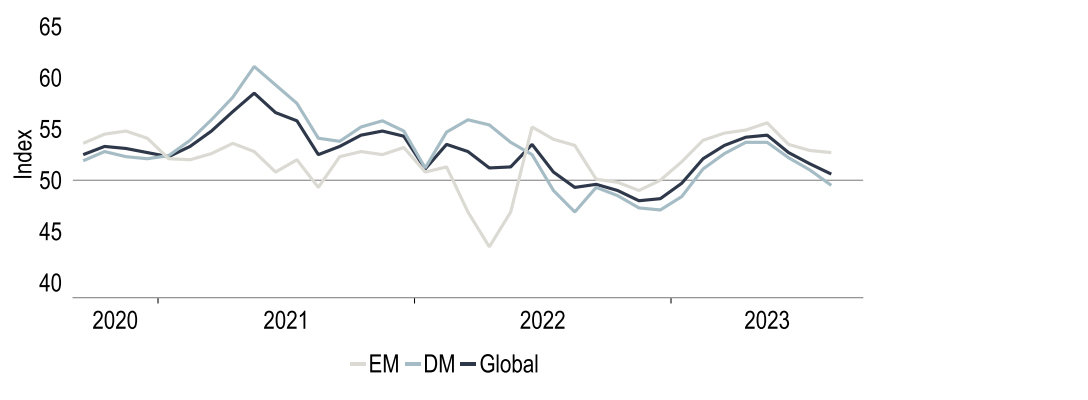

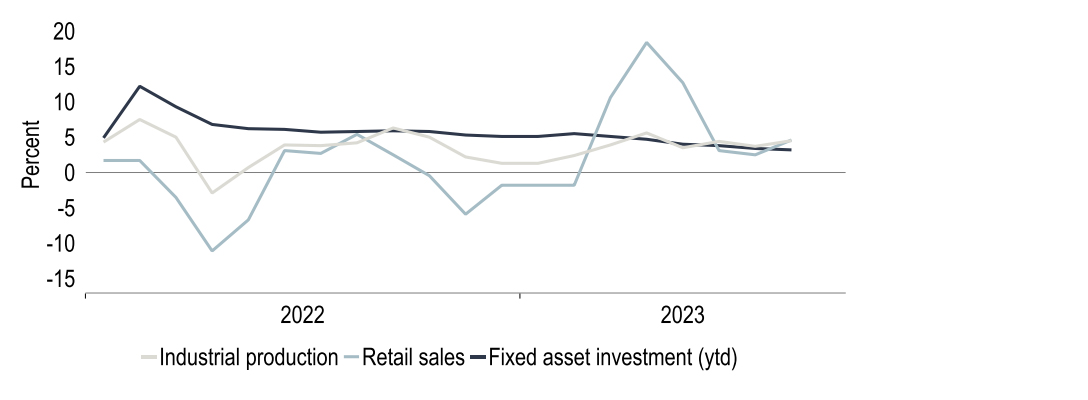

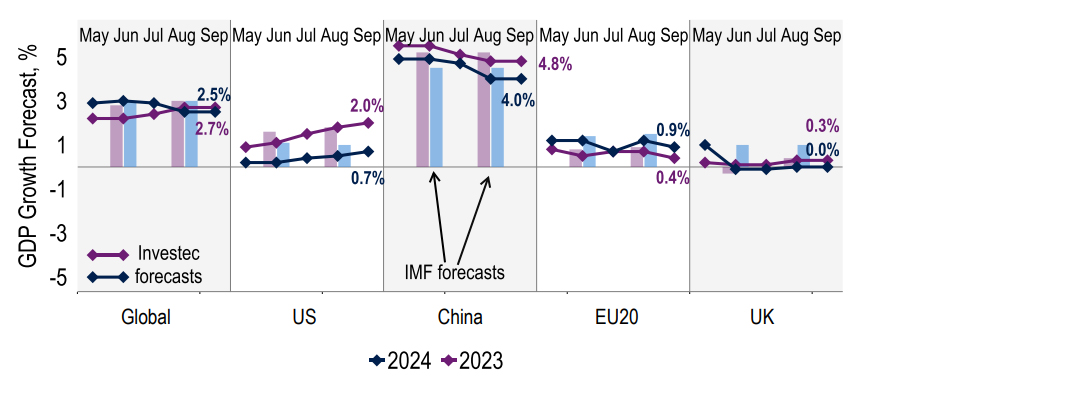

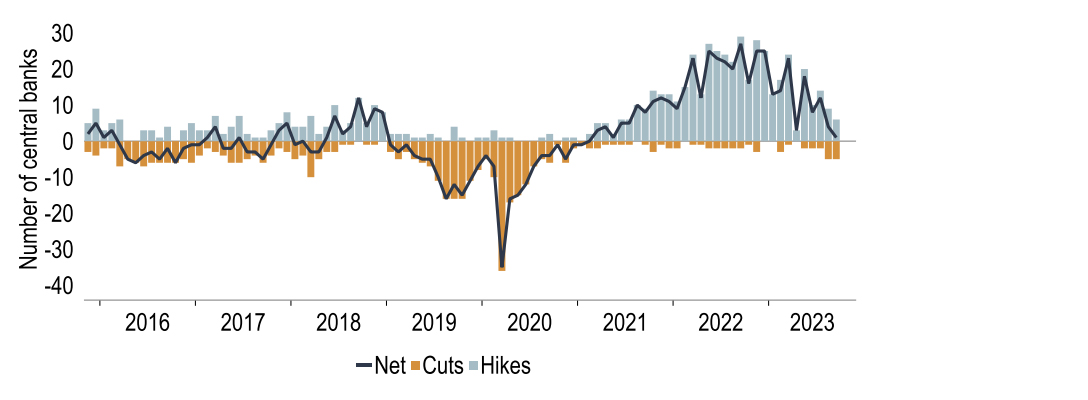

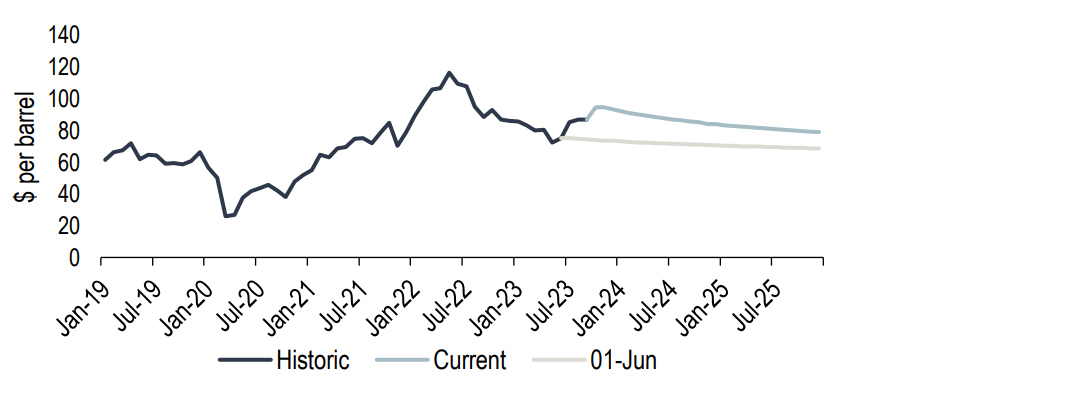

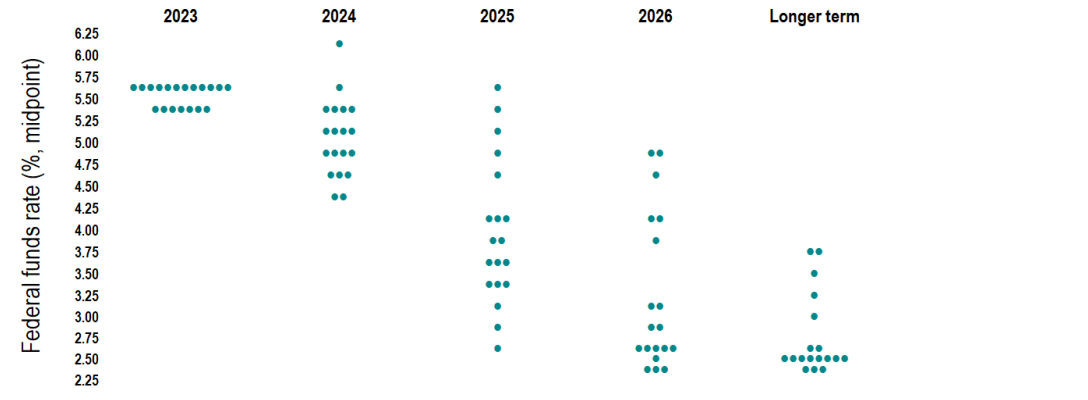

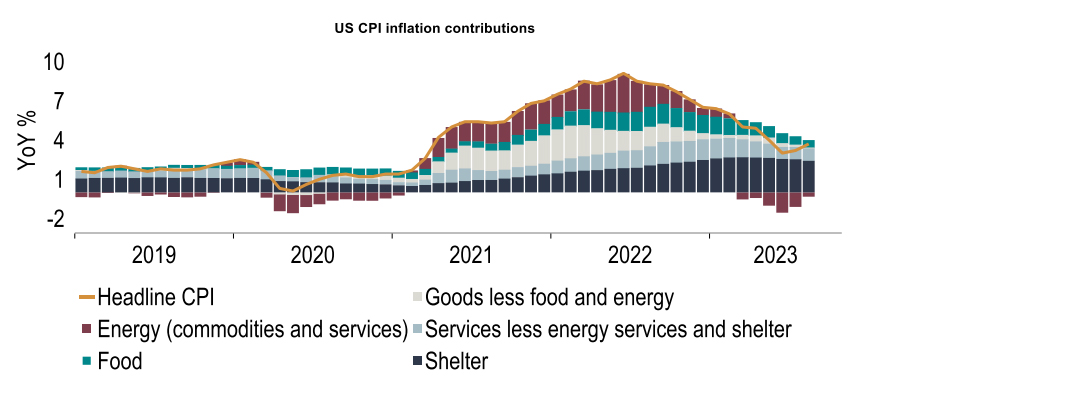

Central bank policy has seen the hawkish hold emerge as flavour of the month, with policy rates reaching their likely peaks. As such the tone is now turning to how long rates remain at the current restrictive levels rather than the peak itself. This messaging that rates may remain at current levels for some time is a factor supporting yields and the US dollar, which has prompted an uplift in our forecasts. However, we continue to believe that directionally the US dollar and yields should soften over the course of 2024. This is driven by our baseline scenario of a further moderation in inflation and a slow down in demand, with signs continuing to emerge of a slow down in global economic activity. Our forecasts for Global growth are unchanged, but continue to anticipate subdued growth over 2023 (2.7%) and 2024 (2.5%), with downgrades to the EU20 offsetting an upgrade to the US.

