Priming the pump for monetary tightening

In our latest Global Economic Overview, we have downgraded our world growth forecast for 2021 as supply chain disruptions, Covid-19 and extreme weather events weigh on production. Despite this, in light of the current inflationary pressures, we expect a tightening of monetary policy by both the Federal Reserve and the Bank of England in the coming months.

The direction of travel of global growth prospects has been disappointing recently, as a variety of factors such as extreme weather, the pandemic and shortages of resources and labour have hit production. While booster jabs should help to limit the scale of any further Covid-19 outbreaks, the other factors seem set to have a more material impact. Overall we have downgraded our global gross domestic product (GDP) forecast for this year to 5.7% (from 5.9%). Next year’s projection remains at 4.7%. But we judge the risks to lie to the downside, especially in China which is facing a degree of electricity rationing and at least some ‘restructuring’ of troubled property company Evergrande, whose effects may spill over into the wider economy.

Elevated inflation and an ongoing recovery in the labour market have prompted the Federal Open Market Committee (FOMC) to consider whether the current level of monetary support is still appropriate. At the September meeting, Federal Reserve Chair Jerome Powell provided some heavy hints that we may see a tapering announcement at the November meeting, with QE purchases ceasing in mid-2022. However, there are still some key factors that could hold back the US outlook. In particular, growth is likely to have slowed in Q3 as the spread of the Delta variant over the summer months, and the impact of Hurricane Ida, weighed on activity. Meanwhile supply chain disruptions and labour shortages are set to remain a concern for the rest of the year. Reflecting on this, we have downgraded our US GDP forecast to 6.0% for 2021 and 4.0% for 2022 (from 6.2% and 4.3%, respectively).

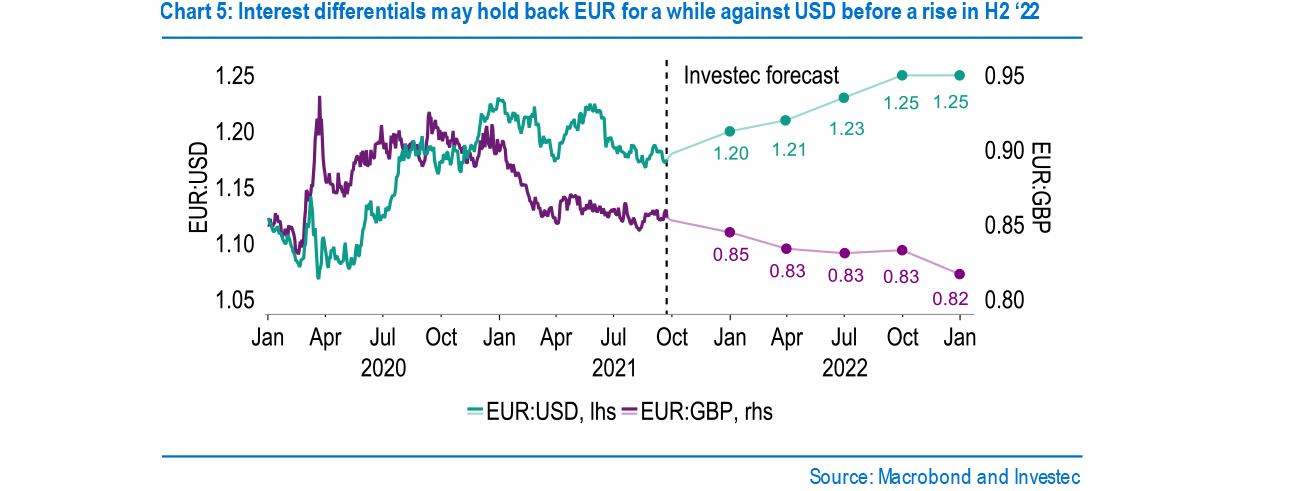

The Euro area economy appears to have put in a strong Q3 GDP performance, despite the moderation of some recent indicators, leaving it on track to erase the pandemic-triggered drop by the end of the year. This looks to be one yardstick by which the European Central Bank (ECB) will judge whether the crisis phase of the pandemic is over and feed into policy considerations looking forward. December certainly looks set to be an important meeting following the moderation of purchases under the central bank’s Pandemic Emergency Purchase Program (PEPP) in September. The end of PEPP, as well as the future of the ECB’s third round of targeted longer-term refinancing operations (TLTRO III), look to be key issues. Meanwhile in the political sphere the search for a new German government will be a key focus following inconclusive election results. In terms of our forecasts we have made only slight changes to GDP with 2021 growth standing at 5.4% and 2022 at 4.7%. Meanwhile we have nudged our end-2021 euro-dollar forecast down to $1.20.

