Global Economic Overview – March 2025

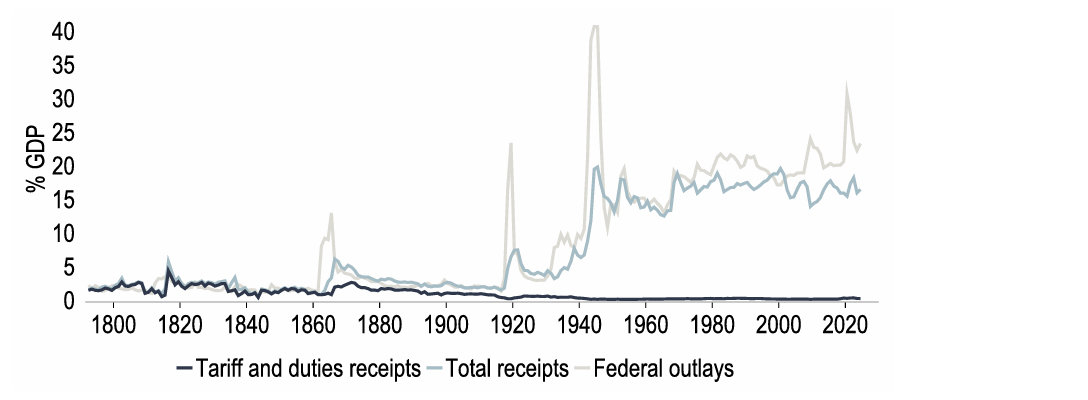

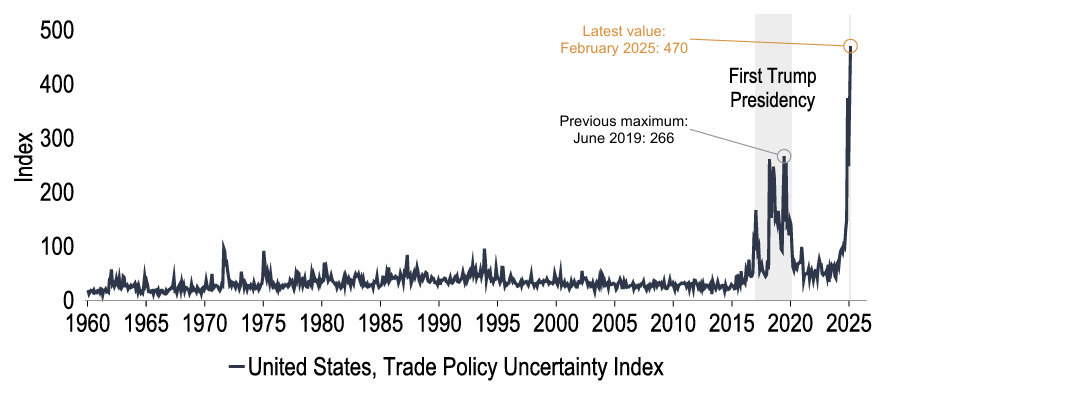

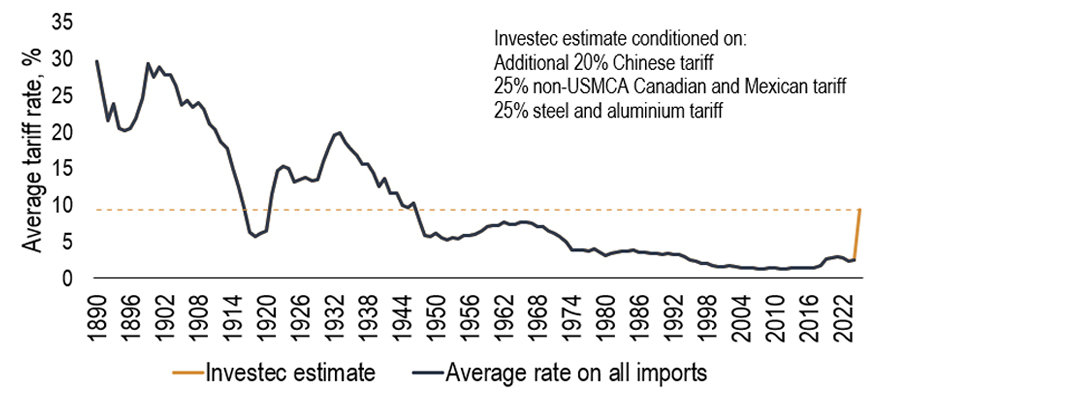

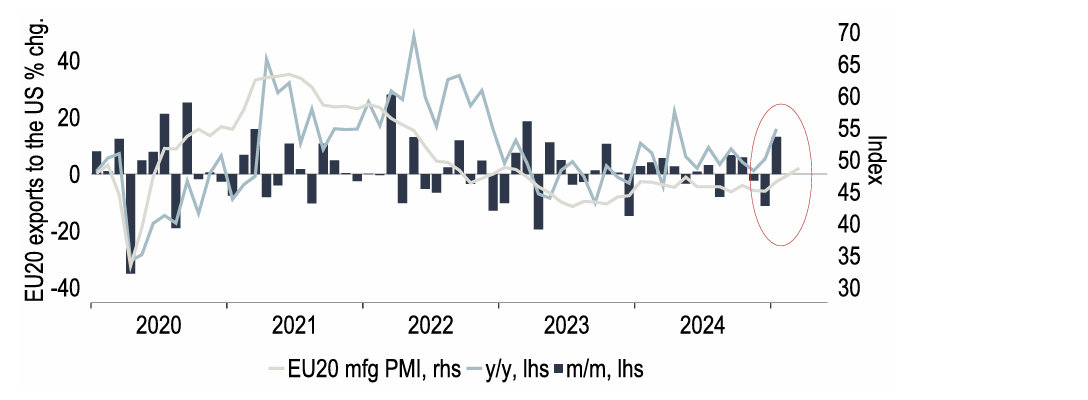

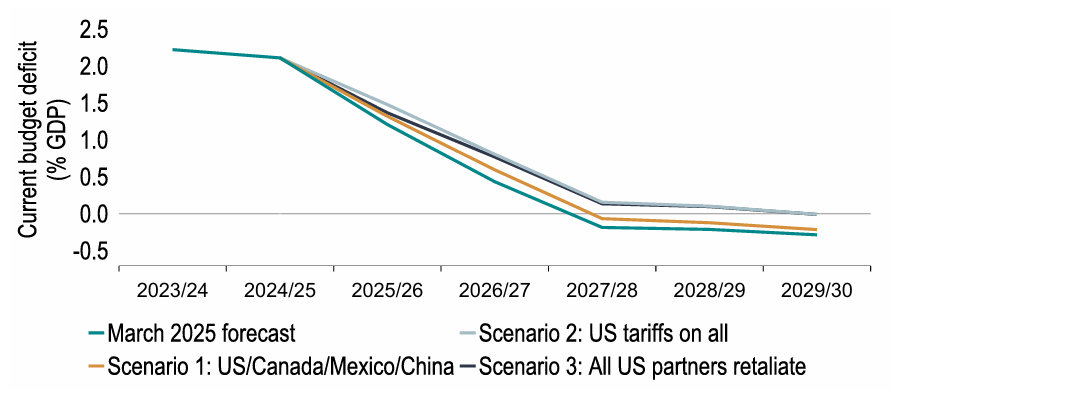

President Trump’s policy agenda has been sending shockwaves throughout the global economy as households and businesses prepare for higher US tariffs. The scope of the impact depends on both the severity and longevity of any tariffs, as well as the degree of retaliation from trading partners.

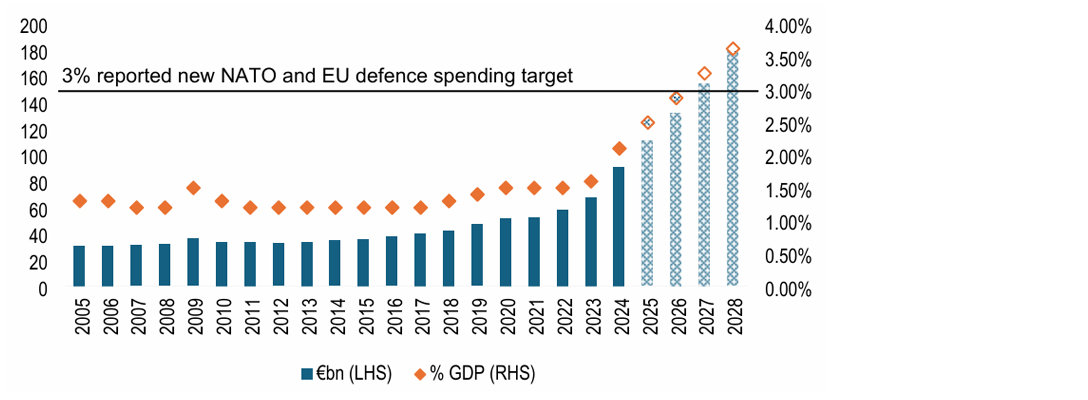

After a bruising period of uncertainty, businesses and financial markets are braced for the US administration’s planned announcement of extra tariffs on 2 April. Behind the scenes, negotiations are underway to limit the damage to trade from ‘Liberation Day’, as Trump has dubbed it. The scope for this is unclear: if tariff rises are to raise meaningful funding towards tax cuts they will need to be both large and durable. But it is not just US actions that will impact economies; countermeasures will too. Conversely though, the planned big step up in European defence spending is a tailwind to counter at least some of the headwinds from US policy shifts, which in any case will not fall evenly across countries. Uncertainty looks almost certain to persist beyond 2 April, leaving scope for markets, and us, to reassess the outlook in future.