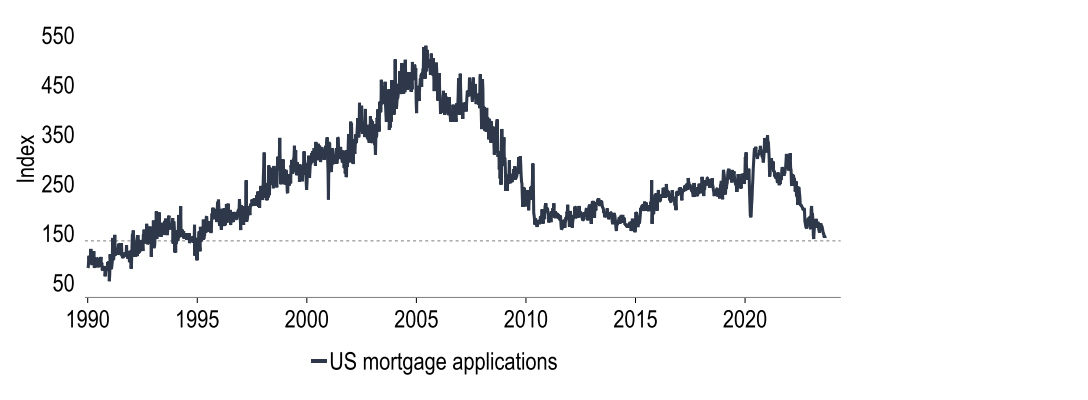

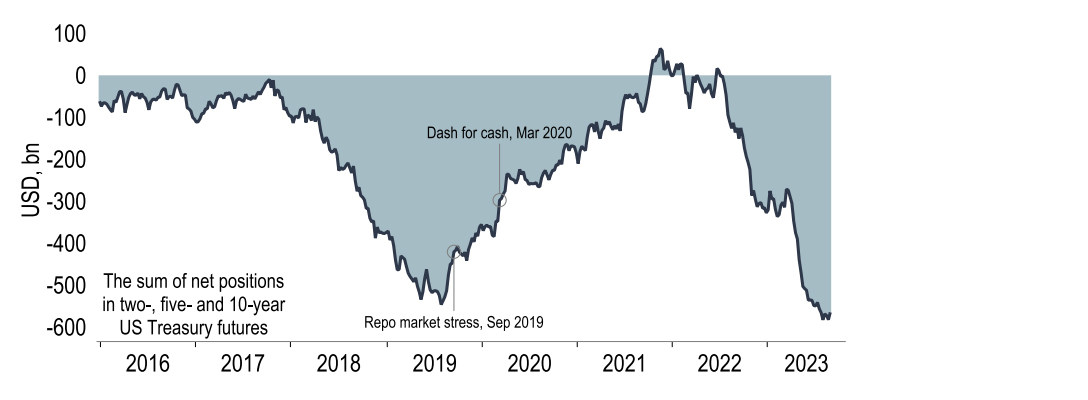

The resilience of the US economy to the higher rate environment has been quite remarkable thus far. We find the recent strength of economic data hard to ignore and therefore have revised our GDP growth forecast for this year up to 2.0% (prior: 1.8%). We also are no longer expecting a recession in Q4/Q1, although we do still forecast essentially stagnating output throughout the winter. But given the relatively more upbeat prospects we have pushed back our expectation for the first Fed rate cut to June next year. With the dollar no longer weighed down by earlier rate cuts relative to the likes of the ECB and the BoE, we have lifted our dollar forecasts. Lastly, although we still think it unlikely that Treasury yields will be maintained at the current high levels, we have softened the pace of decline, expecting the 10Y yield at 3.75% at end-2024.