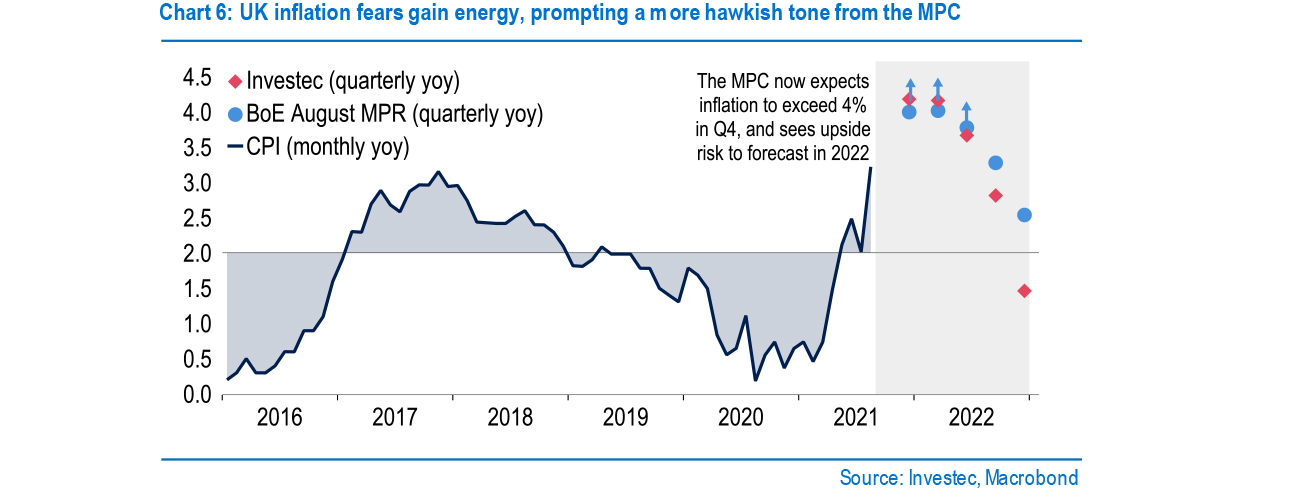

Activity data have softened to a greater extent at the start of Q3 than we had expected. Arithmetically, this will result in weaker full-year GDP growth for 2021 and 2022. But as ‘fast’ indicators hint at a strengthening in momentum more recently, the cuts to our forecasts are not large. We now look for 6.2% and 4.8%, respectively. The main concern though is inflation. In the context of tight labour markets and surging gas prices, which are pressuring utility costs too, we have raised our inflation forecasts for this year and next, to 2.4% and 3.0%. The Bank of England, too, appears concerned that price pressures could persist without it taking action soon. We now expect a first rate hike of 15 basis points (bp) at the February 2022 meeting, and have also pulled forward the timing of the next (25bp) rate rise from November to August. But uncertainty remains about how resilient unemployment will be to the end of furlough.

