Global Economic Overview – September 2024

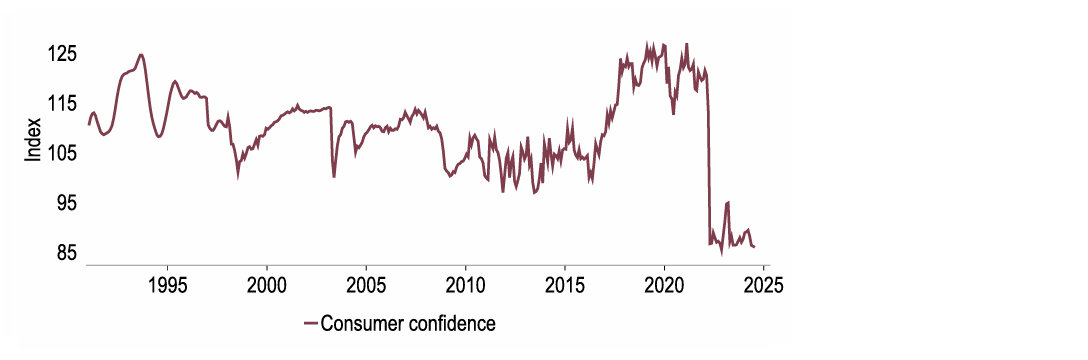

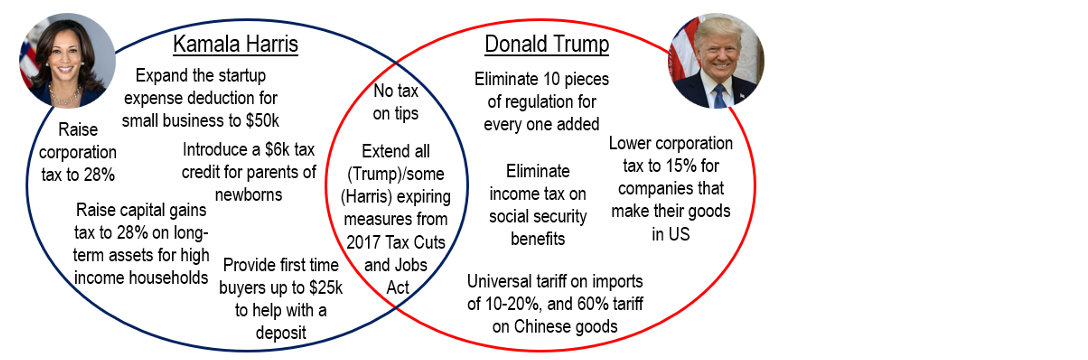

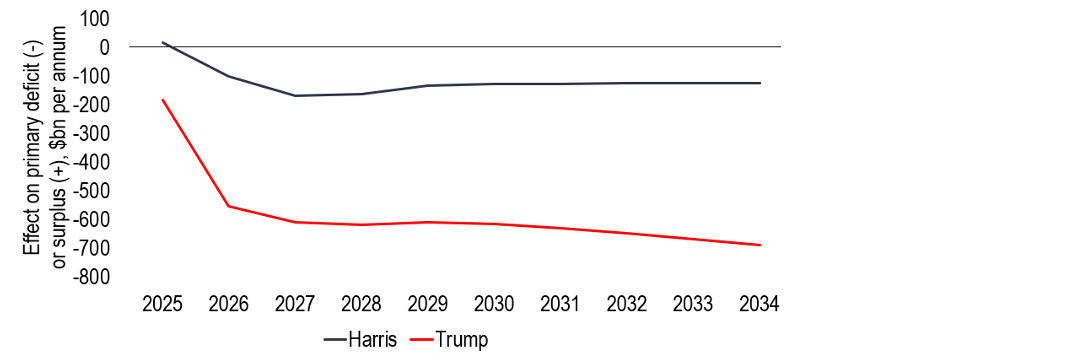

Global financial markets continue to be driven by evolving expectations over where interest rates may be heading. But the global economic backdrop is not just about monetary policy, with the US election on 5 November set to be a focal point and geopolitical tensions continuing to rise around the world.

