On 17 November, UK Chancellor Jeremy Hunt is to unveil the much-awaited Autumn Statement (AS), outlining the government’s medium-term fiscal plans. As the new chancellor and prime minister are keenly aware, a lot rides on this. To say this is a difficult balancing act is an understatement. Politics and economics are pulling in fundamentally different directions: the evident need to assist in light of the cost-of-living crisis, which underpins much of the current wave of industrial action, collides with the hard truth that markets need to see the public finances being kept on a sustainable footing. As the Truss administration found out, the latter is neither negotiable nor easily kicked into the long grass: credibility must be shored up, to avoid a return of the volatility in markets and surges in yields that can worsen conditions for the whole economy in a short space of time.

In light of sharply higher interest rates and the impact of higher inflation on government payments on index-linked gilts – a quarter of all outstanding gilts are index-linked – as well as a deteriorating growth outlook, a considerable ‘fiscal hole’ has opened up. Press reports suggest that the government plans to fill it with some margin to spare. This has the advantage that it leaves room for economic outturns that disappoint expectations, without requiring extra adjustments. The chances of pre-election tax cuts in a year or so are also enhanced, which may well be dangled and trailed now as a sweetener by Chancellor Hunt. But the pain that will come from a fiscal consolidation of £53bn or so (if press reports are accurate) will be felt widely.

Whereas few ex-ante ‘red lines’ have been drawn by Chancellor Hunt, certain spending cuts are probably too difficult to push across the line. Indeed, it looks as though the ‘triple lock’ on pensions will stay, as will benefit increases in line with inflation. But the government may instead insist on below-inflation pay rises in the public sector, making further confrontations with trade unions and even more industrial action likely. Among the low-hanging fruit, overseas aid and defence spending may be lowered – but this is unlikely to suffice. On the revenue side, the government appears minded to primarily take the route of ‘stealth’ tax rises, by extending freezes on various tax allowances and thresholds or even cutting some of them – the £150k income threshold to the 45% additional tax rate being a case in point. However, a number of outright tax rises could ensue as well; capital gains tax has been mooted, for instance.

Still, energy support looks of the essence, which will add to the challenge of achieving fiscal consolidation. Key news to watch out for is the design and planned scale of the successor to the now six-month Energy Price Guarantee (EPG). This has very tangible implications for households and firms as well as, potentially, for inflation.

As regards the economic impact, a fiscal tightening of the scale envisaged (some 2% of GDP) is likely to act as a significant drag on economic activity. This stands to push the UK economy into recession over 2023, when coupled with the (rising) impact of higher interest rates. The other side of the coin is that it makes an additional tightening of the monetary screws by the Bank of England less necessary to contain inflation. Our forecast of a 4% bank rate peak will be reviewed in light of what emerges in the Autumn Statement.

