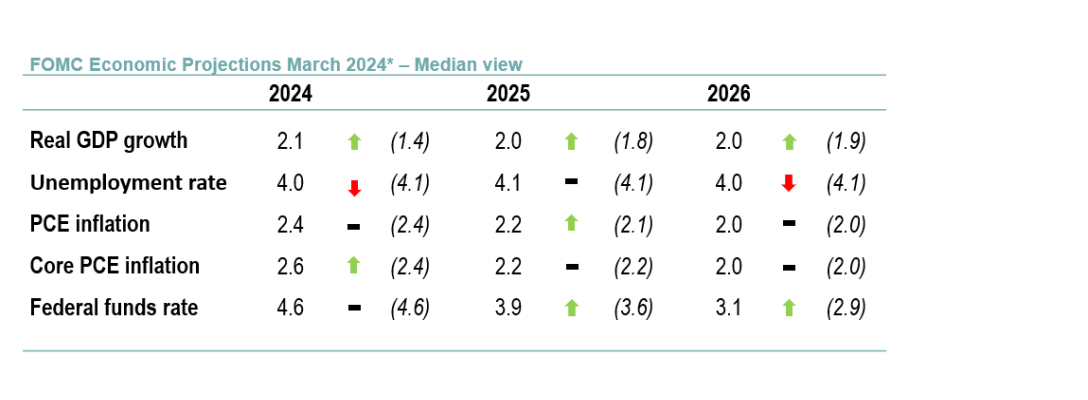

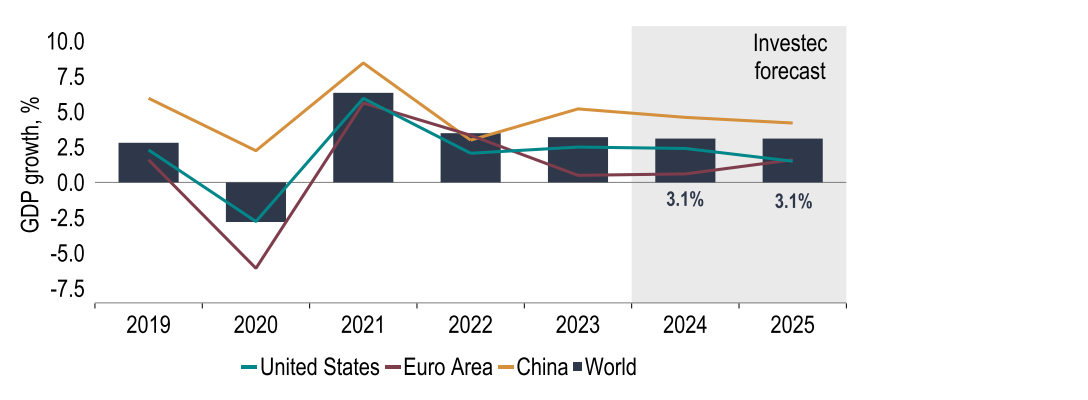

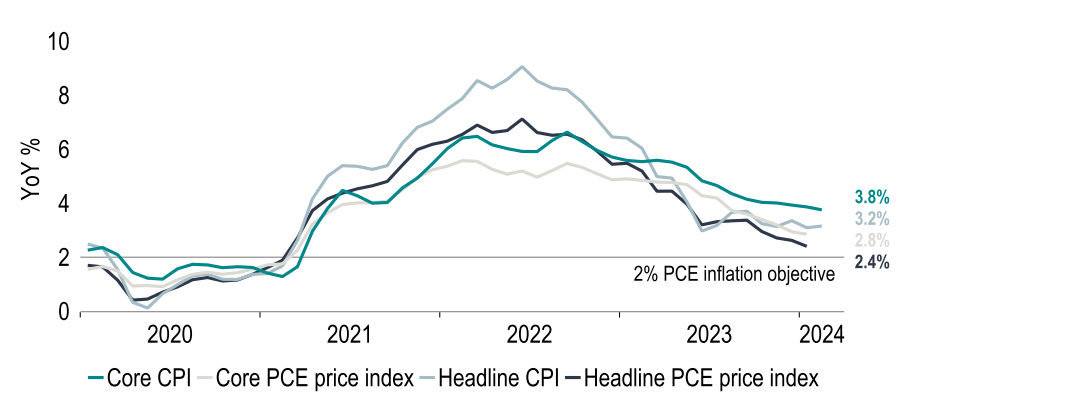

The latest FOMC meeting saw rates held steady once again. But the updated forecasts demonstrated that the committee still believes that several interest rate cuts will be appropriate this year. This is despite the Fed’s growth forecasts having been revised higher. Indeed, given recent robust data we have lifted our own forecasts slightly too, to 2.4% this year (prior: 2.3%) and 1.5% next (prior: 1.4%). This is a Goldilocks scenario for the Fed: inflation has made progress towards 2%, but the economy has performed well. The Fed will be mindful though that if monetary policy exerts too much pressure on the economy through rising real rates, the situation could quickly change, sending inflation below the 2% target and unemployment higher. As such, we maintain our view for three interest rate cuts this year, starting from June.