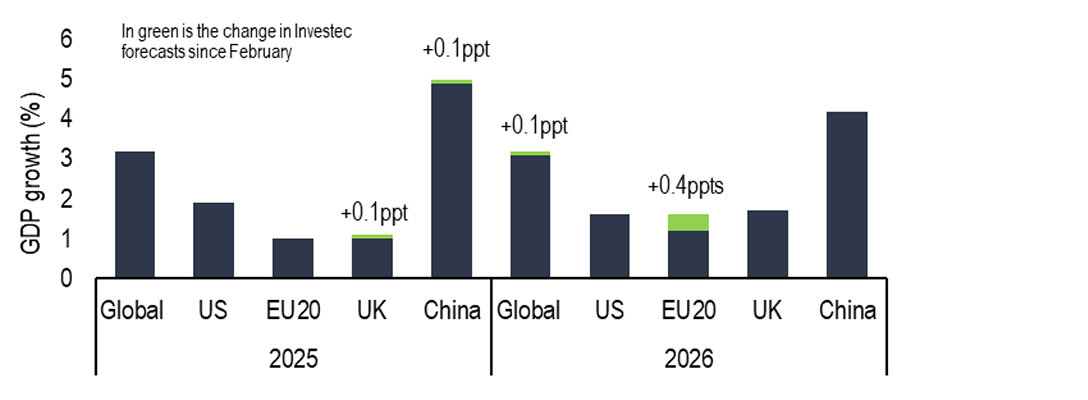

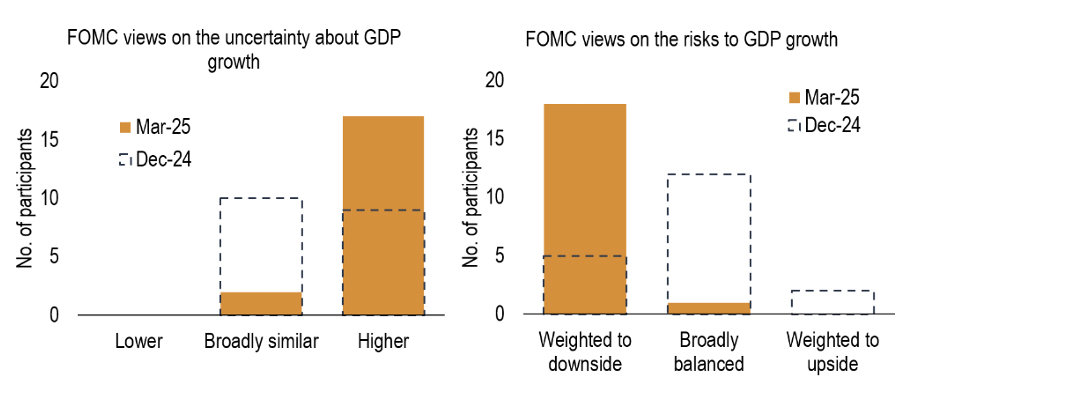

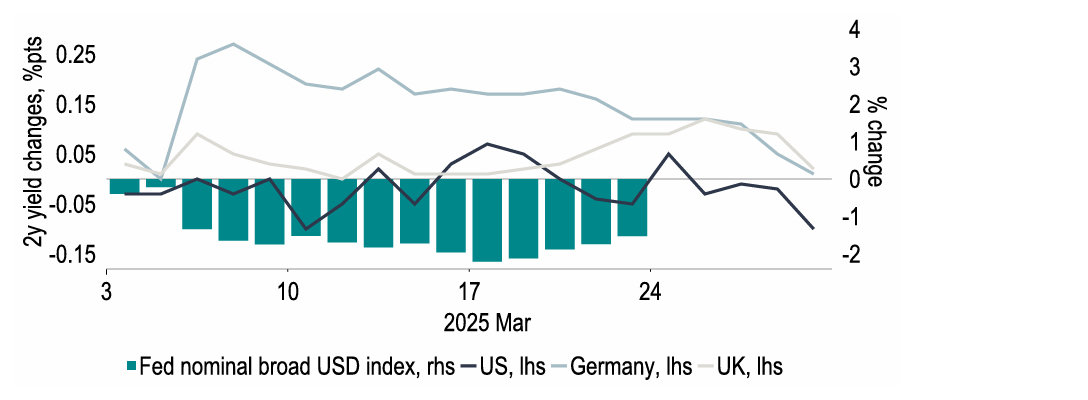

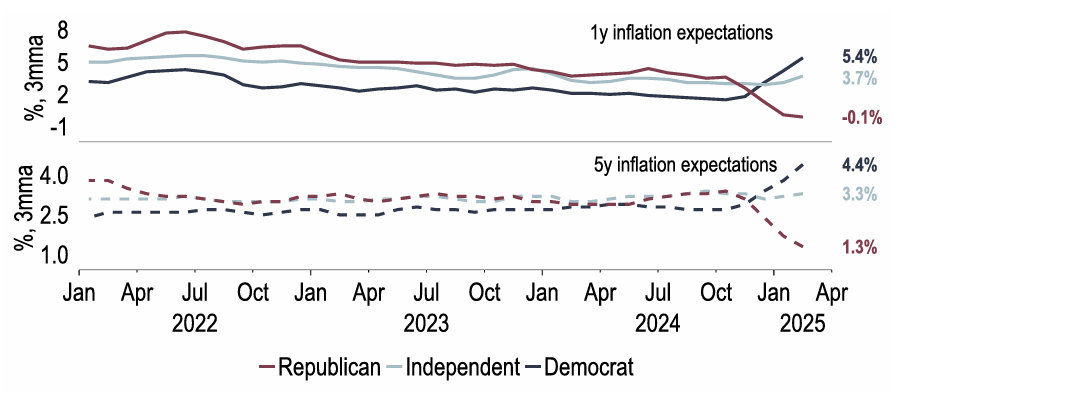

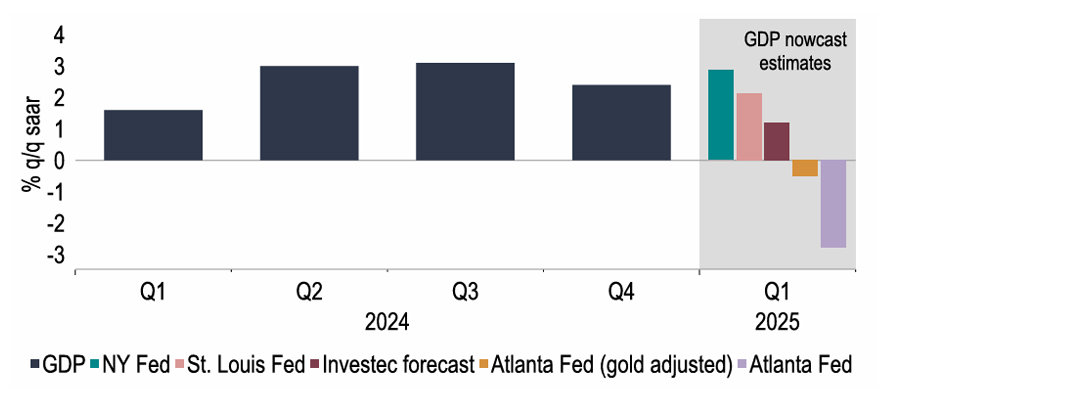

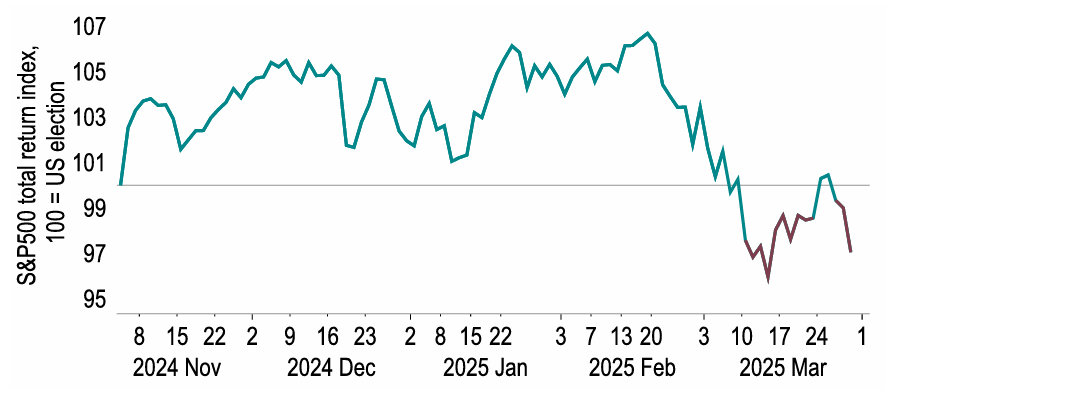

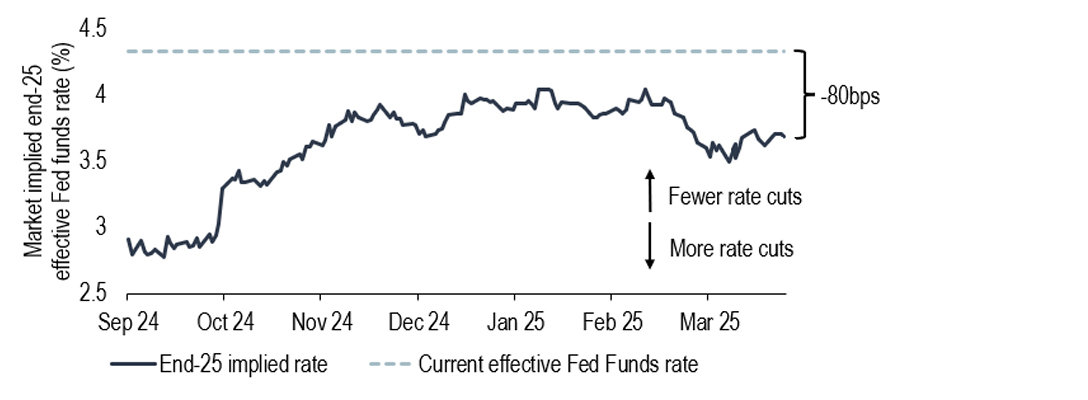

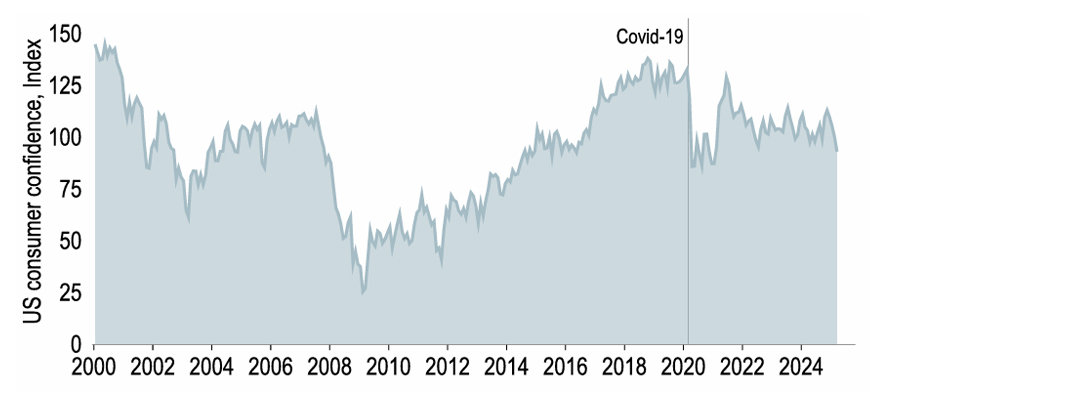

Our forecasts centre on the expectation that President Trump’s policy agenda will, on net, be inflationary and constrain economic growth. The extent to which this occurs, however, largely depends on the evolution of policy not just over the next few days, but also beyond. Financial markets are also weighing the risks to inflation and the economy but seem to be more concerned about the latter, with recession fears contributing to a sell-off in US equities and weighing on US Treasury yields. In contrast, we expect the US economy to slow but escape a recession (our GDP forecasts remain unchanged at 1.9% and 1.6%, this year and next), while the inflationary impact of Trump’s policy will prevent the Fed from cutting rates as much as markets expect. We still pencil in just one 25bp rate cut this year, in December.