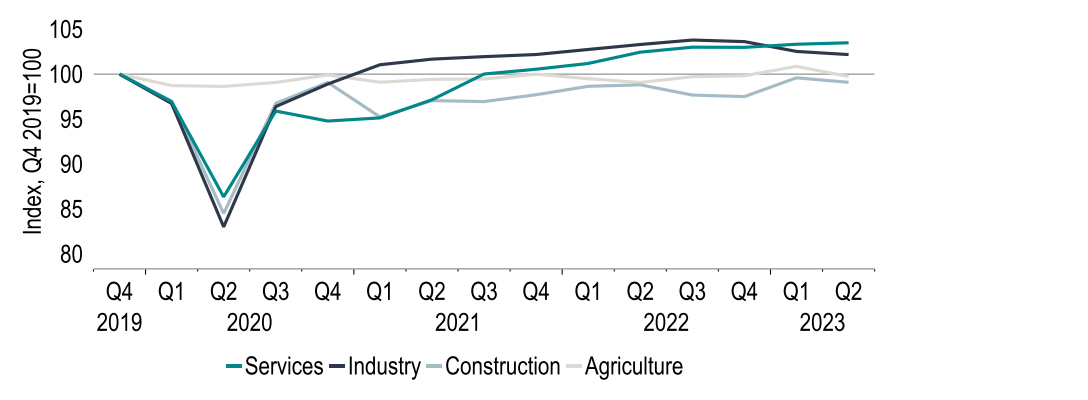

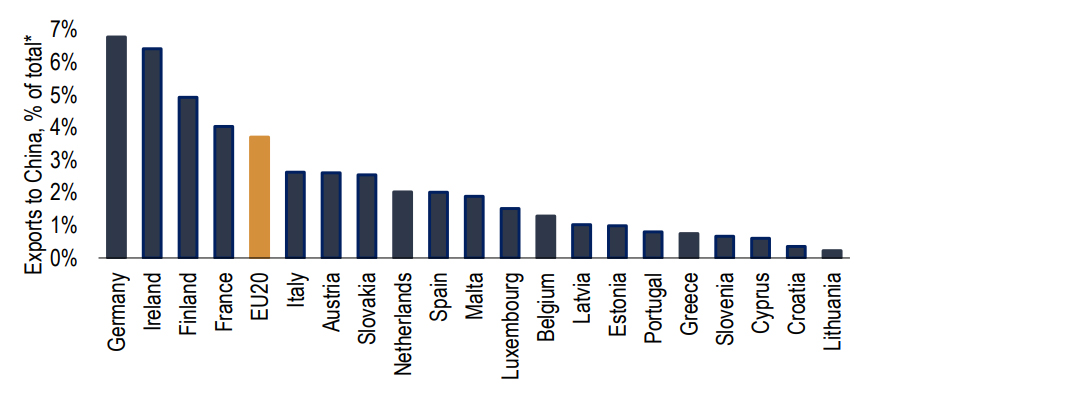

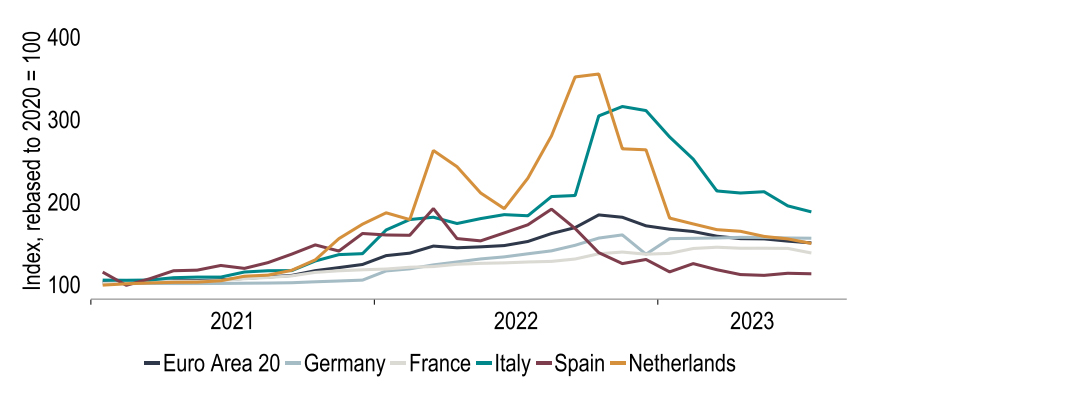

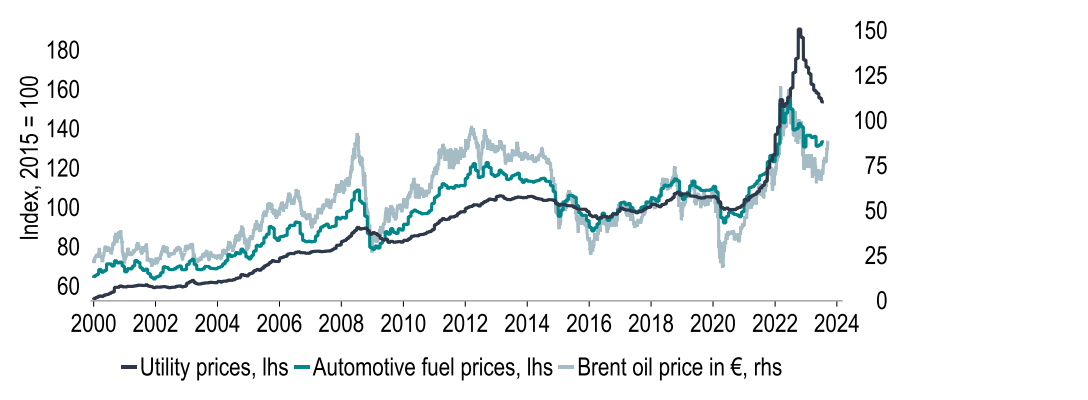

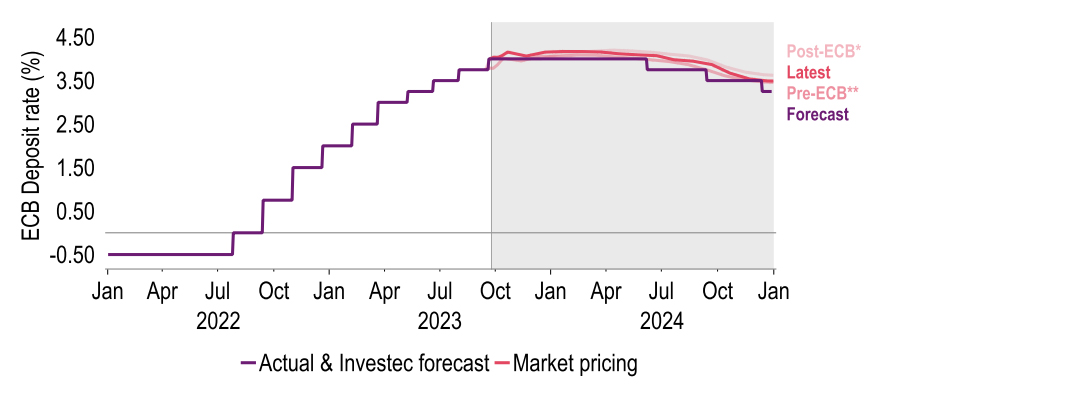

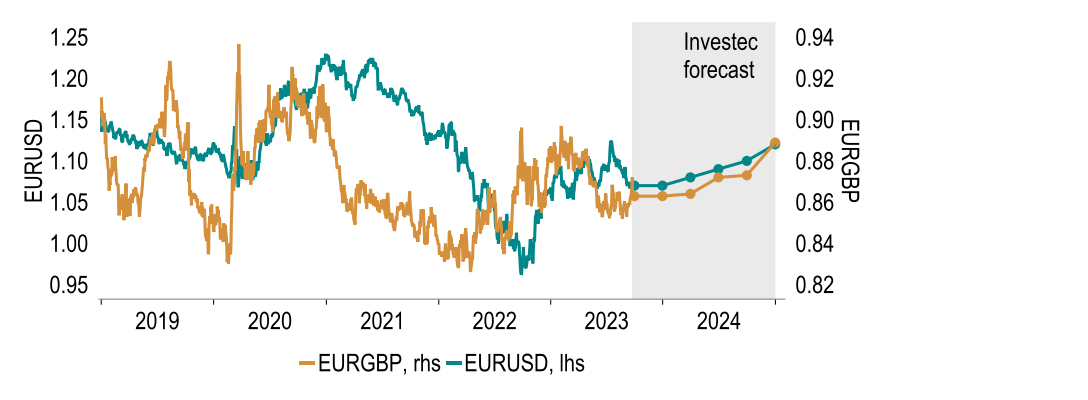

The Eurozone has lost momentum, and the hitherto resilient service sector has now been caught up in the malaise. The tough medicine of rate rises is working as intended and welcomed by the ECB to the extent it reduces inflation pressure. China’s stuttering economy is taking its toll too, first and foremost in Germany, given trade ties. We have cut our EU20 ’23 and ’24 GDP growth forecasts by 0.3%pts each, to 0.4% and 0.9%, respectively. Barring data surprises, further rate rises appear unnecessary. We expect that, from mid-’24, a series of gradual rate cuts could begin as the current degree of restrictiveness may no longer be needed. By end-’24 the Deposit rate may reach 3.25%. Changes in our US rate expectations mean we see less scope than before for EUR appreciation against USD. Our end-’23 and -’24 forecasts are $1.07 and $1.12.