Global

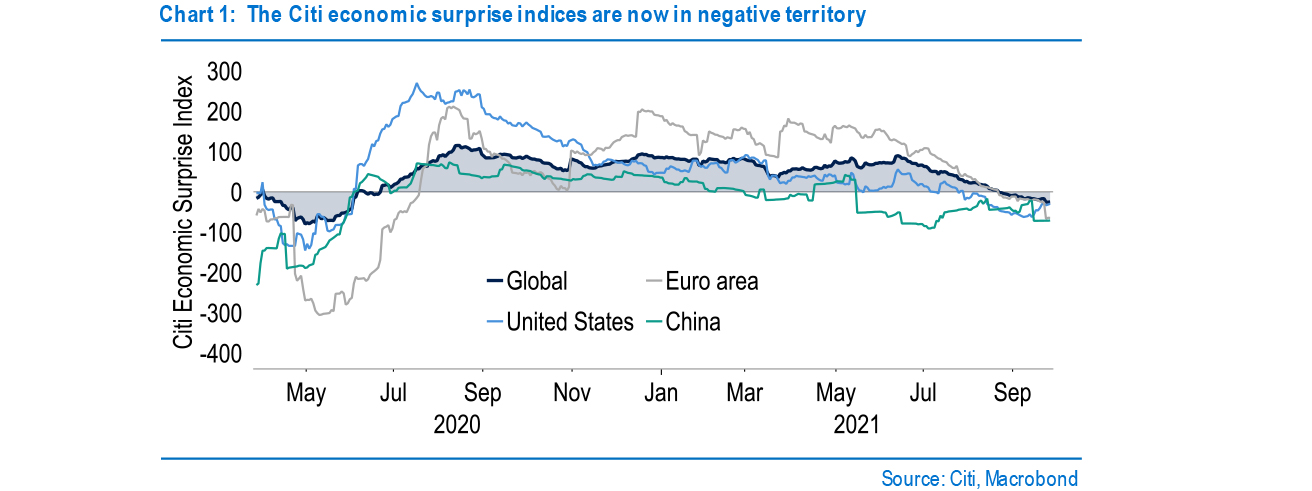

The direction of travel of global economic news has been disappointing recently. This is illustrated by the Citi Economic Surprise index whose readings for the global economy and major trading blocs are currently in negative territory. Delta variant issues seem to have eased in many jurisdictions, only to be supplanted by shortages of raw materials, labour and components. The situation though has its nuances. In the US, some surveys have rebounded and housing market activity indicators have firmed. Meanwhile some reports suggest that the dearth of semiconductors is easing. Bear in mind too the index measures expectations, not absolute rates of activity. Still ‘hard data on Chinese economic conditions have weakened too. Annual industrial production growth now stands at 5.3%, with retail sales rising by just 2.5%. Some of the dip reflects transitory effects from flooding and Delta-related shutdowns. Monthly NBS data also suggest a large negative base effect in September’s numbers, but power shortages will also weigh on growth. Beijing has hinted at another cut in banks’ RRR*. But the authorities’ full response will depend on the extent of action taken to resolve the situation surrounding troubled property developer Evergrande. We cut our 2021 GDP forecast to 8.1% last month and for now maintain this, while acknowledging the various downside risks.

The world Covid vaccination rate now stands at 46%, with the UAE and Portugal at 90% or so. By contrast, rates in parts of Africa are below 10%. Developed countries have pledged to distribute some of their vaccine stockpiles to emerging economies, though many are starting or planning booster (3rd jab) programmes. Israel, the first country to immunise its population, suffered a significant upturn in infections which seems to have been capped by booster jabs. Note though that Israel distributed its 2nd vaccines relatively quickly, within one month of the 1st. Evidence now shows a 3-month gap provides better immunity, suggesting that an Israeli-type upturn in Covid cases is less likely elsewhere.

Various labour shortages are resulting in domestic disruptions – in the UK, a lack of HGV drivers is restricting fuel supplies and threatening Christmas deliveries.

Continued supply shortages are a mounting concern. Initially issues centred on demand and supply mismatches, coinciding with the reopening of economies. However a multitude of additional factors have now come into play. Covid is still rearing its head. For example, China shut down the world’s 3rd busiest port, Ningbo, for two weeks due to a single Delta variant case. Commodity specific shortages, such as natural gas and aluminium, are also causing problems. Putting this into context, a recent ECB study suggested that global goods exports are 2.3% lower as a result. Meanwhile various labour shortages are resulting in domestic disruptions – in the UK, a lack of HGV drivers is restricting fuel supplies and threatening Christmas deliveries. These situations could drag on into the New Year, adding a further squeeze to growth momentum. Certainly we acknowledge this as a risk, but our broad assumption continues to be that much of the moderation is a natural adjustment following the sharp rebound after social restrictions were loosened. A point worth making is that whilst activity is slowing, it remains at a pace which exceeds trend, as evidenced by the OECD’s Composite Leading Indicator. Overall our forecasts for global GDP growth for 2021 and 2022 remain firm in absolute terms, at 5.7% and 4.7%. However 2021 does see a downgrade from 5.9% not least due to revisions to the outlook for the US. 2022 is unchanged.

