The UK moves into the eye of the storm

Although risks of recession are being pushed out to 2023, the new British prime minister has sent markets spiralling with an ambitious fiscal programme. Read the Economics Team’s latest projections for the UK and elsewhere in September’s Global Economic Overview.

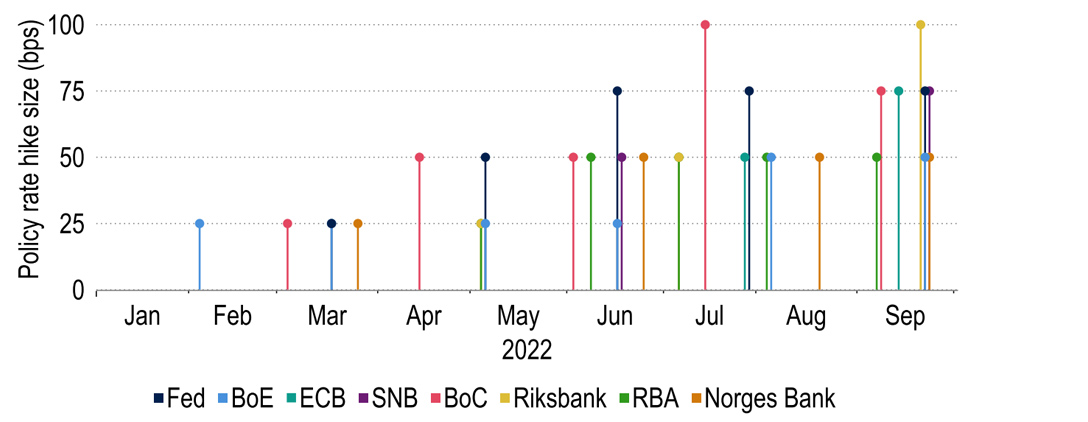

75 basis points have replaced 50 basis points as quickly as 50 basis points replaced 25 basis points when it comes to central bank interest rate rises. Frontloading is still a key theme, but higher for longer is the main expectation. As such, yields have moved sharply up – especially in the UK following the mini-Budget. In the same vein, equity markets have reversed much of the summer rally and the US dollar has strengthened further, prompting Japan to intervene in foreign exchange markets to curb the yen’s slide. Due to UK fiscal support and resilience in the US economy, the main downturn in the global economy is now expected later in 2023 rather than this winter, but our global growth forecasts are slightly altered at 2.5% for this year and 2.0% for next – compared with 2.4% and 2.0% previously.

The US economy remains robust for now, despite the 300 basis points of interest rate hikes so far this year: there is very little labour market slack, and inflation continues to cause a headache for the Federal Reserve. As such, we have shifted up our peak rate expectations to 3.75-4.00%. We maintain our view, however, that the Fed will pivot by year-end, as more convincing signs of receding price pressures may encourage the committee to take stock as economic momentum weakens. Eventually, we expect the impact of higher rates to push the economy into a recession by the third or fourth quarter of 2023, slightly later than previously envisaged.

As with elsewhere, troubling inflation outturns have led to a sharply more hawkish European Central Bank (ECB), with September’s meeting seeing a 75 basis point hike. We now expect rates to continue rising, with the deposit rate reaching a peak of 2.25% early next year. This will present another headwind to the economy, alongside continued risks from energy markets, which we suspect will ultimately result in a double-dip recession. Our Gross Domestic Product (GDP) forecasts now stand at 3.3% for 2022 and 0.0% for 2023. As for the euro, we expect a Fed pivot will contribute to a strengthening of euro-dollar to $1.10 in 2023.

The substantial easing of fiscal policy under new Prime Minister Liz Truss, acting in the opposite direction to the Monetary Policy Committee’s (MPC) efforts to quell inflation, has spooked UK financial markets. Yields have soared across the curve and the pound has plunged, even accounting for US dollar strength. Our expectations for the economy and financial market variables have shifted considerably. We now see fiscal stimulus preventing a recession this winter, but this, along with the currency fall, will require much more monetary tightening to a peak bank rate of 5% – bringing about a shallow recession later next year. Our new forecasts have GDP growth of 3.5% rather than 3.8% for 2022 and +0.8% rather than -0.2% for 2023. Naturally, in such fast-moving markets, and when the legislative process to implement the fiscal statement is yet to take place, uncertainty around the forecasts is larger than usual.