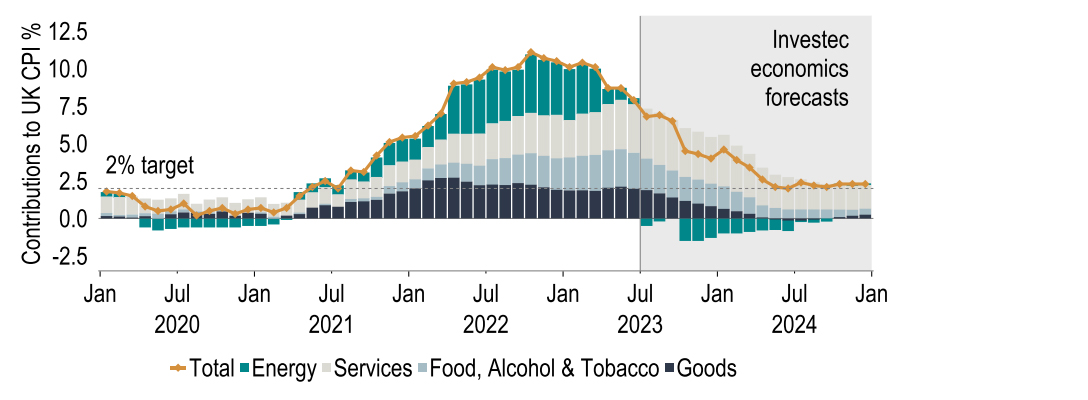

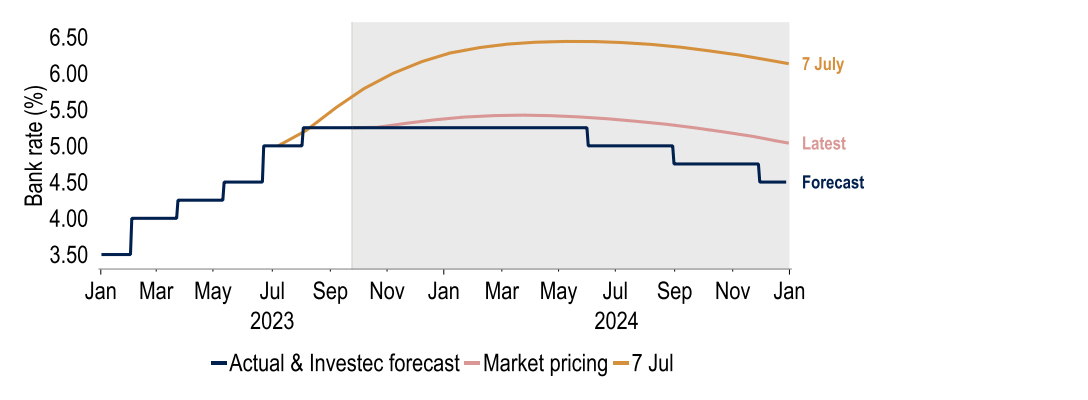

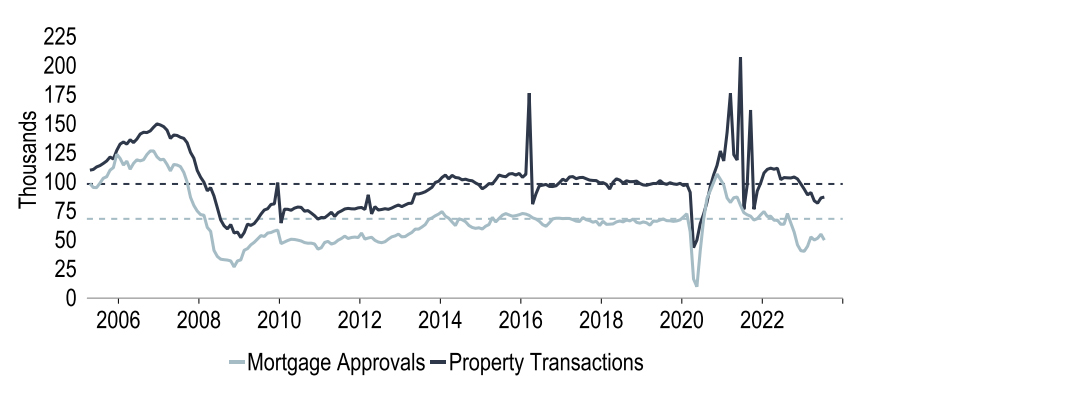

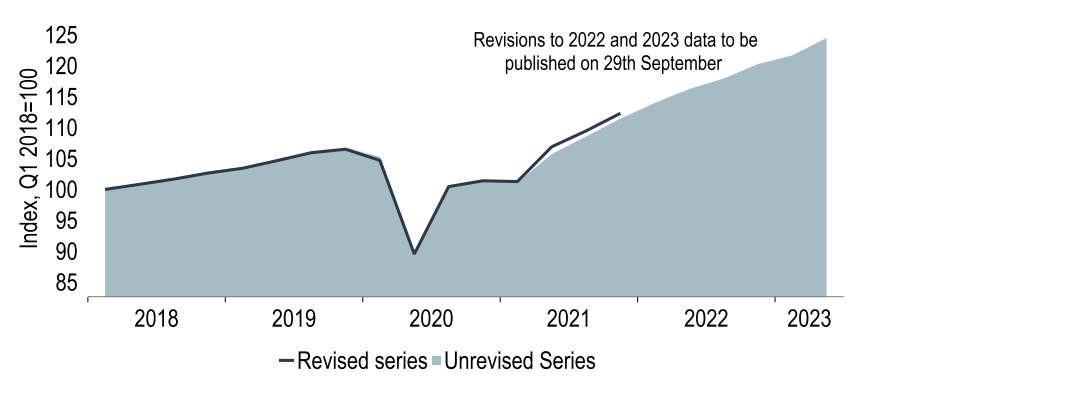

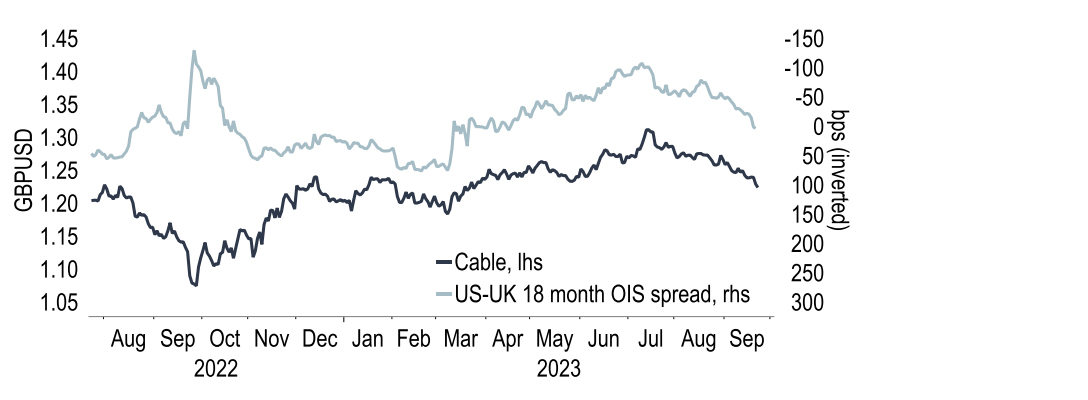

Lower than expected inflation, at last, added to survey evidence pointing to weakening activity, has tilted the balance for the MPC to hold policy rates this month. We are now of the view that the Bank rate is at its peak. If our narrative of a mild recession this winter, along with a further easing in inflation, plays out – watch whether revisions to GDP alter the starting point – a less restrictive policy stance could become appropriate from mid-2024, with three rate cuts by the end of next year, to 4.50%. Markets have already repriced a long way, but we see further scope for rate expectations to be scaled back. Given this relative rate outlook, GBP may stay under pressure in trade weighted terms, failing to participate in what now looks like a smaller USD sell-off inany case. Our end-’23 and end-’24 GBPUSD forecasts are $1.24 & $1.26.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.