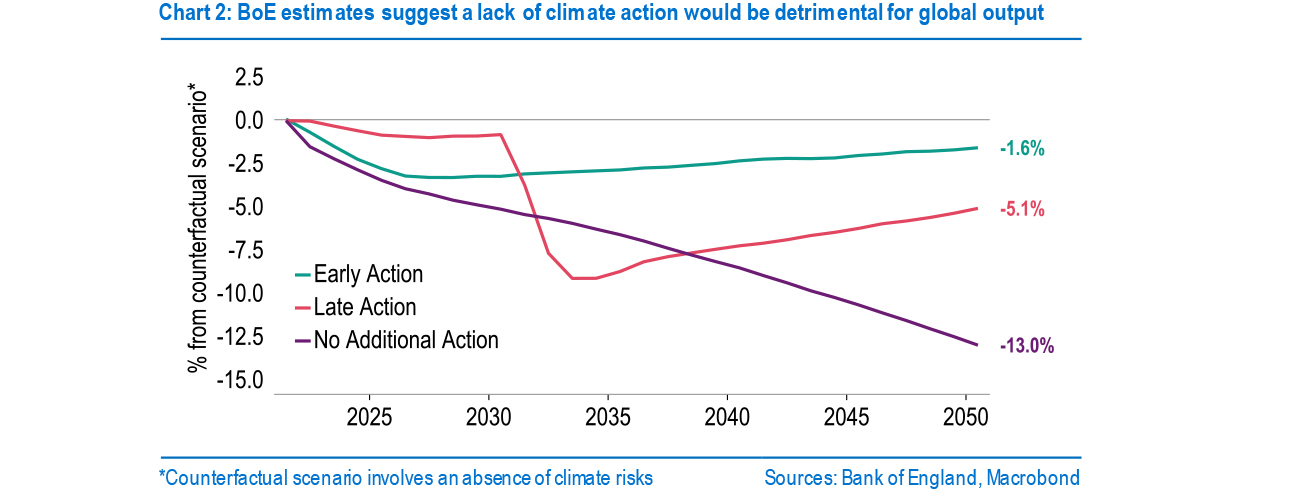

Climate change remains a live topic, especially ahead of COP26. Reports from bodies such as the WEF suggest global GDP growth will take a hit without urgent action. Consistent with this, the BoE and the ECB are conducting stress tests for banks based on climate change scenarios. The BoE’s no additional action on climate change scenario assumes that GDP will be 13% lower* by 2050. The scenario sees surging fossil fuel prices, while increased humidity and temperature reduce productivity and, ultimately, the global economy’s growth potential. A late action (10 years from now) scenario sees a sharp fall in output, which partly recovers in time. The early action scenario, however, sees depressed growth initially but an eventual increase in efficiency and productivity.

United States

The US economy has experienced a rapid recovery from the pandemic, with GDP returning to pre-pandemic levels in Q2 of this year. Although the economic outlook remains positive, there are headwinds that could drag on growth, such as ongoing supply chain disruptions and labour shortages. Moreover, temporary factors, such as the spread of the Delta variant across the US, which resulted in new cases peaking in early September at 200k, as well as the fallout from Hurricane Ida, are set to weigh on activity in Q3. Accordingly, in this forecast round we have downgraded our 2021 US forecast to 6.0% in 2021 and 4.0% in 2022 (from 6.2% and 4.3%, respectively).

On such labour shortages, unfilled vacancies continue to hover at record highs, holding back several measures of activity, such as the PMIs. Difficulties in hiring would typically suggest labour market tightness, yet non-farm payrolls have still not fully recouped losses, remaining below both pre-pandemic levels and below what we would reasonably expect payrolls to be, had the pandemic not existed. This could be due to a variety of reasons, including a skills mismatch in vacancies, as well as the stubbornly low participation rate – there were over 3 million fewer labour market participants in July relative to February 2020.