A tumultuous period for fiscal policy

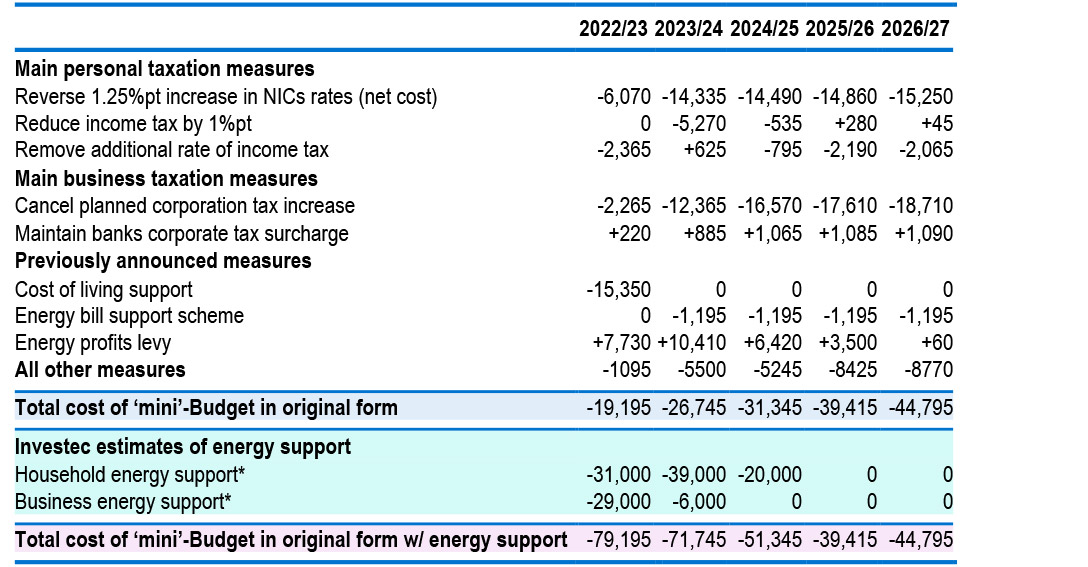

The past couple of months have witnessed the start of the most abrupt UK fiscal U-turn in living memory. When former Chancellor Kwasi Kwarteng took office in September, his intention was to cut taxes in order to help lift the economy’s average rate of growth to 2.5% per annum. Indeed, his ill-fated ‘mini’-Budget on 23 September tried to do just that. The exercise included a material loosening in fiscal policy, with supporting Treasury documents showing the cost of the measures to be £45bn in the fifth year of the projections (£43bn following the reinstatement of the additional 45% income tax rate). However, this costing failed to include the EPG, which was originally designed to last for two years. Our estimates at the time suggested that its total cost could be in the region of £125bn, resulting in an overall fiscal loosening averaging around £75bn in each of the first two years, a significant easing of 3% of annual GDP.

Table 1: Treasury costings of Kwasi Kwarteng’s ‘mini’-Budget

*The cost was dependent on market moves and proposed length of government support

Sources: HM Treasury, Investec

Turmoil in the gilt market ensued, exacerbated by the forced selling of bonds by pension funds using liability-driven investment strategies, which resulted in the Bank of England purchasing £19bn of long-dated stock to stabilise markets. Moreover, sterling hit an all-time intraday low of $1.03. Following the subsequent departures of Kwarteng and PM Liz Truss from their posts, new Chancellor Jeremy Hunt has announced a sharp policy reversal. The majority of Kwarteng’s moves will now not go ahead (the main exception is the unwinding of the 1.25% hike in National insurance Contributions, saving some £32bn. The duration of the EPG will now be six months, not two years, and it will be replaced by a more targeted (i.e. cheaper) scheme, which is yet to be determined.

Fiscal rules

The AS decisions on fiscal policy will be taken in the context of the UK’s fiscal rules, introduced by PM Rishi Sunak when he was chancellor. These are as follows:

- The fiscal mandate: To have public sector net debt excluding the Bank of England as a percentage of GDP falling by the third year of the rolling forecast period.

In addition, there are three supplementary targets:

- To balance the current budget by the third year of the rolling forecast period.

- To ensure that public sector net investment does not exceed 3% of GDP on average over the rolling five-year forecast period.

- To ensure that expenditure on welfare is contained within a predetermined cap and margin set by the Treasury.

It has been made clear by the Institute for Fiscal Studies that more consolidation is necessary in order for the government to meet its fiscal mandate. The view for the further need to rein in the public finances is confirmed by various recent press reports. One suggests that the Treasury may be seeking some £53bn of budget savings, which would allow the government to meet its fiscal mandate by a margin of £10bn. In March, the Office for Budget Responsibility (OBR) concluded that the fiscal mandate would be met with a margin of £28bn. This demonstrates that the underlying deterioration in the fiscal position has been considerable.