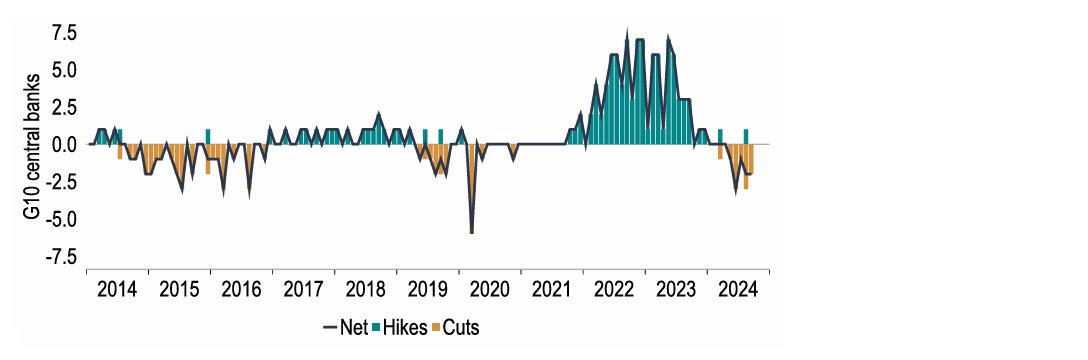

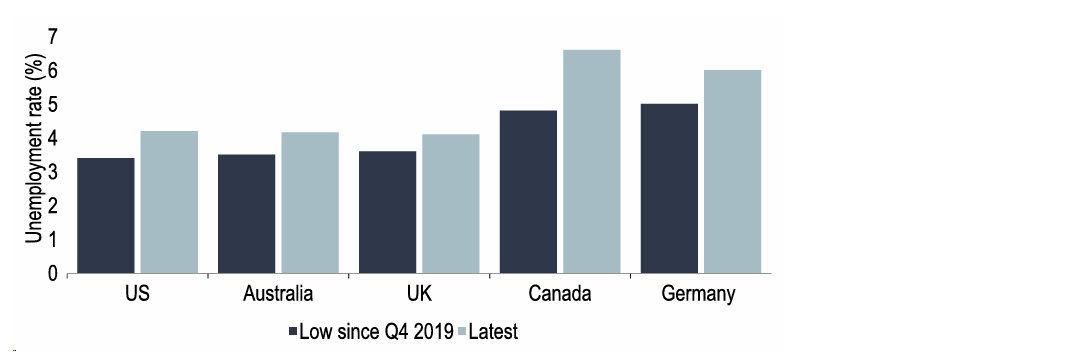

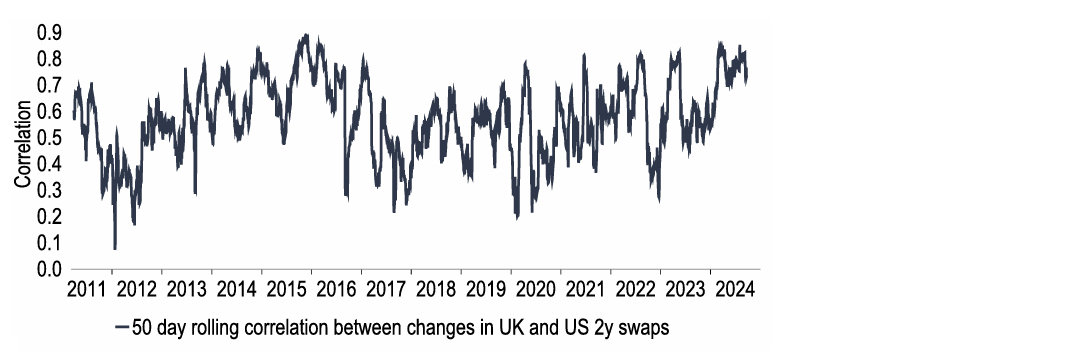

Now that most major Western central banks have started easing monetary policy, the question is: what will the path downward look like? With labour markets loosening and growth starting to disappoint in some economies, central banks may want to ease restrictiveness faster in order to avoid a ‘hard landing’. But although we acknowledge some cracks are starting to appear, our global growth forecasts are little changed at 3.2% for this year and 3.1% for 2025, so a major weakening in the labour market does not seem on the cards. Therefore we consider current market pricing for rates a tad aggressive, perhaps overstating the read across from the Fed’s bumper 50bp cut this month. That said, we do expect the outlook for US rates to continue to be a key driver of market sentiment over the coming months.