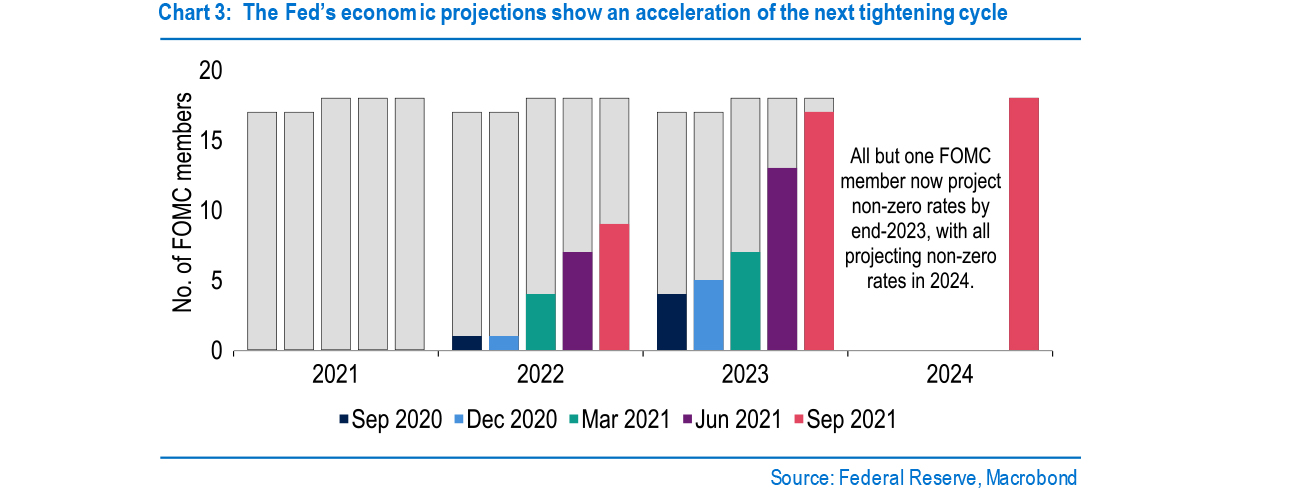

September’s FOMC meeting showed the Fed heading faster towards policy normalisation. Several heavy hints pointed to a November tapering announcement, with QE purchases ceasing in mid-2022.

August’s headline CPI rate edged back to 5.3% from 5.4%, helped by a 1.5% decline on the month in second-hand car prices, the first fall for six months. The 3-month annualised rate suggests some moderation in recent price pressures, though the volatility of car (and energy) prices makes it difficult to draw firm conclusions. The Dallas Fed trimmed mean (PCE) measure excludes extreme moves, and is arguably a more accurate gauge of core inflation – it currently stands at 2.0%. We would still argue that the current US inflation spike is temporary and this view was reiterated by Fed Chair Powell at his Jackson Hole speech last month.

That said, September’s FOMC meeting showed the Fed heading faster towards policy normalisation. Several heavy hints pointed to a November tapering announcement, with QE purchases ceasing in mid-2022. Meanwhile the ‘dot plot’ now shows half of the 18 total committee members backing a Fed funds target hike by end-2022. Of course, we cannot identify the location of the most important dot (i.e. Chair Powell). And as various policy delays over 2013-18 demonstrated, tightening plans could easily be derailed when it comes to both QE and policy rates. For now we stand by our Q1 2023 tightening call, though the risks are tilted towards an H2 2022 move.

Markets have brought forward their expectations of the first hike to the cusp of 2022/2023. The period over H1 2022 is considered off limits, given the Fed is still likely to be buying bonds then, albeit in smaller amounts. Treasury yields have risen too. Those at 10y now stand at 1.53%, 24bps above a month ago, a move entirely accounted for by a pick-up in real yields – breakevens have been steady). Given all of our policy assumptions (including that of an orderly path towards a new debt ceiling and funding bill), we stand by our yield forecasts of 1.75% and 2.00% for end-2021 and end-2022. Note that a factor we have not included is the possible point when the Fed starts to shrink its balance sheet i.e. reverse QE, as it did between 2017 and 2019.