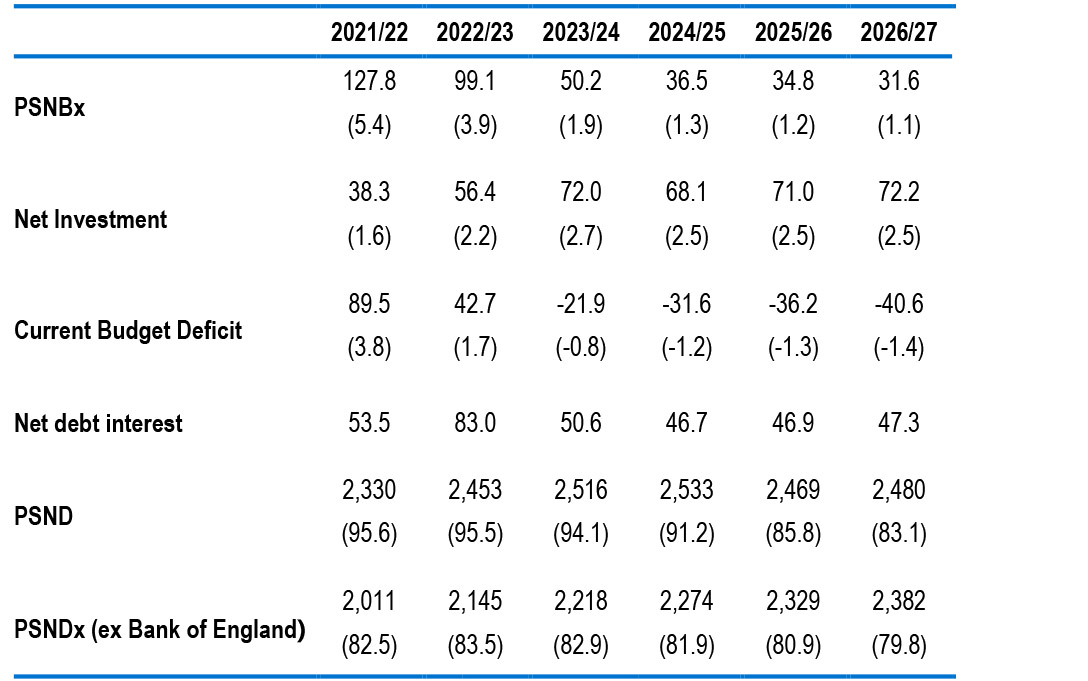

One issue is higher interest rate payments. The rise in gilt yields and interest rates more generally has pushed up the cost of new borrowing. In addition, higher (RPI) inflation has raised the coupon and uplift payments on index linked paper, which account for around a quarter of all gilts. At the time of the Spring Statement, the OBR forecast that interest payments by central government would total £83bn. This looks to be a significant underestimate. In fact, so far in 2022-2023, average monthly payments have exceeded OBR forecasts by some £1.8bn. Were the overshoot to continue at this pace, interest payments would total £104bn this year. A saving grace is that gilt yields have fallen back since their peak in late-September.

Table 2: OBR Spring 2022 fiscal forecasts, £bn (figures in brackets are % of GDP)

Source: Office for Budget Responsibility

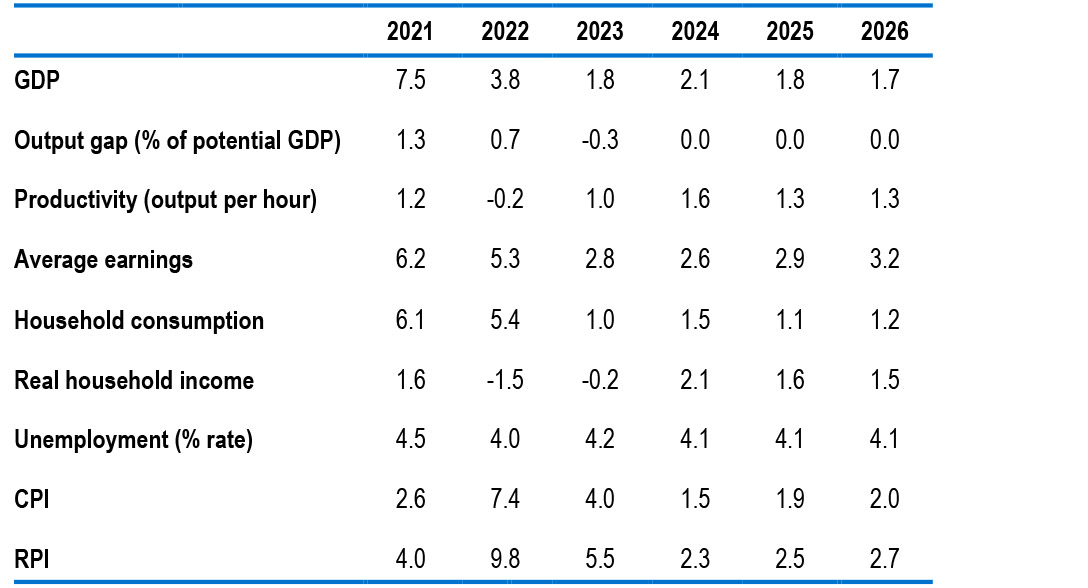

A further factor is that, since the OBR last put together macroeconomic forecasts, for March’s Spring Statement, the macro backdrop has changed enormously. Forecasts then took into account the information available as of 8 March. So soon following the Russian invasion of Ukraine on 24 February, the consequences of the war were still very hard to gauge. One particularly consequential development that was not anticipated was Russia largely turning off the gas taps to Europe over the summer and the lasting terms of trade shock and extra inflationary impulse this has entailed. In light of this, with the benefit of hindsight, the OBR’s March forecasts therefore look considerably too optimistic on economic activity for the coming years. This stands to weaken the tax base and raise expenditure, adding to the fiscal hole.