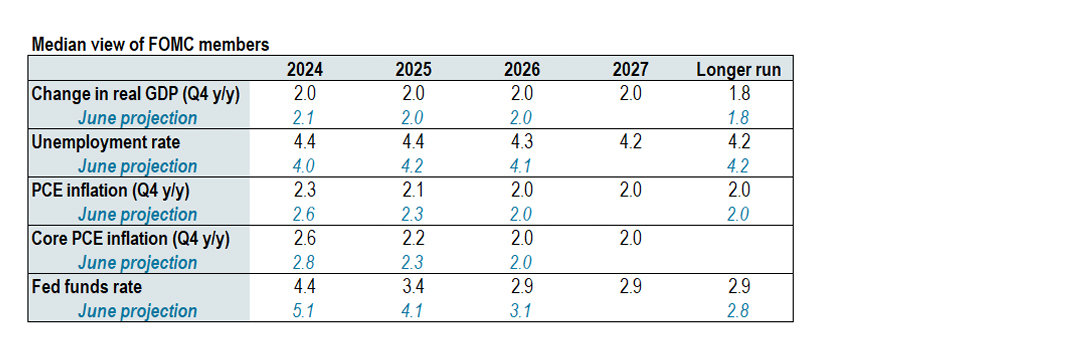

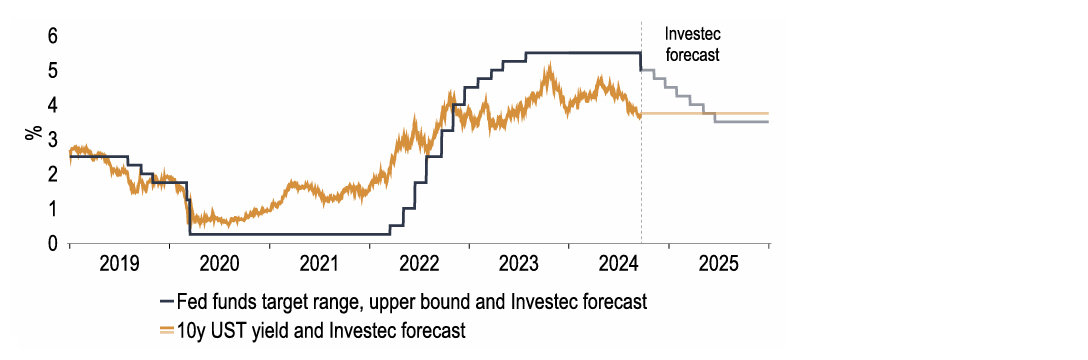

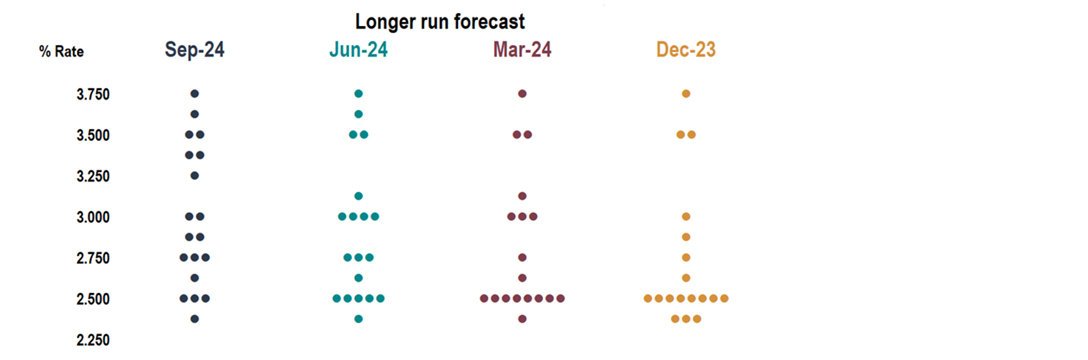

The key development since our last Global is the apparent shift in the Fed’s thinking in its plans to loosen monetary policy. With greater risks now surrounding the employment side of the dual mandate, a quick return to neutral seems to be the preferred path, relative to a slow and steady approach. This was signalled by the ‘jumbo-size’ 50bp cut at the latest meeting and the accompanying ‘dot plot’, where the median view was for 150bp worth of policy loosening by end-2025. We broadly concur. Given our prediction of modest GDP growth around the turn of the year, we expect the reductions to be front loaded, via six back-to-back 25bp cuts from here. This would take the Federal funds target range to 3.25-3.50% by end-2025.