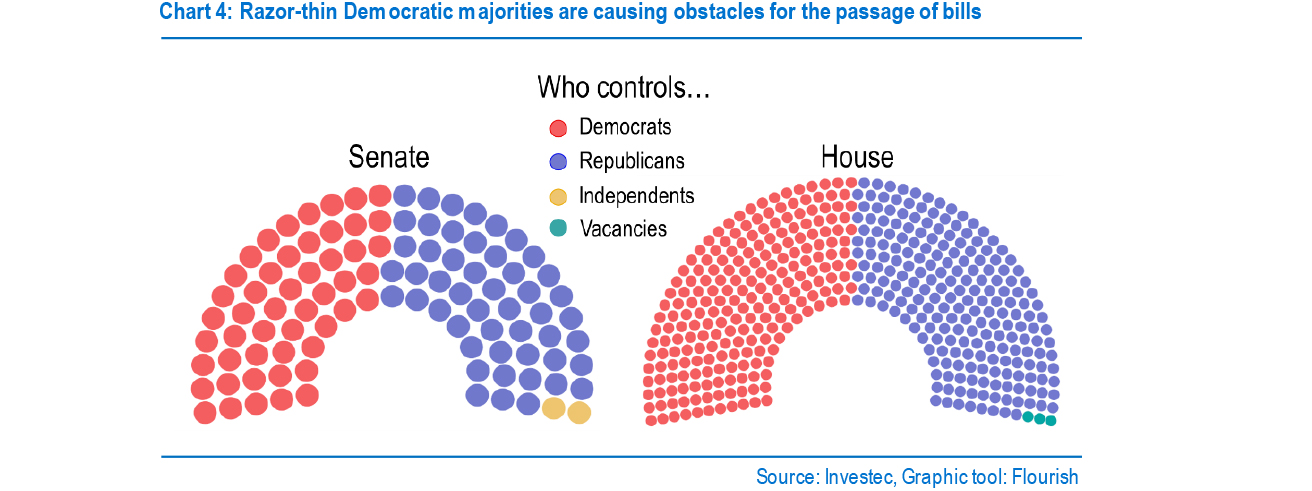

This week will be pivotal for the US. On the agenda are votes on the $1trn infrastructure bill, the $3.5trn budget reconciliation bill, and also the funding bill for the next fiscal year, currently tied to the suspension of the debt ceiling. On the latter, were this not to pass we could see a government shutdown on Friday. This is a real possibility – the bill needs the backing of 10 GOP Senators, and gaining such support will not be easy. Republican Senators have disapproved of the political manoeuvre to tie the funding bill to the debt ceiling suspension, which is believed to encourage ‘reckless spending’ by the Democrats. One option is to separate the two bills, to ensure the resolution of the more imminent funding issue.

Eurozone

September’s Governing Council meeting saw the ECB announce a moderation in PEPP purchases given favourable financial conditions and improving fundamentals. But no specific monthly target value was stated, the ECB instead taking a flexible approach to respond to market conditions as necessary. In the last two quarters purchases have averaged €80bn/month, a figure we suggest will drop to around €60-70bn, slightly higher than the €55bn purchased in January and February. September’s policy decision looks set to be a prelude to a broader recalibration in December, President Lagarde referencing the Dec meeting no less than ten times. Several issues look set to be addressed, the key one being avoiding a sharp slowdown in asset purchases when PEPP reaches its March 2022 end date. At that point purchases could drop to those solely under the APP at €20bn per month. To ensure a gradual adjustment in policy and prevent a deterioration in financial conditions, an option would be to increase APP purchases, countering the end of PEPP. TLTRO-III may also be discussed, given December is the final opportunity for banks to draw funds under the scheme. To date €2.3trn has been distributed and given the ECB’s focus on private borrowing costs as well as broader market rates, the ECB could opt to add additional operations through 2022 to maintain favourable financing conditions as asset purchases slow.