Table 3: OBR Spring 2022 macroeconomic forecasts* (annual % change unless stated)

*2021 estimates are outturns, in some cases revised since

Source: Office for Budget Responsibility

Limiting the hit, however, is that even so, during 2022, GDP growth and the labour market have outperformed the OBR’s expectations. Inflation itself is not a clearly negative factor for the budget deficit, because it lifts tax receipts as well as expenditure. Indeed, one unintentionally large benefit to the public purse has been the strong rise in wages, which has pulled more people into higher income brackets given then-Chancellor Sunak’s four-year freeze in tax allowances and thresholds that took effect in April this year, a trend which looks to persist.

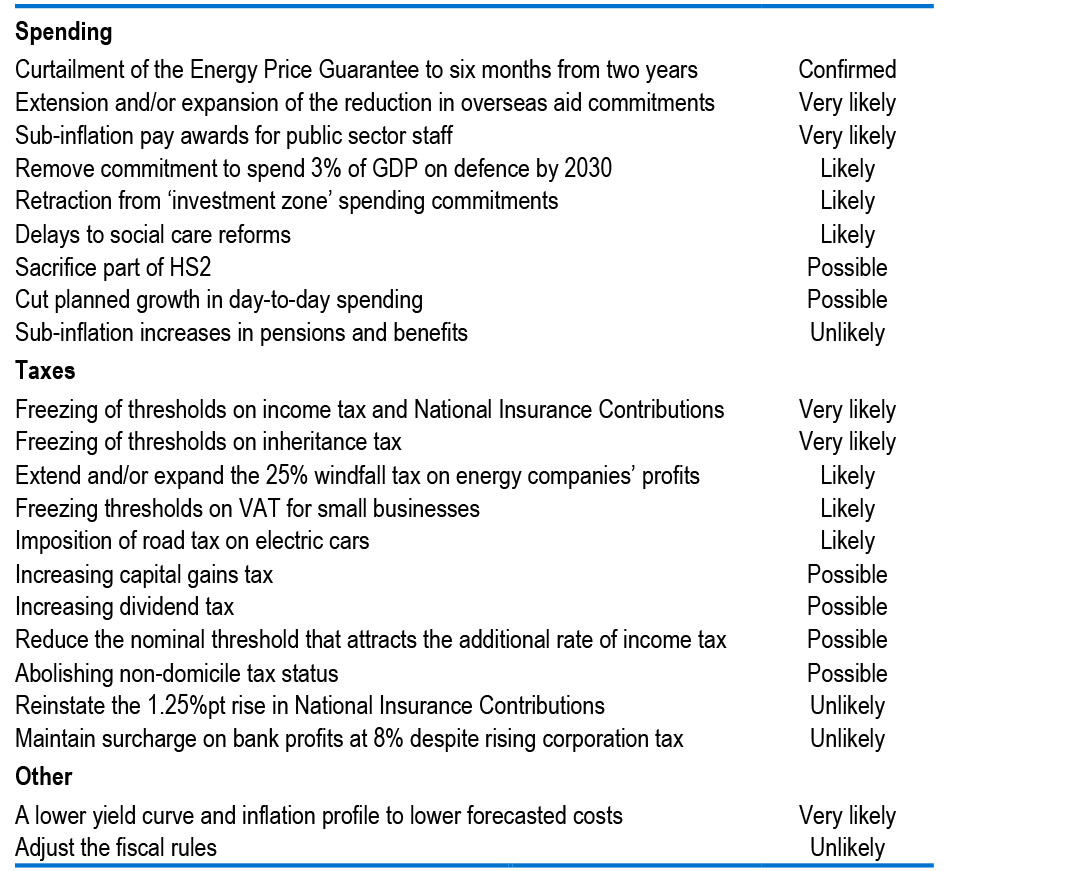

Potential measures

Prime Minister Rishi Sunak and Chancellor Jeremy Hunt have both made clear that the Treasury will aim to consolidate public finances both via tax rises and spending cuts, with every option supposedly being on the table. As alluded to above, falling gilt yields and diminishing expectations of the bank rate should allow the OBR to forecast a lower cost of debt servicing, but there is limited ground towards the c.£53bn aim that can be covered by that alone. Politics will have to be sacrificed in favour of economics, and difficult decisions will have to be made on both the income and expenditure fronts.