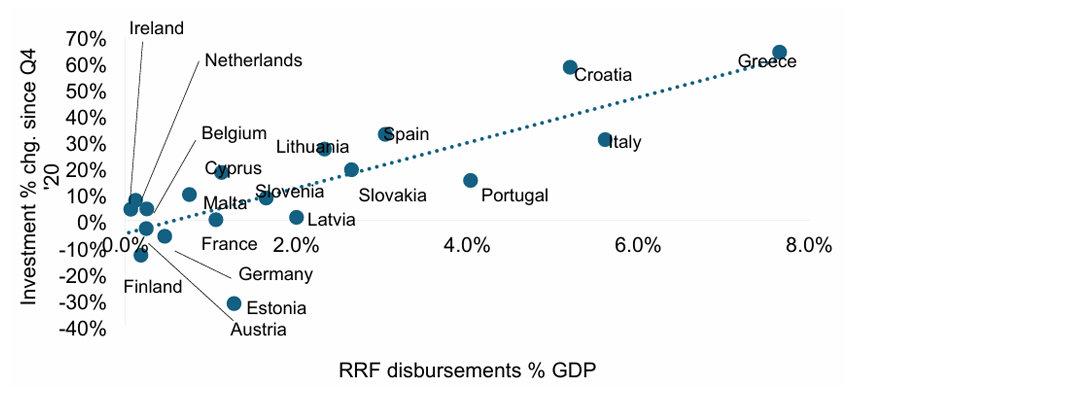

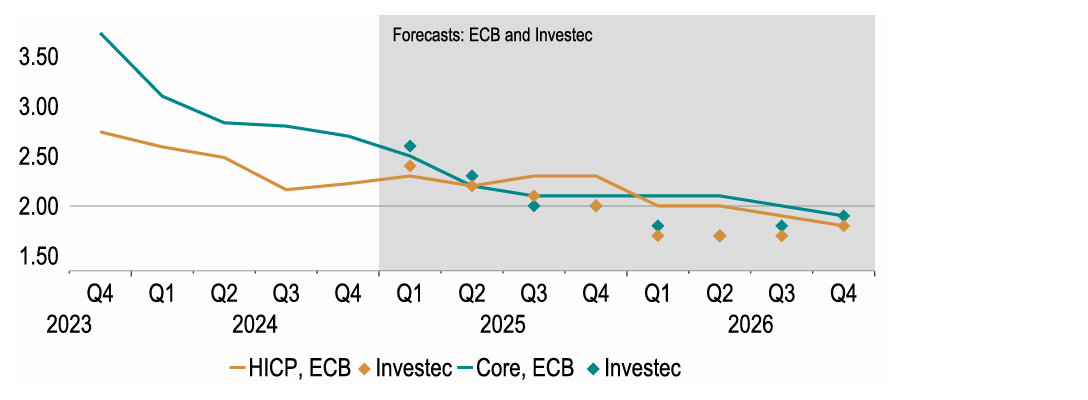

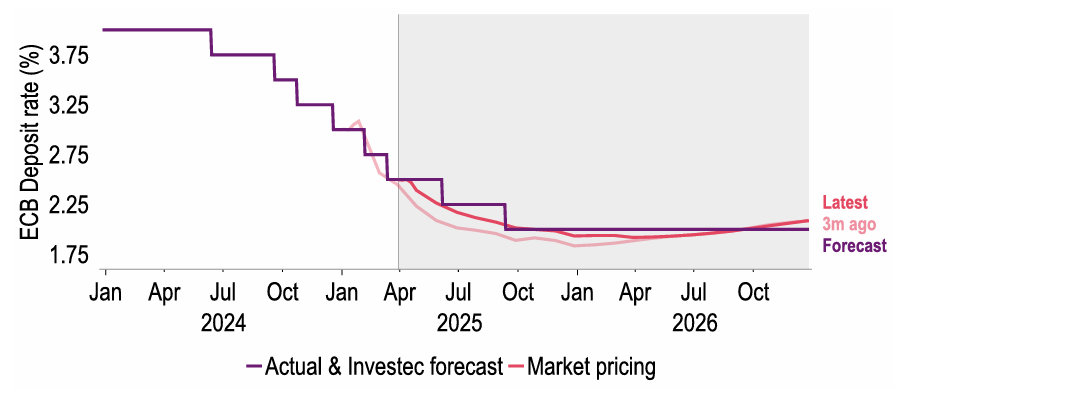

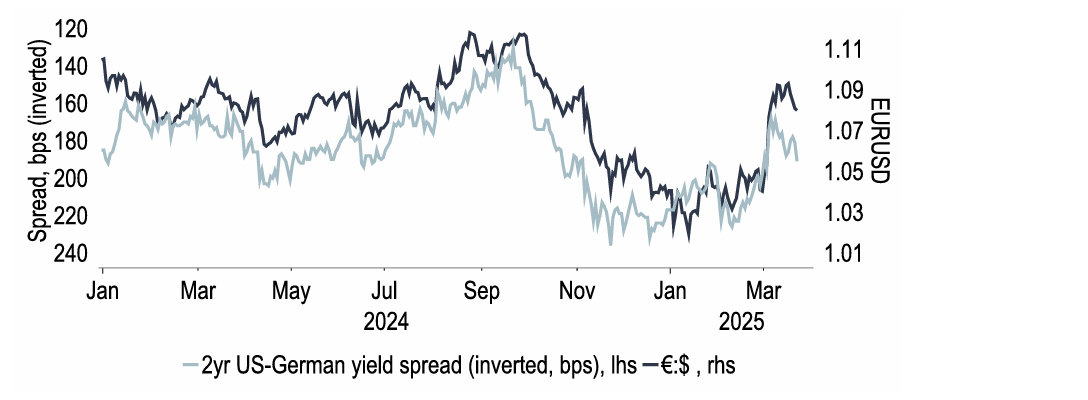

Whereas the threats of escalating tariffs skew near-term growth risks to the downside, medium-term prospects have been boosted by seismic changes in Europe’s approach to defence spending. This is especially true in Germany, where we have lifted our 2026 GDP forecast to 1.7%; as a consequence, our EU20 GDP has been raised to 1.6% too. But 2025 remains unchanged at 1.0%. This has implications for inflation, as do tariff developments. Nonetheless we remain of the view that inflation remains on a path to the 2% target, allowing for a further easing in ECB policy, albeit more cautiously. We now see the Deposit rate reaching 2% in September and holding there. We have hence revised our €:$ forecasts, no longer envisaging parity being reached. Instead we have pushed up our end-year targets to $1.08 (‘25) and $1.15 (‘26).

