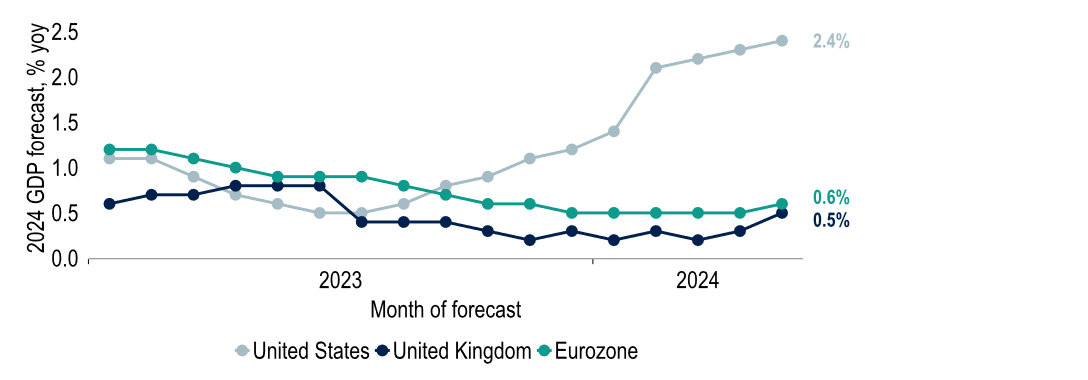

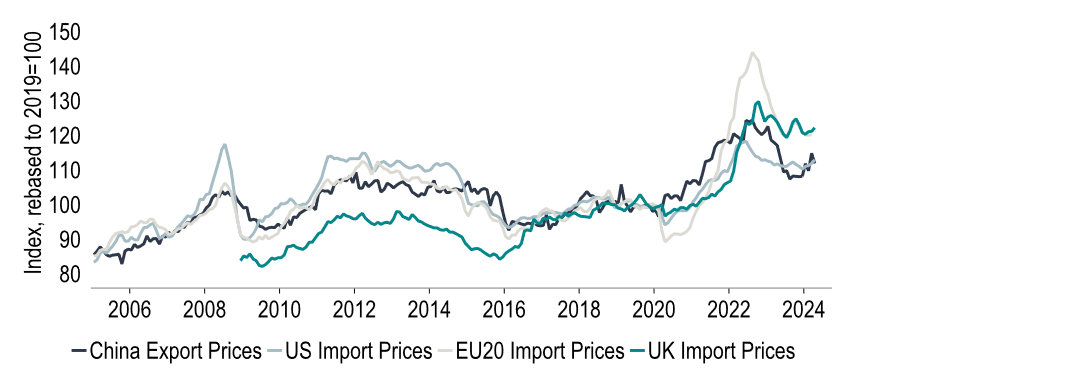

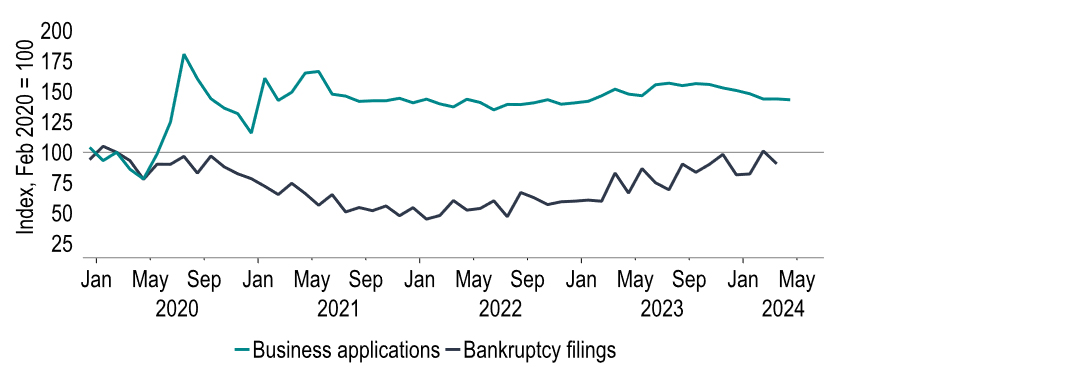

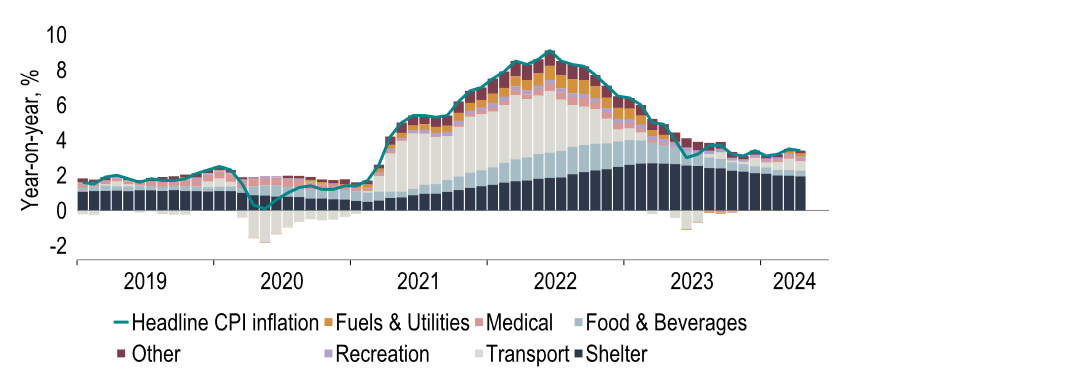

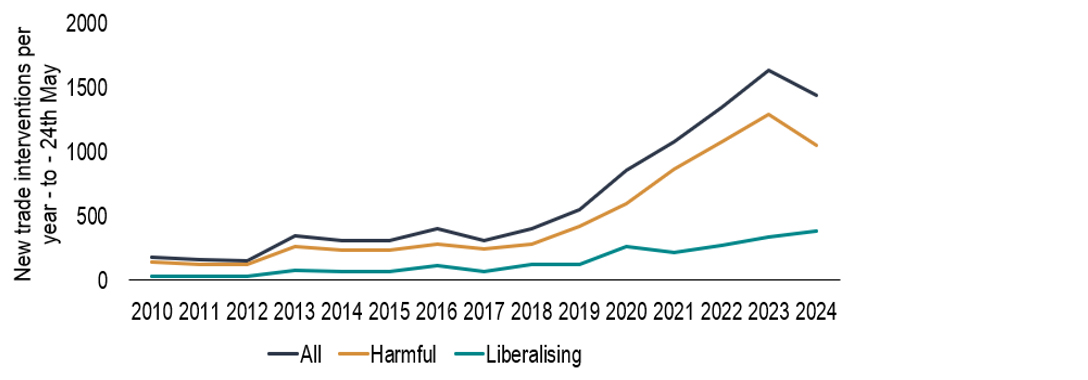

Optimism about 2024 US growth prospects has risen since mid-2023. More recently, consensus forecasts for EU20 and UK GDP growth have also moved up. Even so, we expect their central banks to begin cutting rates before long – the ECB as soon as next month, the BoE in August (post election purdah period) and the Fed in September. This is due to lower inflation, which can be expected to feed into lower inflation expectations too. Helpful in cutting inflation has been that China’s export prices, and thereby others’ import prices, have declined, amid a strategy to push manufacturing as a driver of Chinese growth. We are mindful of the risk rising protectionism could pose, but this is hard to quantify for now. Margin compression may become a negative for stocks; yet stronger growth and lower rates are positive.