Global

75 basis points have replaced 50 basis points as quickly as 50 basis points replaced 25 basis points when it comes to interest rate hikes from the major central banks. The Fed enacted its third consecutive 75 basis point move this month, along with the ECB, the Bank of Canada and the Swiss National Bank. Exceptions include the Bank of Japan, the People’s Bank of China and the Central Bank of the Republic of Turkey on the loosening side, but also a number of other central banks that appear to be nearing their terminal rates, such as the National Bank of Poland. Broadly however, terminal rate expectations have risen significantly in the last month. This was largely in reaction to US Consumer Price Index (CPI) inflation surprising to the upside yet again, and even more so on the core measure, which excludes food and energy prices.

Chart 1: Larger rate hikes have quickly become the norm for central banks

Sources: Macrobond, Investec

Indeed, yield curves have shifted up markedly in recent weeks. This move has been the most extreme in the UK in reaction to the large fiscal easing. In response to this environment, we have made substantial changes to our UK fixed income profile, now expecting 10-year UK gilt yields of 4.50% by year-end. Although we have also boosted our US profile, now seeing 10-year US treasury yields at 3.25% by year-end, compared with 2.75% previously, higher rates continue to be priced in for the UK due to the vast fiscal expansion, and we expect UK gilt yields to outstrip treasury yields for the foreseeable future.

The equity market’s summer rally has proved short-lived. The gains were predicated on the peak of the Fed’s tightening cycle being in sight, and hopes that rates may start to fall in the first half of 2023. But recent reports show underlying inflation pressures are more severe than the market expected, and central banks have indicated their resolve to combat this with higher rates for longer. The realisation of this culminated in the 13 September US CPI report, when the S&P 500 lost 4.3% – its largest daily fall since mid-2020. The index has now lost 14% since its peak on 16 August. That said, fiscal stimulus to manage energy costs stands to support domestically exposed equities in Europe via a shielded consumer, albeit at a great cost.

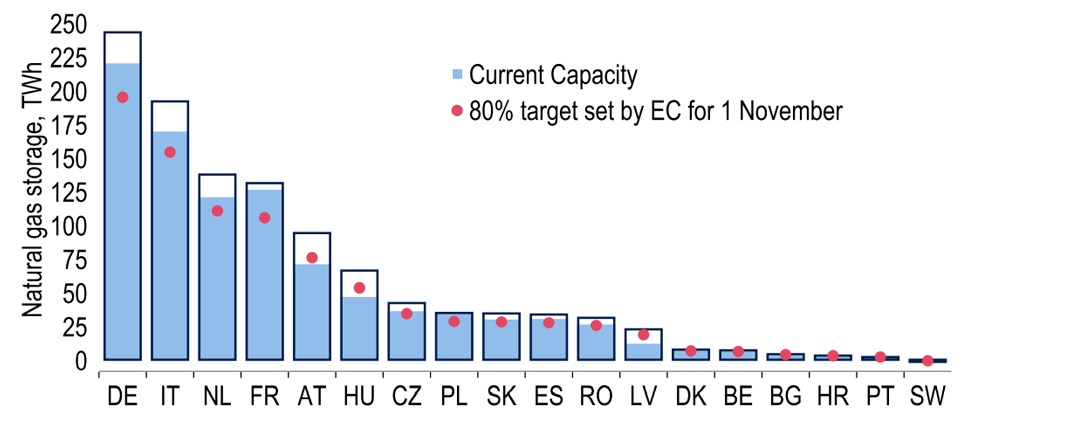

Encouragingly, gas prices in Europe have come down quickly from their peaks in late August – the October 2022 contract for UK natural gas is now priced at 248 pence per therm, less than half of the peak of 703 pence. This is driven by promising progress on filling storage facilities ahead of the winter – Germany has already surpassed its October target – as well as extended discussions within the EU on capping wholesale gas prices in Europe. Nevertheless, prices remain far above their historical averages and will drag on the economy more than in other less exposed nations, such as the US.