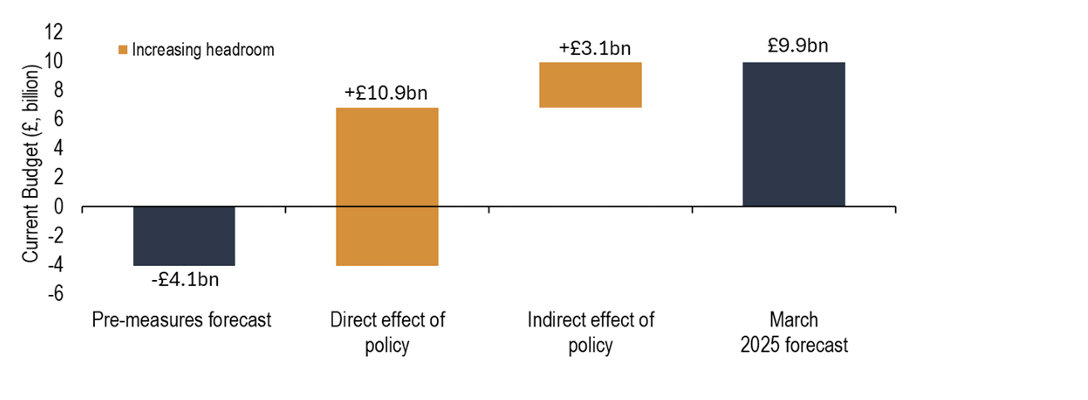

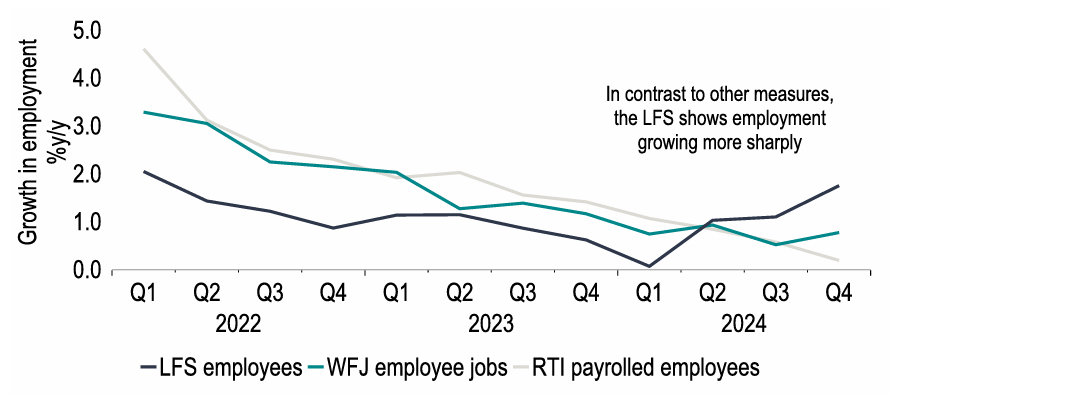

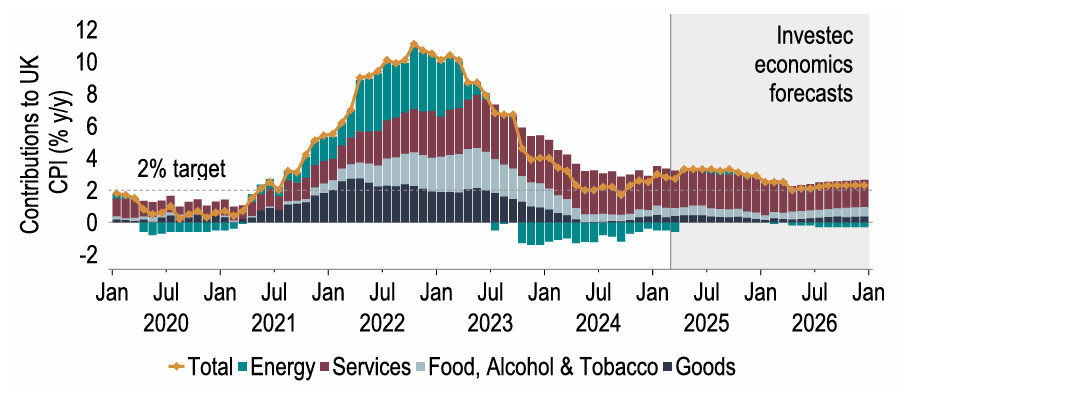

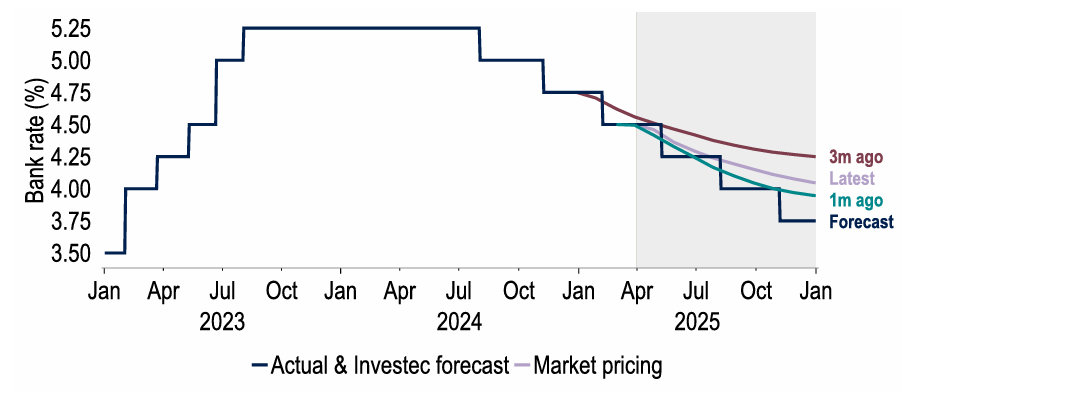

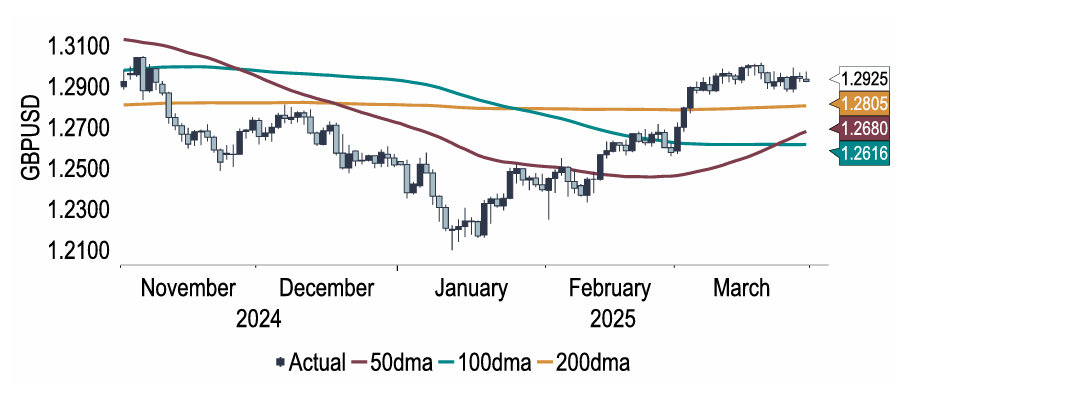

We have not yet factored in effects from any ‘Liberation Day’ tariffs. For now, our 2025 GDP forecast remains little changed at 1.1%. At the Spring Statement, Chancellor Reeves’ tightening of fiscal policy restored £14.0bn against her ‘stability rule’ compared with what would otherwise have been a £4.1bn miss. On inflation, we judge that lower wholesale gas prices and a firmer pound will limit the peak in inflation to 3.3% from 2.8% now and compared with a Bank of England forecast of 3.7%. Coupled with slightly tighter fiscal policy and (perhaps) some questions over whether productivity trends are as weak as official figures show, the MPC should sleep easier over inflation prospects. Accordingly we stand by our call that it will bring the Bank rate down by 25bps to 4.25% in May and to 3.75% by year-end. We have pushed our cable forecast up to $1.28 for the end of this year and to $1.32 by end-2026.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more market insights

Stay up to date with our insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.