Spending cuts – nominal ones at least – are arguably a harder political sell than tax rises at present. The Downing Street duo seem set on bleeding that stone however, with a reported 104 spending cuts up for consideration. One of the largest cost savings on the spending front is the curtailment of the Energy Price Guarantee from two years of support to just six months, with targeted (and cheaper) measures set to be preferred from April 2023 onwards. The energy support is discussed in greater detail below. Commitments on defence spending look likely to be moderated from the current pledge of 3% of GDP by 2030; indeed, this has been acknowledged by Defence Secretary Ben Wallace. Meanwhile, prolonging the cut to overseas aid also seems to be low-hanging fruit – as chancellor, Sunak temporarily reduced foreign aid to 0.5% of GDP from 0.7%. Benefits and pensions were widely touted to be at risk in real terms, but the feeling now seems to be that Sunak and Hunt will raise both in line with inflation, aiming to make the Autumn Statement ‘fair and compassionate’. Public sector pay may not receive the same treatment however, which is at risk of real-term wage cuts – just a 2% pay award is reportedly being considered.

Real/nominal differentials look to be an avenue of attack on the tax front too, with so-called ‘stealth taxes’ widely reported to be under consideration – such as freezing income tax thresholds at current levels, rather than raising them in line with inflation. Yet blunter forces are also expected. Notably, one touted measure is a decrease in the threshold on which the additional rate of income tax is charged, from the current level of £150,000. This would turn a U-turn on the Truss/Kwarteng plans into a full-blown drag race in the opposite direction, and perhaps one that is more popular with the electorate, if not the Conservative party membership. More widely expected is further taxing of energy companies and banks, both of whom appear firmly in the ‘sitting duck’ category. Banks look set to benefit from billions of pounds in reserve remuneration at the Bank of England in the coming years, and while changes to remuneration rates had been discussed, it seemed more plausible that this would be targeted by an extension of the bank surcharge on corporation tax. However, recent reports suggest the Chancellor will reduce the surcharge from 8% to 3%, as previously planned, meaning that after the rise in corporation tax from 19% to 25%, the banks would pay only 1% higher taxes than they do currently. Meanwhile, energy companies may not be so lucky. The energy company windfall tax currently rakes in 25% of profits until 2025 – an extension and perhaps expansion of this is viewed as relatively likely.

Table 4: Potential measures to fill the fiscal black hole

Source: Various media outlets

Energy support

Among the various measures being considered, the topic of energy bill support is a particularly thorny one. This is due to its especially large price tag on the one hand, and its highly visible impact on the other. Indeed, one of the first acts of Jeremy Hunt as chancellor had been to pare back the universal support to households via the £2,500 energy price cap applicable from 1 October from two years to just six months. The duration of universal support to firms was left unchanged relative to initial plans, at six months too.

Kwarteng’s mini-Budget had only included indicative costings of the scheme for the first six months in any case, which at the time were put at c.£60bn (split broadly evenly between support for households and corporates, respectively). But we estimated that the cost of support for the subsequent 18 months could be a further £65bn or so, depending on how market prices evolved.

The cost to the public purse of the scheme is, naturally, a function of two factors: first, the gap between what the ‘fair’ market price for gas and electricity would be minus the fixed price charged of £2,500; and second, the quantity of gas and electricity that is consumed.

The ‘fair’ market price for gas and electricity is best approximated by what Ofgem would set as a price cap. The Q4 price cap (£3,549) was already known and would have been factored into the government’s costings. Given some declines in wholesale gas prices, we anticipate that what Ofgem would set as an energy price cap for Q1 (which our utilities team suggest to be £4,211) is some £375 or so lower than what the government probably factored in when they set the £2,500 energy cap. This may slice £2.6bn or so off estimates of the cost of the six-month energy price guarantee. Whereas welcome, it is not a game-changer: in essence, there is still a large per-unit subsidy to energy prices, despite the fall in (spot) gas prices in recent weeks.

Where there is arguably more scope for surprises is the quantity of energy that is consumed. Clearly, with energy prices still 96% above the level of a year ago, even at the subsidised level of £2,500 for the typical household, the incentive to scale back demand is very substantial. Applying the -0.15 average household gas price elasticity the IMF suggested in a study would point to a 14% reduction in gas demand from a year ago, although the range of uncertainty is large. It seems highly likely that, in any case, some sort of reduction in demand was already factored into the Treasury costing estimates that were released at the time of the mini-Budget. But we do not know exactly how much though, so it is hard to be certain whether they are being over- or under-shot.