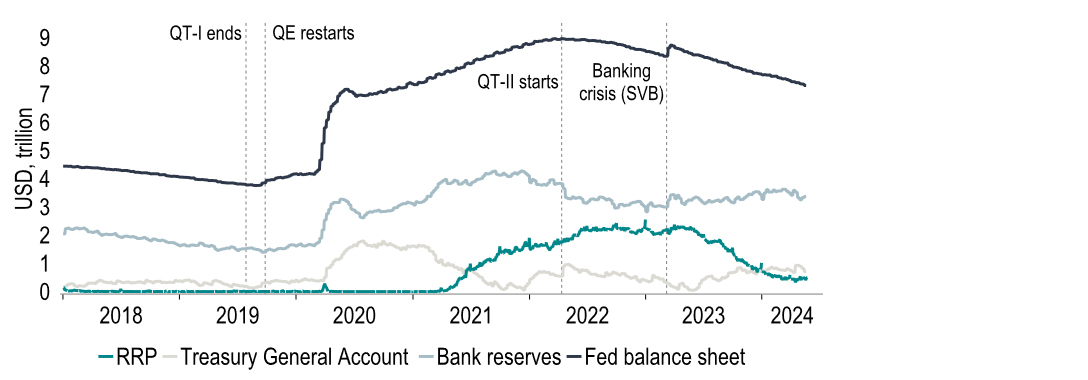

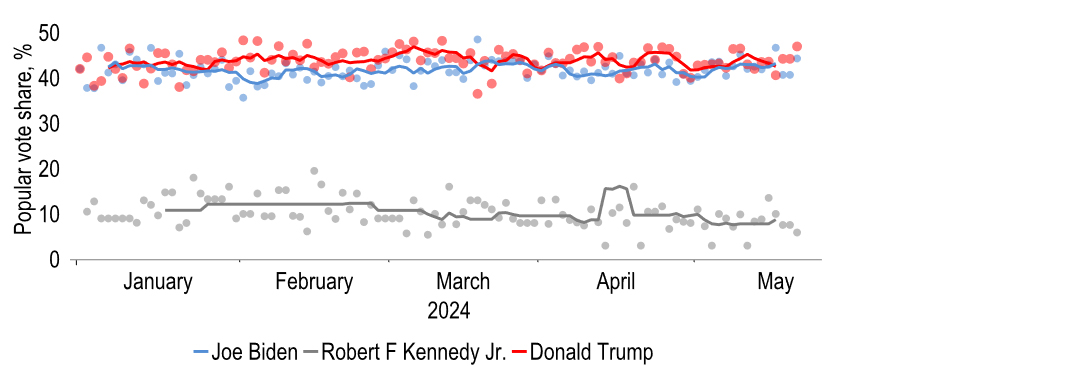

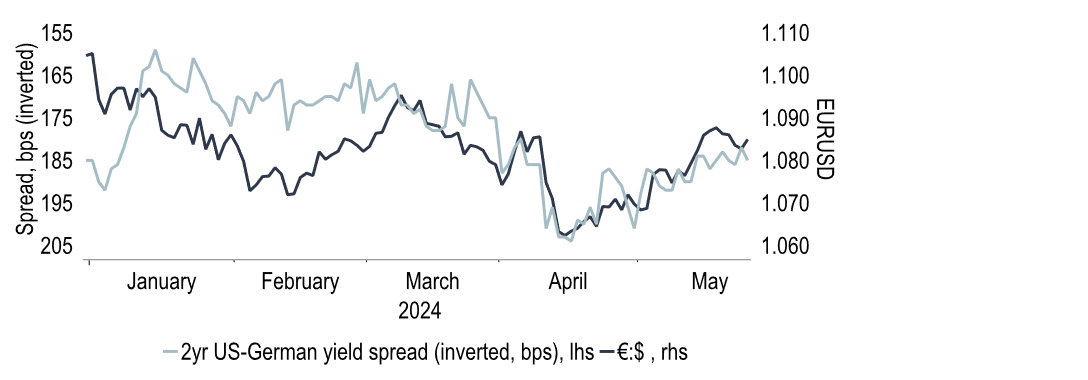

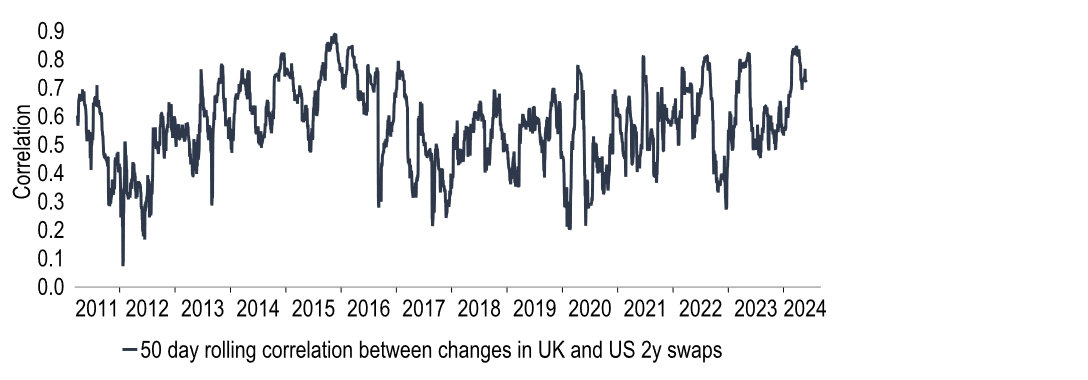

The main message from the last FOMC meeting was that the Fed was not prepared to reduce interest rates anytime soon. That followed hotter-than-expected data that raised fears that it could take longer for inflation to return to the 2% target. But we maintain our view that a first policy rate cut could be as soon as September. There are tentative signs of a loosening in the jobs market and PCE inflation has been making progress towards target. The fairly resilient economic backdrop may result in the FOMC taking the more scenic route to ‘neutral’ though, stopping to assess the impact on the real economy on its way down. We now see an end-‘25 Fed funds target range of 4.00-4.25% (prior: 3.75%-4.00%). As rate cuts become a reality, we expect the greenback to soften, pencilling in EURUSD at $1.12 for end-‘25.