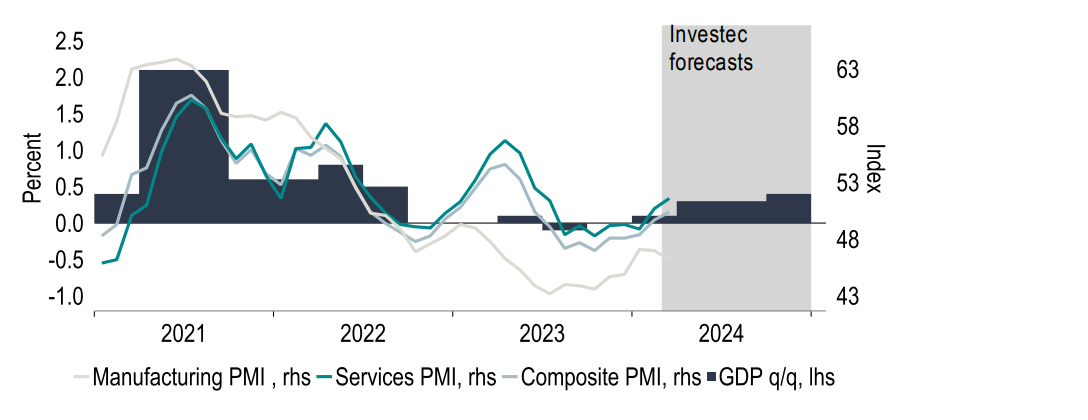

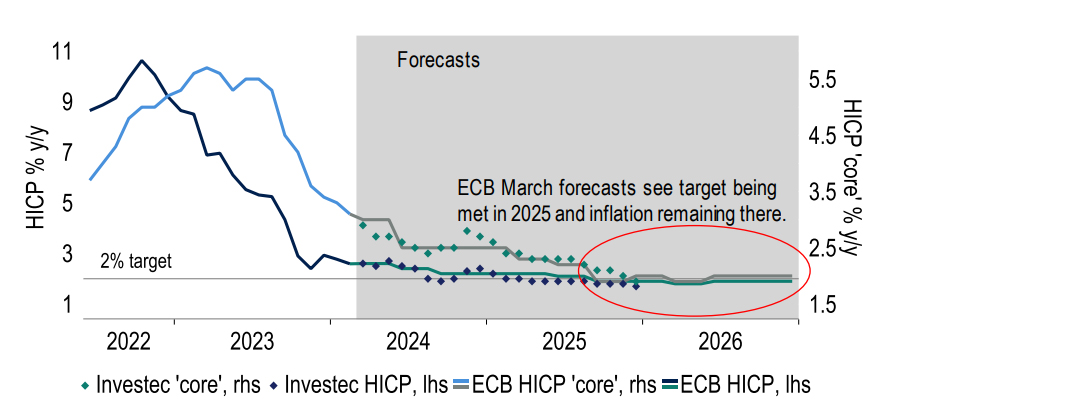

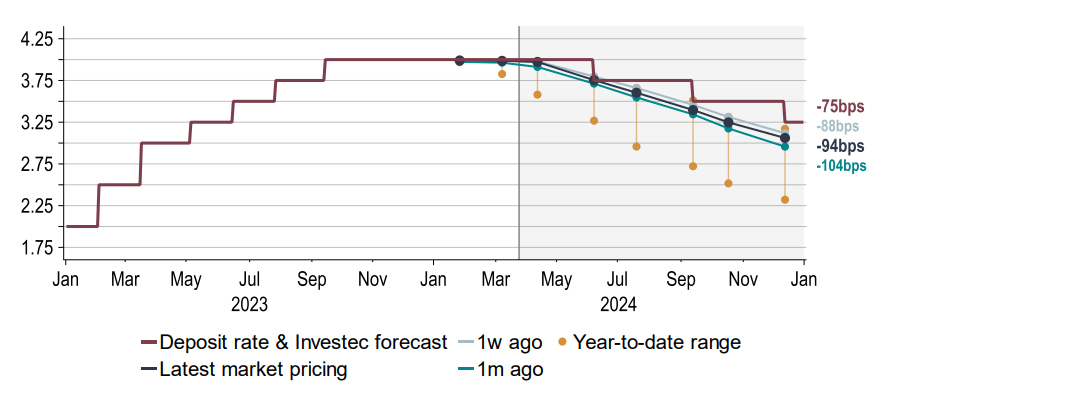

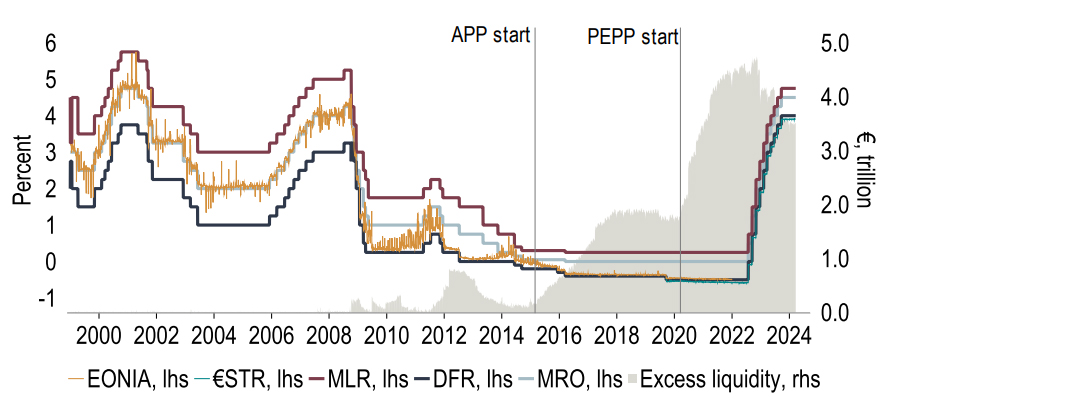

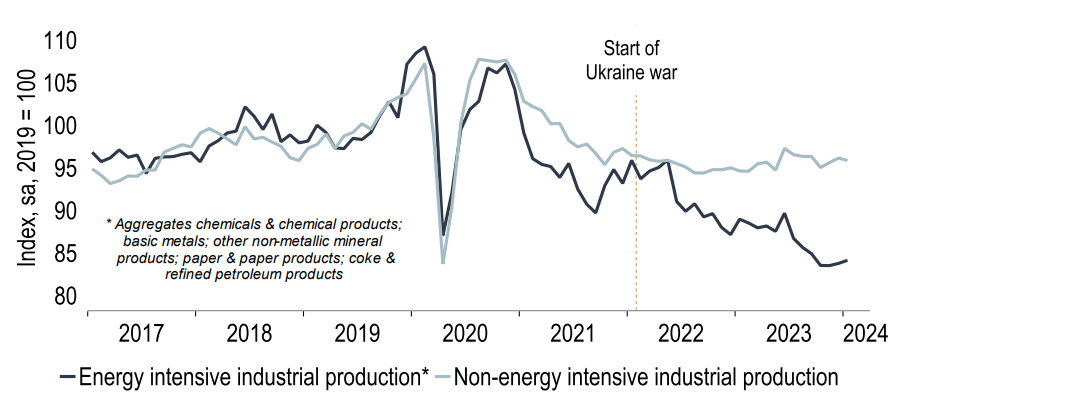

Euro area economic activity at the start of 2024 has remained subdued. But indicators are showing some improvement, which should see quarterly GDP growth turn positive in Q1. This largely aligns with our baseline views, hence our GDP forecasts for both 2024 and 2025 remain unchanged at 0.6% and 1.6% respectively. Our baseline view for ECB policy also remains as before, namely for a first 25bp cut in the Deposit rate in June. Our conviction in this call has been strengthened by the March ECB meeting and subsequent comments from the Governing Council, which have left little doubt over the prospects of a June rate cut. We expect two further rate reductions across the rest of the year, which would leave the Deposit rate at 3.25% in December.