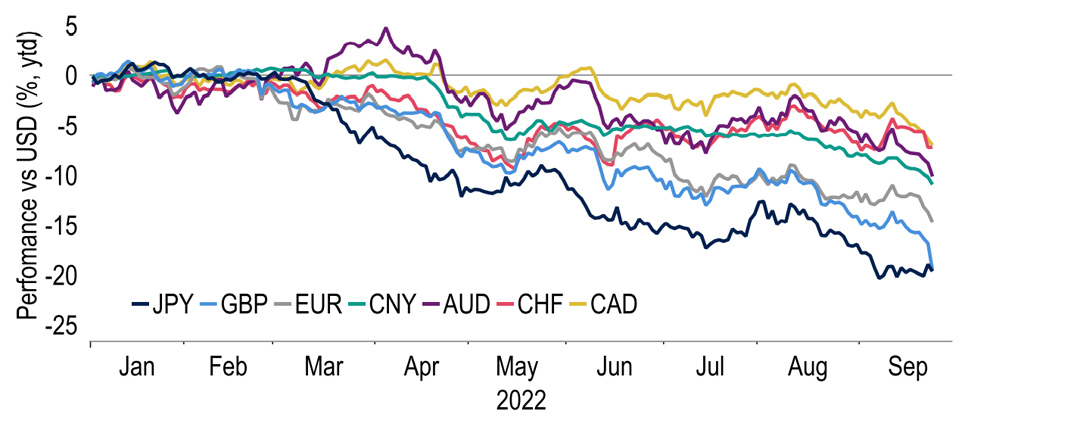

Chart 2: The dollar’s rampant year continues as the Fed ups the ante

Sources: Macrobond, Investec

Adding to this is the continued strength of the dollar, safeguarding the US from another risk facing most economies, namely added inflationary pressure via import costs. Other currencies have hit multi-year, and in some cases multi-decade, lows against dollar this month. Most notably dollar-yen rose into the ¥145s, to a 24-year high, after the Bank of Japan retained its ultra-loose stance. Japanese authorities then intervened to curb the slide, for the first time since 1998. But we are still of the view that dollar strength will unwind somewhat over the medium term, at least to some degree as the Fed pivots.

Globally, we remain unconvinced the so-called ‘soft landing’ can be achieved, given this year has already seen more tightening than 2004-2007 collectively.

Despite the growing global downturn prospects, our 2022 growth forecast is in fact raised a tad compared with our estimate last month: we now expect growth of 2.5% this year (previously 2.4%). This is principally due to resilience in the US economy and fiscal support, but aggressive rate hikes will likely defer the main headwinds from the last quarter of 2022 to the second half of 2023. While the downturn will be concentrated next year, pushing it back rebalances the effect on growth, so our 2023 growth forecast remains unchanged at 2.0%. Broadly, we remain unconvinced the so-called ‘soft landing’ can be achieved, given this year has already seen more tightening than 2004-2007 collectively, and hence our continued pessimism relative to the views of others, including most notably the Fed and the ECB.

United States

At its latest meeting, the Federal Open Market Committee voted to increase the Fed funds target range by a third consecutive 75 basis point hike to 3.00-3.25%, the highest rate since early 2008. This decision was expected and, as such, attention quickly turned to the accompanying projections, including the famous ‘dot plot’. This showed an elevated expected rate path, with all but one member seeing further tightening next year, the median view factoring in a peak in rates of 4.6% (previously 3.8%). Underlying this call is what to us appears an overly optimistic growth profile. Thus far, the Fed has been able to continue frontloading tightening due to the surprising resilience of the economy under the 300 basis points of interest rate hikes so far in this cycle.

Next year’s deteriorating economic outlook will cause a headache for President Joe Biden as he begins the second half of his term.