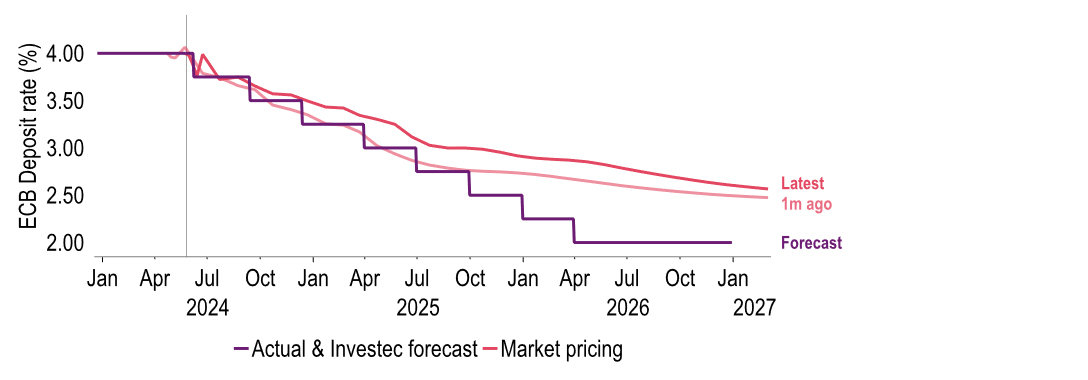

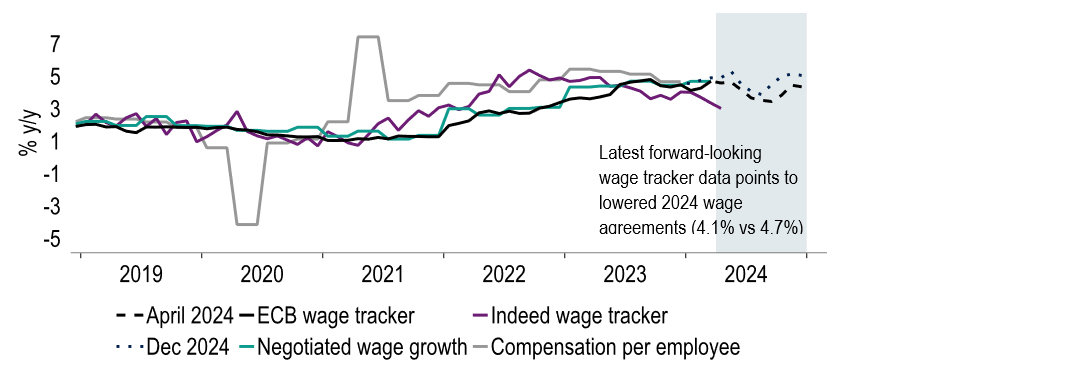

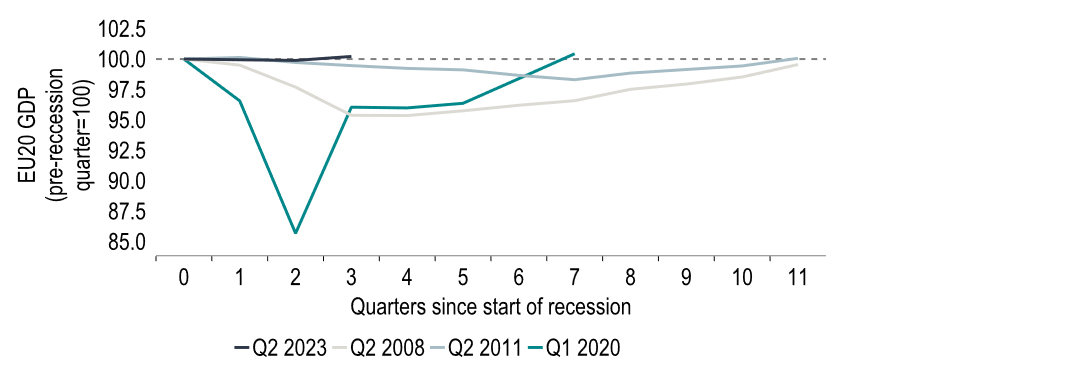

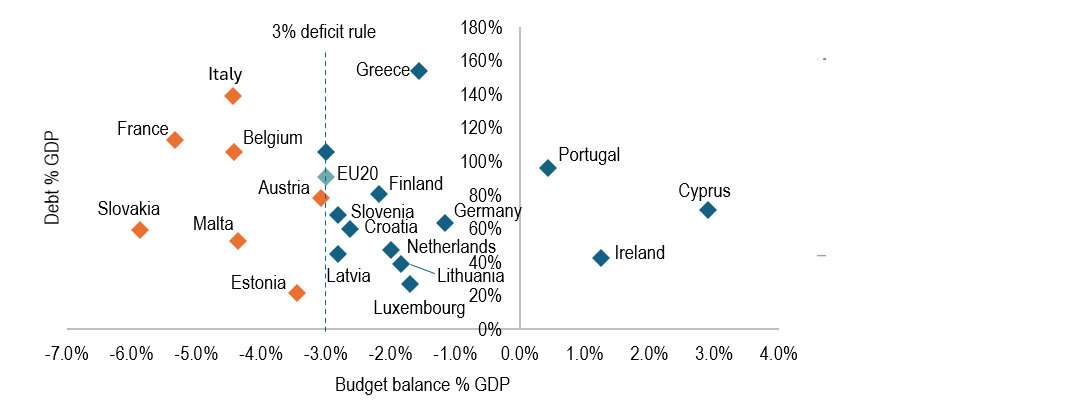

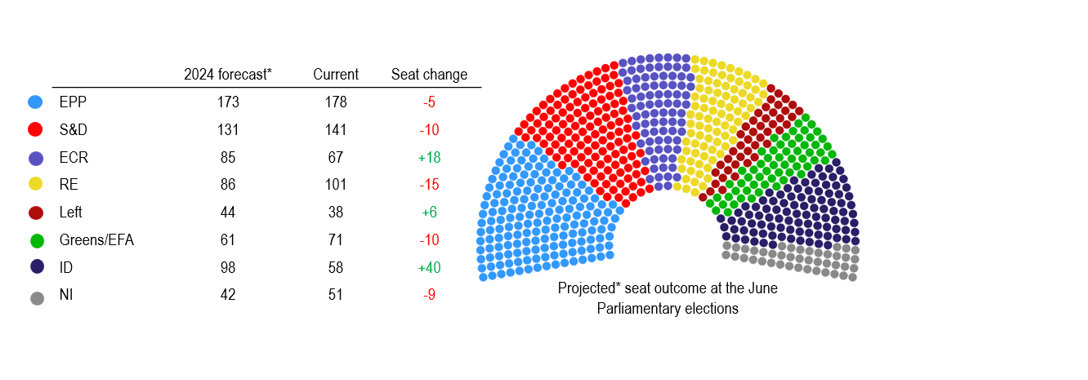

The ECB has left little doubt that it intends to cut policy rates from June, playing down the latest rise in negotiated wage growth. The path of rate cuts thereafter is more open. Our expectation is that wage growth will trend down, helping to cut services inflation. Amid a recovery in GDP (our ’24 GDP growth forecast has been raised to 0.8% and ’25 kept at 1.7%), this should allow the ECB to proceed along a gradual path of lowering rates by 25bps at each quarterly staff projection meeting this year and next. But June is not only an important month for monetary policy: next month the European Commission will set out fiscal adjustment plans for countries deemed to be in excessive deficit, and the European parliamentary elections could engender a shift to the right, with potential repercussions for EU policymaking.