A key judgement underpinning any policy recalibration, in particular the ending of PEPP, is whether the pandemic crisis phase is over. To this end the recovery of the pre-crisis peak in GDP looks to be one yardstick, which, as hinted at by Lagarde, will likely be met in Q4. The path to this should be led by a strong Q3 performance, the spread of the Delta variant failing to have a material impact on activity. We do however expect Q3 to be the peak in growth, with some of the most recent indicators pointing to a moderation, although this was to be expected. Broadly the outlook remains positive, with our forecasts for 2021 seeing a small upgrade to 5.4%, whilst 2022 stands at 4.7%.

Spiralling wholesale gas and electricity prices could contribute to further rises in inflation towards the end of the year.

Having fluctuated near the 2% y/y target between May and July, Eurozone inflation surged to 3.0% in August. There was a big jump too in core inflation, from 0.7% y/y to 1.6%. Base effects played a role in this. But price pressures have genuinely intensified in recent months too: seasonally adjusted consumer price data show three-month annualised changes, in overall and core terms, well above the ECB’s 2% inflation target. Spiralling wholesale gas and electricity prices could contribute to further rises in inflation towards the end of the year. We now see 2021 inflation averaging 2.4% and 2022 inflation 1.8%, 0.2pp and 0.1pp above the latest ECB Staff Projections, respectively.

Germany’s Bundestag elections saw a narrow victory for the Social Democrats (SPD), ahead of outgoing Chancellor Angela Merkel’s CDU/CSU conservative block. But either of these parties could yet end up leading the new government. It will almost certainly* take a three-way coalition to build a majority government. The choice of the hue of the next administration will thus largely lie with the Greens and Liberals (FDP), third and fourth placed, respectively. They have indicated their wish to hold talks with each other first before entering negotiations with either of the two main parties. This will make for protracted discussions. It could take months before a new government takes shape and office.

In trade-weighted terms, the euro is little changed this month, as a rise against the zloty has offset a good part of the slight slippage against the yuan, USD and GBP. Interest rate differentials have remained a key driver of EURUSD. Momentum to tighten policy is building in the US. But the ECB appears more reluctant to take the risk of hiking rates in response to higher inflation, for fear of overreacting to a move that may not persist. We have therefore nudged down our ’21 year-end target for EURUSD to $1.20. But our ’22 target remains at $1.25, as eventually higher rates ought to come closer into view in the Eurozone too. Against GBP, however, EUR could underperform.

United Kingdom

Softer-than-expected UK economic data releases have contributed to concerns that the economic recovery has run out of steam. Although on the back of this softer data we too have downgraded our 2021 growth forecast to 6.2% from 6.7%, we are still optimistic for the remainder of the year. We expect that there was a pick-up in momentum towards the end of Q3, which should result in a strong carry over effect as we head into Q4. Indeed, when comparing to trends witnessed in 2020, ‘fast indicators’ seem to be holding firm, with the economy set to benefit further from a demand rotation from supply-constrained goods to services, following the easing of social restrictions.

However, as highlighted by the BoE in the minutes from the latest meeting, pressure points do remain, such as the current surge in prices, with the MPC recognising the upside risks to its inflation outlook. Reflecting on these pressures, two members voted to end asset purchases immediately, as inflationary worries outweighed labour market fears. Considering this, and remarks made by Governor Bailey this week, in which he suggested that a modest policy tightening could be on the cards, we have brought forward our own rate hike expectations by three months. We now pencil in a 15bps hike in Feb followed by a further 25bps hike in Aug to 0.5%, at which point the balance sheet run-off could commence.

We share the BoE’s worries that above-target inflation may last longer, having lifted our inflation forecast by 0.2pts to 2.4% for ’21 and by 0.6pts to 3.0% for ’22. One reason why is the tightness of the labour market, which may not ease much on furlough ending. Vacancies are at record highs, and reports of labour shortages abound. These look most pronounced in certain segments such as HGV drivers, where the exodus of EU workers seems to have cut the pool of qualified staff. The concern is that, until skills mismatches between those seeking and offering jobs are resolved, this may trigger wider wage pressures. Indeed, a Citi/YouGov survey recorded its largest-ever rise in one-year consumer inflation expectations, of 1pt, to 4.1% in Sep.