But there are already signs of give, which raises questions about the Fed’s expected growth profile, which foresees Q4 2023 GDP at 1.2% year-on-year, relative to our own forecast of -0.2% year-on-year. The housing market is suffering – pending home sales are down 20% year-on-year – and there are also signs of a weakening in broader demand, with Q2 measure of final domestic demand disappointing. Survey measures meanwhile are mixed, presenting very different pictures of the economy – the divergence between August’s services Purchasing Managers' Index (PMI) and Institute of Supply Management Non-Manufacturing Index (ISM) a case in point. One sector that has shown few signs of weakness, however, is the labour market.

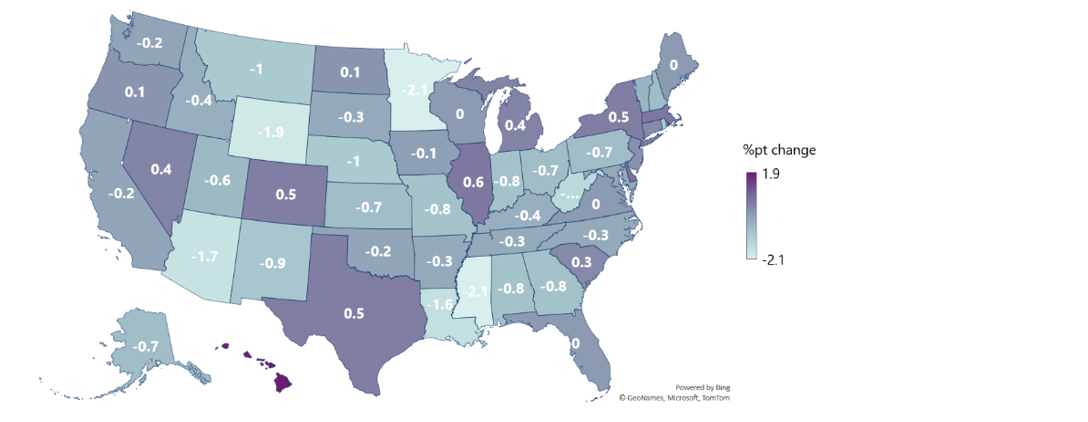

At present, the labour market is very tight: there are two vacancies for every person unemployed, and 36 of the 50 states have an unemployment rate equal to or lower than pre-pandemic levels. Although the current tightness of the labour market may cushion the depth of a downturn, we do not expect it to totally avert one nor itself be immune to an economic slowdown – hiring intentions have already eased. The Fed itself has projected a significant rise in the unemployment rate next year. We foresee annual GDP growth of 1.8% this year and 0.6% next, with next year seeing a period of weaker economic growth over the first half, culminating in a short, mild recession in the third and fourth quarter of 2023.

Chart 3: Unemployment rate lower than pre-pandemic levels in most states

Sources: Macrobond, Investec

Although we are yet to see price pressures ease significantly, weaker demand should weigh on inflation in the coming months. As such, we question how much further the Fed needs to tighten policy. Prior to a policy pause, the Fed will want to see convincing evidence that inflation is on a path back towards the 2% target, fearing a loss of credibility were it to pause too soon. Although the latest inflation report made for uncomfortable reading, there are signs that inflation will indeed soon ease. Consumer inflation expectations data for example have ticked down in recent months, with the New York Fed three-year ahead measure now sitting below the pre-pandemic average.

We expect that further receding price signals will encourage the Fed to pause tightening by year-end. Although the timing of this policy pause is consistent with our previous forecasts, we now envisage it to be from a higher base, with our peak Fed funds target range now at 3.75-4.00% (previously 3.00-3.25%), on top of the $95bn of quantitative tightening (QT) per month. However, as the economy enters a period of contraction in the second half of next year and price pressures drop further, we think that the Fed will remove some of its restrictive through rate cuts, possibly from September next year. On our projections, there would be a nine-month pause between the final rate hike and the first cut, which historically would not be unusual from the Fed.