A more clearly helpful factor is that the weather since October has been very mild. A press report suggested that this has led to a fall in gas demand of 19% and resulted in further savings of £260m relative to what the government had budgeted for. But that may not last. Indeed, it was reported that the Met Office sees a slightly greater than normal chance of a colder winter than usual this year. Should this prove correct, energy demand (and with it spot gas prices) could surge once more this winter, according to our oil and gas analysts.

For corporates, the picture is more complicated, as until October there was no firm-level equivalent to household energy price caps. Still, a rough approximation might be that the cost of subsidising them is not too far off that of subsidising households.

The discussion so far has centred on energy support until late March. But Chancellor Hunt indicated there would be a follow-up scheme that would be more targeted towards households and firms most in need (and thus cheaper). The rationale for providing help is clear: in the absence of subsidies, our utility analysts’ latest estimates are for a Q2 2023 utility bill cap of £3,750, and a Q3 2023 cap of £3,192, still well above £2,500. For many households, that would simply be unaffordable. What exactly is planned is uncertain, however. One press report suggested the successor to the universal £2,500 cap may be similarly large as Sunak’s initial plan in May (£15bn), but skewed towards those on means-tested and disability benefits as well as pensioners. After all, universal payments are very expensive: with c.28m households, each £100 subsidy would come at a cost of c.£2.8bn to the public purse.

In May, then-Chancellor Sunak’s £15bn package was split between £8.5bn of more targeted support for those on means-tested benefits, pensioners and disability benefits (receiving £5.2bn, £2.4bn and £0.9bn, respectively), and £6bn of universal support (the latter funding £200 of the £400 reduction in utility bills). The downside of replicating such an approach now is that this would almost certainly again be treated as a fiscal transfer by the Office for National Statistics and therefore not count as lowering inflation – in contrast to the energy bill cap. If the government can devise an alternative way that does count as lowering CPI and RPI inflation, all the while being targeted, this would be preferable: the cost of servicing index-linked debt would be lower, and to the extent inflation expectations are affected by reported actual data, this may keep wage demands and longer-term inflation lower than it would otherwise be. How achievable that is remains an open question, however.

Where does this leave the economic outlook?

In all, the Autumn Statement looks set to include a considerable amount of fiscal tightening to fill the £53bn black hole, approximately 2.1% of UK GDP. As such, the economic outlook shifts, especially when comparing it to just two months prior when former Chancellor Kwasi Kwarteng delivered the (not so) ‘mini’-Budget. The upcoming period of fiscal austerity will no doubt be a drag on economic growth as higher taxes and cuts to public expenditure constrains investment and limits households’ discretionary spend.

However, this is balanced against the Bank of England no longer having to increase the bank rate as high as under the Liz Truss and Kwasi Kwarteng administration. Now fiscal and monetary policy are working in the same direction, we expect that a lower peak in the bank rate will be appropriate to bring inflation back down to the 2% target. Markets seem to agree with this, with a peak bank rate now priced in at around 4.5%, having exceeded 6% in the aftermath of the ‘mini’-Budget. Our current forecasts envisage a lower peak bank rate of 4.0% than markets currently expect, on the rationale that the weaker economic backdrop will encourage the Bank of England to pause tightening relatively early. This view was supported after the publication of the Bank’s forecasts last week, which see inflation below target within three years, even if rates were to remain constant at the current 3.0% level (albeit with risks predominantly to the upside). If Chancellor Hunt tightens fiscal policy to the extent rumoured recently in the press, the risks to this forecast would lie to the downside.

The turmoil of the last few months has reminded all – both inside and outside the UK – of the importance of fiscal credibility and sustainability, and this Autumn Statement aims to restore confidence in the UK’s public finances. However, it is difficult to see Hunt standing up for an hour solely delivering bad news as he recognises political factors as well as the economics. While he is of course set to tighten the fiscal screws overall, we suspect that he will dangle a carrot of a modest cut in tax rates as a possibility after a year or two, especially bearing in mind that a general election is likely to take place in 2024.

Get more FX market insights

Stay up to date with our FX insights hub, where our dedicated experts help provide the knowledge to navigate the currency markets.

Browse articles in

Please note: the content on this page is provided for information purposes only and should not be construed as an offer, or a solicitation of an offer, to buy or sell financial instruments. This content does not constitute a personal recommendation and is not investment advice.