Vacancies are at record highs, and reports of labour shortages abound. These look most pronounced in certain segments such as HGV drivers, where the exodus of EU workers seems to have cut the pool of qualified staff.

Another reason is energy prices. Further utility price rises are to come soon, as Ofgem’s cap on default energy prices will be raised by 12.2% in October. But wholesale electricity and gas prices have raced further ahead. This is on surging global demand amid easing pandemic restrictions and cold weather in Europe, coupled with a supply squeeze on low renewables generation. Limited gas storage capacity and a fire at the UK-France electricity interconnector have exacerbated the issue. The government has insisted the energy price cap is to stay. It will take a plunge in wholesale prices to avoid a further inflationary hit to consumers and/or a greater fiscal burden at the cap’s next reset point in April.

This is against a backdrop of an already rising share of tax receipts as a proportion GDP. To help the NHS clear the backlog in non-Covid care that has built up during the pandemic and to introduce a cap on social care costs for individuals, the government has announced higher National Insurance contributions and a rise in dividend taxes. This comes amid a general fiscal tightening over 2022/23. Since then, revisions to take into account estimated losses in Covid government loan guarantees have boosted last year’s deficit, although they remain short of the OBR’s March projections. The Budget and Spending Review on 27 Oct will allow the Chancellor to outline further plans to restore fiscal sustainability.

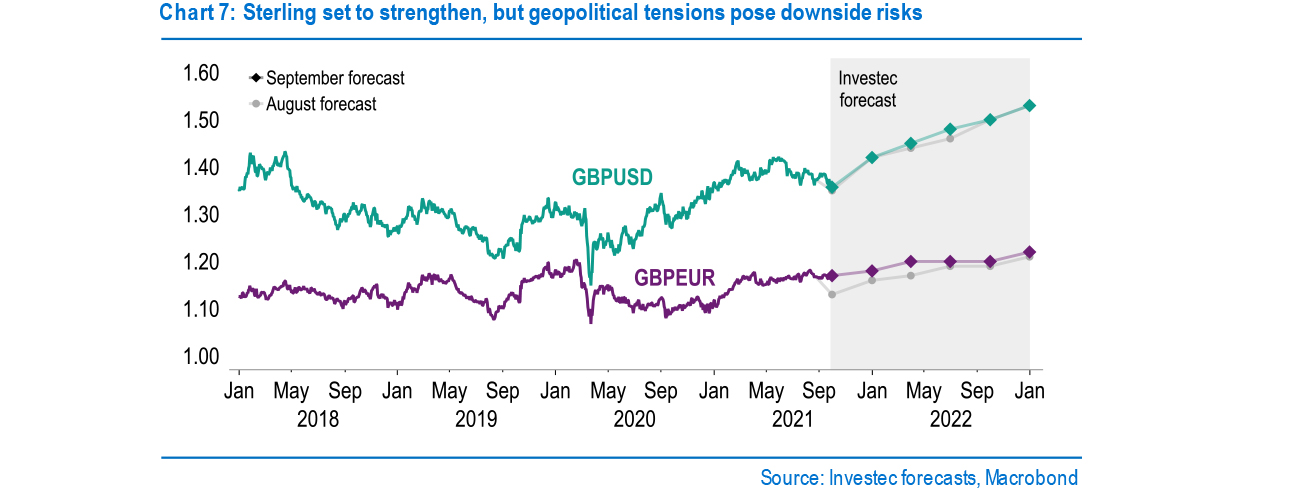

We note some significant risks to the UK in the near-term. The continued tensions over the NI Protocol are a threat, with the DUP criticising the current agreement. Meanwhile, the SNP continues to push for Indyref2 – a fully-fledged campaign will begin once the health crisis has subsided. Another challenge is any potential fallout with the EU over the new AUKUS security pact, which saw France sidelined from a deal with Australia. Yet on balance, we expect the UK’s tightening of monetary policy to drag sterling higher. As such, our forecasts are still for cable to reach $1.42 by end-2021 and $1.53 by end-2022. But we now see sterling rallying earlier in 2022.

Would you like to hear from our economists directly?

Sign up to receive invites to our monthly economic Q&A with a member of our team.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.