Next year’s deteriorating economic outlook will cause a headache for President Joe Biden as he begins the second half of his term. Indeed, economic conditions can sway public opinion, which could impact campaigning for a second term were Biden to run, as has been speculated. We have already seen the effect economic conditions can have on popularity in the run-up to the midterms: the recent decline in petrol prices seems to have boosted the Democrats in the polls, helped also by the passing of the Inflation Reduction Act. It is now looking more likely that the Democrats could retain the Senate, marking a sharp turn in events from the start of the year.

Eurozone

September’s ECB meeting saw July’s 50 basis point hike followed by a larger 75 basis point move, taking the deposit rate to 0.75%. The message from the press conference was equally clear that more tightening was required and at an accelerated pace to address the deteriorating inflation backdrop. Notably, the decision was unanimous, pointing to a hawkish shift in the whole Governing Council. Two technical changes were also made. Firstly, the two-tier deposit rate system was suspended. With the end of negative rates, the system was no longer needed, given it was designed to offset some of the impact on banks.

The message from the ECB press conference was clear that more tightening was required, and at an accelerated pace.

Secondly, the ECB lifted the 0% remuneration ceiling on government deposits. This will now be capped at the deposit rate or euro short-term rate, whichever is lower. The concern was that if the rate remained at 0%, this would lead to a rush for returns and put pressure on the repo market, where collateral scarcity has already led to some strains. Rising inflation worries are clearly front and centre for the ECB, given worse-than-expected outturns and a much higher projected path of inflation. August’s ‘flash’ Harmonised Index of Consumer Prices (HICP) reading of 9.1% was likely a key driver of the 75 basis point decision. But the ECB’s latest set of projections made for equally uncomfortable reading, the inflation profile being revised up across the forecast horizon: 8.1% for 2022, 5.5% for 2023 and 2.3% for 2024.

However, as highlighted by President Lagarde, inflation at the end of the forecast horizon was seen as likely to stay above target (2.2% for Q4 2024 ). Given this forecast was predicated on a three-month Euribor curve which saw rates reaching just over 2%, we would advocate a tightening in policy which sees the deposit rate reaching 2.25% in Q1 2022 as appropriate to achieve the inflation goal. 75 basis point hikes remain a possibility and will be data dependent, but on balance we see two 50 basis point moves this year, before slowing to two final 25 basis point hikes in 2023. This should ultimately take policy into restrictive territory. The path over the rest of 2023 will ultimately depend on the outlook for inflation and also growth.

Chart 4: EU19 countries have exceeded gas storage targets

Sources: Gas infrastructure Europe, Investec

We continue to forecast a recession over this winter, although we suspect a worst-case scenario will be avoided. Risks of gas shortages and power outages remain, but news on gas storage has been positive: German storage has reached 91% capacity, whilst EU targets should also lessen demand pressures. Whereas the outlook for energy security is more encouraging than a month ago, the growth outlook remains weak. In fact, we expect a small double-dip recession, with a second contraction in the second half of 2023, as a consequence of the ECB’s restrictive policy and coinciding with what we expect to be a weak external environment. As such, our updated GDP forecasts stand at 3.3% for 2022 and 0.0% for 2023.

Ultimately, this outlook should be mildly disinflationary and see the ECB ease policy late in 2023, albeit only by 25 basis points, and certainly not to the highly accommodative levels of the past. In fact, we would expect the topic of QT to become live next year with policy rates at neutral. Such a decision, however, will need to take into account its possible implications for fragmentation risks. In broad terms, the return to non-negative interest rates and a reduction in asset holdings should be supportive of the euro, but the current strength of the US dollar has sent euro-dollar through parity to $0.96 and remains a risk. However, we see this beginning to ebb once the Fed reaches peak hawkishness and pauses rate hikes, as we expect, at the end of this year.

Our forecasts therefore see euro-dollar at $0.99 in the fourth quarter of 2022 and $1.10 in Q4 2023. In the near term, we do not expect Sunday’s Italian election to have a meaningful impact. The win for the centre right, which saw them win an estimated 44% of the vote, should now see Brothers of Italy leader Giorgia Meloni become prime minister. Whilst there have been concerns over the direction that the new government might take, some reassuring points are that the anti-EU Italexit calls have died away and at least on pre-election comments there appears to be a desire not to turn to a stance of fiscal policy that disregards EU rules.