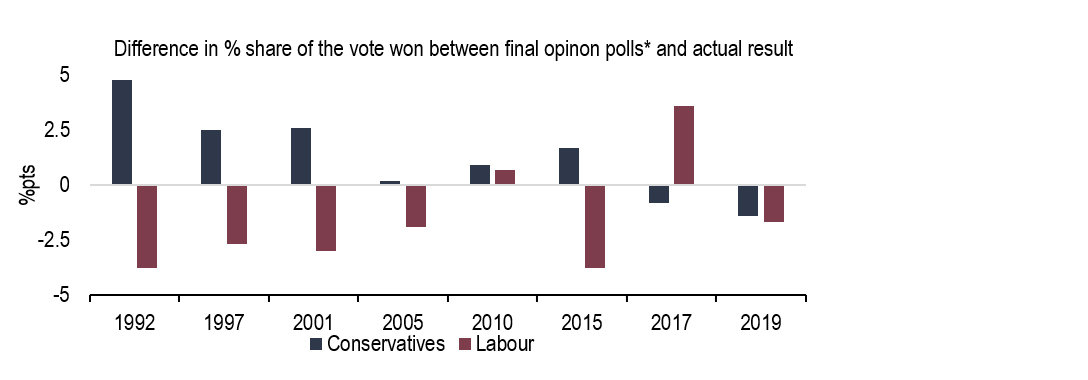

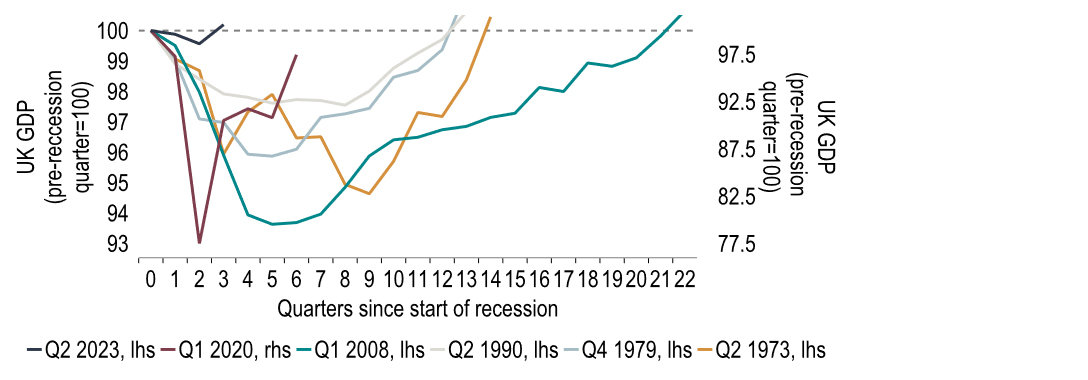

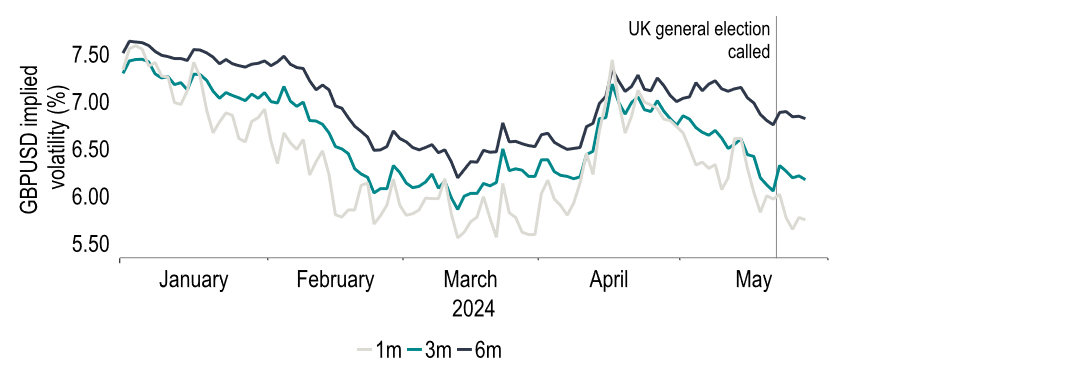

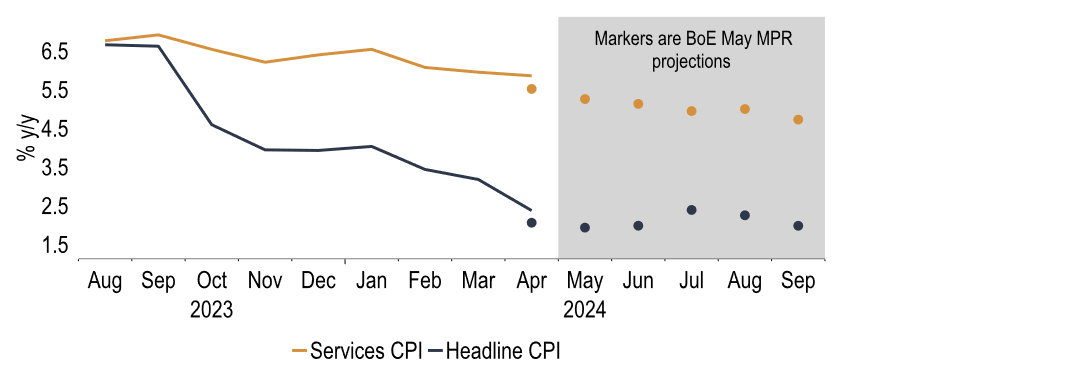

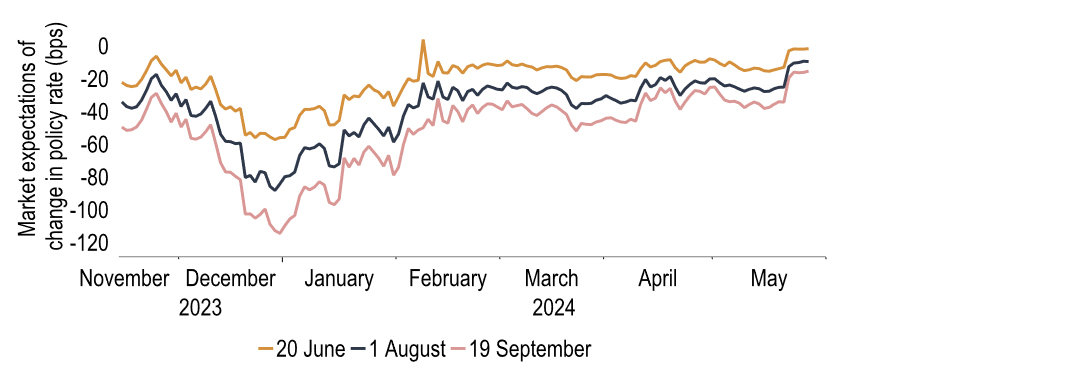

With a UK general election now set for 4 July, the Conservatives trail Labour by 20% plus in the polls, despite the fact that the economy has now officially escaped from recession and that inflation, at 2.3%, has fallen very close to the 2.0% target. This gap might narrow and recent elections have shown the Tories outperforming pre-election polls. Even so, Labour could well be heading towards a huge majority. Most domestic markets (currency options were a modest exception) took little notice of Mr Sunak’s election announcement. We have changed our rate call, partly due to firm data on the services CPI and pay but also because, by convention, the Bank of England declines to make public statements in election periods, making it difficult to explain a rate cut on 20 June. We now expect the first Bank rate cut to take place in August (not June), bringing our end-‘24 target to 4.75% from 4.50% previously.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.