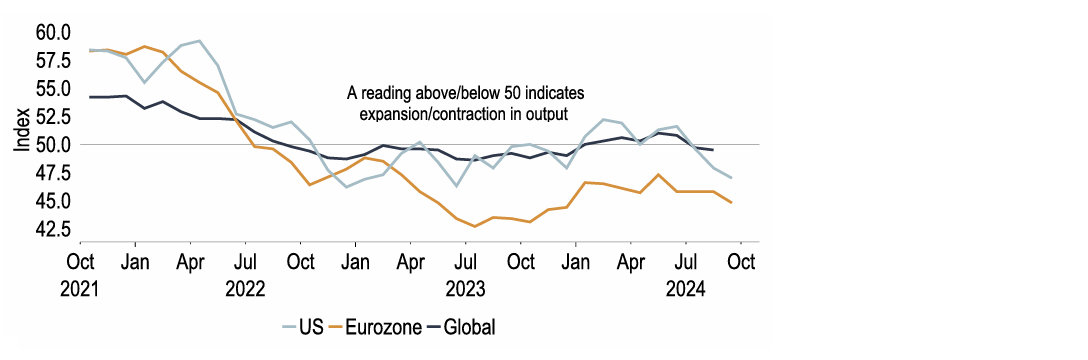

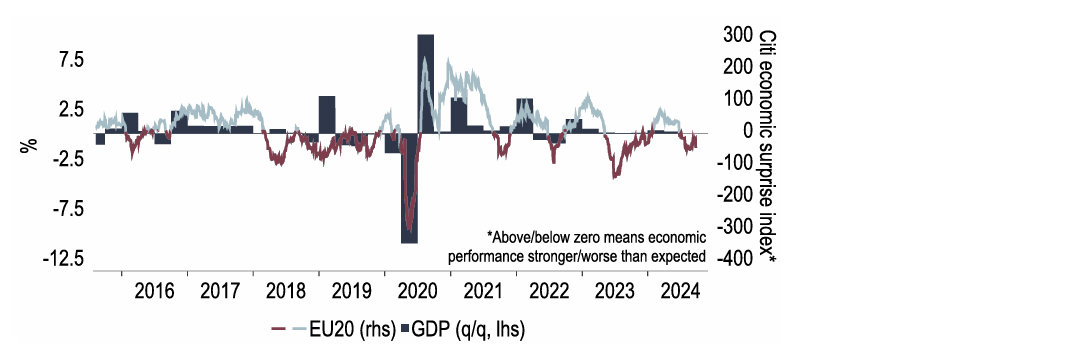

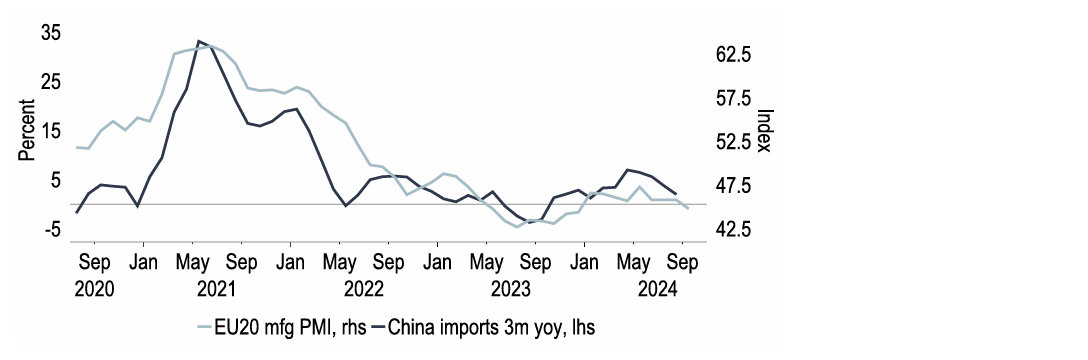

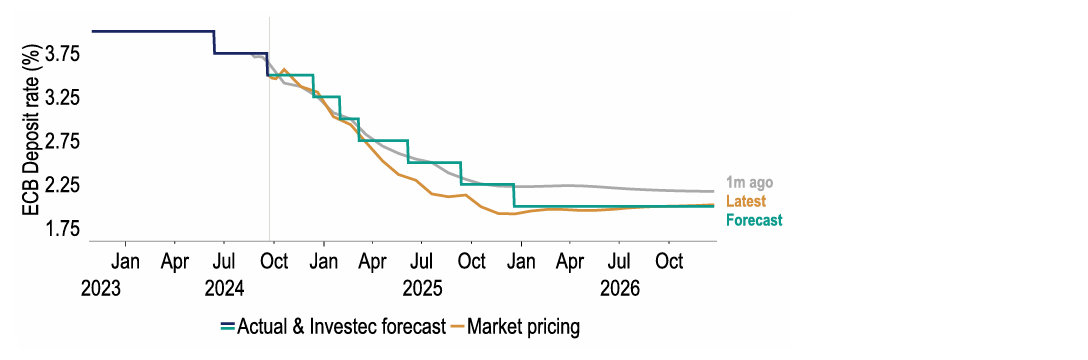

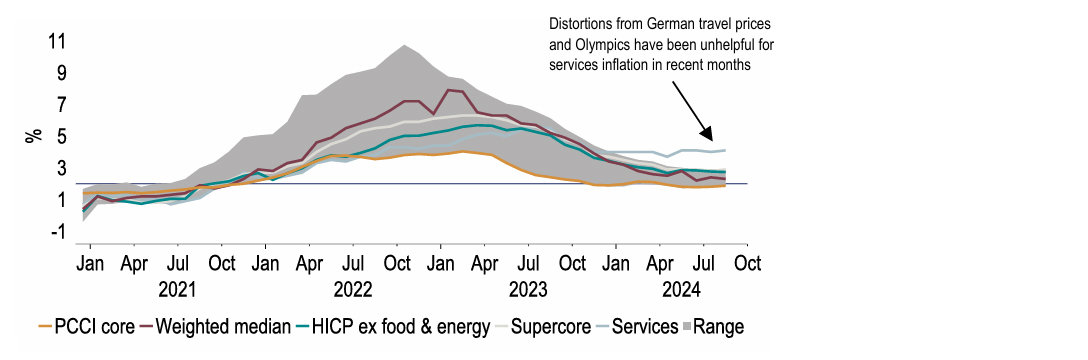

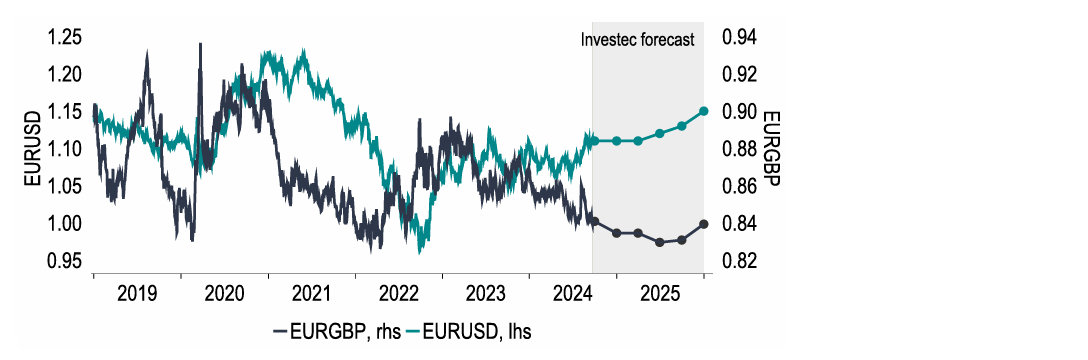

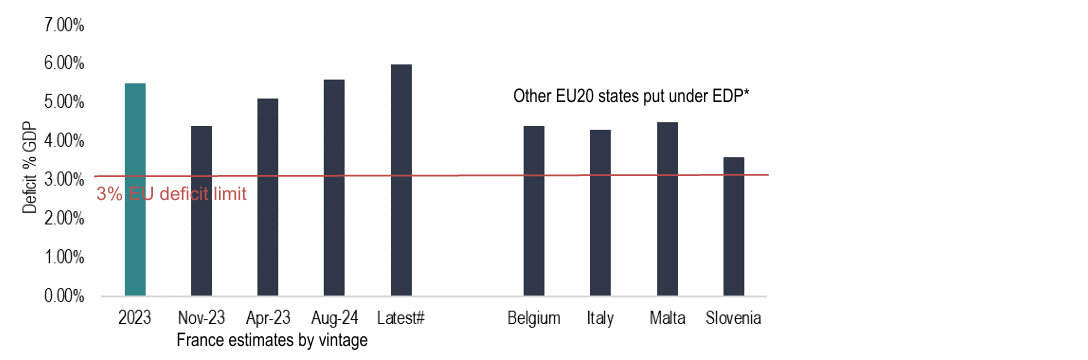

The ECB has now cut interest rates twice this year, bringing the Deposit rate to 3.50%. We anticipate a further gradual easing of policy over the coming year, our end-2025 forecast standing at 2.00%. However we judge that the balance of risks is skewed towards a faster pace of easing and the possibility that the ECB may need to take interest rates below ‘neutral’. This is due to what we perceive to be growing downside risks to the growth outlook. Manufacturing continues to languish in a recession, with few if any signs of a near-term recovery. At the same time the service sector, which has been the engine of growth over H1, is beginning to show signs of slowing levels of activity. Even so, trends within the EU20 differ. In aggregate we have only made small adjustments to our GDP growth forecasts this month, pushing both 2024 and 2025 down by 0.1%pts to 0.7% and 1.4%, respectively.