United Kingdom

The past month has seen seismic change in the UK, with new tax-cutting Prime Minister Liz Truss appointed and the passing of Her Majesty the Queen seeing Charles III proclaimed the new Head of State. The period of national mourning was marked by an additional bank holiday declared on the day of the Queen’s funeral. Amid a sombre mood in the country, and with more business closures than during a typical bank holiday, we have factored in a larger impact on GDP than over the Platinum Jubilee in June/July. This could well tip the UK into a technical recession in Q3, but looks set to be followed by a Q4 rebound in output as activity resumes.

The past month has seen seismic change in the UK, with new tax-cutting Prime Minister Liz Truss appointed and the passing of Her Majesty the Queen.

A longer-lasting impact on economic activity, however, will stem from the enormous fiscal stimulus under the Truss administration. Energy bill relief, through a unit price cap on household energy from 1 October for two years and a similar cap to the wholesale price component of energy bills of non-domestic users for an initial six months, are the largest-ticket items. Our utilities team estimates these alone to come at a cost of circa £90bn and £22-48bn, respectively, far exceeding the £97bn (2% of GDP) of support to the employed and self-employed in furlough. Funded by government borrowing, the aim is to shift the burden of the negative terms of trade shock away from households and firms onto future taxpayers.

Chart 5: A plethora of fiscal measures have been announced on top of energy bill support

Sources: Gov.uk, Investec

Nor is this the only stimulus. The Growth Plan also reverses the April 2022 National Insurance hike, halts the corporate tax hike planned by Boris Johnson’s administration for April 2023, brings forward the cut to the basic rate of income tax by one year and cuts stamp duty. Despite soaring inflation, these are the largest tax cuts in 50 years, with Chancellor Kwasi Kwarteng hinting at even more planned for the next year. Fiscal measures look large enough to prevent a recession this winter, although higher borrowing costs may eventually dominate. With bank holiday distortions, our 2022 GDP forecast has slipped by 0.3 percentage points to 3.5% but our 2023 forecast is up from -0.2% to +0.8%.

By design, the near-term impact on inflation will be to avoid a further jump in the annual rate in October and in January that would otherwise have occurred. That slices roughly 3.5 percentage points off our forecast for inflation at its peak. But the enormous fiscal stimulus comes at the cost of less spare capacity opening up, so the labour market is tighter and downward pressure on core inflation should lessen. Sterling’s plunge also gives an inflationary impulse. We thus expect the MPC to lift rates more forcefully and for longer to bring about an eventual shallow recession in the third and fourth quarters of 2023. We have cut our inflation forecast by 0.6 percentage points to 9.1% for 2022 and by 1.0% to 6.7% for 2023.

Just how restrictive the MPC will have to make its policy rate to quell inflation is very uncertain. This is not least because the gap between actual and target inflation is far greater than the recent historical experience on which any model estimates rely. An extra complication, from the point of view of taming inflation, is the political tension that arises from monetary and fiscal policy pushing in opposite directions. Given the size of the fiscal push, we now pencil in a bank rate peak of 5%, to be reached in May. Indeed, it now looks unlikely that sufficient disinflationary momentum will build for the MPC to start lowering the policy rate again before the end of 2023.

Investor concern about the reset in fiscal stance and its implications for monetary policy has sent gilt yields soaring. Ratings agencies too may well take note. Absent a change of tack during the parliamentary process, a material near-term retrace looks unlikely. We have raised our 10-year yield forecasts to 4.50% by end-2022 and 3.75% by end-2023. In the context of the hefty fiscal price tag, as well as wider dollar strength, sterling has plunged despite rate differentials moving in its favour. From a fresh all-time low against the dollar, we could see further near-term falls. Our new forecasts are $1.00 at end-2022 and $1.15 at end-2023, with cable pulled up next year as euro-dollar strengthens. But uncertainty is naturally high in such volatile markets.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.