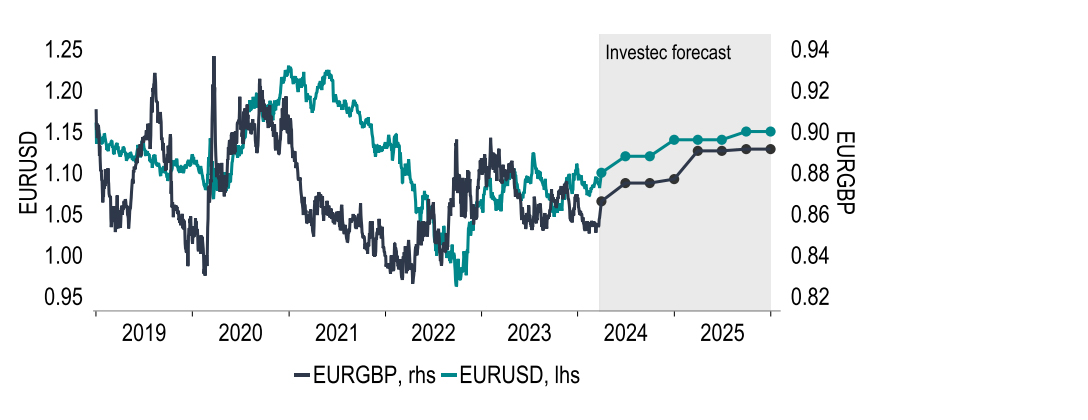

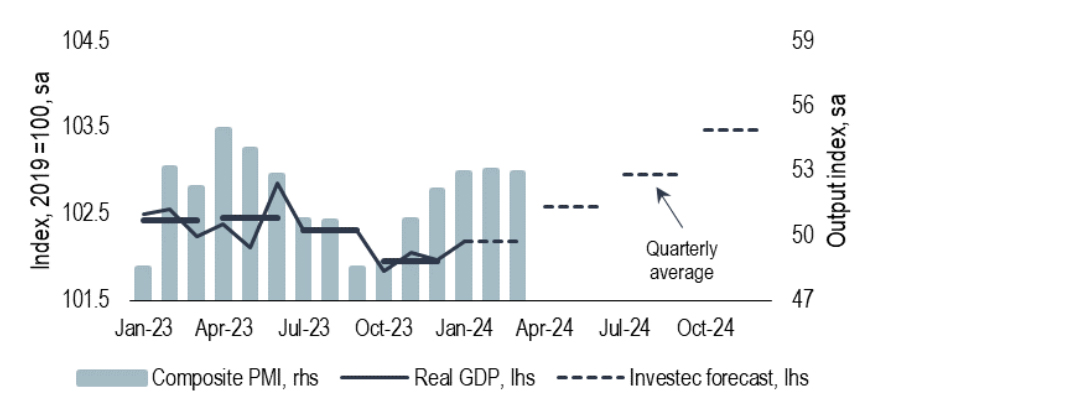

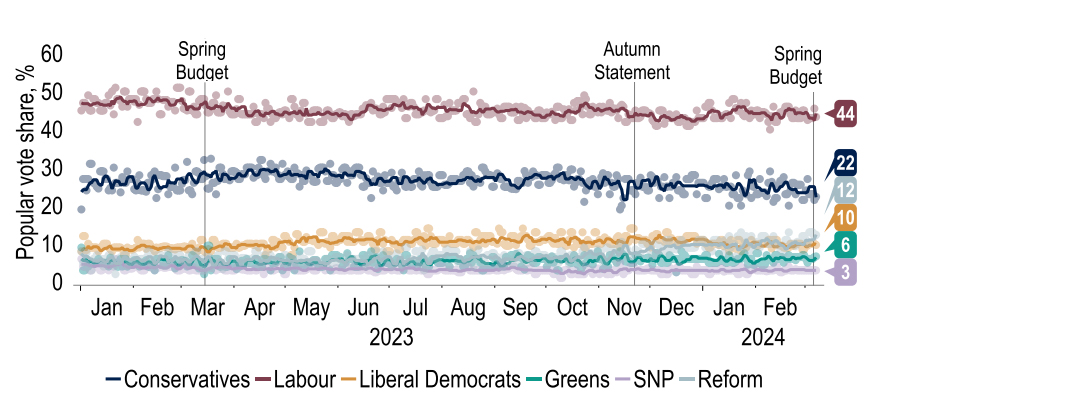

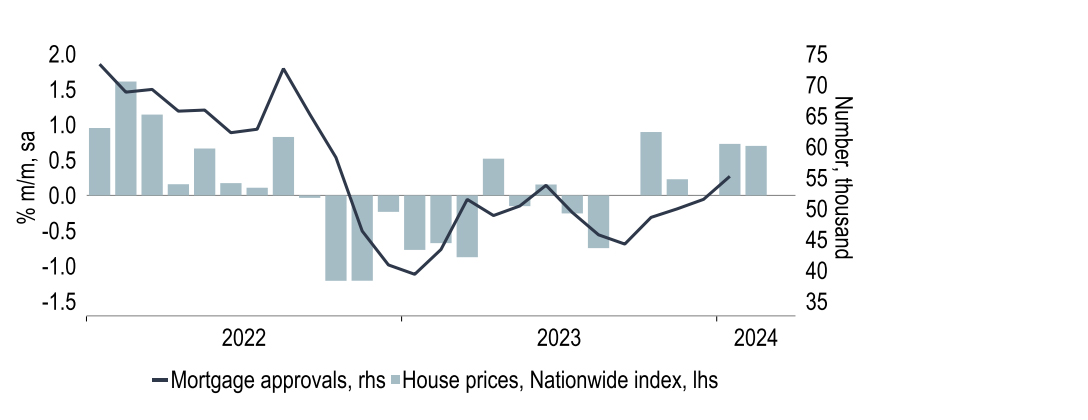

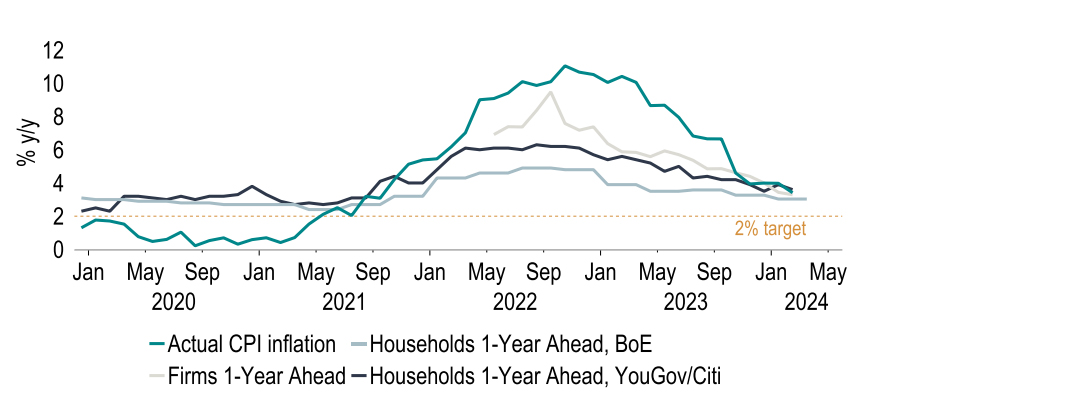

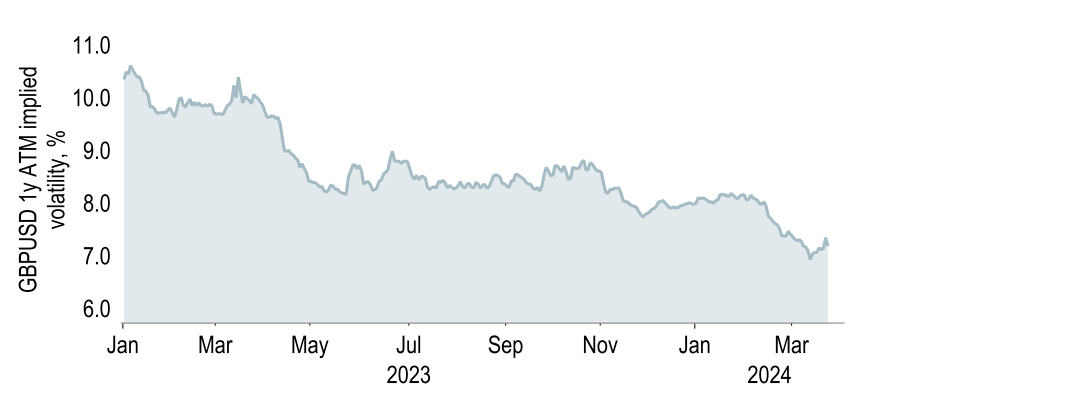

Recent data leave us comfortable with our view that the UK economy already emerged from recession during Q1. Our GDP growth forecasts are unchanged at 0.5% for ‘24 and 1.8% for ‘25. A key support is stronger real household disposable income growth, reflecting a mix of now above-inflation wage growth and National Insurance Contribution cuts. The latter do not seem to have lifted the Tories’ poll ratings, although there is yet time for another fiscal event pre-election if so desired. The Conservatives will also hope for rate cuts soon. Prospects of this seem good: not only is inflation itself falling, but inflation expectations too are receding. We continue to forecast a first rate cut in June, with 75bps of rate reductions in total this year and more to come in 2025. For GBP, we predict a small further rise against USD (end ’24: $1.30, end ’25: $1.29).

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.