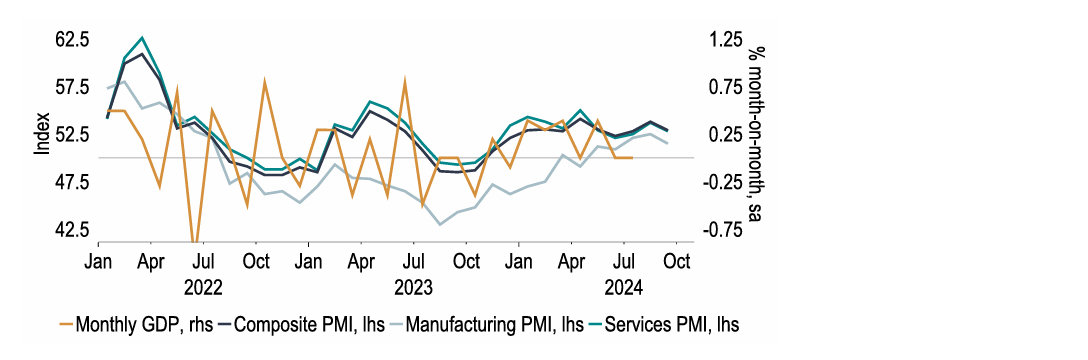

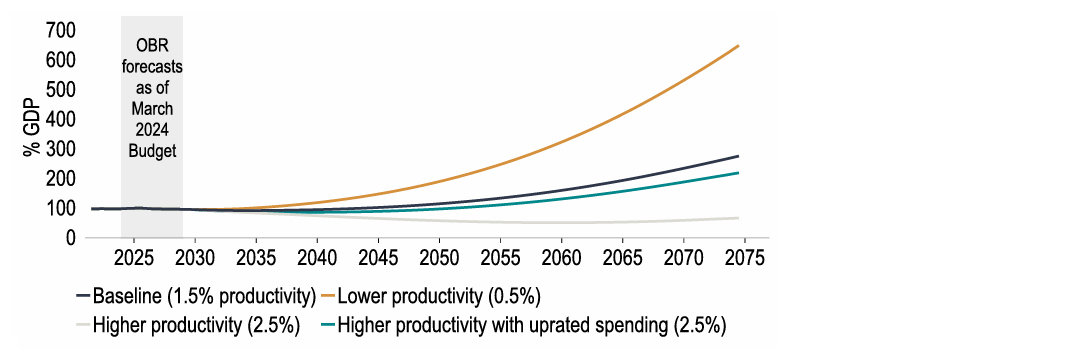

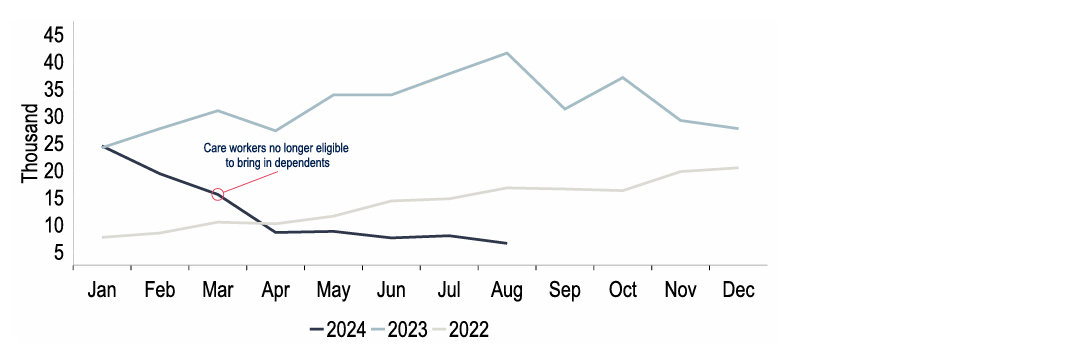

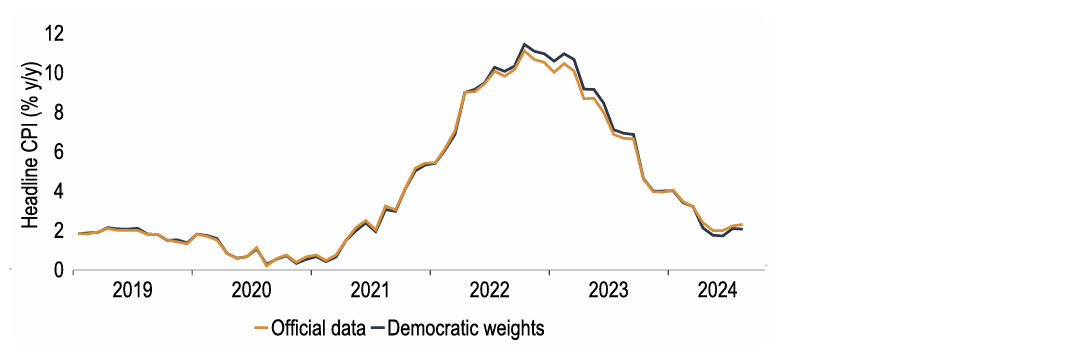

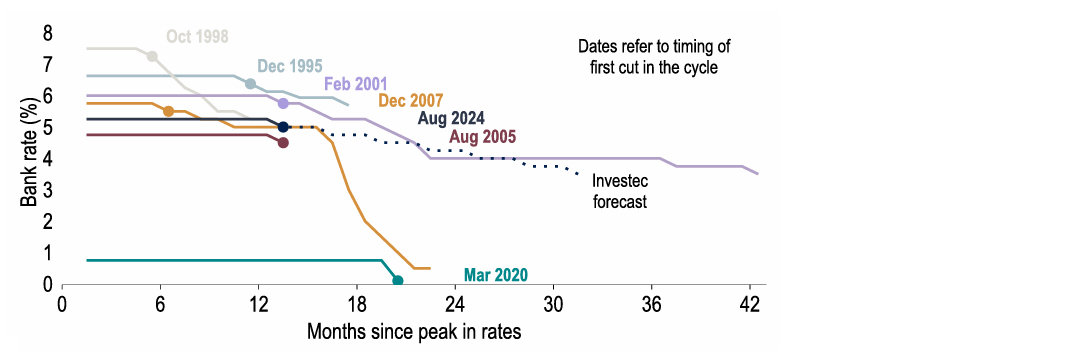

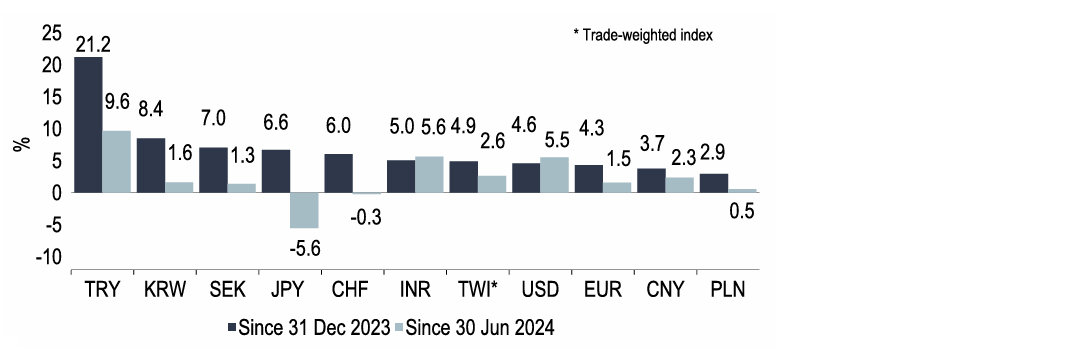

Despite GDP growth having stalled on a month-on-month basis in three of the past four reports, at least on the current vintage of data, we see the underlying picture as more positive than that, not least given business surveys. Much focus has been on the tax rises the government has flagged will come as part of the 30 Oct Budget. We doubt though that this will be the sole means to plug the fiscal ‘black hole’, as this would jeopardise investment and hence productivity growth prospects that are so crucial to the long-term sustainability of public finances. We therefore maintain our GDP growth forecast at 1.2% for ’24 and 1.9% for ’25. Correspondingly we foresee only gradual rate cuts, to 4.75% by end-’24 and 3.75% by end-’25. That would leaveroom for GBP appreciation against USD with its fading rate advantage.

For more information contact our economists

Philip Shaw

Chief Economist

I head up the Economics team for Investec in London after joining in 1997. I am a regular commentator on the economy and financial markets in the press and on TV. I graduated with an Economics degree from Bath University and a master’s in Econometrics from the University of Manchester. I started my career in the Government Economic Service at the Department of Energy before joining Barclays as an economist/econometrician.

Ryan Djajasaputra

Economist

In 2007, I joined Investec as part of the Kensington acquisition, before joining the Economics team in 2010. I provide macroeconomic, interest rate and foreign exchange analysis to Investec Group and its corporate clients. After graduating with a Bachelor’s degree in Economics from UWE Bristol.

Lottie Gosling

Economist

I joined the London Economics team at Investec as a graduate in September 2023. I graduated with a Bachelor’s degree in Economics from the University of Bath with a year-long placement working as an Economic Research Analyst at HSBC.

Ellie Henderson

Economist

I joined Investec in February 2021 as part of the London Economics team, providing economic advice and analysis for the company and its clients. Before joining Investec I worked as an economist for Fathom Consulting, where I predominantly focused on China research. I hold a Bachelor’s degree in Economics from the University of Surrey, as well as a Master’s degree in Economics from Birkbeck, University of London.

Sandra Horsfield

Economist

I am part of the London Economics team, having joined in 2020, providing macroeconomic analysis and advice to the Investec Group and its clients. I hold a Bachelor’s and a Master’s degree in Economics, both from the London School of Economics. I have over 20 years’ experience as a financial markets economist on the buy and sell side as well as in consulting.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.